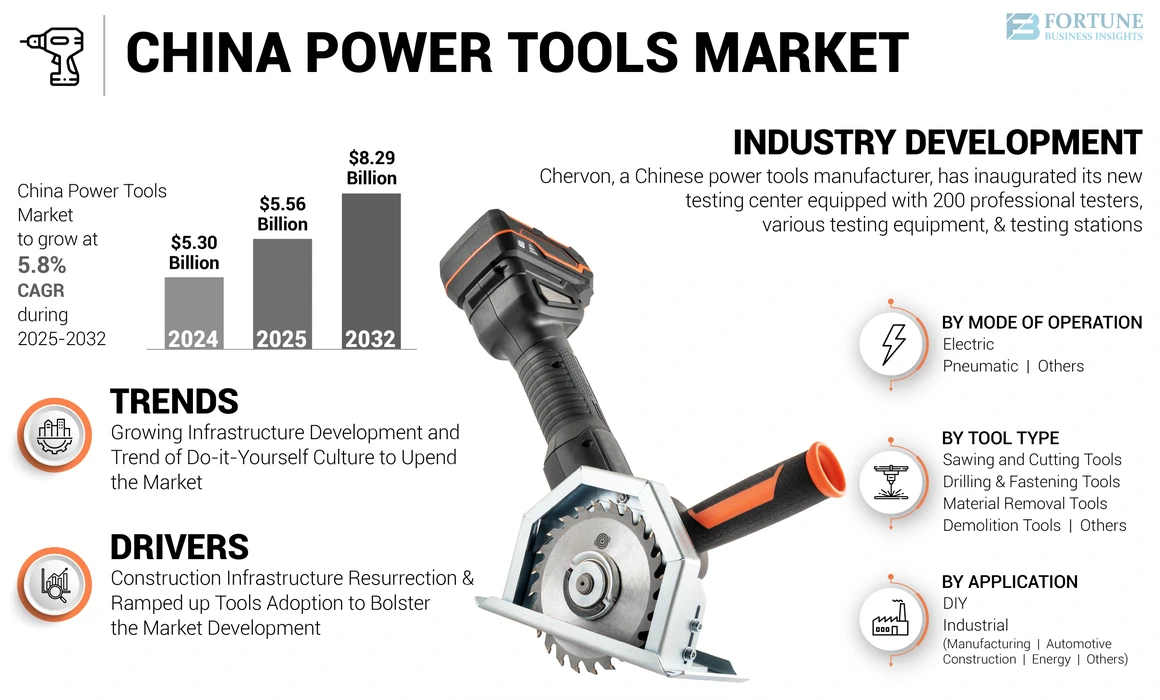

China Power Tools Market Size, Share & COVID-19 Impact Analysis, By Mode of Operation (Electric, Pneumatic and Others), By Tool Type (Drilling & Fastening Tools, Material Removal Tools, Sawing & Cutting Tools, Demolition Tools, and Others), By Application (DIY and Industrial), and Forecast, 2025-2032

China Power Tools Market Size

The China power tools market size was valued at USD 5.30 billion in 2024. The market is projected to grow from USD 5.56 billion in 2025 to USD 8.29 billion by 2032, exhibiting a CAGR of 5.8% during the forecast period.

China has witnessed a significant rise in adoption of electric power tools that minimize field complexities. The advancements it offers, such as smart ergonomics, tool tracking, and power monitoring, ease the workload of the end user. Also, steady adoption of pneumatic tools for heavy load operations and stagnant usage of hydraulic tools for particular operations impact the market.

The growing application of tools for various operations has led to manufacture of different tool types such as drilling & fastening tools. Moreover, use of broadened tools for use for do-it-yourself and household applications dominated the market.

COVID-19 IMPACT

Halt in Infrastructure and Dropped Manufacturing Slowed Market Growth

Observing the initial COVID-19 impact, Wuhan, which has been a traditional manufacturing base for various sectors, went into lockdown phase. It is also the manufacturing hub of modern industrial technology such as optoelectronic, automotive, iron, and steel manufacturing. Thus, the pandemic has negatively hit the production activities of various industries and slowed the market growth.

LATEST TRENDS

Growing Infrastructure Development and Trend of Do-it-Yourself Culture to Upend the Market

The market is growing with supportive government policies and rapid urban infrastructure development. The government is also providing additional funds as growing D.I.Y culture in urban and rural areas has pushed the use of tools for complex household operations, expanding the China power tools market growth over the forecast period. Also, adopting Industry 4.0 in developing countries to automate has helped the operational tool tracking, performance monitoring and capabilities of cordless power tools. These extensive features aid the market growth.

For instance, on January 18, 2023, China's state planner approved a sum of USD 218.35 billion for fixed asset investment projects. The amount is double of last year’s value as authorities gear up to support the COVID-19 hit economy.

DRIVING FACTORS

Download Free sample to learn more about this report.

Construction Infrastructure Resurrection and Ramped up Tools Adoption to Bolster the Market Development

Construction infrastructure in China has grown exponentially and resurrected the construction tools and equipment use. Also, rising popularity of cordless tools across power tools industry owing to powerful, sustainable magnets such as iron nitride is the driver that will support the economic revival. These factors are impactful and are believed to grow the China market size exponentially.

- For instance, in January 2023, China's top economic planner, the National Development and Reform Commission (NDRC), said that in late 2022, it had approved around 109 fixed-asset investment projects covering transport, water conservancy, and others.

RESTRAINING FACTORS

Strict Energy Regulations and Increased Supply Demand Gap to Suppress the Market Growth

Changing energy regulations and global carbon neutrality pledge to create pressure on the market for energy-efficient tools. End-users need easy-to-use, efficient, and advanced power tools to minimize their operation time and workload. Rising prices of raw materials such as copper, aluminum, and steel have raised the primary source material costly. Also, the growing gap in the supply-demand for essential raw materials such as copper is suppressing the market growth.

- For instance, in November 2022, Codelco world’s biggest copper producer, halved its copper sales to China to 50% due to its ongoing production challenges and the closure of its Ventanas smelter.

SEGMENTATION

By Mode of Operation Analysis

Electric Segment to be Dominant with Rising Demand from the Construction Sector

On the basis of mode of operation, the market is segmented into electric, pneumatic, and others.

The electric segment is getting popularize with the newly addition of battery operated power tools that get charged rapidly. Subsequent use of pneumatic and hydraulic devices accounted for the largest industrial applications expanding market share.

By Tool Type Analysis

Drilling & Fastening Tools to Dominate due to Various Applications

On the basis of tool type, the market is divided into drilling & fastening tools, material removal tools, sawing & cutting tools, demolition tools, and others, which include routing tools.

Among these, drilling & fastening tools segment is expected to show high growth due to its growing adoption in both residential D.I.Y and industrial segments.

By Application Analysis

Spending Capability and Rising DIY Tools to Lead to the Segment’s Dominance

Based on application, the market is segmented into DIY and industrial (manufacturing, automotive, construction, energy, and others (ship building). With growing application in all industry verticals, demand for power tools and hand tools in D.I.Y activities to grow dominant over the forecast period due to smart ergonomics and performance capabilities.

KEY INDUSTRY PLAYERS

In the global competitive landscape, established and emerging players in the market have observed a production fall owing to high source material prices. Also, copper shortage for their essential parts, such as motors, wires, and PCBs, has harmed their production. Prominent players have widened their geographical presence with expansion strategies to smoothen the supply-demand gap. Additionally, DIY culture in the market has allowed tech giants to enter the tools market and grow the China power tools market share steadily over the forecast period.

List of Top China Power Tools Companies:

- Robert Bosch GmbH (Germany)

- Stanley, Black & Decker, Inc. (U.S.)

- Hilti Corporation (Liechtenstein)

- Atlas Copco AB (Sweden)

- Makita Corporation (Japan)

- Ingersoll Rand (U.S.)

- Techtronic Industries Co. Ltd. (Hong Kong)

- Chervon Holdings Limited (China)

- Positec Group (Suzhou)

- KYNKO INDUSTRIAL LIMITED (Fujian)

KEY INDUSTRY DEVELOPMENTS:

- June 2022 – Chervon, a Chinese power tools manufacturer, has inaugurated its new testing center equipped with 200 professional testers, various testing equipment, and testing stations.

- February 2022 – Kynko has been a major player in power tools in China, and has launched its cordless driver drill KD90, equipped with an efficient 21V brushless motor.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report provides a detailed analysis of the market. It focuses on key aspects such as an overview of technological advancements, the prevalence of these tools in China, and pricing analysis. Additionally, it includes an overview of the market scenario for DIY and the industrial sector. It also highlights new product launches, key industry developments such as mergers, partnerships, & acquisitions, and the impact of CsOVID-19 on the market. Besides this, the report offers insights into the market trends, supply gap analysis, size share trends analysis, and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation, By Tool Type, By Application |

|

By Mode of Operation |

|

|

By Tool Type |

|

|

By Application |

|

Frequently Asked Questions

A) Growing at a CAGR of 5.8%, the market will exhibit a meticulous growth in the forecast period (2025-2032).

A) Construction infrastructure resurrection and ramped up tools adoption to bolster the market development.

A) Robert Bosch GmbH, Stanley, Black & Decker, Inc., Techtronic Industries Co. Ltd., Chervon Holdings Limited, Positec Group, and KYNKO INDUSTRIAL LIMITED are the major players in the China market.

A) Drilling and fastening tools are dominating the market share in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us