Cloud Monitoring Market Size, Share & Industry Analysis, By Type (Database Monitoring, Website Monitoring, Virtual Network Monitoring, Cloud Storage Monitoring, and Virtual Machine Monitoring), By Cloud Architecture (Public Cloud, Private Cloud, and Hybrid Cloud), By Service Model (SaaS, PaaS, IaaS, and Others), By Enterprise Type (SMEs and Large Enterprise), By Industry (BFSI, Healthcare, IT & Telecom, Government, Manufacturing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

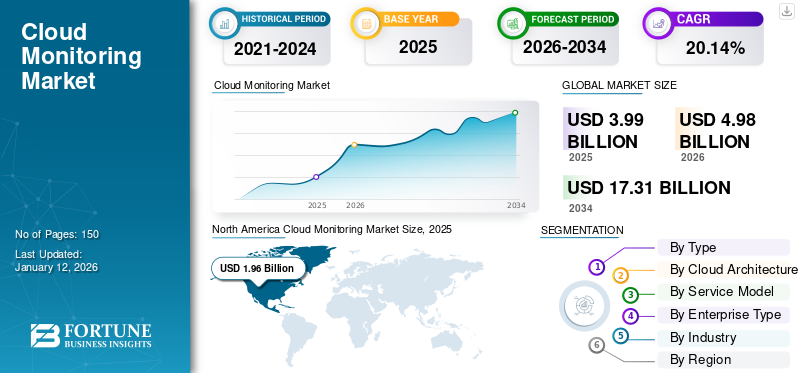

The global cloud monitoring market size was valued at USD 3.99 billion in 2025 and is projected to grow from USD 4.98 billion in 2026 to USD 17.31 billion by 2034, exhibiting a CAGR of 20.14% during the forecast period. North America dominated the global market with a share of 49.09% in 2025.

Cloud monitoring involves overseeing and managing the performance, availability, and security of cloud-based applications, services, and infrastructure. It involves collecting and analyzing data about the cloud environment to ensure optimal performance, identify potential issues, and make informed decisions. A key driving factor for cloud monitoring is the need for businesses to maintain high uptime, reliability, and security in their cloud environments. Organizations can proactively address issues, optimize resource usage, and enhance the overall user experience by continuously monitoring cloud resources. Cloud monitoring tools provide real-time visibility into cloud performance metrics, alerts for anomalies or potential issues, and historical data for analysis and optimization. Overall, effective cloud monitoring is essential for ensuring cloud-based systems' smooth operation and success.

Global Cloud Monitoring Market Overview

Market Size:

- 2025 Value: USD 3.99 billion

- 2026 Value: USD 4.98 billion

- 2034 Forecast Value: USD 17.31 billion

- CAGR (2026–2034): 20.14%

Market Share:

- Regional Leader: North America held about 49.09% market share in 2025.

- Fastest-Growing Region: Asia Pacific is projected to record the highest growth during the forecast period.

Industry Trends:

- Cloud storage monitoring held the largest share in 2024, while website monitoring is expected to grow fastest.

- SaaS-based solutions dominate the market, with IaaS projected to expand rapidly.

- Large enterprises lead adoption, while SMEs are growing quickly with cloud-native monitoring solutions.

- BFSI is the leading vertical, with healthcare, IT & telecom, government, retail, and manufacturing also showing strong adoption.

Driving Factors:

- Integration of AI and predictive analytics for proactive anomaly detection and predictive insights.

- Rising complexity of multi‑cloud and hybrid environments, driving demand for unified observability tools.

- Accelerated cloud adoption due to remote work, scalability needs, and focus on uptime.

- Growing need for compliance and performance monitoring, especially in regulated sectors like BFSI and healthcare.

According to a survey conducted by KeySight, 99% of the companies interviewed revealed that comprehensive cloud monitoring solutions have significantly impacted their business values.

The COVID-19 pandemic significantly impacted cloud monitoring solutions by accelerating the adoption of remote work and increasing reliance on cloud-based services. This led to a surge in demand for cloud monitoring tools to ensure the performance, availability, and security of remote-accessible applications and infrastructure, prompting providers to enhance their offerings with features such as increased scalability, real-time monitoring, and advanced analytics to meet the evolving needs of businesses.

Thus, the increased need for monitoring cloud-based applications during the pandemic propelled the global cloud monitoring market growth.

Cloud Monitoring Market Trends

Rising Demand for Software as a Service (SaaS) in Large Enterprises to Aid Market Expansion

Software-as-a-Service is an on-demand technology used to modify and control system performance. The rising adoption of software as a service in Human Capital Management (HCM), Customer Relationship Management (CRM), enterprise resource management, and other financial applications creates a favorable environment for cloud monitoring adoption, particularly in large enterprises.

Unlike traditional banking application software, it does not require staff to keep the system running smoothly. Also, it doesn't require large investments in PCs, network infrastructure, and backup systems. Furthermore, it provides data security and does not require frequent software upgrades. Therefore, the overall system cost can be reduced. Additionally, the increasing propensity of enterprise buyers to adopt SaaS is expected to fuel the growth of the market.

Download Free sample to learn more about this report.

Cloud Monitoring Market Growth Factors

Rapid Integration of Generative AI to Augment Anomaly Detection and Predictive Analytics in Cloud-based Monitoring Solutions to Fuel Market Growth

Generative AI had a transformative impact on cloud monitoring solutions by enabling more advanced and proactive monitoring capabilities. One key area where generative AI has been leveraged is in anomaly detection. Generative AI models analyze vast amounts of data from cloud environments to establish normal behavior patterns. When deviation occurs, such unusual spikes in traffic or resource usage, these models detect anomalies and alert administrators to potential issues, allowing quicker response times and improved system reliability.

Another way generative AI has influenced cloud monitoring is through predictive analytics. By analyzing historical data and patterns, generative AI can forecast potential issues or performance bottlenecks before they occur. This proactive approach enables organizations to take preventive measures, such as adjusting resources or configurations, to mitigate risks and maintain optimal performance. The AI has empowered cloud monitoring solutions to evolve from reactive to proactive, aiding organizations in managing their cloud environments better and improving overall efficiency and reliability.

RESTRAINING FACTORS

Limited Cloud Visibility and High Level of Technical Expertise Create Cloud Monitoring Challenges

Customers in the market are concerned about limited cloud visibility. Workstations, virtualization, servers, and other systems are independent of physical hardware and difficult to monitor. For instance, the application owner cannot access hypervisor layers. Monitoring requires various monitoring tools, but they do not offer a complete monitoring solution, which can discourage end-users from adopting these solutions. Also, such services require public network connectivity, which can be a threat due to its large attack surface. Internal network monitoring solutions can be isolated from public networks. Further, the high costs of these services hinder their adoption in various fields. The high level of technical expertise required to adopt cloud monitoring services also hinders market augmentation.

Cloud Monitoring Market Segmentation Analysis

By Type Analysis

Increasing Amount of Unstructured Data to Boost the Demand for Cloud Storage Monitoring

Based on type, the market is divided into database monitoring, website monitoring, virtual network monitoring, cloud storage monitoring, and virtual machine monitoring.

Cloud storage monitoring segment accounted for the highest cloud monitoring market share in 2025. The increasing amount of unstructured data drives the demand for advanced technologies such as artificial intelligence, analytics, Internet of Things, and automation. Cloud storage stores and manages data over the internet and can be provisioned according to an on-demand, pay-as-you-go model. Cloud-based storage provides global scalability, agility, remote access, and longevity of data storage. These factors contribute to expansion of this segment.

Whereas, the website monitoring segment will grow at the highest CAGR during the forecast period. This growth is attributed to the rising need for an efficient network in various countries such as India, Japan, and Canada.

By Cloud Architecture Analysis

Increased End-users Spending on Public Cloud had a Major Impact on Segmental Growth

Based on cloud architecture, the market is segmented into public cloud, private cloud, and hybrid cloud.

The public cloud deployment model is projected to lead the market, contributing 42.01% of the market share in 2026. This is due to increased spending on the public cloud. Public cloud services cover many capabilities, from the basics of storage, processing, and network performance, to artificial intelligence and Natural Language Processing (NLP), to standard office applications. Additionally, increasing end-user spending on public clouds is fueling the growth of this segment.

Additionally, the hybrid cloud segment is expected to grow significantly due to increasing demand for hybrid deployments, as enterprises can benefit from private and public deployments. Therefore, increasing demand for hybrid cloud storage due to data security, flexibility, and agility will likely boost market growth in the coming years. Enterprises rely on multiple public clouds, private clouds, and legacy platforms for on-premises to meet their infrastructure needs. These factors are expected to increase the demand for hybrid cloud-based storage.

By Service Model Analysis

Easy Installation and Maintenance of Application Contributes to the Positive Impact on SaaS

As per service model, the market is categorized into Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS), and others (FaaS).

The software-as-a-service (SaaS) model is anticipated to hold a significant position, representing 36.46% of the total market share in 2026. Organizational factors can hit the measuring point of many SaaS-based applications. These monitoring tools provide continuous visibility into SaaS performance and the ability to identify and troubleshoot performance slowdowns and issues proactively. Applications, which are based on SaaS, allow consumers to easily maintain and install applications over the internet instead of maintaining complex hardware and software systems. These factors support the expansion of the SaaS segment in the market.

Furthermore, Infrastructure as a Service (IaaS) will grow at the highest CAGR during the forecast period. These service applications are elastic, real-time scalable, and metered according to usage.

By Enterprise Type Analysis

High Demand for Advanced Cloud Monitoring Systems in Large Enterprises to Aid Market Expansion

On the basis of enterprise type, the market is categorized into large enterprise and SMEs.

Large enterprises are forecast to remain the dominant organization size segment, accounting for 51.46% of the market share in 2026 due to high demand for advanced monitoring systems in large enterprises. Cloud enables large organizations to easily partition operational and data storage across the enterprise to increase productivity, cost-effectiveness, and security. This will support the expansion of the segment in the coming years.

Furthermore, the Small & Medium-sized Enterprises (SMEs) segment will grow at the highest CAGR during the forecast period (2026-2034) owing to the increased need and awareness of cloud monitoring.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Inclination Toward Modernization and Digitization in the BFSI Industry to Boost Market Growth

By industry, the market is categorized into BFSI, healthcare, IT & telecom, government, manufacturing, and others (retail).

Among these, the BFSI segment captured a major market share in 2024. As the financial services industry transitions to modernization and digitization, institutions of all sizes are putting their guard down and capitalizing on the opportunity of the cloud. By using the cloud, financial institutions can shorten new product development cycles, enabling them to respond more quickly and efficiently to the requirements of their banking customers.

Banks and financial institutions have experienced multiple data breaches. The cost of dealing with these breaches is high for business and banking sectors, which focus on cloud monitoring, thereby driving market growth. Further, the healthcare segment will grow at the highest CAGR during the forecast period (2026-2034).

REGIONAL INSIGHTS

Geographically, the market is studied across into key regions, North America, South America, Asia Pacific, Europe, and the Middle East & Africa. They are further categorized into countries.

North America Cloud Monitoring Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

As per our analysis, the North America market held the largest cloud monitoring market share in 2024. The increasing number of vendors and rapid adoption of cloud-based solutions in the region boost the market. Increasing awareness and adoption of cost-effective and scalable cloud-based solutions for ongoing projects will further propel the regional market expansion.

Asia Pacific is estimated to record the highest CAGR in the forecast period (2025-2032). It is primarily driven by the increased adoption of cloud technology by several end-users, especially in China and India. In India, cloud technology is focused on the growing need for business innovation and agility, the ability to scale quickly in a competitive market, and the government's commitment to the Digital India Initiative.

An increased requirement to follow government data monitoring regulations is backing the development of the Europe market. Nations, such as the Bahrain, Oman, United Arab Emirates (UAE), Qatar, and others, are intensely adopting digitization in the cloud, which is projected to increase the market growth.

Further, Middle East & Africa and South America are also growing at a substantial CAGR during the study period.

Key Industry Players

Strategic Partnerships and Product Launches to Boost Market Expansion

Significant players have been engaging into strategic partnerships with other technology suppliers. Major market players are adopting this strategy to integrate cloud monitoring with novel technologies to increase revenue streams. Using business strategy, companies have been gaining capability and enlarging their customer base.

LIST OF TOP CLOUD MONITORING COMPANIES:

- Google LLC (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Nutanix (U.S.)

- Oracle Corporation (U.S.)

- LogicMonitor, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Zenoss, Inc. (U.S.)

- Dynatrace LLC (U.S.)

- Datadog, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: Arrow Electronics updated their ArrowSphere cloud management platform with GreenOps, SecOps, and FinOps dashboards for improved multi-cloud and hybrid cloud monitoring. These updates aided environmental concerns, enhanced security, and optimized costs for channel partners managing multiple cloud accounts.

- September 2023: Cisco acquired Splunk for USD 28 billion to enhance its security and application resilience portfolio. Splunk’s cloud monitoring and incident management capabilities highlighted Cisco’s strategy, offering leading security analytics across applications, devices, and clouds.

- August 2023: NetApp and Google extended their partnership to offer Google Cloud NetApp Volumes. Based on NetApp’s ONTAP operating system, this service provides advanced cloud monitoring capabilities for enterprise workloads by supporting multi-access protocols such as v4.1, SMB, and NFS V3.

- July 2023: Opvisor launched Opvisor/Cloud, a new cloud monitoring platform powered by GenAI. This platform supports HyperScaler, VMware vSphere, operating systems, and apps, providing users with a unified view to monitor performance, bottlenecks, and performance. It enabled administrators to optimize their applications and infrastructure, gain operational insights, and reduce operational overhead to make informed decisions.

- May 2023: Vanta expanded its partnership with CrowdStrike to improve security and compliance operations, announcing new investments from HubSpot Ventures, Atlassian Ventures, and Workday Ventures. Vanta integrated CrowdStrike Falcon to enhance cloud monitoring and policy compliance.

- April 2023: GatesAir introduced IntraAlert, a new Intraplex cloud monitoring service, at NAB Show 2023. IntraAlert offers real-time monitoring capabilities and alert notifications through a free mobile application or web interface, providing account-based access for users. Their service paired cloud-based audio alerting and monitoring with the latest IP Link hardware, enabling easy access through web browsers and mobile apps.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed rapidly at the global level. It further highlights some growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 20.14% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Cloud Architecture

By Service Model

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is estimated to reach USD 17.31 billion by 2034.

In 2025, the market value stood at USD 3.99 billion.

The market is projected to grow at a CAGR of 20.14% over the forecast period (2026-2034).

The BFSI segment held the largest share of the market in 2025.

Generative AI to augment anomaly detection and predictive analytics in cloud-based monitoring solutions.

Some of the top players in the market are Google LLC, IBM Corporation, Cisco Systems, Inc., Nutanix, Oracle Corporation, LogicMonitor, Inc., Microsoft Corporation, Zenoss, Inc., Dynatrace LLC, and Datadog, Inc.

North America is expected to hold the highest market share.

Asia Pacific is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us