The Japan market is projected to reach USD 0.08 billion by 2026, the China market is projected to reach USD 0.28 billion by 2026, and the India market is projected to reach USD 0.09 billion by 2026.

Aviation Crew Management System Market Size, Share, COVID-19 Impact Analysis, By Solution (Hardware, Software, and Services), By Application (Planning, Training, Tracking, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

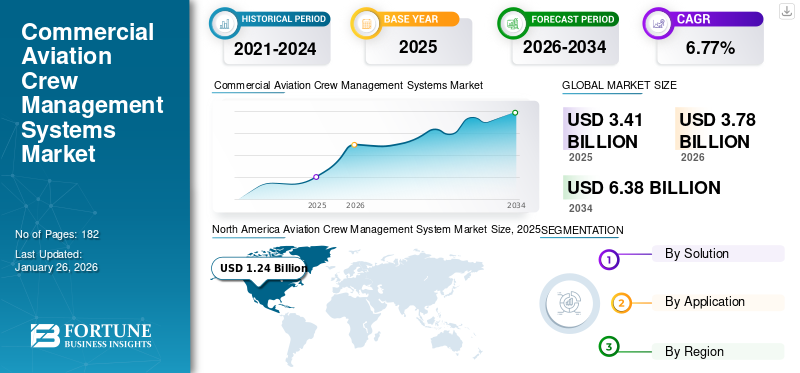

The global aviation crew management system market size was valued at USD 3.41 billion in 2025. The market is projected to grow from USD 3.78 billion in 2026 to USD 6.38 billion by 2034, exhibiting a CAGR of 6.77% over the forecast period. North America dominated the commercial aviation crew management systems market with a market share of 36.45% in 2025.

Aviation Crew Management System (CMS) is a software application that is designed to manage and optimize the allocation of crew resources for airlines, air cargo, and other aviation operators. The system is used to automate crew planning and scheduling as well as provide real-time monitoring of crew availability, training, and qualifications.

The aviation crew management system is a comprehensive system that integrates several functional areas, including crew scheduling, crew rostering, crew tracking, crew qualification management, and crew communication. It collects and processes data on crew availability, preferences, skills, and qualifications to ensure that the right crew members are assigned to the right flights at the right time. The system also monitors crew fatigue, rest requirements, and duty limitations, ensuring that crew schedules comply with regulatory requirements and safety standards.

Additionally, it provides alerts and notifications for unexpected events, such as flight cancellations or crew shortages, and suggests alternatives to minimize disruptions to the flight schedule. This system is mainly used by crew planners, dispatchers, crew schedulers, and crew supervisors. The increasing air traffic is expected to propel the growth of the global aviation CMS market size from 2023 to 2030.

COVID-19 IMPACT

Decrease in Air Travel Demand, Travel Restrictions, and Quarantine Measures Hindered Market Growth Amid the Pandemic

The COVID-19 pandemic had a significant impact on the aviation CMS market. The aviation crew management system involves the management of flight crew and ground staff, which is essential for the smooth operation of airlines. The pandemic has led to a significant decrease in air travel, causing a ripple effect on the aviation industry, including the crew management system industry. The substantial decrease in air travel demand led to the grounding of many aircraft and airlines being forced to lay off a significant number of employees, including crew members. This has resulted in a reduced necessity for crew management systems since fewer staff members require management. For instance, in 2020, the International Air Transport Association (IATA) reported a 66% decrease in passenger demand worldwide compared to the previous year. Additionally, airlines have faced massive revenue downfall, which resulted in laying off large number of employees.

Furthermore, the pandemic has also increased the adoption of digital technologies in the aviation industry, including crew management systems. Airlines are increasingly using digital solutions to manage their workforce remotely, reducing the need for physical contact. For instance, airlines are using mobile applications to allow crew members to manage their schedules, receive training, and access other essential information.

Aviation Crew Management System Market Overview & Key Metrics

Market Size & Forecast

- 2025 Market Size: USD 3.41 billion

- 2026 Market Size: USD 3.78 billion

- 2034 Forecast Market Size: USD 6.38 billion

- CAGR: 6.77% from 2026–2034

Market Share

- North America dominated the aviation crew management system market with a 36.45% share in 2025, driven by the presence of major OEMs, advanced technological adoption, and high investment in crew scheduling and tracking software.

- By solution, the services segment leads the market due to rising regulatory requirements for crew scheduling and compliance, followed by increasing demand for real-time tracking and cloud-based solutions.

Key Country Highlights

- United States: Leading adoption of AI-driven and mobile-enabled crew management systems; major contracts by airlines like CommutAir and strategic expansions by NAVBLUE and CAE strengthen U.S. dominance.

- Europe (Germany & Poland): Lufthansa Systems’ extended agreements with LOT Polish Airlines highlight Europe’s focus on advanced integrated crew management solutions.

- Asia Pacific (India, Singapore, South Korea): Rapid growth due to aviation infrastructure modernization and rising adoption of cloud solutions such as ARMS software by carriers like Jin Air.

- Middle East & Africa / Latin America: Growing airline networks and increasing investment in aviation infrastructure are driving moderate adoption of advanced crew management systems.

Aviation Crew Management System Market Trends

Rising Adoption of Mobile Applications and Growing Integration of Systems with AI to Augment Market

Major players in the aviation crew management system market are focusing on adoption of mobile applications for easy access to crew management, integration with other systems, and the use of Artificial Intelligence (AI) and Machine Learning (ML) to increase their market share. Mobile applications are becoming an essential tool for crew members and airlines. Crew management systems are being designed to provide mobile applications that allow crew members to access real-time schedules, communicate with other crew members, and receive notifications about schedule changes. For instance, in October 2022, CrewApp, an Icelandic company, collaborated with NAVBLUE to provide a crew-centric mobile application. The application has been seamlessly integrated with NAVBLUE’s N-Ops & Crew (N-OC) and is easily accessible.

- North America witnessed aviation crew management system market growth from USD 1.07 Billion in 2023 to USD 1.14 Billion in 2024.

Additionally, the use of AI and Machine Learning (ML) in crew management systems is enabling airlines to optimize crew schedules and improve crew productivity. These technologies can analyze data and provide recommendations for crew scheduling, reducing the workload for crew planners. Additionally, the aviation crew management system is being integrated with other systems such as flight operations, maintenance, and airport systems to provide a seamless and efficient operation. Furthermore, cloud-based systems, product innovations and developments, strategic partnerships, and collaborations are also key trends in the market.

Download Free sample to learn more about this report.

Aviation Crew Management System Market Growth Factors

Rising Concerns toward Mental Health of Crew Members to Propel Market Growth

The aviation industry is a high-stress environment that requires crew members to perform their duties efficiently and accurately while dealing with long working hours, irregular shift patterns, and long periods away from home. Such conditions can have adverse effects on the mental health of crew members, leading to fatigue, stress, anxiety, depression, and other mental health issues. Thus, rising concerns regarding mental health of crew members will contribute to market expansion.

For instance, in December 2020, according to the survey published in research article “Mental Health of Flying Cabin Crews: Depression, Anxiety, and Stress Before and During the COVID-19 Pandemic”, crew members who were grounded in April 2020 displayed elevated levels of fatigue, depression, and stress, whereas individuals who were still flying exhibited symptoms of anxiety that were clinically more significant.

Moreover, aviation crew management systems can monitor the number of hours a crew member has worked and ensure that they receive adequate rest before their next shift. The system can also detect patterns of absenteeism, which may be an indicator of stress or other mental health issues, and alert management to provide appropriate support. These advantages lead to increasing adoption of the system by airlines, thus driving the commercial aviation crew management system market growth.

Emergence of New Airlines Across the Globe to Catalyze Market Growth

The emergence of new airlines across the globe is driving the aviation CMS market. As more and more airlines emerge, there is an increasing need for effective aviation crew management systems to manage their flight operations. For instance, in April 2021, Avolon Holdings Ltd., an Ireland-based aircraft leasing firm, reported that over 90 new carriers are expected to launch by the end of the year as it has already secured investments. These new airlines are emerging in various regions, including North America, Europe, South America, Africa, and Asia.

A few of the emerging airlines are the result of the collapse of other carriers during the pandemic, while others have been holding back, awaiting signs of recovery in air travel before executing pre-existing plans. Crew management systems help airlines manage their crew schedules and rotations, ensure compliance with regulations, and improve operational efficiency. Additionally, the increasing demand for air travel has put pressure on airlines to operate more flights, which leads to an increase in demand for the number of crew personnel. Crew management solutions help airlines to optimize their crew utilization, reduce costs, and improve operational efficiency.

RESTRAINING FACTORS

Complex Regulatory Environment and High Implementation Costs to Hinder Market Proliferation

The aviation industry is highly regulated due to safety and security concerns. Compliance with various regulations is necessary for aviation companies to operate. Implementing crew management systems that adhere to these regulations can be challenging and costly. For instance, regulations require that crew members receive a specific amount of rest between flights. Crew management systems must ensure that crew members receive the required rest periods and comply with regulations, which can be complex and costly to implement.

Furthermore, implementing crew management systems requires significant investment in technology, software, and training. These costs can be high, making it difficult for smaller aviation companies to implement such systems.

Aviation Crew Management System Market Segmentation Analysis

By Solution Analysis

Services Segment to Lead Owing to Increased Regulations for Crew Members to Meet the Current Criteria Standards

By solution, the market is divided into hardware, software, and services. Services segment dominated the aviation crew management system market share of 43.46% in 2026. Services refer to the process of managing and scheduling the flight crew members of an airline or aviation company. These services can be essential for airlines and crew management companies to ensure their crew management systems are operating at peak efficiency. This segment is also estimated to be the fastest growing during the forecast period.

Software segment includes the applications and programs used for crew management such as scheduling software and crew tracking software. It also comprises on-premises and cloud-based services. On-premises deployment involves installing software and storing data on-site. On the other hand, cloud-based deployment involves accessing software and data through the internet which provides more flexibility, scalability, and cost-effectiveness. Software segment is expected to witness significant growth during the forecast period due to increasing demand for cloud-based solutions.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Tracking Segment to Dominate Owing to Increased Need to Ensure Safety and Security of Crew Members

By application, the market is segmented into planning, training, tracking, and others. The tracking segment dominated the market in the base year and is expected to grow significantly in the forecast period due to increasing demand for real-time monitoring and communication.

- The Tracking segment is expected to hold a 49.26% share in 2026.

Planning segment is predicted to witness significant growth during the forecast period. Adoption of advanced technologies such as Big Data analytics and artificial intelligence by OEMs to improve planning and scheduling accuracy is driving the planning and tracking segments over the forecast period.

REGIONAL INSIGHTS

The market is divided by region into North America, Europe, Asia Pacific, the Middle East, and the Rest of the World.

North America Aviation Crew Management System Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.24 billion in 2025 and USD 1.37 billion in 2026. This growth is attributed to the presence of major OEMs in the region and the adoption of aviation crew management system in North America due to advantages such as scalability, efficiency, and cost savings. For instance, in November 2021, NAVBLUE, an Airbus subsidiary, extended its partnership with CommutAir. CommutAir, a U.S. based airline, signed a contract with NAVBLUE to execute N-Ops & Crew and N-Flight Planning (N-FP) solutions in its airlines.The U.S. market is projected to reach USD 1.21 billion by 2026.

The market in Europe held the second-largest share in 2024. This region's growth is due to the growing demand for efficient aviation crew management systems. For instance, in April 2022, Lufthansa Systems signed an extended contract with LOT Polish Airlines for eight years for the use of the crew management solution NetLine/Crew and schedule management solution NetLine/Sched. As a part of the contract, the airline also migrates to Lufthansa’s operation solution NetLine/Ops ++ plus additional hub management. The UK market is projected to reach USD 0.15 billion by 2026, while the Germany market is projected to reach USD 0.21 billion by 2026.

Asia Pacific is expected to be the fastest-growing region during the forecast period. Market growth in this region is attributed to the rising modernization of aviation infrastructure projects and the growth of cloud-based services. In July 2020, LAMINAAR Aviation Infotech, a Singapore-based company, announced that the company has delivered proprietary ARMS application software solutions to Korean carrier Jin Air. The solution includes different modules, Commercial Planning (CPSS), Flight Operations (FOSS), and the Load and Trim (L&T) feature from the Flight Planning & Dispatch module.

Rest of the World is anticipated to witness moderate growth in the aviation CMS market during the forecast period. Market growth in Latin America and Africa is owing to the increasing investments in the aviation sector. In February 2023, LATAM airline announced to increase the network of international routes. Such developments lead to increased demand for efficient management systems across the region.

KEY INDUSTRY PLAYERS

Emerging Markets, Mergers & Acquisitions, Technological Advancements, and Increased R&D are Key Focus Areas of Leading Players

The global market is relatively fragmented with key players, such as CAE Inc., Advanced Optimization System Inc. (AOS), IBS Software Services, NAVBLUE, Jeppesen, and others. Major players focus on technological advancements, product innovations, expansions into emerging markets, and mergers & acquisitions to increase their market share and sustain the market competition. For instance, in February 2022, CAE Inc. completed the acquisition of Sabre’s AirCentre for a deal amount of USD 498.9 million. This acquisition expands CAE’s presence in crew management solutions by adding Sabre’s digital flight and crew operations solutions. Sabre’s AirCentre is a suite of flight crew management and optimization solutions.

List of Top Aviation Crew Management System Companies:

- CAE Inc. (U.S.)

- Advanced Optimization Systems Inc. (AOS) (U.S)

- IBS Software Services (India)

- Jeppesen (U.S.)

- NAVBLUE (France)

- Lufthansa Systems GMBH & Co (Germany)

- InteliSys Aviation Systems Inc. (Canada)

- Hexaware Technologies Ltd (India)

- Hitit Computer Services (Turkey)

- AIMS International Ltd (UAE)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: Laminaar Aviation Infotech's ARMS crew management and mobile applications technology package was selected by Uganda Airlines to enhance their scheduling, training, and decision-making capabilities. By utilizing the innovative technology of ARMS, the airline will have access to a real-time, integrated platform for managing and tracking all crew operations, including mobile app-based features.

- September 2022: Cebu Pacific, the top airline in the Philippines, selected IBS Software to enhance its crew scheduling processes and improve operational efficiency. As the airline expands its domestic and international networks, it is essential to manage staff schedules more efficiently with the increase in flights.

- October 2022: Lufthansa Systems collaborated with Ditto, a peer-to-peer database company, and created a new Crew App using Apple's SwiftUI framework to convert conventional (paper-based) processes into digital ones. The Crew App operates on Ditto's Intelligent Edge Solution, a cross-platform peer-to-peer (P2P) database that enables syncing of data among the crew, even when there is no network connectivity.

- July 2022: Air France, a France-based air carrier, signed an agreement with Boeing’s Jeppesen Crew Rostering solution as part of a five-year contract signed at the Farnborough Airshow to optimize crew schedules for nearly 13,000 cabin crew at the airline.

- December 2020: CAE Inc. acquired Merlot Aero Limited for USD 35 million. Merlot Aero Limited is a New Zealand-based company that provides global deployment of airline operations software. This acquisition helped CAE to expand its offering into digitally enabled crew performance software and expertise.

REPORT COVERAGE

The research report provides a detailed market analysis. It comprises all major aspects such as R&D capabilities and optimization of the manufacturing capabilities and operating services. Moreover, the report offers insights into the market trends analysis and primarily highlights key industry developments. In addition to the above-mentioned factors, it mainly focuses on several factors that have contributed to the global market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.77% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Solution

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the global market size was USD 3.41 billion in 2025.

The market is likely to grow at a CAGR of 6.77% over the forecast period (2026-2034).

Services segment is expected to lead the market due to increasing demand globally.

The market size in North America stood at USD 1.24billion in 2025.

The rising concerns toward mental health of crew members and the emergence of new airlines across the globe are expected to drive the market.

Some of the top players in the market are CAE Inc., Advanced Optimization System Inc. (AOS), IBS Software Services, NAVBLUE, Jeppesen, and others.

U.S. dominated the market in 2025.

Complex regulatory environment and high implementation costs are expected to hamper the market.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Aerospace & Defense

Clients

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us