Data Storage Market Size, Share & Industry Analysis, By Storage Medium (Direct Attached Storage, Network Attached Storage, Software Defined Storage and Hyper Converged Storage, Cloud Storage, and Storage Area Network), By Industry (BFSI, IT and Telecommunication, Governments and Public Sector, Manufacturing, Healthcare and Life Sciences, Retail and Consumer Goods, Media and Entertainment, and Others), By Enterprise Type (SoHo, Mid-size, Large Enterprises), and Regional Forecast 2026-2034

KEY MARKET INSIGHTS

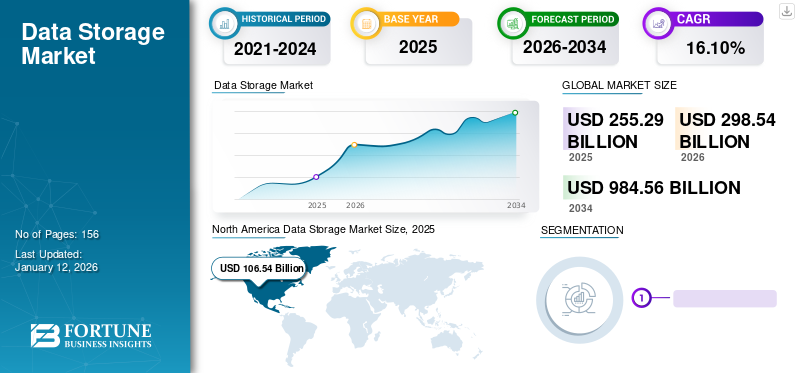

The global data storage market size was valued at USD 255.29 billion in 2025. The market is projected to grow from USD 298.54 billion in 2026 to USD 984.56 billion by 2034, exhibiting a CAGR of 16.10% during the forecast period. (2026-2034). North America dominated the global market with a share of 106.54% in 2025. The data storage Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 226.81 billion by 2032, driven by Increased Demand for Data Storage Solutions due to Rise in Amount of Big Data.

Data storage is a systematic method of archiving and preserving digital information, ensuring its accessibility and security for future use. This method encompasses the utilization of diverse storage mediums, such as direct attached storage, storage area network, network attached storage, and software defined storage to retain data in multiple formats, such as text, images, and videos. It is an essential component of modern computing and business operations, which enables organizations to manage, analyze, and utilize data to make informed decisions, offer services, and drive productivity. The storage technologies range from traditional physical devices, such as hard drives, to cloud-based solutions that offer scalability and accessibility from anywhere with an internet connection.

In October 2023, IBM launched the IBM Storage Scale 6000 System, a cloud-based data platform designed for AI and data-intensive loads. This addition to the IBM Storage for AI and Data portfolio enhances the parallel file system, delivering upto 7M IoPS and 256GB/s throughput for read-only loads of work per system in a close-packed 4U footprint.

The COVID-19 pandemic significantly impacted the market growth, leading to increased demand for cloud storage and data center services. As remote work and digital transformation accelerated, businesses required more storage capacity for data processing and analytics. This surge in demand strained existing infrastructure, leading to investments in scalable storage solutions. Software defined storage also started to gain momentum during the pandemic as the private and public sectors started to shift from traditional channels to digital channels to access the services and share data from remote locations.

IMPACT OF GENERATIVE AI

Increasing Size of Datasets Due to Generative AI to Enhance Market Growth

The impact of generative AI on the data storage market growth is profound, aiding in transformative changes in data creation, processing, and storage requirements. Generative AI, powered by technologically advanced machine learning models, such as GPT-3, can autonomously generate vast amounts of diverse and complex data. This surge in data creation necessitated a reevaluation of storage architectures to accommodate the increased volume, variety, and velocity of generated content.

The development of generative AI models, characterized by continuous learning and adaptation, heightens the demands for storage infrastructure. The iterative training processes and constant refinement of these models generate substantial datasets, requiring scalable and distributed storage solutions. Technologies, including distributed file systems and object storage, have become vital to handle the distributed nature of training and storing the diverse datasets generated during the training cycles. For instance,

In November 2023, Storj, an enterprise-grade cloud object storage, unveiled Storj Select, offering customizable distributed storage solutions for organizations with sensitive data. This feature ensured compliance with specific security standards, such as SOC2, GDPR, and HIPAA, by storing customer data only on qualified points of presence. Moreover, CloudWave, a leading healthcare data security solutions provider, selected Storj for compliant storage.

Data Storage Market Trends

Rising Innovations and Quick Adoption of High-Speed Storage Devices to Propel Market Growth

The continuous advancements in storage devices are expected to create lucrative opportunities for the market. The storage sector is experiencing an ongoing transformation in storage media, notably the surge of Solid-State Drives (SSDs) and Nonvolatile Memory Express (NVMe) devices. SSDs have gained immersive traction owing to their high speed, durability, and efficiency when compared to traditional Hard Disk Drives (HDDs). This technological surge allows storage vendors to cater to the increasing demand for high-speed storage solutions, resulting in business growth. For instance,

In July 2023, Solidigm launched the industry-first Solidigm DS-P5336, a Quad-Level Cell (QLC) SSD for data centers, offering capacities from 7.68TB to 61.44 TB. This SSD allows storing 6X more data in the same space compared to all-HDD arrays, catering to the evolving storage needs driven by AI and 5G workloads. Leveraging QLC, the DS-P5336 provides compelling economics, allowing 2X more data than TLC SSDs and 6X more storage than HDDs in a similar space at TLC speed.

The growing requirements of businesses and consumers have further driven the need for high-speed storage.

Download Free sample to learn more about this report.

Data Storage Market Growth Factors

Increased Demand for Data Storage Solutions due to Rise in Amount of Big Data to Fuel Market Growth

The data storage market is witnessing a rise in demand mainly due to the growing volume of big data due to the increased digitization of businesses and the global economy. Companies are generating and collecting vast amounts of data, such as customer information, operational metrics, financial transactions, and others with the shift toward digital operations. Entertainment, e-commerce, finance, healthcare, and manufacturing industries are striving for an explosion in data production. For instance,

- According to Zippia, in 2022, the amount of data generated and stored reached 94 zettabytes, showcasing a significant rise in data creation and consumption since the onset of the COVID-19 pandemic. This growth can be driven by the increased remote work and greater use of home entertainment during this period. The growing importance of data analytics for gaining insights, optimizing operations, and making informed decisions has led to a substantial increase in the volume of data collected, raising the demand for storage solutions.

IoT devices, such as sensors in smart cities, wearables, and connected machinery in industrial sectors, generate continuous streams of data that are unstructured and high in volume. In response to the surge in big data, businesses are seeking advanced storage solutions to manage and analyze the information securely and efficiently. Traditional storage infrastructures are often inadequate for handling the scale and complexity of big data, leading to the adoption of distributed file systems, scalable cloud storage solutions, and high-performance storage technologies.

RESTRAINING FACTORS

Lack of Data Security and Data Corruption to Hamper Market Proliferation

The data storage market faces challenges that have a significant impact on its growth. High-profile data breaches and cyber threats have made organizations highly cautious about migrating their sensitive data to the cloud. Hence, the storage providers implement robust security measures and encryption protocols to address this issue. Moreover, the ever-increasing data volumes pose a substantial risk of data corruption, potentially causing data loss and business disruptions. To address this concern, key providers focus on maintaining data integrity by implementing strategies, such as redundant storage and advanced error correction methods, effectively safeguarding against data corruption.

Data Storage Market Segmentation Analysis

By Storage Medium Analysis

Rise in Small and Medium Enterprises to Boost Cloud Storage Segment Growth

Based on storage medium, the market is distributed into direct attached storage, network attached storage, software defined storage and hyper converged storage, cloud storage, and storage area network.

The cloud storage segment is further segregated into public, private and hybrid cloud deployments. Public Sector estimated to hold the highest data storage with a share of 18.73% in 2026, due to its cost-effective pricing and quick deployments. Cloud storage involves storing data on remote servers through the internet, offering scalable resources with pay-as-you-go models. The increasing number of small and medium enterprises also contributes to the growth of cloud computing service providers.

Direct Attached Storage (DAS) connects directly to a single server, while Network Attached Storage (NAS) offers file-level storage accessible over a network. Storage Area Network (SAN) provides block-level storage access through a dedicated high-speed network, and Software Defined Storage (SDS) decouples storage services from hardware for flexibility & contributing 29.72% globally in 2026.

Each solution has its distinct characteristics, suited for several requirements in terms of performance, scalability, and accessibility. DAS, NAS, SAN, SDS, and cloud storage represent diverse options for managing and accessing data.

By Industry Analysis

Rising Demand for Latest Secure Storage Solutions in BFSI Sector to Boost Segment Growth

Based on industry, the market is segregated into BFSI, IT and telecommunication, governments and public sector, manufacturing, healthcare and life sciences, retail and consumer goods, media and entertainment, and others.

The BFSI segment is projected to hold the market with a share of 23.00% in 2026, owing to the rising demand for safe and secure storage mediums, which enable banking companies to process and analyze vast amounts of data.

In IT and telecom, data storage is critical for managing vast amounts of network and system data, facilitating seamless communication and supporting network architecture.

In healthcare and life sciences, storage plays a pivotal role in securely storing and retrieving patient records, medical images, and research data, enabling efficient healthcare delivery. It is projected to grow at the highest growth rate, owing to the increasing volume of unstructured healthcare data and rapid technological developments across the globe.

In retail, storage is essential for managing inventory, customer information, and transaction records, ensuring streamlined operations and personalized customer experiences.

To know how our report can help streamline your business, Speak to Analyst

By Enterprise Type Analysis

Rapid Data Generation in Large Enterprises to Enhance Segment Growth

Based on enterprise type, the market is dispersed into SoHo, mid-size, and large enterprises.

The large enterprises segment is expected to hold the highest market with share of 61.57% in 2026 , owing to their reliance on extensive and scalable storage solutions to manage vast amounts of diverse data, support complex business applications, and ensure high-performance data processing across large-scale operations.

In SoHo (small office/home office) environments, data storage is vital for managing limited-scale business data, supporting basic file storage, and enabling small-scale collaboration.

In mid-sized enterprises, storage solutions become more robust, catering to increased data volume, enhanced collaboration needs, and more sophisticated applications, ensuring efficient business operations.

Each sector's storage requirements vary, with SoHo focusing on simplicity, mid-sized enterprises seeking scalability, and large enterprises demanding comprehensive, high-performance storage solutions to meet their diverse needs.

REGIONAL INSIGHTS

In our research, we have considered the geographical aspects of the market, which are North America, Europe, the Middle East & Africa, South America, and Asia Pacific. These regions are further classified into many leading countries.

North America

North America Data Storage Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is projected to hold the highest market share owing to the presence of key players, North America dominated the global market in 2025, with a market size of USD 106.54 billion in 2025, including IBM Corporation, Dell Technologies, Microsoft, and others across the country. The major reason that is contributing to market growth, is the increasing number of data centers in the region. The pandemic has surged the demand for storage and processing power as enterprises strive to remain agile and responsive to the pandemic, and simultaneously, the pandemic has led to a scarcity of storage capacity in some data center. As a result, the data center is turning to cloud providers for their storage and processing needs. This, in turn, is increasing market growth in the region.

Increasing internet traffic and user-generated data contributes to the market growth, with North America having the highest volume of IP traffic. According to CISCO, IP traffic in the North America reached 108.4 EB per month in 2022. The U.S. market is projected to reach USD 101.86 billion by 2026.

Europe

The European Union is investing heavily and taking quick steps toward digitalization. According to the Digital Economy & Society Index report, Europe wants to increase the number of ICT professionals from 8.9 million in 2021 to 20.0 million by 2030. Also, the report stated that by 2030, around 75% of businesses would adopt AI technology, big data, and cloud services and nearly 80% of individuals will have at least basic digital abilities. Thereby, growing digitalization resulted in surging demand for storage solutions in the region. As the European government regulates storage technology, enterprises in the region are investing in digitalization. According to European Bank Investment, around 46% of enterprises claimed that they are taking steps toward digitalization, and this is surging the demand for these solutions in the region. The UK market is projected to reach USD 16.43 billion by 2026, and the Germany market is projected to reach USD 13.49 billion by 2026.

Asia Pacific

Asia Pacific is witnessing growth in the volume of unstructured data across enterprises, and this data is being stored on-premise devices or in the cloud environment. The demand for IoT devices, which are producing massive amounts of data, is also accelerating in the region. An increase in the adoption of digital payments leads to a considerable amount of daily data generation that enterprises need to process, thereby boosting the demand for data storage solutions. Enterprises face challenges posed by escalating data volumes, velocity, and variety, augmenting the demand for these solutions. Additionally, the increased internet penetration for online shopping generated massive amounts of essential data, resulting in the adoption of these solutions. The Japan market is projected to reach USD 12.04 billion by 2026, the China market is projected to reach USD 24.83 billion by 2026, and the India market is projected to reach USD 8.98 billion by 2026.

Middle Easte and Africa

Middle Eastern countries are undergoing a technology-led renovation to expand and move away from their dependency on oil. For instance, Saudi Vision 2030’s push for digitalization aided in boosting social and economic development, increasing investments in technology and developing more localized supply chains. The government in the region aims to build digital infrastructure in smart cities, and this is expected to generate a massive amount of data. It is critical to optimize data capture, storage, and processing.

List of Key Companies in Data Storage Market

Key Players Expand Their Product Portfolio and Integrate Latest Technologies to Enhance Efficiency

Key players in the industry are constantly launching new solutions for data storage and expanding their presence in particular regions. They are also expanding their storage medium offerings by partnering with other enterprises to launch and enhance their existing storage solutions. Several players are also collaborating with companies that offer newer technologies to integrate them and augment their own storage solutions by increasing speed and reducing energy consumption.

In June 2023, HPE extended its partnership with Equinix to expand the GreenLake private cloud portfolio to Equinix International Business Exchange data centers. This expansion involved the pre-provisioning of GreenLake for Private Cloud Business Edition and GreenLake for Private Cloud Enterprise at key Equinix data centers globally, enabling customers to swiftly access a diverse range of private cloud options.

List of Key Market Players Profiled:

- NetApp, Inc. (U.S.)

- Pure Storage, Inc. (U.S.)

- Seagate Technology Holdings Public Limited Company (Ireland)

- Equinix, Inc. (U.S.)

- Huawei Investment & Holding Co., Ltd. (China)

- IBM Corporation (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Dell Technologies Inc. (U.S.)

- Hewlett Packard Enterprise Company (U.S.)

- Hitachi Vantara LLC (Hitachi Ltd.) (Japan)

- Western Digital Corporation (U.S.)

- NETGEAR, Inc. (U.S.)

- Biomemory (France)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Ugreen partnered with Intel, announcing the collaboration during the launch of its NASync Network Attached Storage devices at the 2024 ES. This partnership aimed to integrate Intel processors for improved storage efficiency and smart decision-making, enhancing daily work and life experiences with advanced features powered by AI.

- December 2023: Biomemory launched DNA Cards, the first-ever DNA data storage available for public storage. These credit card-sized cards, consisting of 1 KB of capacity, showcased the practicality of molecular computing as a sustainable alternative to traditional silicon chipsets, with a minimum lifespan of 150 years.

- October 2023: Hitachi Vantara launched the Hitachi Virtual Storage Platform One as a modernized version of its traditional data storage portfolio. With this launch of a solitary hybrid cloud data platform, the company aims to address the complex challenges faced by IT leaders who strive to scale data and modernize applications across critical, multi-cloud, and distributed hybrid infrastructure.

- August 2023: NetApp extended its partnership with Google Cloud to offer enhanced storage performance and cloud flexibility. They introduced Google Cloud NetApp Volumes as a fully managed first-party service, enabling seamless integration of businesses' critical workloads, including demanding use cases, such as VMware and SAP, without the need for refactoring or process redesign.

- May 2023: Hammerspace acquired Rozo Systems, a high-performance scale-out NAS vendor, and aimed to integrate RozoFS, its primary product, into its data management software. This integration reduced data footprint and ensured consistent storage access performance for Hammerspace consumers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 16.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Storage Medium

By Industry

By Enterprise Type

By Region

|

Frequently Asked Questions

The market is projected to reach USD 984.56 billion in 2034.

In 2025, the global market was valued at USD 255.29 billion

The market is projected to grow at a CAGR of 16.10% during the forecast period.

The BFSI sector is expected to lead the market.

Increase in the amount of big data to fuel market growth.

NetApp, Inc., Pure Storage, Inc., Seagate Technology Holdings Public Limited Company, Equinix, Inc., Huawei Investment & Holding Co., Ltd., IBM Corporation, Amazon Web Services, Inc., Dell Technologies Inc., Hewlett Packard Enterprise Company, Hitachi Vantara LLC (Hitachi Ltd.), and Western Digital Corporation are the top players operating in the market.

North America is expected to hold the highest market share.

By industrial sectors, the healthcare and life sciences sector is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us