Dermatophytic Onychomycosis Treatment Market Size, Share & Industry Analysis, By Product Type (Tablets and Nail Paints), By Route of Administration (Oral and Topical), By Type (Prescribed and Over-the-Counter (OTC)), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Channels), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

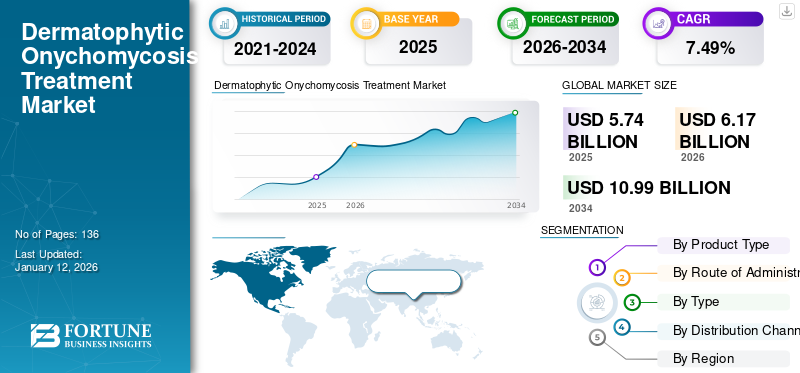

The global dermatophytic onychomycosis treatment market size was valued at USD 5.74 billion in 2025 and is projected to grow from USD 6.17 billion in 2026 to USD 10.99 billion by 2034, exhibiting a CAGR of 7.49% during the forecast period. North America dominated the dermatophytic onychomycosis treatment market with a market share of 44.33% in 2025.

Onychomycosis (OM) is a fungal infection of the nail resulting in discoloration and thickening of the nail. It accounts for about one-third of the total fungal infections in the world. Furthermore, around 70%-80% of the total onychomycosis infections are caused by dermatophytes. This rising prevalence has resulted in an increasing demand for drugs used for dermatophytic onychomycosis treatment.

- For instance, according to an NCBI article published in 2022, onychomycosis accounts for about 50% of nail diseases and is prevalent among 5.5% of the total population across the globe.

Moreover, the increasing prevalence of diabetes leads to high risks of developing nail fungus infections. According to research, the risk of developing onychomycosis increases with age; the rising geriatric population is the major factor driving the market growth. The increasing research, rapid adoption of nail lacquers, and rising new launches of generic drugs indicated for dermatophytic onychomycosis treatment are a few factors further expected to boost the global dermatophytic onychomycosis treatment market growth during the forecast period.

Onychomycosis is the most common nail disorder across the globe. Clinical examination, dermoscopy, and mycological examination are mostly recommended for all patients with suspected onychomycosis, which requires clinical visits. However, during the pandemic, the market witnessed a decline due to reduced patient visits and deferred diagnosis, owing to temporary closure of dermatology clinics.

Furthermore, the implementation of nationwide lockdown, stringent regulations for non-essential healthcare services, and shifted focus toward managing the increased COVID-19 cases negatively impacted the market growth.

- For instance, according to an article published in 2021 by NCBI, there was a reduction in patient visits in many dermatology clinics in Turkey during the pandemic. The decrease in visits was observed among patients mainly suffering from superficial fungal infections, dermatoses, and others.

However, the market regained normalcy in the post-pandemic scenario, owing to the reopening of clinics and increased telemedicine usage by healthcare facilities to diagnose and provide treatment to patients suffering from dermatophytic onychomycosis.

Dermatophytic Onychomycosis Treatment Industry Landscape Overview

Market Size & Forecast:

- 2025 Market Size: USD 5.74 billion

- 2026 Market Size: USD 6.17 billion

- 2034 Forecast Market Size: USD 10.99 billion

- CAGR: 7.49% from 2026–2035

Market Share:

- North America held the largest share of the dermatophytic onychomycosis treatment market in 2025, accounting for 44.33% of the global revenue. This dominance is attributed to the high volume of prescriptions for onychomycosis (approximately 5 million annually), favorable health reimbursement policies, and strong sales of branded products like Jublia and Kerydin.

- By product type, nail paints dominated the market in 2024, driven by increasing demand for topical solutions such as Jublia and ciclopirox, a growing shift away from oral antifungals due to liver toxicity risks, and ongoing innovation in nail lacquer formulations offering deeper nail bed penetration and reduced side effects.

Key Country Highlights:

- The U.S. leads in product approvals, R&D activities, and prescription volume for dermatophytic onychomycosis. Major developments such as FDA approvals for Jublia and the introduction of generics like Tavaborole have made treatment more accessible, contributing to strong market growth.

- Japan continues to play a pivotal role in Asia Pacific's growth due to early adoption of topical antifungals like Clenafin and Jublia. However, reduced sales during the COVID-19 pandemic and subsequent economic disruptions temporarily affected revenue. The market is now recovering with renewed product launches and clinical studies.

- China is witnessing growing demand due to its expanding diabetic and geriatric populations. The increasing availability of OTC antifungal medications through expanding pharmacy chains and the adoption of telemedicine platforms for dermatological care are contributing factors.

- Europe’s market expansion is supported by increasing prevalence (4.3% of the population), rising demand for generics, and favorable reimbursement policies. Partnerships such as the one between Almirall S.A. and Kaken Pharmaceutical to commercialize efinaconazole are strengthening the regional landscape.

Dermatophytic Onychomycosis Treatment Market Trends

Gradual Shift toward Topical Solutions is the Latest Trend

One of the major market trends is the growing preference for topical treatment solutions. Oral anti-fungal drugs are associated with liver damage and are not prescribed to patients with liver and heart diseases. As a result, effective topical treatments might be the preferred choice under certain conditions but not in all cases. On the other hand, the growing problem of anti-fungal resistance to existing oral drugs is one of the factors shifting the physician's preference toward topical drugs. According to a 2017 survey conducted by Moberg Pharma AB on dermatologists and podiatrists in the U.S., seven out of 10 doctors avoid prescribing oral terbinafine owing to the associated liver damage risk. Furthermore, dermatologists and podiatrists worldwide feel that there is a great need for better topical solutions than the existing ones. A gradual shift toward topical solutions has created significant market opportunities for topical drugs and has led to robust R&D for the development of effective nail lacquers.

Download Free sample to learn more about this report.

Dermatophytic Onychomycosis Treatment Market Growth Factors

Rising Prevalence of Dermatophytic Onychomycosis to Drive the Market Growth

One of the key factors driving the growth of the market is the rising prevalence of onychomycosis. The prevalence of toenail onychomycosis infection is much higher than that of fingernails. The rising prevalence of nail fungal infections caused by dermatophytes and a considerable upsurge in the number of prescriptions for dermatophytic onychomycosis treatment are expected to fuel the market growth.

According to a press release by Moberg Pharma AB, around 10% of the general population across the globe is suffering from onychomycosis, with approximately 35 to 40 million Americans having nail fungus. This rising prevalence is expected to favor the market growth during the forecast period.

In addition, the rising prevalence of diabetes is another reason for the increasing occurrence of dermatophytic infection. As per the International Diabetes Federation, around 537 million adults aged between 20-79 years were living with diabetes in 2021, and the number is projected to increase to reach 643 million by 2030. Thus, the rising burden of diabetes among the population increases the risk of developing the infection, and is anticipated to surge the demand for dermatophytic onychomycosis drugs.

Presence of Potential Pipeline Candidates to Foster the Market Growth

The rising prevalence of onychomycosis, as well as the lack of effective treatment, has encouraged significant R&D investment by pharmaceutical companies for the development of novel therapeutics. Currently, many available topical dermatophytic onychomycosis treatment solutions are unable to penetrate deep inside the nail bed, and thus cannot completely cure the infection. Thus, several companies are actively working to overcome this challenge by conducting research on compounds with deeper penetration into the nails for efficient and effective dermatophytic onychomycosis treatment.

For example, Hexima, a biotechnological company, is conducting a phase I/IIa clinical study on HXP124, a plant defensin anti-fungal molecule for the treatment of nail fungus. HXP124 has shown greater penetration rates when compared to Kerydin and Jublia.

Thus, the increased research spending and the launch of potential drug candidates are projected to provide significant momentum to the market.

RESTRAINING FACTORS

Lack of Awareness among Patients May Impede the Market Growth

The major factor hindering the market growth is the lack of awareness among the population regarding the infection. People usually neglect the symptoms such as thickening of the nails, decolorization, and separation of the nails from the nail bed caused due to dermatophytic onychomycosis infection. Due to this, the nail fungal infection remains undiagnosed. In addition, many people refrain from treatment or seeking doctor's help due to very limited awareness about the infection.

According to a study published in the NCBI in the year 2019, the adherence rate for oral and topical onychomycosis treatment is 45% and 24%, respectively. Poor adherence is due to long treatment duration and lack of awareness among the patients. Thus, the ignorance from patients has resulted in many people being left untreated, which, in turn, is restricting the growth of the market.

Dermatophytic Onychomycosis Treatment Market Segmentation Analysis

By Product Type Analysis

Nail Paints Segment to Dominate owing to Growing Jublia Uptake

Based on product type, the market is segmented into tablets and nail paints. The nail paints segment is estimated to dominate the market in 2026, accounting for a 50.29% market share. The increasing adoption and growing preference toward topical nail lacquers when compared to oral anti-fungal drugs coupled with increasing uptake of Jublia, is expected to augment the segment growth during the forecast period. However, decreased sales of Clenafin, especially in Japan, owing to the COVID-19 pandemic, has negatively impacted the revenue of the nail paints segment.

The tablets segment is anticipated to grow considerably during the forecast period due to rising government efforts to switch to generic drugs for dermatophytic onychomycosis treatment. Furthermore, terbinafine and griseofulvin are considered to be gold standards among oral drugs for dermatophytic onychomycosis treatment. This is expected to favor the tablets segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration Analysis

Topical Segment to Dominate due to Significant R&D Investment for Drug Development

On the basis of route of administration, the market is segmented into oral and topical. The topical segment accounted the largest sub-segment in 2026, holding a 50.29% market share. The growth of the segment is mainly due to the fact that several companies are involved in the development of a topical formulation for the treatment of onychomycosis using the nano-delivery platform technology. In addition, some of the pharmaceutical companies are submitting new drug applications for the topical anti-fungal treatment. For instance, in January 2024, Vanda Pharmaceuticals was granted the U.S. FDA approval to move forward with an investigational new drug called VTR-297, which is a topical anti-fungal candidate intended for the treatment of onychomycosis.

On the other hand, oral drugs are associated with adverse side effects, such as liver damage, and thus many dermatologists and podiatrists prefer prescribing topical solutions for dermatophytic onychomycosis treatment. This, coupled with increasing research for the development of topical drugs, is expected to accelerate the growth of the tablets segment. Oral medications have more cure rates, owing to higher penetration and higher effectiveness when compared to topical solutions, which is the primary reason responsible for the growth of the oral segment. However, as most oral antifungals can be taken only through prescription and people were avoiding hospital visits amid the COVID-19 pandemic, the revenue of the oral segment declined during 2020-2021.

By Type Analysis

Over-the-Counter Segment Dominated due to Surging Sales of Ciclopirox

Based on type, the market is bifurcated into prescribed and Over-the-Counter (OTC). The OTC segment segment accounted for a 54.21% market share in 2026, mainly due to the gradual shift toward nail paints and increasing sales of ciclopirox for dermatophytic onychomycosis treatment.

Furthermore, the growing prevalence of onychomycosis, rising number of podiatrists, and presence of favorable health reimbursement policies are the major factors driving the prescribed segment expansion. However, reduction in hospital visits due to government’s stringent regulations to close the non-emergency outpatient department in hospitals during the pandemic has negatively impacted the prescribed segment growth, which was continued in 2020 and 2021.

By Distribution Channel Analysis

Retail Pharmacies Generated Maximum Revenue due to Rising Sales of OTC Drugs

By distribution channel, the market is segmented into online channels, retail pharmacies, and hospital pharmacies. The retail pharmacies segment emerged as the largest sub-segment in 2026, capturing a 40.62% market share owing to increasing sales of OTC drugs and the rising prevalence of diabetes and fungal nail infection. In addition, the expansion of retail pharmacies in developing nations, launch of various retail pharmacy stores, and others are anticipated to accelerate the segment growth in the coming years.

- For instance, in September 2024, Apollo Pharmacy, one of the prominent omnichannel pharmacy retailers in India, established its 5000th store in Chennai. Such factors are anticipated to increase patient access to onychomycosis drugs, supporting market growth.

Post the COVID-19 pandemic, there has been an increasing preference toward online pharmacies for procurement of medicines. This is expected to provide remarkable growth to the online channels segment during the forecast period. In addition, benefits such as no waiting lines, significant discounts offered by the e-pharmacy, and others also increase patients' shift toward these channels, which is expected to bolster the segment growth during the forecast period.

The hospital pharmacies segment is expected to expand considerably during the forecast period due to increasing number of privately owned clinics and rising number of dermatologists and podiatrists.

REGIONAL INSIGHTS

North America

North America dominated the global dermatophytic onychomycosis treatment market share and was valued at USD 2.54 billion in 2025. Increasing number of prescriptions for onychomycosis, rising research, and surging demand for Jublia and Kerydin are the key factors for the growth of the market in North America. According to a press release by Moberg Pharma AB, the total number of annual prescriptions written for onychomycosis treatment in North America is around 5 million, which, in turn, is expected to drive the market growth in North America. Also, increasing submission of new drug applications to regulatory authorities is one of the additional factors responsible for the regional market’s growth. For instance, in April 2020, Bausch Health Companies Inc. announced that the U.S. FDA had given approval to its supplemental new drug application for JUBLIA (efinaconazole) topical solution. This drug is used for the treatment of dermatophytic onchomycosis.

Europe

The Europe onychomycosis treatment market is anticipated to grow owing to increasing prevalence of onychomycosis coupled with favorable health reimbursement policies in the region. The regional expansion can also be credited to the growing preferences for generic drugs and improved Over-the-Counter (OTC) drug distribution for dermatophytic onychomycosis treatment. According to the Journal of the European Academy of Dermatology and Venereology, onychomycosis prevalence in Europe is 4.3%. Thus, due to the above-mentioned factors, the market is expected to grow in Europe. The UK market reaching USD 0.28 billion by 2026 and the Germany market reaching USD 0.33 billion by 2026.

Asia Pacific

In Asia Pacific, the market is poised to grow at the fastest CAGR during the forecast period owing to new product launches, rising prevalence of diabetes, and increasing geriatric population. In March 2020, Kaken Pharmaceuticals Co., Ltd., a Japan-based pharmaceutical manufacturer, launched Jublia in Hong Kong. This launch and other factors are expected to foster the market growth in Asia Pacific. The Japan market reaching USD 0.33 billion by 2026, the China market reaching USD 0.30 billion by 2026, and the India market reaching USD 0.25 billion by 2026.

Moreover, improving distribution channels, rising patient awareness, and increasing health expenditure are factors propelling the market growth in the rest of the world.

List of Key Companies in Dermatophytic Onychomycosis Treatment Market

Bausch Health Holds the Leading Position owing to High Jublia Sales

Bausch Health Companies, Inc. accounted for the largest global market share owing to higher sales of Jublia. The product has a cure rate of 15%-18% compared to other nail lacquers and exhibits minimal side effects compared to oral drugs for dermatophytic onychomycosis.

Furthermore, favorable health reimbursement for Jublia is the main reason for the company's dominant share. On the other hand, Pfizer is ranked second in the market due to increasing demand for Kerydin. However, the market share of both companies is estimated to decline due to the patent loss of Jublia, launch of generics, and the economic crises created by the COVID-19 pandemic.

- For instance, in July 2021, Lupin launched Tavaborole Topical Solution, a generic equivalent to Kerydin Topical Solution in the U.S. The product was meant for the treatment of onychomycosis of the toenails caused by Trichophyton rubrum or Trichophyton mentagrophytes.

LIST OF KEY COMPANIES PROFILED:

- Bausch Health Companies Inc. (Canada)

- Pfizer Inc. (U.S.)

- Galderma (Switzerland)

- GlaxoSmithKline plc (U.K.)

- Janssen Pharmaceuticals, Inc. (U.S.)

- Cipla Inc. (India)

- Kaken Pharmaceuticals Co., Ltd. (Japan)

KEY INDUSTRY DEVELOPMENTS:

- December 2022: Bausch Health Companies Inc. announced the filing of a patent for a method aiming at treating onychomycosis. This patent filing has strengthen company's position in the global market.

- July 2021 – Zydus Lifesciences received the U.S. FDA approval to market efinaconazole topical solution for the treatment of onychomycosis. Through this approval, the company strengthened its position across the country.

- July 2021 – Almirall S.A. and Kaken Pharmaceutical entered into a license and distribution agreement in which Kaken Pharmaceutical granted exclusive rights to Almirall for the development and commercialization of topical antifungal efinaconazole in Europe. Through this move, Almirall S.A. expanded its geographical footprint in Europe.

- April 2021 – Aleor Dermaceuticals received tentative U.S. FDA approval for an efinaconazole topical solution intended for the treatment of fungal toenail infections.

- March 2020 – Kaken Pharmaceuticals Co., Ltd. announced the Hong Kong launch of Jublia. Such launches are expected to expand the company’s geographical presence.

- April 2020 – Bausch Health Companies Inc. received the U.S. FDA approval for a 10% topical solution, Jubila, to treat patients aged six years and above suffering from onychomycosis.

REPORT COVERAGE

The market research report presents a comprehensive assessment of the global market by offering valuable insights, facts, industry-related information, and historical data. Furthermore, the report offers in-depth analysis and information as per market segments, helping our readers to get a comprehensive overview of the global market. It also provides various key insights such as pipeline analysis, regulatory & reimbursement overview, new product launches, and recent mergers, acquisitions, and partnerships.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR |

CAGR of 7.49% from 2026-2034 |

|

Unit |

Volume (K Units) |

|

Segmentation |

By Product Type

By Route of Administration

By Type

By Distribution Channel

By Geography

|

Frequently Asked Questions

The value of the global market was USD 6.17 billion in 2026.

Fortune Business Insights says that the market value is projected to reach USD 10.99 billion by 2034.

The value of the market in North America was USD 2.54 billion in 2025.

The market is projected to record a CAGR of 7.49% during the forecast period of 2026-2034.

The nail paints segment is the leading segment in the market.

The rising prevalence of dermatophytic onychomycosis and the presence of potential pipeline candidates are the key factors driving the market growth.

Bausch Health Companies Inc. and Pfizer Inc. are the major players in the market.

North America is expected to hold the largest market share during the forecast period.

The gradual shift toward topical treatment options is the key trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us