EdTech and Smart Classroom Market Size, Share & Industry Analysis, By Instructional Aid (Smart Classroom and Mobile Learning), By Smart Classroom Hardware (Interactive Projectors, Interactive Whiteboards, and Others) By Educational Tool (Admission Automation Tools, Administration Tools, Learning Management Tools, Alumni Management Tools, Placement Management Tools, Library Management Tools, and Others), By End-user (Higher Education, K-12, and Kindergarten), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

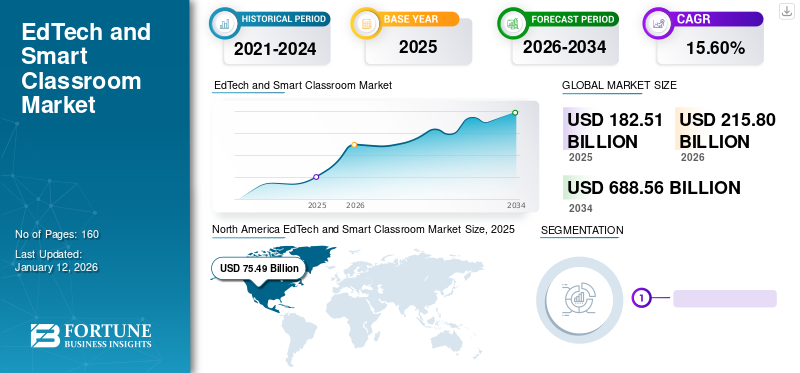

The global edtech and smart classroom market size was valued at USD 182.51 billion in 2025 and is projected to grow from USD 215.8 billion in 2026 to USD 688.56 billion by 2034, exhibiting a CAGR of 15.60% during the forecast period. The North America dominated the global market with a share of 41.40% in 2025.

The education sector has immense opportunities for growth today. It is a fast-evolving industry as institutes and learners have realized the value of a holistic learning environment and are continuously investing in it. According to the education intelligence provider HolonIQ, around 3% of global education expenditure is allocated to digital infrastructure. It also states that digital transformation's significant potential is expected to reach USD 10 trillion by 2030, up from USD 6 trillion in 2018. This is likely to support the adoption of edtech and smart classroom solutions in the coming years.

COVID-19 IMPACT

Mobile Learning Gained Traction amid COVID-19

Innovators and governments invested billions of dollars in the education sector, enabling the edtech and smart classroom industry to gain pace during the pandemic. Online learning applications are becoming increasingly popular, with millions of users worldwide. Other types of educational technology, such as e-textbooks, curriculum management software, administration, and communication platforms, have improved their effectiveness. In addition, the price of edtech gadgets and the internet data required to use them has been reduced.

In addition, smart education solution providers, as well as other telecom companies and the government, have moved to ensure that low-income students can take online classes. For instance,

• In 2020, Telkomsel, an Indonesian cellular network operator, announced plans to provide 500,000 smartphones to kids and 30GB of free data per month to users of Ruangguru, a K-12 learning app.

• In 2020, Starhub, a Singapore-based telecommunications company, offered low-income students free broadband subscriptions, and the Ministry of Education distributed 3,300 pieces of equipment to low-income students.

LATEST TREND

Download Free sample to learn more about this report.

Social Distancing Prompts Stakeholders to Focus on Distance Learning Programs

Distance learning became one of the most significant developments in the e-classroom industries due to the closure of educational institutes during the COVID-19 crisis. The pandemic has significantly changed the way information is taught and learned. Learners are transitioning to digital learning concepts via digital platforms as a result of social distancing norms. Despite the reopening of several educational institutions, the trend of distance learning is likely to continue over the next few years. As a result, the demand for online educational platforms is growing. Distance learning might take the form of a slide-based online activity or an online course that helps learners gain the necessary skills.

DRIVING FACTORS

Growing Investments in the Education Sector to Spur Market Opportunities

The global market has witnessed a rapid shift in recent years, owing to the widespread adoption of mobile technology and increased education spending. For instance, investments in VC-backed education firms increased in 2020, when USD 14.6 billion was committed globally. This is an increase from USD 7 billion in 2019. Articulate raised USD 1.5 billion for corporate training technology, while BYJU’S raised USD 460 million for K-12 individualized learning programs, extending the momentum into 2021. Similarly, education tech startups focused on skill development have received a bunch of costs. For instance, Roblox, an online gaming platform that teaches programming, raised USD 150 million in investment in February 2020. Such major investments and budgets are likely to drive the edtech and smart classroom market growth during the projected period.

Reduced Costs of Internet Data and Online Learning Material to Accelerate Market Growth

Increasing mobile penetration and the low cost of e-learning materials are seen as game-changer in the education industry's growth. In terms of mobile and internet penetration, Europe, the U.S., and emerging countries lead the trend. Meanwhile, significant growth is expected from emerging markets, with mobile as an essential device for acquiring knowledge. Therefore, the market is anticipated to witness booming growth in the near future.

RESTRAINING FACTORS

High Cost of Infrastructure and Lack of Technical Skills to Impede the Market Growth

Smart classroom infrastructure is expensive, such as smart equipment, including PCs, projectors, tablets, and various complex software. Furthermore, to stay up to date with software advancements and modifications, educational institutions may need to acquire a tech professional, which is an additional cost. Thus, the adoption of these solutions is likely to be hampered by such increased expenditures.

SEGMENTATION

By Instructional Aid Analysis

Mobile Learning Segment to Gain Traction Backed by Implementation of Online Learning Programs

Based on instructional aid, the market is classified into smart classroom and mobile learning.

In the coming years, mobile learning is likely to grow in popularity. To reduce the impact of the COVID-19 threat on the education system, governments have created online learning programs, tests, and distance learning programs for students as part of security measures. These factors are expected to increase the usage of mobile learning services, resulting in attractive prospects for market-leading players. The mobile learning segment held the largest share of the market in 2026, accounting for 56.22% of the total market share.

The smart classroom segment is expected to account for a considerable share of the market. However, due to the COVID-19 pandemic, schools, universities, and other educational institutions were closed. Owing to this, the global market experienced a revenue decline for the financial year 2020-2021.

By Smart Classroom Hardware Analysis

Ongoing Technological Advancements to Drive the Interactive Whiteboards Segment

By smart classroom hardware, the market is categorized into interactive projectors, interactive whiteboards, and others (interactive displays, tables, and audio systems). Interactive whiteboards, also called smart boards, are expected to grow at a significant CAGR over the forecast period. The segment's growth is mainly attributed to the rising demand for e-learning and interactive learning among colleges and schools.

Moreover, the interactive projectors segment accounted for 18.57% of the market share in 2026., as they are the most preferred solutions for classrooms & collaborative office meetings.

By Educational Tool Analysis

Learning Management Tools to Grow Immensely Stoked by Integration with AI

By educational tool, the market is divided into admission automation tools, administration tools, learning management tools, alumni management tools, placement management tools, library management tools, and others (document management, classroom management system, student response system, and others). The administration tools (ERP & CRM) segment accounted for 23.05% of the market share in 2026.

Learning management tools segment is predicted to grow at the fastest rate due to their integration with AI-enabled capabilities. The admission automation software industry is also expected to rise rapidly due to rising student enrolment around the world.

Customer Relationship Management (CRM) and corporate resource planning software are included in the Administration Software Solution (ERP). To successfully manage their routine operations, elite educational institutions use administration software solutions. The whole educational tool segment, including library management tools, alumni management tools, and placement management with integrated features, is predicted to grow.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

High Investments and Funding to Contribute to Growth of Higher Education Segment

The market is divided into higher education, K-12, and kindergarten by end-user.

Higher education is likely to hold the majority of the market due to growing expenditures and funding for education technology. Learning management software is being used by K-12 students. The COVID-19 epidemic has also accelerated the adoption of education tools in the K-12 sector.

REGIONAL INSIGHTS

North America EdTech and Smart Classroom Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Geographically, the market is fragmented into five major regions, such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America edtech and smart classroom market share generates the most revenue and is rapidly growing as universities and institutions employ technologically upgraded solutions/services to provide meaningful training to their students. According to GSMA Intelligence, the number of mobile users in North America held a significant share of the market, with the market size valued at USD 75.49 billion in 2025. Furthermore, higher product acceptance would boost the virtual reality industry in the region. The US market is projected to reach USD 62.69 billion by 2026.

Asia Pacific is expected to grow rapidly during the forecast period. Government-led programs, such as government-funded literacy expansion projects in rural areas, are predicted to increase the demand for smart education in India, Japan, and Australia. The Japan market is projected to reach USD 8.57 billion by 2026, the China market is projected to reach USD 19.4 billion by 2026, and the India market is projected to reach USD 5.57 billion by 2026. For instance,

- The National Digital Library of India is an online library run by the Ministry of Human Resource Development that provides academic information arranged by topic area for various levels of smart education and learning. Furthermore, the Ministry of Education, Culture, Sports, Science, and Technology (MEXT) in Japan provides an e-learning forum organized by age and educational level.

The Europe market is expected to grow at an exponential CAGR during the forecast period. The regional market's growth is mainly attributed to the wide adoption of e-learning solutions among universities and schools. The UK market is projected to reach USD 9.83 billion by 2026, while the Germany market is projected to reach USD 8.93 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

In the coming years, the Middle East & Africa is expected to experience significant growth. The market is expected to dominate the region. During the projection period, South America is expected to increase moderately. In recent years, Brazil's private education sector has experienced substantial expansion.

KEY INDUSTRY PLAYERS

New Market Expansion through Partnership and Collaboration with Educational Institutes

Blackboard Inc., SMART Technologies, Amazon Inc., Cisco Systems, Inc., and Google Inc. are strategically cooperating with educational institutes, higher education universities, government, and local schools around the world to provide enhanced edtech and smart classroom solutions. The companies are extending their global reach and expanding their business potential due to their relationship.

List of the Key Companies Profiled:

- SAP SE (Germany)

- Apple Inc. (U.S.)

- IBM Corporation (U.S.)

- Alphabet Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Amazon.com Inc. (U.S.)

- Microsoft Corporation (U.S.)

- SMART Technologies ULC (Canada)

- Dell Inc. (U.S.)

- Fujitsu Limited (Japan)

KEY INDUSTRY PLAYERS

- May 2022 – Dukkantek, a provider of store management platform engaged in a partnership with Qureos, a UAE-based provider of eductaion platform. Through this partnership, Dukkantek aims to create employment opportunities across the GCC.

- May 2021 – SAP SE launched SAP Learning Hub, a free educational offering for students and instructors. This new free service for the next generation of talent will give the knowledge and opportunity required to achieve digital skills in high demand.

- April 2021 – EdCraft is an education platform founded by McKinsey alumni. It has secured USD 1 million funding from angel investors located in Silicon Valley. EdCraft is a Russian online educational platform for primary school children. This platform is accessible on mobile and web.

- March 2021 – Huawei Technologies Co., Ltd. launched a smart classroom solution based on HUAWEI IdeaHub Board and the education cloud platform. This solution is used for online learning, live streaming, or remote teaching. Furthermore, the group discussion scenario allows professors and students to share content and communicate with one another, which boosts student enthusiasm and encourages them to take charge, increasing the educational experience and efficiency.

- December 2020 – 2U Inc. partnered with the global business school Institute for Management Development (IMD) to expand students' online learning programs. Under the 2U brand, the college aims to cover digital supply chain operations, cybersecurity for business leaders, and digital strategy.

REPORT COVERAGE

An Infographic Representation of EdTech and Smart Classroom Market

To get information on various segments, share your queries with us

The education technology and smart classroom market research report offer qualitative and quantitative insights into the product and an exhaustive analysis of market size & growth rate for all possible market segments. Along with this, the report comprises a detailed analysis of market dynamics, emerging trends, and the competitive landscape. The main insights included in the report are the trends in the adoption of individual segments, recent developments in the industry, such as mergers & acquisitions, integrated SWOT analysis of key players, alliances, Porter's five-force analysis, business strategies adopted by major players in the market, key industry trends, and macro & micro-economic indicators.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Instructional Aid, Smart Classroom Hardware, Educational Tool, End-user, and Region |

|

By Instructional Aid |

|

|

By Smart Classroom Hardware |

|

|

By Educational Tool |

|

|

By End-user |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to reach USD 688.56 billion by 2034.

In 2025, the global market was valued at USD 182.51 billion.

The market is projected to grow at a CAGR of 15.60% over the forecast period.

The mobile learning segment is expected to lead the market during the forecast period.

High capital funding and government initiatives are the key factors driving the market growth.

IBM Corporation, 2U Inc., Microsoft Corporation, and Blackboard Inc. are the global market players.

North America is expected to hold the highest market share.

Asia Pacific is expected to exhibit the highest growth rate during 2026-2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic