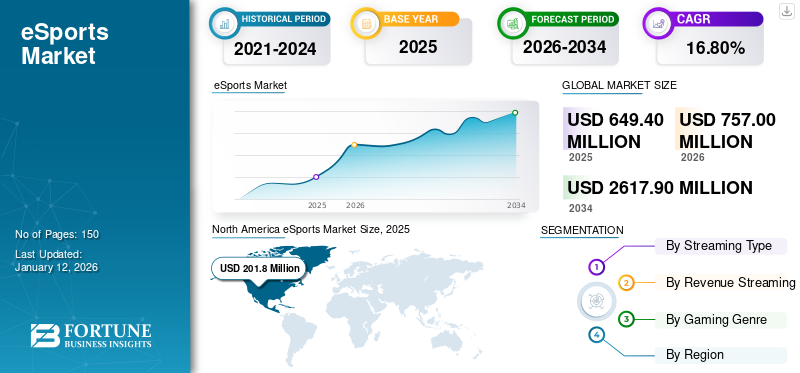

eSports Market Size, Share, and Industry Analysis, By Streaming Type (Live and On-demand), By Revenue Streaming (Media Rights, Advertisement, Sponsorship, Ticket & Merchandise, Game Publisher Fees, and Others), By Gaming Genre (Real-Time Strategy Games, First Person Shooter Games, Fighting Games, Multiplayer Online Battle Arena Games, Mass Multiplayer Online Role-Playing Games, and Others), and Regional Forecast, 2026-2034

eSports Market Size

The global esports market size was valued at USD 649.4 million in 2025. The market is projected to grow from USD 757 million in 2026 to USD 2,617.90 million by 2034, exhibiting a CAGR of 16.80% during the forecast period. North America dominated the market with a share of 31.10% in 2025.

The growing trend of live streaming of games, gaming investments, rising viewership, ticket sales, engagement activity, and demand for league tournament infrastructure are the factors influencing the esports market growth. The market is benefiting from growing revenue opportunities from increased participation of gamers, organizers, influencers, and game developers. Attractive international prize money and opportunities to earn high income have made eSports a professional career choice among youngsters. Additionally, colleges and universities have begun offering dedicated programs to develop gaming skills among students. For instance,

- In March 2023, U.S.-based Syracuse University announced that it will soon offer a new degree course dedicated to electronic sports. Through this program, the university aims to offer new excellence for upcoming tools and trends.

The COVID-19 outbreak fueled the demand for online gaming and user interaction with multiplayer games. Gaming companies’ revenues witnessed a significant rise during this period as several individuals turned to electronic sports for entertainment. Additionally, as social distancing norms decreased business and consumer activity considerably, gaming offered an attractive distraction for people looking for social interaction at home.

eSports Market Trends

Increasing Advertisements through Gaming Platforms to Propel Market Growth

This market earns its revenue from advertisements that are aimed at electronic sports viewers, which include ads displayed during live streams on online platforms or electronic sports TV. Advertising is likely to generate significant eSports market revenue in the coming years due to increasing viewership on online platforms such as YouTube and Twitch. As per the spokespersons of respective companies, YouTube saw its viewership rise by 6 million in 2022, while Twitch won a streamer award for concurrent viewership in 2023.

Thus, with the growing number of streamers, advertising-related content is likely to rise, which, in turn, will aid in generating revenue for the market. For instance,

- In October 2022, Nike, an international sport apparel company, released its first commercial on an esport platform.

Thus, a rise in advertisements is expected to help the esports market share grow during the forecast period.

Download Free sample to learn more about this report.

eSports Market Growth Factors

Rising Popularity of Video Games to Spur Market Growth

Constant advancements in technology across the world have forced individuals to rely on smartphones, high-tech gadgets, and the internet. With many people interested in playing video games, video gaming companies have adopted a recurring revenue model in recent years. Additionally, video game tournaments, virtual reality products, and consumer spending on video content are experiencing tremendous growth globally due to the introduction of advanced technologies.

The growth of the eSports market is driven by popular new eSports games, such as Valorant, Mobile Legends: Bang Bang, and League of Legends: Wild Rift. As technology improves, eSports is likely to become more accessible in the future.

Rise of electronic sports as a professional career due to exciting international prize pools, revenue from streaming, individual sponsorships, and increasing popularity of gaming tournaments are accelerating the market’s progress. Furthermore, companies are focusing on enhancing their product offerings for athletes and to provide better streaming experience for viewers.

Therefore, the rising popularity of video games is boosting the market growth.

RESTRAINING FACTORS

Health and Addiction Concerns for Electronic Sports to Impede the Market Growth

Gamers may experience metabolic disorders resulting from light-emitting diode computer monitors and psychological problems related to gambling addiction and social behavior disorders. A recent study by Zwiebel on the health effects of electronic sports players discovered that they are more expected to suffer musculoskeletal injuries in the back, neck, and upper extremities. In addition, spending excessive time in front of a computer monitor can cause metabolic disorders. Most of these issues arise from sedentary lifestyle and poor posture, which are common among these players.

Further, the introduction of electronic sports college scholarships is also another concern, as youngsters can now justify their overuse of games as being the next electronic sports stars, even when in reality the chances of being the one are extremely low. Thus, the aforementioned factors are expected to hamper the market growth.

eSports Market Segmentation Analysis

By Streaming Type Analysis

Live Streaming to Gain Momentum Due to Swift Digital Transformation

Based on streaming type, the market is bifurcated into live and video-on-demand. The live segment is expected to dominate the market during the forecast period. The growing focus on fan engagement is likely to fuel the demand for live electronic sports events. Also, rise in the number of smartphone users is expected to boost the demand for live electronic sports tournaments.

The video-on-demand segment is likely to grow rapidly during the forecast period owing to the rising demand for in-house entertainment. The number of Over the Top (OTT) platform viewers is increasing as they can access the game at any time. It is expected to help the video-on-demand segment grow in the electronic sports industry.

By Revenue Streaming Analysis

Media Rights Segment will Grow Due to Increasing Viewership

Based on revenue streaming, the market is segmented into media rights, advertisement, sponsorship, ticket & merchandise, game publisher fees, and others.

The media rights segment is projected to dominate the market, accounting for 25.26% of the total share in 2026. According to the PayPal insights of 2020, 62% of Spain viewers purchased eSports related products, and thus various media companies are investing in these sports.

The sponsorship segment, followed by advertisement, is expected to gain rapid momentum during the forecast period. There has been a consistent increase in the audience and supporters in recent years, leading to new chances for growth and higher investments. The investment landscape has evolved greatly due to the diverse opportunities provided by the ecosystem. The investments in the market are majorly made by conventional venture capital firms, strategic investors, and private equity. Similarly, various gaming platforms include in-app advertisements to boost revenue generation.

To know how our report can help streamline your business, Speak to Analyst

By Gaming Genre Analysis

First Person Shooter Games to Dominate Market due to Vast Variety of Games

Based on gaming genre, the market is classified into real-time strategy games, first person shooter games, fighting games, multiplayer online battle arena games, mass multiplayer online role-playing games, and others.

The FIFA games segment is expected to represent 22.18% of the market share in 2026. The first person shooter games segment is expected to hold a dominant market share during the forecast period. Various game developers are offering a vast variety of first-person shooter games. Earlier, these games offered a realistic 3D environment.

The fighting games segment is also expected to showcase significant growth. The rising popularity of these games in virtual video games is helping the market grow.

The multiplayer online battle arena (MOBA) games segment is set to record a strong growth rate during the forecast period, as these games offer a wide range of competitive and lucrative genres. MOBA games are seeing new trends, such as cross-platform play, where players on different devices can compete, and a rise in mobile MOBA games due to the immense popularity of smartphones. Developers are using AI and machine learning to improve gameplay, and virtual reality is also being integrated for a more immersive experience. These changes are expected to boost the eSports market growth.

REGIONAL INSIGHTS

Based on geography, the market is divided into North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further categorized into countries.

North America eSports Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America

North America accounted for the largest market share in 2024. The region has a significant number of online gamers that is expected to drive the market growth. The leading organizations in the region are Activision Blizzard, Inc., Riot Games, Inc., X1 Esports and Entertainment Ltd., and others. These companies are investing heavily in research & development activities to obtain a competitive edge and satisfy consumer needs. The U.S. market is projected to reach USD 149.8 billion by 2026.

- In July 2022, Twitch announced new security features for its platform. This included allowing streamers to customize who can "attack" them and share lists of banned accounts with other viewers. Both features were in response to the wave of hate attacks that had hit marginalized streamers over the past year.

Asia Pacific

Asia Pacific is likely to witness the highest CAGR over the forecast period. Countries including China, Japan, and India are anticipated to experience robust demand considering the rapid switch to digital platforms for entertainment through sports events. Similarly, South Korea is a potential market for the market players to expand their business considering the increasing number of gaming viewers. The vast opportunities for the gaming & entertainment industry in Asia Pacific have surged the demand for electronic sports. The Japan market is projected to reach USD 43.2 billion by 2026, the China market is projected to reach USD 44.6 billion by 2026, and the India market is projected to reach USD 36.4 billion by 2026.

The presence of a strong sports market across European countries is expected to create lucrative market expansion opportunities for electronic sports platform providers. Many fans are looking for new gaming platforms. Similarly, various stakeholders are significantly investing in this market in Europe owing to the growing audience for gaming and higher return on investment.

Europe

The UK market is projected to reach USD 31 billion by 2026, while the Germany market is projected to reach USD 39.2 billion by 2026.

South America has a significant population that is interested in sports. This is expected to fuel the market expansion. Considering the vast growth opportunities in the region, various brands and sports companies are investing in South American countries. For example, companies, such as Cooler Master and Logitech have collaborated with sports organizations of Argentina. These initiatives will fuel the market growth.

The government of Middle East & Africa is investing in sports to boost the sports industry as entertainment for people. For instance, the Government of Saudi Arabia committed to invest USD 3.3 billion in the gaming industry. Thus, the growing gaming industry is expected to boost the expansion opportunity for electronic sports in the Middle East & Africa market. Similarly, the pandemic has surged the demand for in-house entertainment that was catered through these platforms. Thus, the potential growth of these platforms in MEA grew significantly as various investors entered the market. For instance,

Key Industry Players

Key Players Emphasize on Innovative Electronic Sports Platforms to Reinforce their Market Positions

The market consists of a vibrant startup ecosystem. Many startups are expected to innovate their business processes and develop sports analysis solutions for end-users. Such an ecosystem is expected to create strong competition, prompting the existing companies to continually implement new technological advancements and update their product offerings. Therefore, rise in competition is expected to create more opportunities for the market participants and expand the market size.

List of Top eSports Companies:

- Twitch Interactive, Inc. (U.S.)

- Activision Blizzard, Inc. (U.S.)

- Tencent Holdings Limited (China)

- Riot Games, Inc. (U.S.)

- Gfinity plc (U.K.)

- X1 Esports and Entertainment Ltd. (U.S.)

- Loco (Stoughton Street Tech Labs Private Limited) (India)

- Caffeine (U.S.)

- DLive Entertainment Pte. Ltd. (U.S.)

- Sony Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Video editing SaaS provider, VideoVerse, announced the acquisition of Reely.ai, an AI-based content creator to boost its capabilities in delivering AI-powered content to its customers.

- April 2023: NODWIN Gaming announced the acquisition of 51% stakes of Branded, a Singaporean live media company. Through this acquisition, the company aims to expand its gaming and esports network across international sponsors.

- February 2023: Nvidia and Microsoft announced a partnership to bring Xbox PC games to the NVIDIA GeForce Now cloud gaming platform. This partnership enabled Microsoft to get more cloud games from Activision Blizzard titles, which are going to be streamed on NVIDIA GeForce.

- February 2023: Vodafone Idea entered a strategic partnership with Gamerji to expand in the esports space. The companies are offering gaming genres, such as cricket, action role, battle games, and more.

- January 2023: Xbox Canada announced its collaboration with Piadia, an enterprise led by women, to expand its product offerings by providing a women-centric electronic sports and gaming platform. The companies are focused on filling the gap of gender equality by offering a safe place to connect.

- June 2022: Sony Corporation acquired Repeat.gg, a platform provider for electronic sports tournaments, to expand its presence on PlayStation. The new expansion was expected to support gamer enthusiasm and competition.

REPORT COVERAGE

The research report on the market includes the study of key regions across the world to get a better knowledge of the industry. Furthermore, the report provides insights into the most recent industry trends and an analysis of technologies that are being quickly adopted at a global level. It also emphasizes on the growth-stimulating drivers and restrictions, allowing the reader to obtain a thorough understanding of the market

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 16.80% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Streaming Type

By Revenue Streaming

By Gaming Genre

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 2,617.90 million by 2034.

In 2025, the market stood at USD 649.4 million.

3. At what CAGR is the market projected to grow during the forecast period of 2025-2032?

By revenue streaming, the sponsorship segment is the fastest growing revenue streaming segment.

Rising popularity of video games is expected to spur the market growth.

Twitch Interactive, Inc., Activision Blizzard, Inc., Tencent Holdings Limited, Riot Games, Inc., Gfinity plc, Loco (Stoughton Street Tech Labs Private Limited), X1 Esports and Entertainment Ltd., Caffeine, DLive Entertainment Pte. Ltd., and Sony Group Corporation are the top players in the market.

North America is expected to hold the largest market share.

By streaming type, the video on-demand segment is expected to grow with the highest CAGR.

Below is the list of companies that are studied in order to estimate the market size and/or understanding the market ecosystem

This list does not necessarily mean that all the below companies are profiled in the report. The report includes profiles of only the top 10 players based on revenue/market share. Kindly refer to chapter 11 of the ToC

- Twitch Interactive, Inc.

- Activision Blizzard, Inc.

- Tencent Holdings Limited

- Riot Games, Inc.

- Gfinity plc

- X1 Esports and Entertainment Ltd.

- Loco (Stoughton Street Tech Labs Private Limited)

- Caffeine

- DLive Entertainment Pte. Ltd.

- Sony Group Corporation

- dailymotion

- GOODGAME STUDIOS

- younow

- glimpse.me

- FACEIT

- Logitech Services S.A. (streamlabs)

- Midnite

- Network Next, Inc.

- PandaScore

- BoomTV

- Community Gaming

- Psyonix LLC

- Rooter Sports Technologies Pvt. Ltd.

- BoomTV

- AfreecaTV Corp.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us