Agricultural Biologicals Market Size, Share & Industry Analysis, By Type (Biopesticides, Biostimulants, and Biofertilizers), By Source (Microbial and Biochemicals), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment, and Others), By Crop (Row Crops {, Cereals, Oilseeds, Fiber crops, and Pulses}, Fruits & Vegetables {Fruits and Vegetables}, Turf and Ornamentals, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

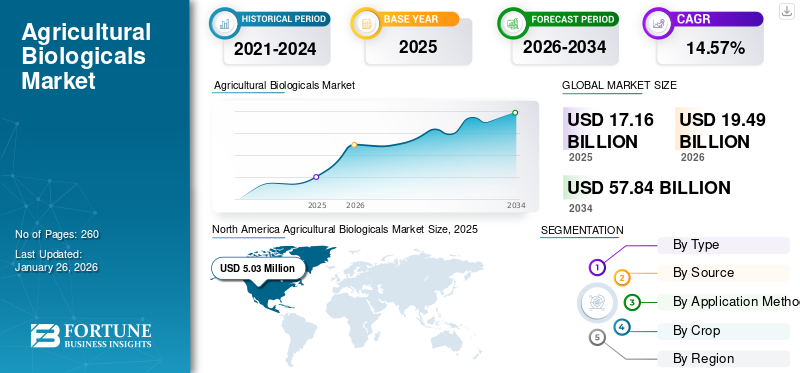

The global agricultural biologicals market size was valued at USD 17.16 billion in 2025 and is projected to grow from USD 19.49 billion in 2026 to USD 57.84 billion by 2034, exhibiting a CAGR of 14.57% during the forecast period. North America dominated the agricultural biologicals market with a market share of 31.80% in 2025.

The exploitation of the environment due to the overuse of crop protection chemicals is expected to foster the demand for biological products. These products can be applied solely or in combination with synthetic pest-resistant chemicals. Their widespread applications in agriculture are projected to boost the global market growth in the coming years. The demand for these products is increasing to meet the demand for pre and post-harvest management of crops as well. The commercialization aspect of the same can be further facilitated by adopting product innovation strategies, developing last-mile comprehensive service, and laying a strong foundation of effective marketing and distribution.

Furthermore, the manufacturers such as BASF SE, Bayer AG., Novozymes A/S, Syngenta AG, and UPL Ltd. among others are the key players in the agricultural biologicals industry. Growing focus on research and development of innovative product solutions is expected to support the market's steady growth.

Agricultural Biologicals Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 17.16 billion

- 2026 Market Size: USD 19.49 billion

- 2034 Forecast Market Size: USD 57.84 billion

- CAGR: 14.57% from 2026–2034

Market Share:

- North America dominated the agricultural biologicals market with a 31.80% share in 2025, driven by the increasing adoption of biopesticides, biofertilizers, and biostimulants for sustainable farming practices across the region. By type, biopesticides held the largest market share in 2024, supported by the growing focus on pest-resistant crops and advancements in organic farming methods.

Key Country Highlights:

- United States: The U.S. market reached USD 4.29 billion in 2025, driven by increasing acreage for field crops such as wheat, soybeans, and cotton. The Environmental Protection Agency’s initiatives to simplify biostimulant regulations and Yara’s launch of its YaraAmplix biostimulant portfolio in 2024 are supporting market growth.

- Germany: The market is projected to reach USD 0.76 billion in 2025, supported by the EU’s Farm to Fork policy aimed at reducing pesticide use by 50% by 2030 and the growing adoption of biopesticides for environmentally safe crop protection.

- France: France is expected to reach USD 0.83 billion in 2025, driven by increased government support for reducing chemical fertilizer dependency and growing investments in biocontrol product research and development.

- Italy: Italy’s market is estimated at USD 0.72 billion in 2025, fueled by rising demand for organic farming practices and consumer preference for residue-free agricultural products.

- China: China’s market is projected to reach USD 1.86 billion in 2025, supported by government initiatives promoting sustainable farming and advancements in microbial-based crop protection technologies.

- Japan: Japan’s market size is estimated at USD 0.68 billion in 2025, driven by the increasing use of biostimulants and microbial fertilizers to improve productivity while maintaining soil health.

- Brazil: Brazil’s market is projected at USD 2.54 billion in 2025, driven by the expansion of organic farming and increasing demand for eco-friendly pest management solutions.

- Israel: Israel’s market is forecast to grow at a CAGR of 12.87% during 2025–2032, supported by government policies encouraging sustainable agriculture and adoption of organic cultivation practices.

- Europe: The European market is anticipated to reach USD 5.03 billion in 2025, supported by the European Green Deal and national-level initiatives promoting the use of non-chemical crop protection solutions.

- Asia Pacific: The Asia Pacific market is estimated at USD 3.64 billion in 2025, led by China, India, and Japan, where governments are encouraging organic farming and reducing reliance on chemical pesticides.

MARKET DYNAMICS

MARKET DRIVERS

Ever-rising Demand for Organic Food to Play a Crucial Role in Product Demand

The global production of fruits, vegetables, and cereals is growing steadily. With the rise in disposable income in developed and emerging economies, the demand for high-quality fruits and vegetables is increasing rapidly. As per data provided by the FAOSTAT, the global production of fruits and vegetables reached 2.1 billion tons in 2023. Using such products helps improve soil fertility and increase microbial content by replenishing the population of microorganisms in the soil. Moreover, several agricultural crops had shown increased crop yield when biofertilizers were used.

MARKET RESTRAINTS

Lack of Well-Defined Regulatory Guidelines for Biologicals May Hamper Market Growth

A major restraint for the agricultural biologicals market growth is the vague nature and limited scope of regulatory systems across the world. The absence of international harmonization undermines the very purpose for which these governing bodies have been formed. The procedural delays in the registration and approvals of novel products are also inhibiting its effective growth. The market needs standardization of information that enables its organic growth and reduces the number of inconsistencies for manufacturers and producers. There is still no single, globally accepted definition for such products for legal, regulatory, or commercial purposes. For instance, the term “plant biostimulant” has been in use since the year 1997. Such factors had held the growth of the agricultural biologicals market.

MARKET OPPORTUNITIES

Growing push toward organic farming to Create Opportunity for Market Expansion

Government across the world are undertaking several policies (E.g. European Union farm to fork policy that aims to reduce pesticide consumption by 50% till 2030) and implementing them to reduce the farmer’s reliance on chemical pesticides and fertilizers. They are providing incentives to the farmers to grow organic crops thus creating a framework which supports transitioning of farmers to low residue agricultural inputs. As new technologies are constantly being developed, companies have the opportunity to develop products targeted toward such markets and develop new products. Companies can increase their market shares in respective categories by launching new product lines or expanding their current product lines.

BIOFERTILIZERS MARKET TRENDS

A Rise in Initiatives and Support by Government to Fuel Market Growth

Governments across the globe are increasingly acknowledging the negative impact of conventional pesticides. Biopesticides, with their natural origins and targeted action, offer a more sustainable alternative aligning with government goals for environmental protection. The product is regarded as safer compared to other conventional pesticides, and thus, in many countries, its registration requires less data and time. For instance, in India, the Central Insecticide Control Board and Registration Committee have developed simplified rules for the registration of biopesticides compared to chemical pesticides registrations in order to promote the use of biopesticides products in agriculture.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

Development in Organic Farming Escalated Biopesticides Segment Growth

By type, the market is divided into biopesticides, biostimulants, and biofertilizers.

To know how our report can help streamline your business, Speak to Analyst

The biopesticides segment is projected to dominate the agricultural biologicals market, accounting for 58.90% of the global market share in 2026, owing to the increasing focus of farmers and agriculturists on the development of pest-resistant products to increase the yield of high-quality crops. The advancements in organic farming and growing demand for eco-friendly products are further surging the demand for biopesticides across the globe. Moreover, the increasing interest of stakeholders in the agriculture industry in pest management and the adoption of a safer strategy to manage the pest population are some of the major factors driving the segment’s growth.

Biopesticides segment is expected to grow at a CAGR of 16.72% over the forecast period.

By Source

Growing Adoption among Farmers to Augment Microbial Segment Expansion

Based on source, the market is segmented into microbial and biochemicals.

The microbial segment is expected to lead the market, contributing 56.23% globally in 2026. The segment is anticipated to retain its dominance throughout the forecast period, owing to the increasing adoption of microbial by farmers to solve various major agricultural issues. These issues include protection of plants, maintenance of soil health, and increase in crop productivity. The increasing research on various microbes that have the potential to play significant roles in crop protection is further expected to boost the segment’s growth during the forecast period. In 2025, the segment is anticipated to dominate with 55.23% share. Microbial segment is expected to grow at a CAGR of 15.88% over the forecast period.

The biochemicals segment is also projected to grow steadily in the future. Biochemicals are agricultural inputs derived from biological sources, such as food, plants, trees, and biological waste. Thus, they serve as a good substitute for conventional chemicals and help reduce reliance on fossil fuels. Moreover, the use of biochemicals in agriculture can decrease carbon emissions and maintain the ecological balance, which is expected to pave the way for the segment’s growth.

By Application Method

Foliar Application Segment Held Larger Revenue Chunk Due to its Sufficient Potency to Increase Plant Growth and Productivity

In terms of application method, the market is divided into foliar spray, soil treatment, seed treatment, and others.

The foliar spray segment accounting for 64.34% of the global market share in 2026 due to the fact that applying them with foliar spray provides numerous agronomic benefits over others and is the most commonly used approach due to its simplicity. Furthermore, the increased adoption of foliar spray by large and small-size organic and conventional farmers is anticipated to help the segment grow. By application, the foliar segment held the share of 62.6% in 2024.

Seed treatment is set to flourish with a growth rate of 13.90% growth across the forecast period. The soil treatment segment is also observing substantial growth as the demand for effective soil treatment is growing due to the decrease in agricultural land available for crop cultivation.

[PWSFpmDuog]

By Crop

Row Crops Segment Exhibited a Majority Share Attributed to the Rising Demand for Organic Products

On the basis of crop, the market is segregated into fruits & vegetables, row crops, turf & ornamentals, and others.

The row crops segment which include cereals, oilseeds, fiber crops and pulses led in 2024 owing to a rise in consumer preference for less processed and organic foods. Pesticide residues are often substantially higher in these crops. As a result, grocery store chains and food marketers are under more pressure to compete on the basis of pesticide residue management. Moreover, farmers are looking for products, such as biologicals that can be utilized without increasing pesticide residue problems. Furthermore, the segment is set to hold 55.98% share in 2026.

The fruits & vegetables segment is also observing significant growth due to their growing consumption and health-promoting factors. The segment is projected to grow at a CAGR of 15.59% during the study period.

Agricultural Biologicals Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, South America, and Middle East & Africa.

NORTH AMERICA

North America Agricultural Biologicals Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for USD 5.46 billion in 2025. The growth of this market in the U.S. is predicted to be fueled due to several factors. These include the increasing acreage for field crops, such as wheat, cotton, and soybeans, and a worrying rise in plant diseases and infections. The U.S. Environmental Protection Agency has played a proactive role in recognizing the robust demand potential for biostimulants, and the agency is thus working in the direction of reducing the regulatory uncertainty, which will ultimately reduce the costs of bringing a product to market. The U.S. market reaching USD 4.85 billion by 2026.

- For instance November 2024, Yara launched its YaraAmplix biostimulant product portfolio in the U.S. and Canada market.

EUROPE

Europe is anticipated to witness a notable growth in the coming years. The Europe held a share in 2023 valuing at USD 3.94 billion and in 2024 with USD 4.46 billion. The growing prices of nitrogen and phosphorous-based chemical fertilizers and increasing awareness regarding their negative impacts on the environment and human health are accelerating the use of these products in the region. During the forecast period, European region is projected to record the growth rate of 14.03%, which is the third highest among all the regions and touch the valuation of USD 5.03 billion in 2025. This involves a regulatory approach to encourage the registration of biopesticide products and major investment for non-chemical crop protection research and development. The UK market reaching USD 0.29 billion by 2026 and the Germany market reaching USD 0.87 billion by 2026.

ASIA PACIFIC

After Europe, the market in Asia Pacific is estimated to reach USD 3.64 billion in 2025 and secure the position of third-largest region in the market. The governments in China, India, and other Asian countries are developing plans to encourage better and more efficient pesticide production and also encourage farmers to adopt such products to protect their crops. The Japan market reaching USD 0.26 billion by 2026, the China market reaching USD 2.16 billion by 2026, and the India market reaching USD 0.79 billion by 2026.

SOUTH AMERICA and MIDDLE EAST & AFRICA

Over the forecast period, South America and Middle East & Africa regions would witness a moderate growth in this marketspace. South America market in 2025 is set to record USD 2.54 billion as its valuation. Consumer demand for chemical-free products and rising agricultural operations in the region are driving the demand for biocontrol products in the region. In Middle East & Africa, Israel is set to grow at a CAGR of 12.87% during the forecast period. The increasing use of sustainable farming practices, along with favorable government policies and support for organic crop cultivation, are key factors influencing the growth of the market in this region.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Focus on Merger and Acquisitions and Collaboration to Compete in Market

The global market exhibits a moderately consolidated structure due to the presence of several well-established and emerging companies. The prominent companies hold a significant share in the market owing to their huge client base, strong brand loyalty & distribution network, and growing global food production. Prominent manufacturers such as Novozymes and Syngenta also focus on expanding their footprint by increasing their product development, investing in new product launches, and then installing new equipment to reduce carbon emissions. These players also collaborate and acquire regional and local brands to diversify their product portfolio. For instance, in 2024, Corteva invested in startup such as Puna Bio and Symbiotics which are key players in the biological solutions market.

LIST OF KEY AGRICULTURAL BIOLOGICALS COMPANIES PROFILED

- Bayer AG (Germany)

- BASF SE (Germany)

- Syngenta AG (Switzerland)

- UPL Limited (India)

- Marrone Bio Innovations (U.S.)

- SEIPASA S.A. (Spain)

- Koppert Biological Systems (Netherlands)

- PI Industries (India)

- Novozymes A/S (Denmark)

- Gowan Group (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: MustGrow Biologics Corp. launched three biological solutions using cutting edge technology in the Canadian market. Key products offered by the company includes EZ-Gro Max, EZ-Gro Cyto, and Rootella mycorrhizal inoculants.

- March 2025: European company Cultiva launched biostimulants “Parka” which received official registration under the European Union fertilizer regulation. This registration helped the company expand its product’s access to the European Union farmers.

- October 2023: Openeem Bioscience, a Brazil-based agrochemical start-up, launched "biobotanical matrix", a new biological product aimed at controlling agricultural pests and diseases. It has planned to launch its crop protection products by the year 2026.

- September 2023: Croda International, a U.K.-based company, introduced a new delivery system named Atlox BS-50, a ready-to-use microbe delivery system that helps reduce the final product development time and thus supports faster new product development.

- September 2023: FMC corporation launched a new biopesticide brand in Brazil named Biológicos da FMC. The new brand aims to improve productivity and adopt new modes of action for sustainable agriculture.

- August 2023: Bionema Group Ltd., a U.K.-based agricultural biologicals manufacturer, launched a new range of biofertilizer products that can be used in horticulture and agriculture crops, sports turf and other ornamental crops.

- May 2023: Nutrition Technologies, one of the leading Agtech companies, launched Diptia, a biofertilizer derived from insect frass. This new product helps reduce fungal plant disease and supports plant growth

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.57% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type · Biopesticides · Biostimulants · Biofertilizers |

|

By Source · Microbial · Biochemicals |

|

|

By Application Method · Foliar Spray · Soil Treatment · Seed Treatment · Others |

|

|

By Crop · Row Crops o Cereals o Oilseeds o Fiber crops o Pulses · Fruits & Vegetables o Fruits o Vegetables · Turf and Ornamentals · Others |

|

|

By Region North America (By Type, Source, Application Method, Crop Type, and Country)

Europe (By Type, Source, Application Method, Crop Type, and Country)

Asia Pacific (By Type, Source, Application Method, Crop Type, and Country)

South America (By Type, Source, Application Method, Crop Type, and Country)

Middle East and Africa (By Type, Source, Application Method, Crop Type and Country)

· Rest of the Middle East & Africa (By Application Method) |

Frequently Asked Questions

The global agricultural biologicals market size is projected to grow from USD 19.49 billion in 2026 to USD 57.84 billion by 2034, exhibiting a CAGR of 14.57% during the forecast period.

In 2025, the market value stood at USD 5.46 billion.

The market is expected to exhibit a CAGR of 14.57% during the forecast period of 2026-2034.

By type, the biopesticides segment led the global market in 2024.

The increase in the production of horticulture crops and cereal crops is one of the key factors driving the market growth.

BASF SE, Bayer AG., Novozymes A/S, Syngenta AG, and UPL Ltd. are a few of the key players in the market.

North America held the largest market share in 2024.

The rising adoption of integrated pest management practices for sustainable agriculture is becoming a prominent global trend.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us