Baby Apparel Market Size, Share & Industry Analysis, By Type (Top Wear, Bottom Wear, and Others), By Material (Cotton, Wool, and Others), By End-user (Girls and Boys), By Price (Economy and Premium), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores/Branded Stores, Department Stores, Online/E-commerce, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

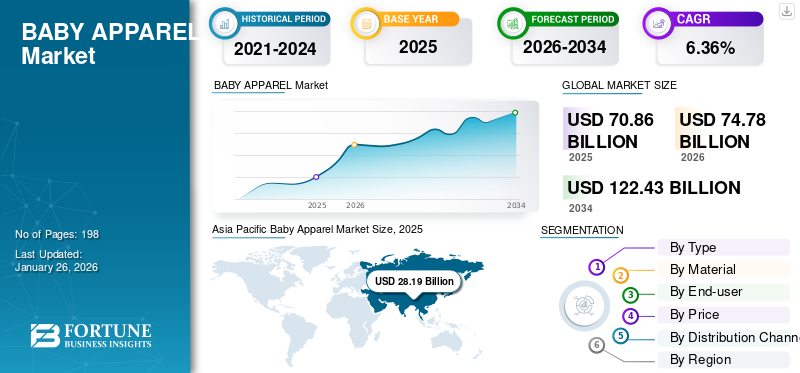

The global baby apparel market size was valued at USD 70.86 billion in 2025. The market is projected to grow from USD 74.78 billion in 2026 to USD 122.43 billion by 2034, exhibiting a CAGR of 6.36% during the forecast period. Asia Pacific dominated the baby apparel market with a market share of 39.78% in 2025.

Baby clothing is manufactured using cotton materials that are gentle and breathable, ensuring safety for the delicate organs and skin of infants while offering the utmost comfort. The trends in fashion and parents' preferences play an important role in selecting baby clothing, which is based on numerous considerations such as convenience, protection from toxic chemicals and dyes, and more.

Growing social media influence and changing fashion trends have strongly impacted the children's apparel and clothing industry. Modern-age parents are keen on clothing choices for their kids, thereby enhancing the demand for fashionable clothes. Furthermore, the adoption of online shopping among parents will further fuel market growth.

On the other hand, manufacturers such as Carter's, H&M, Nike, and others are promoting sustainable clothing worldwide. For instance, in April 2023, PatPat, the first children's clothing brand in the U.S., launched a new line of baby garments made from Naia cellulosic fibers, introducing them worldwide, ensuring that the rompers are both eco-friendly and soft on delicate baby skin. The PatPat Naia baby collection includes over 45 different romper designs suitable for newborns and toddlers. Therefore, sustainable kids' clothes are likely to have a positive impact on product consumption rates.

The COVID-19 pandemic led to the closure of retail stores owing to the restrictions on non-essential items, which, in turn, exhibited a negative impact on market growth. For instance, as per Q2 2020, results of the Children's Place Inc., one of the leading kids apparel companies, temporary store closures declined its overall sales revenue as the Children's Place had to close down about 98 stores out of its 102 stores in the first half of fiscal 2020. However, the company witnessed a 118.2% increase in its digital sales in Q2 2020, owing to shifting consumer preference toward online buying. Besides, strict lockdown restrictions imposed by governments, coupled with social distancing norms, further obstructed celebrations such as baby showers and naming ceremonies. Cancellations of such events decreased product demand, thus inhibiting baby apparel market growth.

GLOBAL BABY APPAREL MARKET SNAPSHOT

Market Size & Forecast:

- 2025 Market Size: USD 70.86 billion

- 2026 Market Size: USD 74.78 billion

- 2034 Forecast Market Size: USD 122.43 billion

- CAGR: 6.36% from 2026–2034

Market Share:

- Asia Pacific dominated the baby apparel market with a 39.78% share in 2025, driven by rising birth rates, growing middle-class incomes, and the expansion of e-commerce channels in countries like China and India.

- By type, the top wear segment (especially bodysuits) is expected to retain the largest market share due to convenience, easy diaper access, and increased demand for multifunctional clothing among new parents.

Key Country Highlights:

- China: Termination of the one-child policy and rising middle-class income boost baby clothing sales; second-largest global child population (UNICEF 2023).

- India: Expanding online retail platforms (e.g., FirstCry, Flipkart) and increasing urban birth rates drive market growth.

- United States: High demand for premium and organic baby apparel; Walmart’s 2023 launch of M + A by Monica + Andy showcases organic focus.

- UAE: Presence of premium brands like Dior and growing retail infrastructure are stimulating demand for high-end babywear.

- Europe: Demand for full-body nightwear and winter wear is strong due to seasonal climatic factors and rising purchasing power of working women.

Baby Apparel Market Trends

Bio-sensor based Baby Products Are Trending in the Marketplace

Smart baby apparel is gaining higher traction in the market, owing to its ability to detect various activities of an infant easily. Wearable smart clothing detects information from sensors attached to baby clothes, which can be transferred to the parents' smartphones so parents can keep a watch on their baby. For instance, in June 2019, the Nanit brand launched its Breathing Wear for babies with a fabric that is characterized by customized patterns. This engineered pattern can be read by the Nanit Plus camera that is connected to the smartphone, allowing parents to monitor the breathing motion of the baby easily. Therefore, technological developments are expected to boost product demand.

- Asia Pacific witnessed baby apparel market growth from USD 25.23 billion in 2023 to USD 26.59 billion in 2024.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Surging Birth Rate to Propel Product Demand Across the Globe

Developments in medical sciences have resulted in reduced infant mortality rates, which, in turn, have strongly supported product consumption. For instance, according to the World Health Organization, significant advancements have been achieved globally in decreasing childhood mortality since 1990. The worldwide count of deaths among children under five has fallen from 12.8 million in 1990 to 4.8 million in 2023. From 1990 to 2023, the global mortality rate for children under five has decreased by 59%, reducing from 93 deaths per 1,000 live births in 1990 to 37 in 2023.

Similarly, techniques such as in-vitro fertilization as well as surrogacy have helped parents overcome concerns of infertility and thereby have increased the number of newborns, positively impacting the market growth. Besides, infants up to the age of 24 months usually outgrow their sizes rapidly as compared to teenagers leading to frequent purchases of new clothes.

Greater Access to Fashion Products to Support Market Growth

Increasing access to apparel and accessories, coupled with the infrastructural development of retail stores in emerging economies, accelerates market expansion. For instance, in January 2025, Babyshop, a well-known brand under the Dubai-based Landmark Group and a reliable provider of children's essentials globally, made its official entry in India with its flagship outlet at Express Avenue Mall in Chennai. With over 50 years of experience, Babyshop runs over 250 stores across 14 countries, catering to more than 100 million families worldwide. This achievement signifies the start of Babyshop's journey in India, offering a legacy of reliability, quality, and care to parents in the country.

This, in turn, will expand the business across the globe. Besides, the increasing number of working women has increased their purchasing power, which has resulted in greater demand for designer clothes for toddlers. Social media trends, such as matching mother and baby clothing, along with the increasing trend for baby photoshoots, have further increased demand for new-age stylish baby garments.

Furthermore, a rise in the demand for branded baby apparel among consumers globally, along with changes in consumer lifestyle and growing disposable income, are the driving factors for the market growth. Manufacturers' rise in social media marketing is the key strategy adopted to attract a large consumer base in a short period. The wide availability of fashionable baby apparel in offline and online sales channels, such as Amazon, Flipkart, FirstCry, and others, will further drive the market growth. In addition, the introduction of new stores across the globe is giving rise to product demand. For instance, in August 2024, Brainbees Solutions Ltd., the parent company of FirstCry, aimed to launch 350 additional FirstCry stores over the next three years by utilizing funds from the upcoming initial public offering.

However, the easy availability of fashionable baby apparel made from natural and organic materials, such as organic cotton and hemp, will further propel the market growth.

Market Restraints

Leasing Practice of Baby Products to Hamper Market Growth

Increasing adoption of 're-commerce,' renting, or leasing practices of baby clothing across the globe is expected to affect the demand for new clothes and limit the market growth. Besides, strict regulations imposed by government authorities on the manufacturing of products for babies in terms of the use of chemicals are expected to pose a challenge to the players.

Market Opportunities

Growing Trend of Buying Kids Clothing of Sustainable Materials Create Growth Opportunities

Increasing parental populations’ preference for buying kids' clothing made of high-quality, skin-friendly, breathable, and sustainable materials creates new opportunities for the companies to expand sustainable apparel business worldwide. In addition, the growing trend of gift-giving breathable & skin-friendly material-based kids' clothing during baby showers and birthday celebrations favors product revenues globally.

Segmentation Analysis

By Type

Top Wear Segment to Dominate Owing to Greater Convenience Offered by Bodysuits

Based on type, the market is segmented into top wear, bottom wear, and others.

Top wear is further classified into tops/shirts, bodysuits, and others. The bodysuits segment is expected to hold a significant baby apparel market share during the forecast period as they are a convenient baby dressing option for parents in terms of diaper coverage and give them easy access to diaper changes. Similarly, these types of clothes are comfortable for babies and can be used as an ideal outfit for outside use. Girls usually tend to wear dresses/frocks contributing to greater demand for top wear. Besides, a wide variety of vests and jackets as winter wear further adds impetus to the top wear segment's growth, making it a dominant segment.

- The top wear segment is expected to hold a 51.91% share in 2026.

The bottom wear segment is further sub-segmented into trousers/leggings, skirts, and others. The trouser/legging segment is expected to hold a major share as these products are available as unisex products, whereas skirts are only used by baby girls. Besides, all-in-one suits or full-body suits are also gaining momentum in the market as they can effectively cover the whole body of the baby. In addition, consumers are more focused on stylish apparel and clothes for babies, owing to which manufacturers are more focused on producing designable, attractive, and convenient baby dresses.

To know how our report can help streamline your business, Speak to Analyst

By Material

Higher Material Softness makes Cotton Segment Dominant

Based on material, the market is segmented into cotton, wool, and others.

The cotton segment dominates the market share of 59.12% in 2026, due to its inherent softness, which is highly preferred in kids wear. The baby's skin is delicate and sensitive to external factors, and as the baby's apparel is in direct contact with the skin, it needs to be made up of soft materials. For instance, as per Cotton Council International and Cotton Incorporated's 2019 Global Childrenswear Study, about 85% of survey respondents said that cotton clothing is comfortable for their children.

Besides, trendy silk baby clothing, as well as woolen wear that is to be used in cold climatic conditions, are growing at a rapid rate, which is further expected to augment the baby clothing market growth. The wool segment is likely to grow with a CAGR of 5.42% during the forecast period (2025-2032).

By End-user

Boys Segment to Hold Major Share Due to Presence of a Greater Number of Newborn Boys

Based on end-user, the market is segmented into boys and girls.

The boys segment is expected to hold a major market share of 52.25% in 2026, as the number of boys born is greater than that of newborn girls across the globe, thereby exhibiting a greater need for baby boy's clothes. For instance, as per the data released by the United Nations Statistics Division under' World Population Prospects: The 2019 Revision', the sex ratio at birth is expected to be 1.06 male births per female birth worldwide, whereas it is expected to be 1.09 male births per female birth in Asia from 2020 to 2025. The boys segment is likely to grow with a CAGR of 5.69% during the forecast period (2025-2032).

However, the wide variety available in baby girl's apparel, such as one-piece dresses, skirts & skorts as well as divider skirts, among others, is likely to grow the girls segment rapidly over the forecast period. The girls segment is poised to gain 48% of the market share in 2025.

By Price

Economy Segment to Lead Due to Growing Demand for Affordable Apparel Products

Based on price, the market is bifurcated into economy and premium.

The economy segment is expected to hold the major share during the forecast period. Lower production cost greatly decreases the cost of each garment. This enables brands to provide more budget-friendly clothing while still sustaining their profit margins. Affordability is one of the important factors, especially in low and middle-income countries. Parents prioritize cheaper clothing options over premium ones. Additionally, platforms such as Instagram and Facebook have emerged as prominent channels for fashion trends, highlighting budget-friendly apparel and influencing the purchasing decisions of younger audiences.

However, in 2024, the premium segment held the largest share of the market and is projected to experience considerable growth at a significant CAGR during the forecast period. The growth of the premium segment in the baby apparel market is fueled by its unique designs, skilled craftsmanship, and superior quality, encompassing luxury and designer brands.

By Distribution Channel

Customized Services Provided by Physical Stores to Boost Demand for Hypermarket/Supermarket

Based on distribution channel, the market is segmented into supermarket/hypermarket, specialty stores/branded stores, department stores, online/e-commerce, and others.

A hypermarket/supermarket is expected to hold the major share as it offers a wide range of products and a "one-stop shop" experience. Customers prefer in-store shopping, especially in hypermarkets and supermarkets, due to the diverse product range, customer service, and shifting consumer desires for more convenient shopping experiences, driving segmental growth. For instance, in October 2024, in a survey conducted by X-hoppers in partnership with Sago, around 51% of consumers in the U.S. and U.K. preferred shopping in physical stores, with a stronger inclination observed among individuals over the age of 55.

However, the online/e-commerce sector is projected to experience significant growth during 2025-2032. Shopping online has simplified access for consumers to a diverse range of clothing, allowing them to shop from the ease of their homes, contributing to the market's expansion.

BABY APPAREL MARKET REGIONAL OUTLOOK

Geographically, the market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Baby Apparel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global baby apparel market with a valuation of USD 28.19 billion in 2025 and USD 30.03 billion in 2026, accounting for over 39.40% of global revenue. An increasing number of newborns in the region is likely to have a positive impact on product sales majorly in China, India, and Southeast Asia. In addition, increasing birth rates in these countries will encourage baby clothing manufacturers to invest more in these countries. China is poised to be valued at USD 11.01 billion in 2025. With the termination of a single-child policy in China that now allows a couple to have two children, China is expected to become one of the largest markets for baby apparel during the forecast period, owing to the increasing child population. For instance, according to the UNICEF (United Nations International Children's Emergency Fund) 2023 report, China has the second-largest child population globally (ages 0–17 years), with approximately 298 million children, comprising 158 million boys and 139 million girls (2020 Census). The demographic shifts in China are transforming its society in various ways and significantly influencing children and their families. The increasing middle-class population, coupled with the increasing standard of living in the region, is further expected to bolster the market growth of baby products. Additionally, the availability of apparel products in online distribution channels, such as Amazon, Flipkart, and others, will drive market growth. India is expected to stand at USD 8.25 billion in 2026, while Japan is poised to reach USD 4.25 billion in the same year.

- In China, the top wear segment is estimated to hold a 11.67% market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the second largest market, poised to be worth USD 18.48 billion in 2025. Increasing the purchasing power of working women in Europe is expected to support market growth in the region. The U.K. market is increasing, projected to reach a value of USD 3.18 billion in 2025. Moreover, increasing demand for full-body nightwear and winter wear owing to cold climatic conditions in the winter season in Europe, is driving the market growth. Germany is anticipated to hit USD 5.16 billion in 2026, while France is estimated to be valued at USD 2.68 billion in 2025.

North America

North America is the third largest market and is estimated to reach a market value of USD 12.97 billion in 2025. Higher spending on baby products in North America is projected to support market growth in the region. Increasing demand for organic baby products is driving the market. For instance, in February 2023, Walmart introduced a unique collection of soft, organic baby clothing called M + A by Monica + Andy, which is available on e-commerce sites and will be launched in 1,100 stores.

Additionally, higher consumption of premium and designer kids' wear in the region is expected to aid in greater revenue generation.

In the U.S., there is an increasing demand for advanced apparel products that prioritize comfort, allowing babies to stay comfortable. Furthermore, increasing partnerships and collaborations with retailers, suppliers, and online marketplaces help baby apparel brands reach new customer base, across the U.S. The U.S. market is poised to be valued at USD 11.63 billion in 2026.

South America and the Middle East & Africa

South America is the fourth leading region, projected to hit USD 7.60 billion in 2025. South America and the Middle East & Africa held a relatively lower market share. International brands are making efforts to grow their market presence in these untapped markets to expand their business. For instance, in May 2020, Christian Dior opened its virtual pop-up store in the UAE featuring various fashion products along with the baby apparel line 'Baby Dior' that is specifically designed for Ramadan in the UAE. Besides, improved apparel retail infrastructure facilities with increased access to baby products are expected to offer growth opportunities to players in these regions. The UAE market is expected to grow with a valuation of USD 468.96 million in 2025.

Key Industry Players

Highly Competitive Kidswear Industry to Support Development

The baby apparel industry is highly fragmented, which, in turn, is expected to increase competition between players. Therefore, key players are adopting strategies such as improvements in the supply chain as well as mergers and acquisitions to strengthen their foothold in the market. For instance, in April 2019, The Children's Place acquired Gymboree and Crazy 8 assets offering various kidswear. This is expected to expand the product portfolio of Children's Place.

Similarly, players are making efforts to attract new consumers by launching new product lines. For instance, in August 2020, H&M introduced its kidswear capsule collection, which is based on the famous Harry Potter film series. The collection includes tops, hoodies, trousers, dresses, and bodies, among others, for babies. Besides, an increasing number of local startups is further expected to bolster the global market growth.

LIST OF KEY BABY APPAREL COMPANIES PROFILED

- Carter's, Inc. (U.S.)

- Hennes & Mauritz AB (Sweden)

- Gerber Childrenswear LLC (U.S.)

- Cotton On Group (Australia)

- The Children's Place, Inc. (U.S.)

- Industria de Diseño Textil, S.A (Inditex) (Spain)

- Nike, Inc. (U.S.)

- Mothercare plc (U.K.)

- Gianni Versace S.r.l. (Italy)

- Burberry (U.K.)

KEY INDUSTRY DEVELOPMENTS

- January 2023: LVMH, also known as LVMH Moët Hennessy Louis Vuitton, launched its first baby apparel, shoes, and accessories collection. The collection will consist of a diversified range of apparel and accessories for babies from three to twelve months of age. This new collection launch will help enhance its product line.

- May 2023: Ed-a-Mamma announced the launch of its new baby collection, which focuses on the age group of 0-3 years. The collection consists of sets and standalone pieces such as denim, dresses with bloomers, bodysuits, caps, t-shirts, sleepsuits, and others.

- April 2022: H&M, Hennes & Mauritz AB, launched sustainable baby clothes that can be composted when worn out. The 12-piece collection for babies is made from organic cotton and consists of tops, bottoms, hats, and others.

- April 2021: Carter Inc., which deals in branded apparel designed specifically for babies, announced the launch of its recycling program, Kidcycle. The company's focus on sustainable products has increased with this program's launch.

- October 2020: Loulou LOLLIPOP launched its Fall 2020 Baby Apparel collection. It features bodysuits made with eco-friendly materials and Eco-Soft Technology.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as the competitive landscape, materials, and leading product types. Besides this, the report offers market insights and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.36% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Type

|

|

By Material

|

|

|

By End-user

|

|

|

By Price

|

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 70.86 billion in 2025 and is anticipated to reach USD 122.43 billion by 2034.

In 2025, the Asia Pacific market stood at USD 28.19 billion.

Growing at a CAGR of 6.36%, the market will exhibit a steady growth rate during the forecast period (2026-2034).

Top wear is expected to be the leading segment in this market during the forecast period

Increasing the number of births and increased access to baby products are major factors driving the growth of the market.

Carters, H&M, Inditex, and Nike are a few major players in the global market.

Asia Pacific dominated the baby apparel market with a market share of 39.78% in 2025.

Organic and bio-sensor based baby clothing is expected to drive adoption in the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us