Antioxidants Market Size, Share & Industry Analysis, By Type (Natural and Synthetic), By Application (Food & Feed Additive, Pharmaceutical & Personal Care Products, Fuel & Lubricant Additives, Plastic, Rubber, & Latex Additives, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

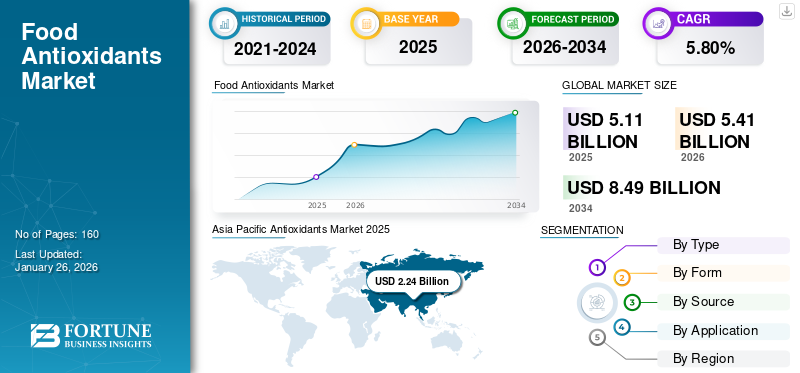

The global antioxidants market size was valued at USD 5.11 billion in 2025. The market is projected to grow from USD 5.41 billion in 2026 to USD 8.49 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. Asia Pacific dominated the antioxidants market with a market share of 43.89% in 2025.

Archer Daniels Midland Company, BASF SE, Givaudan, Kemin Industries Inc., and Koninklijke DSM N.V. are the front-runners in the industry. They are shaping the industry with their marketing strategies, including innovative antioxidant offerings, geographical expansion, and mergers & acquisitions.

Antioxidants are compounds that inhibit free radical formation by preventing the oxidation process, which may damage the cells of organisms. They can be obtained naturally from various fruits and vegetables, such as raspberries, spinach, and eggplant, or are artificially synthesized to be utilized as additives for numerous purposes. Other than their wide incorporation as preservatives in various processed food products, they are extensively used as a fuel, plastic, and latex additive. Along with this, it is also a vital ingredient in various pharmaceutical and cosmetic products. Furthermore, the rising global population, high demand for processed foods, and the surging growth in the pharma sector are some of the factors that would cumulatively aid in driving the global antioxidants market throughout the forecast period (2025-2032).

MARKET DYNAMICS

Market Drivers

Increasing Consumption of Processed Food to Propel Market Growth

Antioxidants are continuing to gain momentum in the food and beverage industry and are nowadays considered important additives. The growing awareness about several benefits of the additive in preventing chronic diseases, such as diabetes, among consumers has led to their wide utilization. The increasing demand for and consumption of processed foods, which widely contain antioxidant compounds, have influenced market growth. Their presence prevents oxidation and extends the shelf life of food products. The increasing working population and the fast-paced lifestyle of people have led to their surging reliance on processed foods. According to the United States Bureau of Labor Statistics, 2025, the working population in the U.S. accounted for nearly 60%.

Furthermore, functional foods are becoming more influential, with consumers demanding high-protein, nutritionally rich superfoods. These factors have encouraged manufacturers to develop innovative products and adopt new technologies. For instance, in December 2023, BASF SE, a global company, launched Irgastab® PUR 71, a cutting-edge antioxidant that improves regulatory compliance and performance for polyols and polyurethane foams.

Surging Urbanization & Increasing Global Meat Consumption to Spur Market Growth

Rising disposable income, growing population, and rapid urbanization have significantly fueled the demand for animal products in developing economies. According to the United Nations Department of Economic and Social Affairs data, nearly 55% of the world’s population lives in urban cities, and this figure is anticipated to reach 68% by 2050. Global meat consumption has constantly been increasing over the past 20 years, increasing by 58% to reach 360 million tons, of which 54% of this increase is attributed to population growth. While traditional meat preservation techniques, such as salting, drying, and smoking, are still in use, the sector has evolved toward multiple advanced methods, namely, novel thermal treatments and the addition of preservatives. This is expected to fuel the demand and sales of these compounds, which, in turn, will boost the global antioxidants market growth.

Market Restraints

Stringent Regulations on Food Additives to Hamper Market Performance

Various regulatory bodies closely monitor the food additives and preservatives content as they pose a public health risk. A few of the major threats are allergic responses and digestive disorders. To ensure maximum food safety, these regulatory bodies have laid down various norms about the dosage amount of preservatives used in food products. Long-term efforts are being made in terms of food standards, food legislation, and flood control systems to counter the additives over dosage and quality discrepancies. These regulations negatively impact new product approvals and industry operations, thereby hampering market growth.

Market Opportunities

Increasing Health Concerns to Present a Great Opportunity for Market Players

Increasing use of antioxidant additives across various applications, including food, supplements, animal feed, cosmetics, and others, is opening wider and ongoing market opportunities for key players in the industry. Increasing health concerns among consumers and growing awareness of the health benefits associated with antioxidants are likely to push product demand. Since product demand is continuously increasing, key players are focusing on strengthening their production capacities. This will assist them in meeting consumers' demand while also strengthening their geographical presence. For instance, in March 2025, BASF SE, one of the key ingredients manufacturers, invested in a new manufacturing site in Puebla, Mexico, to increase the capacity of aminic antioxidants for lubricants. The new plant is aimed at meeting the demand for antioxidant additives from the lubricant industry. Such developments will significantly contribute to the global antioxidants market growth during the forecast period.

Antioxidants Market Trends

Increasing Demand for Anti-aging Products is a Vital Market Trend

The growing demand for anti-aging products among consumers has gradually increased the utilization of these compounds in numerous cosmetic products. These products help protect human cells against any inflammatory and aging damage. They are incorporated into several personal care products, such as creams, conditioners, shampoos, body lotions, and others, to prevent them from spoilage and from turning rancid on exposure to oxygen. Some of the common antioxidant compounds used in cosmetics are vitamin A, vitamin C, butylated hydroxyanisole (BHA), and others. Europe is one of the key markets for cosmetic products. The steadily increasing demand for natural ingredients makes the region an attractive market for companies seeking to enter the segment and develop new and innovative natural ingredients for cosmetics & personal care products. According to the Soil Association indicated that the U.K.’s organic health & beauty market increased by 7.3% in 2024, doubling in size compared to the last 10 years.

Impact of COVID-19

The COVID-19 pandemic outbreak affected the global economy and various end-use industries. Governments imposed lockdowns and implemented social distancing norms, while many manufacturing facilities remained shut. The market’s supply chain was disrupted due to trade barriers and restricted public mobility, which negatively impacted product demand. However, antioxidants such as vitamins and N-acetylcysteine (NAC) positively help to improve consumers’ immunity and overall health. Furthermore, these compounds have proven immune-boosting, antiviral, antioxidant, and anti-inflammatory effects, which assist in overcoming viral infections. Thus, product demand has increased significantly during the pandemic period. Despite supply chain challenges, product sales experienced positive growth in the pandemic period.

SEGMENTATION ANALYSIS

By Type

Synthetic Segment Dominated due to Owing to its Wide Availability

The synthetic segment is projected to dominate the market with a share of 58.60% in 2026. Based on type, the market is segmented into natural and synthetic. The synthetic segment held the highest market share in 2024 due to its wide availability and lower costs. The product is chemically synthesized using various techniques and is extensively used in food, feed, fuel, and other industries. The four major types include butylated hydroxyanisole (BHA), butylated hydroxytoluene (BHT), propyl gallate (PG), and tert-butyl hydroquinone (TBHQ). The maximum permissible limit of synthetic compounds in food varies by region and by the type of food in which they are used.

The demand for natural antioxidant compounds is surging among consumers due to growing inclination toward safer and clean-label products. Although the natural antioxidants industry is relatively smaller than its synthetic counterpart, the increasing traction of clean-label products among consumers is likely to exhibit tremendous potential for natural antioxidants to emerge as a leading segment in the coming years.

To know how our report can help streamline your business, Speak to Analyst

By Form

High Shelf Stability Boosted the Dry Segment Growth

Based on form, the market is categorized into dry and liquid. The dry segment held the highest market share in 2024. It contains a higher concentration of antioxidants, which means that even a small serving may offer a higher dosage in end-use applications. Additionally, this form of the product can be easily stored for a longer time.

The liquid segment is anticipated to expand at the highest CAGR during the forecast period. The product is easy to consume and can be easily mixed with multiple applications, including food, cosmetics, supplements, and others.

By Source

Easy Accessibility and Affordability Encouraged the Petroleum-Derived Segment Expansion

Based on source, the global antioxidants market is segmented into fruits & vegetables, oils, spices & botanical extracts, and petroleum-derived products. The petroleum-derived segment dominated the market with the highest share in 2024. These products are generally more affordable to produce than natural alternatives. It assists in preventing oxidation and degradation in various applications, including fuels, lubricants, and polymers. Therefore, wide application areas, easy accessibility, and cost-effectiveness are driving the segment’s growth.

The spices & botanical extracts segment is expected to exhibit the highest growth rate during the forecast period. The increasing popularity of natural and clean-label ingredients in food, supplements, feeds, and cosmetics is likely to drive the spices and herbal extracts segment. Spices and botanical extracts can inhibit lipid oxidation and microbial growth, thereby extending the shelf life of food products and making them valuable for food preservation. Herbal extracts such as rosemary, oregano, thyme, sage, and peppermint are also available at a lower cost.

By Application

Plastic, Rubber & Latex Additives Segment Dominated due to their Rising Adoption

The Plastic, Rubber & Latex Additives segment is projected to dominate the market with a share of 31.98% in 2026. By application, the market is segmented into food & beverages, feed additives, pharmaceutical & personal care products, fuel & lubricant additives, plastic, rubber & latex additives, and others. The food & beverages segment is further subdivided into bakery, snacks, confectionery, oils & fats, baby formula, and others.

The plastic, rubber & latex additives segment held the highest market share due to their extensive utilization. These additives are added to plastic products to inhibit degradation caused by thermomechanical or thermooxidative conditions. They also enhance the appearance, strength, stiffness, and flexibility of the final product.

The food & beverages segment is anticipated to grow substantially and is poised to witness the highest CAGR due to the increasing demand for additives in various meat, poultry products, and animal food. These additives are added to food and feed to enhance their nutritional properties and maintain their flavor, freshness, and odor.

Antioxidants Market Regional Outlook

The global market report covers analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Antioxidants Market 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.24 billion in 2025 and USD 2.37 billion in 2026. Asia Pacific in 2024 held the largest antioxidants market share and stood at USD 1.83 billion. The region is showcasing significant growth, being one of the largest consumers of fuel. The rising consumer demand for healthy and natural products is likely to drive product usage in the food, dietary supplements, personal care, and cosmetics industries. Additionally, rising population growth and the growing demand for fuel from various end-use sectors, such as power generation industries and transportation, are likely to boost market growth. In addition to this, the region’s large processed food sector also helps in driving market expansion. The Japan market is expected to reach USD 0.50 billion by 2026, the China market is expected to reach USD 0.62 billion by 2026, and the India market is expected to reach USD 0.38 billion by 2026.

China is one of the key consumers of antioxidants in the global space. It is used in polymers, fuels, and lubricants to prevent degradation caused by oxidation. The country is one of the key producers of polymers and lubricants in the global space. According to the Quaker United Nations Office, China produced 65,500 kilotonnes in 2023. The country’s expanding industrial base and growing processed food industry will drive the product demand in the upcoming years.

Download Free sample to learn more about this report.

North America

North America is projected to witness significant growth in the market. The well-established food industry and the rapidly expanding defense and aerospace sector have propelled the regional market growth. Manufacturers are utilizing new advanced technologies for formulating antioxidant blends, further supporting expansion. Furthermore, the increased incorporation of the additive among plastic, latex, lubricant, and rubber industries, coupled with the existence of major players in the region, will influence growth. The U.S. market is expected to reach USD 0.49 billion by 2026.

U.S. is one of the leading market in the region and posing a lucrative growth opportunities for industry players in the upcoming years. Increasing demand for natural and clean-label ingredients in processed food prepacked meals is likely to drive the demand for the product in the U.S. Additionally, emerging health prevalence among individuals coupled with the rising awareness about natural antioxidants is boosting industry growth across the country.

Europe

Europe is expected to foresee considerable growth due to its well-established automotive sector and an increasing number of personal vehicles. According to the European Automobile Manufacturers Association, in 2023, the EU car market grew by nearly 13.9% growth compared to 2022, reaching a full-year volume of 10.5 million units. Additionally, the region is witnessing a surging demand for cosmetic products and is currently the largest cosmetic market, which will stimulate growth. The U.K. market is expected to reach USD 0.17 billion by 2026, while the Germany market is expected to reach USD 0.35 billion by 2026.

South America

South America is observing significant industrialization and development, paving the way for regional market expansion in the upcoming years. Countries such as Brazil and Argentina are experiencing strong industrial growth and an improvement in the standard of living. Increasing processed and packed foods are likely to contribute to the natural antioxidants product demand in the region.

Middle East & Africa

The increasing tourism sector and expanding food industry are key factors driving market growth in the Middle East. The surging strategic urbanization in Africa has influenced a rise in meat consumption in the region. Furthermore, the region’s huge livestock sector plays a crucial role in driving the market.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus on Expanding Production Capacity to Strengthen their Industry Presence

With several global key players capturing a significant share, the market is moderately consolidated in nature. Archer Daniels Midland Company, BASF SE, Givaudan, Kemin Industries Inc., Koninklijke DSM N.V., and ICC Industries Inc. (Frutarom Industries Ltd.) are some of the major players in the market.

These players are set to boost their market presence and expand their product portfolios. They are focusing on strategic alliances and expanding their production capabilities. For instance, in December 2019, BASF opened its antioxidant manufacturing plant in Shanghai, China, with a production capacity of 42,000 tons.

Key Players in the Antioxidants Market

|

Rank |

Company Name |

|

1 |

BASF SE |

|

2 |

Archer Daniels Midland Company |

|

3 |

Givaudan |

|

4 |

Kemin Industries Inc. |

|

5 |

Koninklijke DSM N.V. |

The Archer Daniels Midland Company, BASF SE, Givaudan, Kemin Industries Inc., and Koninklijke DSM N.V. are the leading companies in the market. The global market is moderately fragmented, with the top 5 players accounting for a limited portion of the global antioxidants market share.

List of Key Antioxidants Companies Profiled:

- BASF SE (Germany)

- ICC Industries Inc. (U.S.)

- Kemin Industries Inc. (U.S.)

- Archer Daniels Midland Company (U.S.)

- Barentz International BV (Netherlands)

- Kalsec, Inc. (U.S.)

- Eastman Chemical Company (U.S.)

- Camlin Fine Sciences Ltd. (India)

- Koninklijke DSM N.V. (Netherlands)

- Givaudan (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- May 2025: NYK Group, a Japanese company specializing in chemical R&D and producing chemicals, launched BioxiGuard, an antioxidant product specially developed for marine biodiesel fuel (“biofuel”). This product will be available from August.

- December 2024: Clean Fino-Chem, an Indian specialty chemicals manufacturing company, initiated commercial-scale production of Butylated Hydroxy Toluene (BHT), a widely used antioxidant in food, cosmetics, and industrial applications.

- September 2024: Syensqo, a Belgian company dedicated to producing materials and ingredients, launched Riza, a new brand offering rosemary-derived plant-based antioxidants and flavor products.

- February 2024: OZiva, an Indian clean-label and plant-based wellness brand, introduced its OZiva Bioactive Gluta Fizzy, an antioxidant formulated for skin care and to control skin cell damage.

- May 2022: BASF SE, a global company, doubled its production capacity in Singapore by opening an additional production line at its antioxidants plant on Jurong Island.

REPORT COVERAGE

The global market report analyzes in-depth market research and highlights crucial aspects such as global market trends, market dynamics, regional insights, prominent companies, and applications. Besides this, the market statistics report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentations |

By Type, Form, Source, Application, and Region |

|

Segmentation |

By Type

|

|

By Form

|

|

|

By Source

|

|

|

By Application

|

|

|

By Region North America (By Type, Form, Source, Application, and by Country)

Europe (By Type, Form, Source, Application, and by Country)

Asia Pacific (By Type, Form, Source, Application, and by Country)

South America (By Type, Form, Source, Application, and by Country)

Middle East and Africa (By Type, Form, Source, Application, and by Country)

|

Frequently Asked Questions

Fortune Business Insights says that the worldwide market stood at USD 5.11 billion in 2025.

At a CAGR of 5.80%, the global market will exhibit steady growth over the forecast period (2026-2034).

By source, the petroleum-derived segment led the market.

Asia Pacific held the largest market share in 2025.

Archer Daniels Midland Company, BASF SE, Givaudan, Kemin Industries Inc., and Koninklijke DSM N.V. are the leading companies in the market.

Increasing demand for anti-aging products is a key market trend.

The plastic, rubber, and latex additives segment is set to lead the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us