Knee Replacement Market Size, Share & Industry Analysis, By Procedure (Total Knee Arthroplasty, Partial Knee Arthroplasty, and Revision Arthroplasty) By Implant Type (Fixed Bearing, Mobile Bearing, and Others) End-user (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

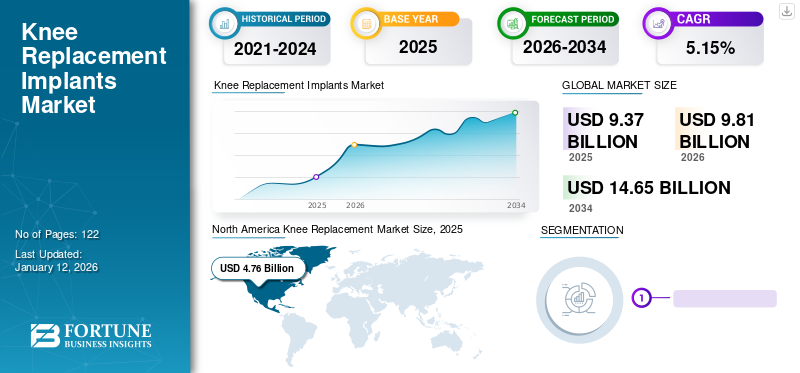

The global knee replacement market size was valued at USD 9.37 billion in 2025. The market is projected to grow from USD 9.81 billion in 2026 to USD 14.65 billion by 2034, exhibiting a CAGR of 5.15% during the forecast period. North America dominated the global market with a share of 50.75% in 2025.

The knee arthroplasty surgery removes the damaged tissues and cartilages from the knee joint and replaces it with an artificial knee implant. The demand for this procedure is likely to grow at a significant rate in the coming years with a dramatic increase in the prevalence of osteoarthritis and other knee diseases such as psoriatic arthritis and rheumatoid arthritis worldwide.

Based on a study conducted by the Arthritis Foundation, around 14 million people have symptomatic knee osteoarthritis in the U.S. Rise in the geriatric population and growing demand for minimally invasive surgical procedures are anticipated to propel the growth rate during the forthcoming years. According to the Agency for Healthcare Research and Quality (AHRQ), more than 600,000 knee replacement surgeries are performed in the United States every year. The younger generation with a high level of body mass index has also become another major factor in the enhancement of surgeries. The increase in healthcare expenditure and technological advancement in replacement surgeries for knee are likely to boost the market during the forecast period.

Significant Drop in Elective Procedures Amid COVID-19 Pandemic Turned to Lower Revenues

The world is struggling with COVID-19 pandemic resulting in a significant impact on the economy. Emerged from China and now covered all across the globe, the disease has disturbed the lives of people making them jobless, uncertain about the future, and new healthcare challenges than the usual ones. Leading players in the orthopedic world are experiencing a significant drop in the revenue evident from the quarterly financial reports. This is attributable to the ban on elective surgical procedures, the massive volume drops in knee replacement procedures, delaying the business deals, supply chain disruption, and the unwillingness of people to visit the healthcare facilities due to the fear of getting infected.

According to Centers for Medicare and Medicaid Services, non-urgent spine and orthopedic surgeries including hip and knee replacement are considered as non-urgent and are classified under Tier 2a and should be postponed.

Knee Replacement Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 9.37 billion

- 2026 Market Size: USD 9.81 billion

- 2034 Forecast Market Size: USD 14.65 billion

- CAGR: 5.0% from 2026–2034

Market Share:

- North America dominated the global knee replacement market with a 50.75% share in 2025, driven by high prevalence of osteoarthritis, a large geriatric population, advanced healthcare infrastructure, and favorable reimbursement policies.

- By procedure, Total Knee Arthroplasty held the largest share in 2024, propelled by rising geriatric patients and growing awareness and adoption of robot-assisted surgeries.

Key Country Highlights:

- Japan: Growing aging population and increasing adoption of minimally invasive and robotic surgical techniques are expected to drive demand for knee replacement procedures.

- United States: High incidence of knee osteoarthritis (about 14 million symptomatic cases), increasing number of surgeries (600,000+ annually), advanced implant technologies, and favorable insurance coverage contribute to market dominance. The Infrastructure Investment and Jobs Act supports growth in orthopedic surgery infrastructure.

- China: Rapidly growing prevalence of knee disorders, rising disposable incomes, flourishing medical tourism, and improving healthcare infrastructure fuel market growth.

- Europe: Rising chronic diseases, including diabetes and bone disorders, combined with innovative implant designs, strong distribution networks, and increasing knee replacement surgeries in EU5 countries drive market expansion.

LATEST TRENDS

Download Free sample to learn more about this report.

Rise in the Adoption of AI and Robotics in Surgical Procedures

An increase in the efficiency of surgical procedures with the use of advanced technologies such as the use of artificial intelligence (AI) and robotics has been observed with various studies. There is an increasing demand for these technology-based medical devices across the globe. AI helps surgeons to develop a very personalized surgical plan which analyzes each patient based on the dynamic motion of the knee. The rise in the research and development spending and increasing new product launch in robotics are likely to spur the market growth in the near future.

DRIVING FACTORS

Growing Prevalence of Knee Osteoarthritis to Drive the Market

An increase in the prevalence of knee osteoarthritis across the globe is one of the major factors likely to boost the demand for bone surgeries in the coming future. Rise in the diagnosis rate of knee arthritis among the adult population is projected to increase the demand for knee implants in the coming years. According to the Osteoarthritis Research Society International (OARSI), it has been reported that the prevalence of global knee osteoarthritis is likely to reach 5% and is projected to rise with the rise in the aging population.

The rapid increase in the aging population and the growing epidemics of obesity at a significant rate are likely to fuel the demand for knee replacement surgeries during the forecast period. According to the Arthritis Foundation, the annual incidence of knee osteoarthritis in the United States is highest between the age group 55 and 64 years old.

Technological Advancements to Enhance the Procedure Efficacy Attracting More Patients

Increasing awareness about the material innovations and designs of knee implants and robot-assisted knee surgeries are currently becoming the key trends impacting the sales of these products used in the replacement surgeries. Robot-assisted technology is promoting higher accuracy in procedures and has reduced the dependence of procedural outcomes on the surgeons. Also, several key players engaged in the market are offering more comprehensive knee implants with the addition of robotic surgery to their portfolio.

For instance, in 2016, Smith & Nephew acquired Blue Belt Holdings, Inc. to access the Navio Surgical System that offers robot-assistance in partial knee surgeries through CT- free navigation system and a handheld robotic bone shaping device. An increase in the demand for personalized knee implants and the entrance of new players in the market offering innovative knee implants are likely to upsurge the knee replacement market growth in the coming years.

RESTRAINING FACTORS

High cost of the Orthopedic Procedures and Limited Availability of Skilled Surgeons to Restrict Market

Knee replacement procedures are performed with us of implants that are engineered from precious metals with advanced technologies. Moreover, stringent regulations for approval of these products make these products costly. Developing regions with limited healthcare spending and lack of skilled surgeons has witnessed restricted entry of these products.

SEGMENTATION

By Procedure Analysis

To know how our report can help streamline your business, Speak to Analyst

Rise in Robot-Assisted Surgery to Contribute to Dominance of Total Knee Replacement Segment

Based on the procedure, the market segments include total knee arthroplasty, partial knee arthroplasty, and revision arthroplasty. Among them, the total knee arthroplasty segment held the largest knee replacement market share in the year 2024, and it is projected to expand at a considerably high CAGR during the forecast period. This is attributable to the rise in the geriatric patient population and an increase in the awareness about robot-assisted surgeries.

Revision arthroplasty segment is anticipated to be the fastest-growing sector owing to the growing revision knee procedures in total knee replacement procedures, technological developments in revision implants, and a shift of knee surgical procedures among younger patients. The partial knee arthroplasty segment is likely to expand at a considerable CAGR during the forecast period owing to the presence of key market players involved in the development of innovative partial knee implant.

Also, partial knee arthroplasty procedure involves the replacement of only the damaged knee bone which has boosted the demand for customized implants among patients. This will lead to an increased preference for partial knee arthroplasty among healthcare professionals in the forthcoming years.

By Implant Type Analysis

Fixed Bearing Implants Segment to Lead the Market Driven by High Advantages

Based on implant type, the market segments include fixed bearing, mobile bearing, and others such as medial pivotal implants and customized implants. Among them, the fixed bearing implants segment held the largest market share in the year 2024. Fixed bearing implants are long-lasting, provide good motion, and are a popular choice of implants. However, due to the superior range of motion provided, the demand for by mobile bearing implants has increased. The mobile bearing implant segment is projected to expand at a considerably high CAGR during the forecast period.

By End-user Analysis

Hospital Segment to Continue Its Dominance Throughout the Forecast Period

Based on end-user, the market has been categorized into hospitals, orthopedic clinics, ambulatory surgery centers, and others. Among them, the hospital segment captured a major share in the market. This is mainly due to the presence of advanced facilities and rising healthcare infrastructure in hospitals. The hospital segment is anticipated to continue its dominance in the forthcoming years. This is attributed to the rise in the number of orthopedic surgeries performed in the hospitals and the growing number of hospital visits by patients with orthopedic injuries.

The orthopedic clinic segment is projected to witness remarkable growth during the forecast period owing to the rise in the number of orthopedic clinics. Moreover, a growing number of orthopedic surgeries in ambulatory surgery centers is likely to augment the demand for replacement products of knees during the forecast period.

REGIONAL INSIGHTS

North America Knee Replacement Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The market size in North America stood at USD 4.76 billion in 2025. The U.S. market is projected to reach USD 4.52 billion by 2026. An increase in the number of patients diagnosed with osteoarthritis and a rising geriatric population are major factors likely to boost market growth in the region. In addition, the growing penetration of computer-aided implant designs, robot-assisted surgeries in the U.S., and a favorable reimbursement scenario are expected to propel the knee implant market during the forecast period.

Europe

Europe is likely to hold the second-largest market share after North America owing to the rise in the number of chronic diseases such as diabetes and the increasing prevalence of bone disorders. The UK market is projected to reach USD 0.22 billion by 2026, while the Germany market is projected to reach USD 0.54 billion by 2026. Innovations in implant material and design, the presence of leading players with strong distribution networks, and growing demand for knee replacement procedures are likely to fuel the knee implants market in EU5 countries by 2032.

The market in the Asia Pacific is likely to witness fast-paced growth during the forecast period, driven by increasing prevalence of knee disorders, flourishing medical tourism, rising disposable incomes, and gradually improving healthcare infrastructure. The Japan market is projected to reach USD 0.71 billion by 2026, the China market is projected to reach USD 0.61 billion by 2026, and the India market is projected to reach USD 0.14 billion by 2026.

Latin America and Middle East & Africa

Latin America and Middle East & Africa are likely to experience slower growth in the market owing to the lower number of orthopedic surgeons and slower income expansion. However, a growing number of orthopedic injuries and diseases, along with rising adoption of replacement procedures, are expected to drive the knee arthroplasty market in these regions during the forecast period.

KEY INDUSTRY PLAYERS

Strong Product Offerings by Key Players Are Likely to Propel the Knee Replacement Industry Growth

Zimmer Biomet, Stryker, DePuy Synthes Companies (Johnson & Johnson Services, Inc.), and Smith & Nephew are the leading players in the knee implants market with a strong brand presence combined with a wide range of product offerings. These players are likely to continue their dominance in knee arthroplasty area and generate significant revenue in the forthcoming years owing to the persistent investments in research and development for the launch of cost-effective and innovative knee implants.

Moreover, a strong focus on strategic partnerships with other players in the knee implants segment is likely to support the expansion of their footprints in the market.

Other players involved in the distribution and manufacturing of orthopedic implants with a considerable market share include Aesculap, Inc.– a B. Braun company, Medacta International, Conformis among others

LIST OF KEY COMPANIES PROFILED:

- Zimmer Biomet (Indiana, U.S.)

- Stryker (Michigan, U.S.)

- DePuy Synthes Companies (Johnson & Johnson Services, Inc.) (Indiana, U.S.)

- Smith & Nephew (London, U.K.)

- Aesculap, Inc.– a B. Braun company (Center Vally, USA)

- Medacta International (Castel San Pietro, Switzerland)

- MicroPort Scientific Corporation (Shanghai, China)

- Conformis (Massachusetts, U.S.)

- Other Prominent Players

KEY INDUSTRY DEVELOPMENTS:

- October 2019: Think Surgical Inc. announced that the U.S. Food and Drug Administration has granted clearance for it to market its TSolution One system for total knee replacement in the U.S.

- September 2017: Zimmer Biomet announced the launch of the Persona Partial Knee System, the latest addition to its portfolio of personalized and anatomically designed knee implant systems.

REPORT COVERAGE

The global knee replacement market research report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional industry analysis, and challenges. It further offers an analytical depiction of this market trends and estimations to illustrate the forthcoming investment pockets. The market research is quantitatively analyzed from 2019 to 2032 to provide the financial competency of the market. The information gathered in the report has been taken from several primary and secondary sources.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Procedure

|

|

By Implant Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

As per Fortune Business Insights study, the global knee replacement market is predicted to reach USD 14.65 billion by 2034.

In 2025, the market was valued at USD 9.37 billion.

The market is projected to grow at a CAGR of 5.15% during the forecast period (2026-2034)

Total knee arthroplasty is the leading segment in the market.

Rising prevalence of orthopedic diseases combined with increasing geriatric population, increasing awareness of advanced knee implants, and growing product launches are the key factors driving the growth of the market.

Zimmer Biomet, Stryker, DePuy Synthes Companies (Johnson & Johnson Services, Inc.), and Smith & Nephew, are the top players in the market.

North America is expected to hold the highest share in the market.

Hospitals and orthopedic clinics segments in the end-user category are expected to drive the adoption of the knee implants

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us