Orthopedic Implants Market Size, Share & Industry Analysis, By Product (Joint Reconstruction [Knee, Hip, and Extremities], Spinal Implants [Spinal Fusion Devices, and Spinal Non-fusion Devices], Trauma Implants, and Others), By Material (Metal Alloys, Polymers, Ceramics, Hybrid), By Procedure (Hip Arthroplasty, Knee Arthroplasty, Spinal Procedure, and Others), By End-user (Hospitals & Ambulatory Surgery Centers, and Orthopedic Clinics & Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

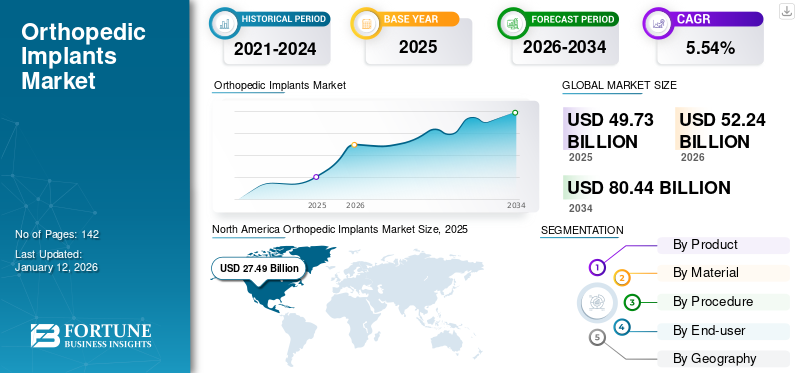

The global orthopedic implants market size was valued at USD 49.73 billion in 2025 and is anticipated to grow from USD 52.24 billion in 2026 to USD 80.44 billion by 2034, exhibiting a CAGR of 5.54% during the forecast period. North America dominated the orthopedic implants market with a market share of 55.28% in 2025.

Orthopedic implants are used to replace or support the bones or joints with an aim to reduce the pain and improve functionality. The growing burden of orthopedic disorders, along with increasing demand for effective orthopedic treatment options, is fueling the market growth. Geriatric population is more prone to such orthopedic disorders. Therefore, the rising geriatric population has also been fueling the demand for these implants.

- For instance, as per the data published by the World Health Organization (WHO) in 2024, the proportion of people 60 years old and above among the total population worldwide is expected to reach 22% in 2050, nearly doubling it from 2015, which was around 12%.

Moreover, market players such as Zimmer Biomet, DePuy Synthes (Johnson & Johnson Services, Inc.), Smith & Nephew, and Stryker have been focusing on the development and launch of technologically innovative products to strengthen their position in the market.

Market Dynamics

Market Drivers

Growing Geriatric Population Along With the Rising Burden of Orthopedic Disorders to Fuel the Market Growth

The growing geriatric population has been fueling the issue of orthopedic deformities such as fractures, arthritis, bone abnormalities, and others.

- For instance, according to the data published by the International Osteoporosis Foundation (IOF) in 2022, globally, around 8.9 million fractures occurred annually.

- Similarly, as per the data published by the World Health Organization (WHO) in October 2024, 1 out of 6 people will be aged 60 years and above by 2030. Additionally, the population of individuals aged 60 and above is expected to reach 2.1 billion by 2050.

The growing issue of orthopedic disorders in the geriatric population has been fueling the demand for orthopedic surgeries. Furthermore, favorable reimbursement scenarios for orthopedic procedures is also boosting the market growth.

- For instance, according to a report published by the Journal of Bone and Joint Surgery in 2021, the average reimbursement by the Medicare program for orthopedic procedures was reported to be 10.5% of the treatment cost. The increasing coverage offered to the patient population is contributing to the orthopedic implants market growth.

The increasing number of orthopedic procedures due to the growing burden of orthopedic disorders among the geriatric population, along with the favorable reimbursement policy, has been fueling the market growth.

Increasing Investment by the Market Players for the Development of Novel Products is Expected to Fuel the Market Growth

Growing competition and demand for bone implantations encourages major market players to invest in developing novel implants and focusing on customization.

- For instance, in January 2023, Trabtech, a medical technology company, announced a seed investment and research fund of around USD 1.4 million. The funding aimed to be used for research and development of new implants in the orthopedic and pediatric fields.

Market players have been focusing on the investment for the development of technologically advanced products, with an aim to increase the availability of technologically advanced products, thereby fueling the market growth.

Market Restraints

Limitations including High Cost of Orthopedic Implants is Restricting the Market Growth

The demand for the product is growing significantly due to the increasing number of orthopedic surgeries. However, there are certain side effects related to these implants that might occur post-surgery, such as implant rejection, septic arthritis, and osteomyelitis, caused due to bacteria Staphylococcus and allergies owing to metallic degradation. These side effects create health risks to the patient, leading to limited adoption of such devices.

- For instance, according to an article published by ShodhKosh in January 2024, high-risk adverse effects such as surgical site infection, discomfort, device failure, edema, and others, are limiting the utilization of implants among the patients’ population.

Due to such risk factors, patients prefer alternative treatment options, just as treatment through drugs.

Moreover, the high cost of the orthopedic procedure increases the total expenditure of the patients undergoing surgery. Higher cost, coupled with revision procedures to be conducted depending on the wear of the implant, may decrease the adoption of the implant, further impeding the market growth.

- For instance, according to a 2023 article published by the National Center for Biotechnology Information (NCBI), the total cost of knee replacement surgery ranges from USD 15,000 to USD 70,000.

Therefore, the risk factors associated with the use of implants, along with their high cost, are limiting their adoption, thereby deterring the overall market growth.

Market Opportunities

Increasing Focus of the Market Players on Expanding their Products in Emerging Countries Offers Opportunity for the Market Growth

Market players have been focusing on expanding their product availability in the middle and low-income countries. This, along with the improvement in the healthcare infrastructure in such countries, is expected to offer market growth opportunities.

Market Players’ Focus on Technological Innovations is Expected to Create Opportunities for Market Growth

Market players have been focusing on the adoption of advanced technologies for the development of more efficient and customized products. This is expected to fuel the market growth during the forecast period.

Market Challenges

Stringent Regulations Limit the Market Growth

Clinical trials with longer duration and stringent regulations delay the launch of new products. Moreover, complex approval cycles can delay new technologies including smart or personalized implants reaching markets.

Complex Manufacturing Processes Restricts the Market Growth

Development of implants with advanced materials such as bioactive ceramics, among others, requires a complex manufacturing process, which further acts as a challenge for the market’s growth.

Download Free sample to learn more about this report.

Orthopedic Implants Market Trends

Integration of Advanced Technology Including AI is an Emerging Market Trend

The demand for implants has been increasing due to the growing number of patients suffering from orthopedic disorders. In order to fulfill this demand, market players have been focusing on innovation in the products, which includes the launch of customized implants. With the emphasis on these innovations, market players aim at enabling orthopedic experts to use multiple approaches to fit an implant. Modernizations, such as portable navigation to guide the surgeon through the implantation, completely remote robot-assisted orthopedic surgery, and Artificial Intelligence (AI) powered guidance software assisting the surgical procedures is fueling the demand for various features associated with these products.

Moreover, integration of 3D printing in the production of specialized implants to develop a multi-layered composite implant is one of the primary market trends in producing these devices, with various key players investing in the technology.

- For instance, in March 2023, Curiteva, Inc. received FDA 510(k) approval for its Inspire 3D Porous PEEK HAFUSE Cervical Interbody System. It is a 3D printed PEEK implant manufactured by the company’s own Fused Filament Fabrication 3D printer.

- In March 2023, Invibio Biomaterial Solutions launched PEEK-OPTIMA AM filament, an implantable polyetheretherketone polymer, for the manufacturing of 3D-printed medical devices. The launch of these filaments is likely to support the manufacturing for these products in the market.

Furthermore, the increasing government initiatives toward manufacturing and the development of advanced devices such as implants is anticipated to support the uptake of such innovations, thereby fostering market growth.

SEGMENTATION ANALYSIS

By Product

Increase in Hip and Knee Procedures Aided in Joint Reconstruction Segment Growth

Based on product, the market is segmented into joint reconstruction, spinal implants, trauma implants, and others.

The joint reconstruction segment is projected to dominate the market with a share of 46.44% in 2026. Joint reconstruction is further sub-segmented into the knee, hip, and extremities. The growing number of hip and knee procedures globally is anticipated to support the segment's growth over the forecast period. The extremities segment is expected to register notable growth due to increased sports injuries, replacement surgeries of upper extremities, and ankle fractures.

The spinal segment is expected to grow significantly during the forecast period. The segment’s growth is attributed to the increasing number of spinal surgeries, which have been fueling the demand for spinal implants. The spinal implant segment is further sub-segmented into spinal fusion and non-fusion segments. Occupational hazards such as longer working hours have given rise to spinal conditions such as scoliosis and spondylitis. These conditions increase the demand for spinal procedures, thereby surging the uptake of spinal implants. The growing adoption and product launches by key market players are anticipated to drive the segment growth during the forecast period.

- For instance, in January 2024, Acelus, a medical technology company involved in expandable spinal implant technologies, launched a linesider modular-cortical system, which will be used in spinal implant surgeries among patients.

The trauma implants and other segments are anticipated to grow at the fastest CAGR during the forecast period due to the high demand for trauma implants, owing to the increasing number of road accidents and sporting injuries. The segment is anticipated to grow during the study period due to the increasing traffic mishaps leading to a higher demand for trauma implants.

To know how our report can help streamline your business, Speak to Analyst

By Material

Increase Use in Joint Reconstruction Contributes to the Dominance of Metal Alloy Segment

On the basis of material, the market is segmented into metal alloys, polymers, ceramics, and hybrids.

The metal alloys segment is expected to account for 31.05% of the market share in 2026. Out of the total orthopedic surgeries using implants, joint reconstruction is the major segment using implants. Metal alloy implants are mainly used in joint reconstruction. Therefore, the growing number of joint reconstruction surgeries contributes to the metal alloys segment dominance.

The polymers segment is expected to grow at the fastest CAGR during the forecast period. The segment’s growth is attributed to the increasing focus of the market players on expanding their production facilities and enhancing product portfolio for polymer implants.

- For instance, in February 2023, Victrex plc, through its subsidiary Invibio Biomaterial Solutions, announced the expansion of its manufacturing capability with the addition of medical devices R&D at its Lancashire, U.K., manufacturing site. With this development, the company aims to develope and launch its PEEK polymer implantable device.

By Procedure

Increase in Knee Surgeries Aided Growth of Knee Arthroplasty Segment

On the basis of procedure, the market is divided into Hip Arthroplasty, Knee Arthroplasty, Spinal Procedure, and Others

The knee arthroplasty segment is anticipated to hold a 30.69% market share in 2026. The segment’s dominance is attributed to the growing number of knee surgeries being conducted globally.

- For instance, as per the data published by the American Joint Replacement Registry, in the U.S., 254,345 total knee arthroplasties were conducted in 2023, experiencing a growth of 30.6% from the prior year.

Furthermore, the hip arthroplasty segment accounted for the second largest share in 2024. The segment’s growth is attributed to the growing burden of hip disorders and the growing focus of the market players on new product launches

By End-user

Increased Utilization of Orthopedic Implants by Hospitals & Ambulatory Surgery Centers Supports Segment’s Growth

Based on end-user, the market is segmented into hospitals & ambulatory surgery centers and orthopedic clinics & others.

The hospitals & ambulatory surgery centers segment is forecast to represent 56.25% of the total market share in 2026, capturing a significant share. The comprehensive reimbursement policies provided by large hospitals offering implantations are responsible for the segment's dominance. Moreover, initiatives by manufacturers to launch advanced products through partnerships with key hospitals and higher adoption of advanced implantation techniques, such as robot-assisted orthopedic surgeries, are anticipated to drive the segment's growth. Leading hospitals in the U.S., the U.K., and various other developed countries have installed robotic systems for orthopedic procedures, which plays a key role in attracting a large patient pool for treatment in these facilities.

- For instance, in March 2022, THINK Surgical announced a collaboration with Centennial Hills Hospitals Medical Center based in California, U.S., installing and supporting the TSolution One robot. The system is compatible with various choices of knee implants from multiple manufacturers with an open implant library.

The orthopedic clinics & others segment is expected to grow at fastest CAGR over the forecasted period. This is due to the increasing number of orthopedic experts establishing private practices along with novel implant procedures such as remote surgical implantations. This provides the capability for various experts to collaborate through private practice and is anticipated to support the growth of the orthopedic clinics & others segment. Moreover, key service providers collaborating to expand their presence and increasing demand for orthopedic surgeries are projected to foster the segment's growth.

- For instance, in April 2022, Spire Orthopedic Partners, a leading orthopedic clinic chain, partnered with Peabody, a Massachusetts-based Orthopedic Surgical Center and Sports Medicine. The partnership aims to expand its network of private practices operated by orthopedic surgeons individually in the U.S.

Furthermore, growing adoption of telemedicine during the pandemic for remote orthopedic consultations and scheduling of surgeries has provided opportunities for orthopedic clinics for improving awareness among the patient population.

Orthopedic Implants Market Regional Outlook

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Orthopedic Implants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market by generating USD 27.49 billion in 2025. The growing burden of orthopedic disorders such as osteoporosis and other bone-related disorders is fueling the cases of bone fractures. This factor is driving the demand for implants across the region. The U.S. market is projected to reach USD 26.28 billion by 2026.

- According to a 2021 article published by the National Center for Biotechnology Information (NCBI), about 1.5 million fractures occur due to osteoporosis each year in the U.S.

Additionally, advanced healthcare systems, favorable reimbursement frameworks, high patient awareness, and strong implant adoption, especially for joint replacements and minimally invasive surgeries, is boosting the market growth in the region. The market in the U.S. is growing significantly due to the rising emphasis of market players on partnerships and collaboration for the launch of innovative products with patient-centric customization.

- For instance, in March 2022, LimaCorporate S.p.A. announced a collaboration with OrthoCarolina Center in New York City, U.S., with successful implantations of ProMade, a patient-specific 3D printed implant. This development demonstrates the benefits of onsite development of implants combined with surgeons' expertise such as reducing the duration of the procedure and patient-specific customization of implants.

Europe

Europe accounted for the second-largest share in the global market. The surging patient population affected by arthritis, musculoskeletal diseases, and other bone disorders, alongside strategic initiatives by key industry players, such as mergers and acquisitions, in the region, are boosting the market growth. Moreover, diversifying product types combined with regulatory approvals for such products, adoption of robotics and minimally invasive implants, and solid public reimbursement policies across Germany, the U.K., and France are expected to augment the regional growth. The UK market is projected to reach USD 1.14 billion by 2026, while the Germany market is projected to reach USD 2.97 billion by 2026.

- For instance, in January 2023, Zimmer Biomet Holdings, Inc. entered into a definitive agreement to acquire Embody, Inc., a medical device company specialized in soft tissue healing. The acquisition aimed to expand the product portfolio of Zimmer Biomet Holdings, Inc. by acquiring core products of Embody Inc, such as TAPESTRY, a bio-integrative implant for tendon healing and TAPESTRY RC, an arthroscopic implant system.

- In December 2021, Bioretec Ltd., a developer of bioresorbable implants, applied to gain a CE certification for the RemeOs trauma screw to commercialize it in the European Union.

Asia Pacific

The Asia Pacific market is anticipated to grow at the fastest rate. An increase in the number of patients getting orthopedic treatments is due to advancements in bone scan diagnostics for determining bone density among diagnostic laboratories, better reimbursements by private and governmental institutions, and the development of healthcare infrastructure. This, coupled with favorable regulation by governments to support orthopedic procedures, is expected to enhance the market growth in Asian countries. The Japan market is projected to reach USD 2.99 billion by 2026, the China market is projected to reach USD 2.57 billion by 2026, and the India market is projected to reach USD 0.58 billion by 2026.

Latin America and Middle East & Africa

Moreover, the emphasis of market players on commercializing implants in these regions, along with improvement in the healthcare infrastructure, is fueling the market growth. Furthermore, the increasing trauma and joint replacement procedures is also fueling the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Market Players on New Product Launches is Fueling Market Players’ Revenue Growth

Key players, including Zimmer Biomet, DePuy Synthes (Johnson & Johnson Services, Inc.), Smith & Nephew, and Stryker, have consolidated the global market. The strong bone implant product portfolio and substantial expenditure in research and development to introduce technologically sophisticated implants are leading to these companies' dominance.

A well-established distribution channel and strategic partnerships with significant service providers to increase product reach propel market expansion. The major players are introducing technologically sophisticated items to obtain an advantage in the highly competitive business.

- For instance, in May 2023, Stryker launched the Ortho Q Guidance System with ortho guidance software, enabling advanced surgical planning and offering guidance for hip and knee procedures. The software can be easily controlled by the surgeon from the sterile field.

Moreover, the rise in the number of domestic market players focusing on developing customized implants is focusing on providing competitive pricing, which is further estimated to cater to the increasing needs among developing markets across the globe.

LIST OF KEY ORTHOPEDIC IMPLANTS COMPANIES PROFILED

- Zimmer Biomet (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Smith+Nephew (U.K.)

- Stryker (U.S.)

- Agilent Technologies, Inc. (U.S.)

- CONMED Corporation (U.S.)

- Medtronic (Ireland)

- DJO LLC. (U.S.)

- Exactech, Inc. (U.S.)

- Corin Group (U.K.)

- Conformis (U.S.)

- United Orthopedic Corporation (U.S.)

- Medacta International (Switzerland)

- Globus Medical (U.S.)

- B. Braun SE (Germany)

KEY INDUSTRY DEVELOPMENTS

- October 2024 – Smith+Nephew announced the launch of the LEGION Hinged Knee (HK) System in the U.S.

- September 2024 – Maxx Orthopedics, Inc. announced the U.S. Food and Drug Administration (FDA) approval of the Freedom Titan PCK revision knee system.

- September 2023 – Enovis completed the acquisition of LimaCorporate S.p.A, a privately held global orthopedic leader focused on restoring motion through an innovative portfolio of implant solutions.

- July 2023 – Smith+Nephew launched the REGENTEN bioinductive implant to cater to the growing demand for implants among patients suffering from rotator cuff repair in India.

- May 2023 – Zimmer Biomet launched a new cement-less knee product, the Persona Osseo Ti KEEL Tibia. This implant allows surgeons, during an operation, to decide if a procedure needs to be cemented based on the patient’s bone quality.

REPORT COVERAGE

The research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, products, and end-users. Besides this, it offers insights into the trends in the global market and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.54% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Material

|

|

|

By Procedure

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 49.73 billion in 2025 and is projected to reach USD 80.44 billion by 2034.

In 2025, the market size in North America was valued at USD 27.49 billion.

The market will record a CAGR of 5.54% during the forecast period.

By product, the joint reconstruction segment will lead the market.

Increasing geriatric population, prevalence of orthopedic diseases, and increasing investments in developing novel implants are key factors driving the market.

Zimmer Biomet, DePuy Synthes (Johnson & Johnson Services, Inc.), Smith & Nephew, and Stryker are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us