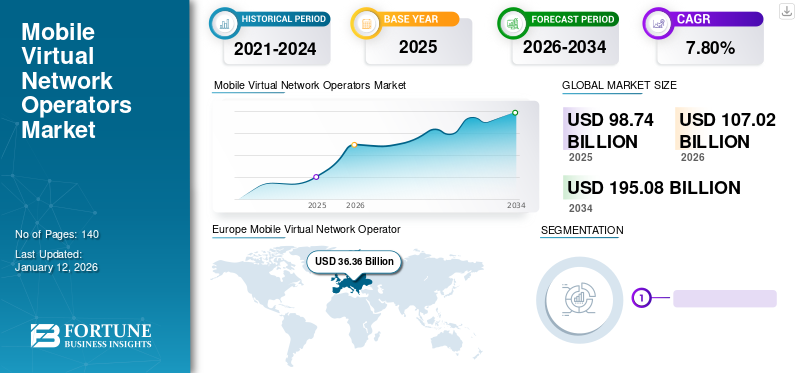

Mobile Virtual Network Operator (MVNO) Market Size, Share & COVID-19 Impact Analysis, By Operational Model (Reseller, Service Provider, and Full MVNO), By Service Type (Postpaid and Prepaid), By Subscriber (Business and Individual/Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global mobile virtual network operator (MVNO) market size was valued at USD 98.74 billion in 2025 and is projected to grow from USD 107.02 billion in 2026 to USD 195.08 billion by 2034, exhibiting a CAGR of 7.80% during the forecast period. Europe dominated the global mobile virtual network operator (MVNO) market with a share of 36.80% in 2025. Additionally, the U.S. mobile virtual network operator market is projected to grow significantly, reaching an estimated value of USD 49.72 billion by 2032.

A Mobile Virtual Network Operator (MVNO) is a wireless network service provider. It doesn’t retain the radio access spectrum nor the networking infrastructure but provides mobile services under its trademark name by leasing to utilize the networking services of a licensed mobile operator. These providers independently retail and brand their wireless services, which target a specific market and are supported by the new and existing consumer base.

This market is fragmented, highly competitive, and rapidly evolving. It is subjected to upgrading technology, ever-changing customer needs, and frequent releases of new products and services. The collaboration of the core business with telecom services opens up new business opportunities for companies, reduces communication costs, and ensures customer loyalty. For a parent operator, creating an MVNO enables it to expand business penetration, enhance its customer base, generate additional sources of income from infrastructure rental, and promote new services.

COVID-19 IMPACT

Increasing Requirement of Data Plans due to Virtualization and Remote Functioning to Enhance the Market Growth

The adverse effects of coronavirus impacted digital spending among industries around the globe. According to IDC, the overall technology spending in 2022 accounted for around USD 5.47 trillion. However, IDC also states that global IT spending is anticipated to decline by 2.7% due to COVID-19.

Furthermore, IDC states that global technology spending will decline by 1.6% and reach around USD 4.1 trillion. In contrast, telecom spending is likely to be impacted marginally. Moreover, the expenditure on Mobile Network Operator (MNO) and MVNOs technology is projected to increase soon.

Similarly, as enterprises shift toward a remote work environment, cloud-based solutions and increasing virtual conventions enable the workforce to collaborate and stay connected. These factors enhance the demand for the network brand and cellular plans, enabling organizations to support remote working and securely manage the data during the COVID-19 pandemic.

LATEST TRENDS

Download Free sample to learn more about this report.

Market Consolidation to be a Key Trend Prevailing in the Local Market

Market consolidation is expected to be a key trend occurring in three main ways; sub-brands being reabsorbed, strategic mergers & acquisitions to acquire customers, and market exits (with reabsorption of customers by MNOs or others).

Instead of rolling out new sub-brands, some MNOs are expected to rearrange their branding strategies and reabsorb their sub-brands. Some mobile network operators have benefited from the hosted virtual network operator going out of business by acquiring their consumer bases as direct consumers.

Growth through mergers & acquisition activities is another strategy open to ambitious Mobile Virtual Network Operator. Fixed line operators and cable operators are acquiring these service providers to extend their service offerings, wherein established MVNOs are buying competitors to upscale their customer database and transform their business models. For instance, in April 2022, Altice France signed an agreement to acquire Coriolis Telecom Inc., a prepaid and value mobile provider in France. Coriolis Telecom was acquired for USD 298 million, with an additional USD 117 million, and also manages a subscription base of 30,000 businesses and 500,000 consumers in the region.

DRIVING FACTORS

5G and Quick Adoption of Latest Wireless Technologies to Surge Demand for New Generation of MVNOs

5G is expected to boost a new era of connectivity, increasing efficiency, and new services across industries. Mobile network operators continue to hold a strong position in 5G deployment and future technology testing. According to the GSMA Intelligence Mobile Economy report 2022, 400 million emerging 5G subscribers are expected by 2025, with a majority of consumers emerging from Asia Pacific and Sub-Saharan Africa due to heavy investments from network operators and the wide range of 5G smartphones at varying prices. The report also states that at least 200 million people connected to internet for the first time in 2021, which is further categorized into 53% of internet users, 41% of covered users, and 6% non-covered.

The above factor illustrates the increasing penetration of 5G in the MVNO industry and the demand for cheaper 5G-supported mobile devices. These factors are likely to facilitate the Mobile Virtual Network Operator market growth in the long term.

RESTRAINING FACTORS

Increasing Competition among MNOs and MVNOs to Challenge the Market Growth

The fundamental problem faced by the MVNO is the lack of wireless infrastructure as they do not have the ownership of any spectrum allocation. Moreover, since the focus of these wireless providers is on the niche market segments, they must optimize the investment in the network infrastructure and management to maximize returns and reduce expenses. Therefore, the virtual network operators should utilize the MNO's wireless infrastructure to offer customer services by renting access to data and voice services. The dependency of Mobile Virtual Network Operator on the network provider restricts their ability to develop new services. It leads to increased competition with the MNOs in traditional market segments.

Customer breakdown becomes more difficult for these wireless providers due to rapidly changing requirements and increasing demand for feature-rich, multiple high-quality, and low-cost services. For instance, retail customers interested in M2M services demand low-price enhanced services such as location tracking and data mining. In the discount segment, customers focus on data services but frequently require real-time applications and high-quality voice. If the customers' dynamic requirements are not satisfied, they will likely switch to another service provider.

Thus, the above factors imply that long-term contracts with MNOs for networking infrastructure and dependency, and likely to limit the market growth.

SEGMENTATION

By Operational Model Analysis

To know how our report can help streamline your business, Speak to Analyst

Demand for Control on Networking Services and Independent Technological Platforms to Propel Market Growth

Based on operational model, the market is dist ributed into reseller, service provider, and full MVNO. Full MVNO segment dominates the market with contribution of 53.50% globally in 2026, of Mobile Virtual Network Operator and is expected to grow at the highest CAGR during the forecast period.

A reseller operates under its brand or co-brand with the MNO. It is responsible for branding, sales & distribution costs. It also shares the revenue with the MNO. Alternatively, the service provider does not own the radio spectrum infrastructure either. However, it maintains customer care and billing platforms. In this operational model, the virtual network operator has the potential to deploy a cellular card and can set prices independently of the prices set by the MNO. The MNO is responsible for the costs associated with the IT platforms and wholesale access rate structures.

Full MVNO can operate like a Mobile Network Operator (MNO). However, they don’t possess the ownership of the radio access network infrastructure. It is responsible for operations, data, and customers and has full authority over all the services and products offered by the mobile operator in the market. Numerous resellers and service providers’ mobile operators evolve their businesses to transform into full MVNOs and generate higher revenue and income. For instance, in December 2019, CoopVoce, a service provider MVNO in Italy, secured 1.5 million consumers. The company invested EUR 60 million to develop technology platforms to control its cellular services and transform into a full virtual network operator.

By Service Type Analysis

Increasing Demand for Pay-Per-Use Plans to Propel the Market toward Postpaid Plans

The market is divided into postpaid and prepaid based on service type. Postpaid data plans are projected to dominate the market with a share of 54.35% in 2026, of Mobile Virtual Network Operator and maintain a healthy CAGR during the forecast period.

Prepaid plans require users to pay for the services before the initiation, which does not entail a contract. Postpaid plans entail a contract and require users to pay for the services utilized over a month. Postpaid plans provide features such as lower data throttling and network deprioritization. The plans are also bundled with multiple perks, such as OTT subscriptions and vouchers, to appeal to consumers. Prepaid plans have disposable credibility and allow users to terminate their subscriptions without a contract.

According to a survey by Nielsens, most mobile smartphone users in developed regions such as the U.K., U.S., and Australia select contract-based cellular postpaid plans rather than prepaid services. Only 30% of feature phone users and 15% of smartphone users in the United States use prepaid cellular services. Thus, postpaid plans with beneficial contracts with network-embedded handsets, wireless data cards, and pay-per-use pricing models increase the demand for postpaid plans.

By Subscriber Analysis

Diverse Product Portfolio and Integration of Beneficial Functions to Enhance Business Growth

Based on subscriber, the market is divided into business and individual/residential with a share of 67.57% in 2026. Business based subscribers are set to dominate the market. as businesses deploy MVNO plans to standardize the operating models and implement business management functions such as funding requirements, market assessment, financial analysis, product differentiation, and market segmentation. Additionally, increasing the utilization of 5G is propelling the market toward growth.

Mobile Virtual Network Operator is suddenly receiving a boom in the telecom industry as it proved a successful business model for many innovative marketers in the last 5 years. Technological progress is one of the crucial factors in the communications industry, and mobile services are evolving for both the B2B and consumer markets. However, telecom industry enterprises prioritize individual and residential consumers due to increasing deployability, enhanced capabilities for sales, and an increasing consumer base. For instance, in December 2022, T-Mobile established its goals by serving more than 260 million users for ultra 5G capacity. The company also launched a 1900 MHz mid-band to enhance 5G speeds and deliver improved performance compared to competitors.

REGIONAL INSIGHTS

Europe Mobile Virtual Network Operator (MVNO) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Our research has evaluated the geographical aspect into five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

Europe

Europe is projected to dominate with the highest Mobile Virtual Network Operator market share owing to increasing mobile penetration and utilization of IoT devices. Europe dominated the global market in 2025, with a market size of USD 39.03 billion. For instance, the organization ‘MVNO Europe’ represents the interests of MVNOs active in European mobile and Internet of Things (IoT) markets, which negotiated toward the wholesale access to host MNOs networks. This organization aims to create a more accessible market for all virtual mobile operators, resulting in speedy growth and a high rise in the mobile communication sector. Currently, most European countries have deployed commercial 5G services, and approx. 2/3rd of the operators have launched 5G networks after looking at the spontaneous adoption rate. The UK market is projected to reach USD 6.96 billion by 2026, and the Germany market is projected to reach USD 6.81 billion by 2026.

North America

North America to emerge as the second leading region for market share in the global market. This market presence can be attributed to the headquarters of MVNO vendors such as Verizon Communications Inc., Comcast Corporation, DISH Network Corporation, and T-Mobile US Inc., among others, and substantial investments in cloud applications. These factors contribute to the growth of the market across the region. Mobile networks are one of the vital aspects of economic recovery and digital transformation across the North American region. For instance, in 2021, the U.S. Congress passed a bill for telecom infrastructure of USD 65 billion from federal funding to expand 5G connectivity and broadband access. Additionally, the Canadian government recently established USD 2.1 billion of the Universal Broadband Fund to support high-speed internet projects in developing regions. The U.S. market is projected to reach USD 28.72 billion by 2026.

South America

Leading countries from South America have made significant changes in their regulations, providing enormous opportunities for local and global service providers to introduce new services, capture major industry verticals, and generate regional revenue. Also, the communications regulators have gradually eliminated easy-to-access barriers for virtual network operators. The mobile market in South America is expected to register approx. 75% more mobile internet users compared to the previous decade. Further, the grey mobile has a strong presence in the SA market (19.6%) after Africa (21.3%), and government authorities partnering with device manufacturers are making substantial efforts to tackle such businesses that hamper the market growth in the region.

Middle East and Africa

The Middle East and Africa appears the fastest-growing regional market with highest CAGR, offering immense potential for market growth. MVNO licensing in the Middle East and Africa would benefit consumers and network operators. Furthermore, investors seek opportunities from consumer behaviors to adopt MVNOs as early as possible. For instance, during the pandemic, the GCC region witnessed 5 new licenses offered by telecom market regulators in 2 major markets.

Asia Pacific

The increased penetration of mobile devices and other technical aspects, such as 5G, bolsters the outline for MVNO services in the Asia Pacific region. Companies in the automotive industry, such as Audi, with 5G connected cars, and the logistics industry, are becoming part of these network operators to provide direct-to-consumer communication services, especially in rural regions, where traditional telecommunications do not reach. These players view communication services as an opportunity to generate revenue. The Japan market is projected to reach USD 3.77 billion by 2026, the China market is projected to reach USD 7.35 billion by 2026, and the India market is projected to reach USD 2.19 billion by 2026.

KEY INDUSTRY PLAYERS

Growing Partnership to Expand Market Opportunities for Key Players to Expand Business

Key players, such as Verizon Communications Inc., Comcast Corporation, Verizon Wireless, T-Mobile USA Inc., Google Fi (Google LLC), Freenet AG, and Lyca Mobile, are expanding global business through strategic collaborations and partnerships. MVNOs are collaborating with MNOs to provide dedicated network services to consumers. Furthermore, these players are also capitalizing on advanced infrastructure for implementing next-generation network operators.

List of the Key Companies Profiled:

- Verizon Communications Inc. (U.S.)

- Comcast Corporation (U.S.)

- FreeNet AG (Germany)

- AT&T Inc. (U.S.)

- T-Mobile USA Inc. (U.S.)

- Charter Communications Inc. (U.S.)

- Lyca Mobile (U.K.)

- Cricket Wireless LLC (U.S.)

- Alphabet Inc. (Google Fi) (U.S.)

- Republic Wireless (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 – T-Mobile partnered with Nextbase, which provides smart car dash-cams. The partnership enabled Nextbase to deploy IQ dash-cam with network connectivity, which featured over-the-air notifications, updates, and real-time video, among others.

- December 2022 – Charter announced plans to develop hybrid fiber/coax (HFC) plans over the network at USD 100 per neighborhood. The company plans to enhance multi-gig plans and build a mobile spectrum network, further improving its Wi-Fi network, deployment of CBRS spectrum, and its MVNO partnership with Verizon Wireless.

- December 2022 – Grover partnered with Gigs, which is a data-subscription telecom as a service platform provider, to launch their mobile virtual network operating services. The company also provides eSIM services in the U.S. and has entered European markets recently.

- January 2022 – World Health Energy Holdings (WHEN) Group announced the acquisition of CrossMobile, a licensed Mobile Virtual Network Operator in Poland. Considering the healthy market growth in the Europe region, this acquisition resulted in the deployment of network infrastructure and business growth of their cyber-security solutions, along with a large consumer base to enhance their businesses.

- March 2021 – DISH Network acquired Republic Wireless, which expanded the consumer base by 200,000 wireless users. This acquisition strengthened their telecom footprint and intentions for 5G deployment.

REPORT COVERAGE

An Infographic Representation of Mobile Virtual Network Operators Market

To get information on various segments, share your queries with us

Our study on this market delivers principal business insights on global regions to advance business assessments and decisions considering the market. Furthermore, the report offers crucial insights into the current market trends and industry developments as well as a comprehensive review of emergent technologies adopted worldwide. It also highlights the key growth-stimulating aspects and elements, which enables the reader to obtain an in-depth awareness of the market.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Operational Model, Service Type, Subscriber, and Region |

|

By Operational Model |

|

|

By Service Type |

|

|

By Subscriber |

|

|

By Region |

|

Frequently Asked Questions

The global market is projected to reach USD 195.08 billion by 2034.

In 2025, the market stood at USD 98.74 billion.

The market is projected to grow at a CAGR of 7.80% in the forecast period (2026-2034).

5G and quick adoption of latest wireless technologies to drive new generation of MVNOs.

Verizon Inc., FreeNet AG, Comcast Corporation, Charter Communications Inc., Lyca Mobile, and T-Mobile USA Inc. are the top players in the market.

Europe is expected to hold the highest market share.

By operational model, the full MVNO model is expected to grow with the highest CAGR in the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic