Motor Control Center Market Size, Share & Industry Analysis, By Voltage (Low Voltage, Medium Voltage), By Type (Conventional Motor, Smart Motor), By Component (Busbar, Circuit Breaker & Fuses, Relay, Variable Speed Drives, Others), By End-User (Oil & Gas, Iron & Steel, Minerals & Mining, Food & Beverage, Automotive, Commercial, Others), and Regional Forecasts, 2026-2034

Motor Control Center Market Size

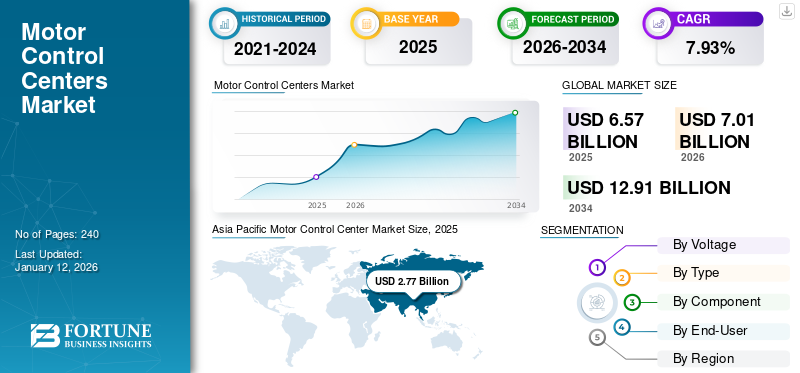

The global motor control center market size was valued at USD 6.57 billion in 2025. The market is projected to be worth USD 7.01 billion in 2026 and reach USD 12.91 billion by 2034, exhibiting a CAGR of 7.93% during the forecast period. Asia Pacific dominated the global market with a share of 42.13% in 2025.

A motor control center assembles one or more closed sections with a common power bus containing the motor control unit. It may contain variable frequency drives and programmable controllers and may be the entry point for electrical energy into the facility. This is a large enclosure specifically used to house standard motor control equipment. They are used in various industrial and commercial applications. The device is located in a separate climate control room to protect the engine control center from dust and corrosion. A motor control may also be located on the plant floor near the machines it controls.

The COVID-19 pandemic hampered the year-on-year growth of the market in 2020 as investments in many sectors have decreased globally. One of the leading contributors to the market is the oil & gas industry. Falling oil prices due to oversupply and declining demand negatively impact refineries, further stagnating their investments in advanced equipment. Even the automotive industry has taken a severe hit, and the consequences include a suspension of part exports from China, large-scale production shutdowns across Europe, and the closure of the U.S. assembly plants.

Motor Control Center Market Trends

Ongoing Trends in Industrial Automation are Driving Market Growth

Factors contributing to the global low-voltage motor control center market growth include the penetration of industrial automation in emerging markets, improved uptime of industrial equipment, and increased power generation capacity. Industrial automation has progressed gradually, with few changes in market configuration. But the speed of change is accelerating, thanks to technology disruptions and macro trends, such as reshoring, a global skilled labor shortage, and environmental, social, and governance (ESG) efforts. In an era of constant technological development, industrialization, urbanization, and improvements in existing industrial infrastructure have provided manufacturers of low-voltage motor control panels with significant opportunities for wider application. It is expected to support further growth of the motor control panel market.

Oil & gas refineries use low-voltage motor control centers to centrally control the electric motors that power various industrial processes such as pumps, production and processing, air compressors, and drilling. As a result, several global companies are adding new features to their low-voltage motor solutions to cover a wide range of applications. For example, Eaton Corporation launched Freedom 2100 Motor Control Centers (MCCs) with intelligent features that provide the most secure and efficient means of consolidating motor control and related controls as well as industrial communication and distribution equipment.

Download Free sample to learn more about this report.

Motor Control Center Market Growth Factors

Increasing Demand for Industrial Automation and Mechanization is Stimulating MCC Demand

Industrial development has increased the need for automation and mechanization of various industrial processes. The mechanization of various industrial processes requires many motors, and thus, MCC is required to control all of these motors. The MCC can plug in control components, which can be plugged in and out. This means there is no need to wire the device. The motor control center consists of busbars and other control equipment that can be used to control the motion of the motors and place the components in the integrated panel.

In the context of industrialization, automation is one step ahead of mechanization. Although mechanization has given human operators machines to assist with the muscular demands of work, automation greatly reduces the need for human sensory and mental demands. Automation will continue to be a key trend in 2023, and businesses will use it to reduce costs and speed up processes. Businesses can automate mundane tasks and free up employees for more meaningful tasks. Automation will also become a key factor in supply chain management and logistics, enabling faster and more efficient delivery of goods and services. Hence, increasing demand for industrial automation contributes to the growth of the market. In October 2023, Automation Direct added new SureServo2 servo systems that accept 460 Vac three-phase input power. With output power from 400 W to 15 kW, these 12 new perfectly matched sets of servo motors, drives, cables, and accessories have all the features of our existing SureServo2 servo systems.

Increasing Demand for Intelligent Motor Control Centers is Revitalizing the Growth of the Market

A motor control monitors and controls the operation of a series of electrical loads. When integrated with communications and smart devices, these devices become intelligent and provide actionable insight into your energy system. Intelligent control centers are utilized by engineers, Original Equipment Manufacturers (OEMs), contractors, and facility and maintenance managers to expedite project schedules, minimize expenses, improve workforce efficiency, and obtain essential knowledge about plant operations. With the inclusion of communication capabilities, real-time and historical power system data and remote access to motor control center information, a new level of building and process monitoring is achieved, directly impacting the overall profitability. An intelligent MCC is connected to the network.

According to the National Electrical Manufacturers Association (NEMA), a network-enabled motor control includes devices with ports or jacks that connect directly to a network via a network cable or wireless connection, on which nodes form a group of nodes. Industrial communication networks must be robust, reliable, and capable of connecting to various platforms. Intelligent MCCs that offer the safest and most effective method for grouping motor control and associated control, as well as industrial communications and distribution equipment, are actively participating in the market. For Instance, in October 2023, Toshiba Electronic Devices & Storage Corporation launched two 600V small intelligent power devices (IPD) products for brushless DC motor drive applications like air conditioners, air cleaners, and pumps. Volume shipments of “TPD4163K” and “TPD4164K,” which have output current (DC) ratings of 1A & 2A, respectively.

RESTRAINING FACTORS

Global Fall in Crude Oil Prices Leading to Stagnancy in Investment from the Oil & Gas Industry

The oil & gas industry is one of the main end-user sectors of the global market. The severe fall in crude oil prices is majorly due to concerns about a weakening global economy and recession fears deterring energy demand. However, the recent drop in crude oil prices has decreased capital budgets, resulting in lower demand for industrial equipment. While global oil supplies are dwindling, many oil traders believe demand is declining even faster due to economic slowdowns in various countries. Such downturns usually cause a significant reduction in oil and petroleum product consumption. Additionally, higher gasoline stockpiles and a recent rate hike by the European central bank have impacted current crude oil prices.

The industry is working toward optimizing operations and using fewer resources to cope with the current oil price environment. The ongoing issues in China and Europe contribute to the decline in oil and gas prices in the U.S., resulting in reduced investments in the oil & gas industry, which is expected to constrain the global market.

Motor Control Center Market Segmentation Analysis

By Voltage Analysis

Rising Demand for Low Voltage Motor Control Centers to Dominate the Market

Based on voltage, the market is segmented into low voltage and medium voltage. Due to the extensive use of low voltage motor control in various industries, the low voltage segment currently dominates the market with a share of 66.33% in 2026. These low voltage control centers are being implemented on a large scale in various industries, including paper and pulp, iron and steel, metal and mining, and food and beverage. The demand for medium voltage motor control centers is increasing day by day.

By Type Analysis

Smart Motors Dominate the Global Market Due to Their Advantage over Conventional Motor

The market is segmented into conventional motor and smart motor based on type contributing 69.92% globally in 2026. The smart motor segment dominates the market due to its advantage over conventional motors. Various functions are integrated into a single intelligent device, minimizing the components required. Hence it is leading the global market. The smart motor segment is also gaining share through improved safety, diagnostics, increased availability, microprocessor-based control, and networking technology replacing hard wiring. Therefore, increasing demand for smart motors due to their technical advantages will surge their demand in the global market.

By Component Analysis

Circuit Breaker & Fuses Segment Due to its Growing Use to Catalyze Market Growth

The market is segmented based on components into busbar, relay, circuit breakers & fuses, relay, variable speed drives, and others with a share of 23.25% in 2026. Due to the growing use of these centers for switchgear components as safety measures, the circuit breaker & fuses segment dominates the market. As it is necessary to control the speed of the motor and improve its performance in homes, offices, shops, and industrial facilities, the variable speed drives segment is also gaining market share. The market is expanding due to the relay segment and other components such as soft starter pushbuttons, power disconnects, and selector switches.

By End-User Analysis

Immensely Growing Oil & Gas Sector to Stimulate Market Growth

Based on end-user, the market is segmented into oil & gas, iron & steel, minerals & mining, food & beverage, automotive, commercial, and others with a share of 26.89% in 2026. The oil & gas segment is estimated to hold the largest market share due to its extensive use in the petroleum industry to power processes and utilities. The minerals & mining segment holds the second largest market share due to the increasing industry acceptance of these centers that manage and monitor mining operations. The automotive market segment drives the demand due to increasing usage of busbars, circuit breakers, and other electrical components, which is expected to drive the global motor control center market share in the automotive industry.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, by region.

Asia Pacific Motor Control Center Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Among all regions, the Asia Pacific holds the largest motor control center market share. It is expected to maintain a steady growth rate. The growth of the market in the region can be attributed to strong economic growth and government-supportive policies to accelerate the industrialization of the region.The Japan market is projected to reach USD 0.24 billion by 2026, the China market is projected to reach USD 1.61 billion by 2026, and the India market is projected to reach USD 0.36 billion by 2026.

North America's expanding oil & gas industry uses electrical switchgear and components to power process industries and utilities. Many steel, minerals, and mining industries use these centers to improve operational efficiency and add significant value to their markets. Europe will dominate the market in future due to expanding industrial infrastructure and increased investment in energy suppliers.The United States market is projected to reach USD 1.22 billion by 2026.

Countries in the Middle East & Africa are largely dominated by oil & gas companies that need reliable power supplies. Companies that operate oil and gas facilities and energy suppliers focus on controlling their power plants and processes from a central location. African countries primarily focus on industrial infrastructure developments that offer a positive outlook for market growth during the forecast period.

Key Industry Players

Key Participants are Intent on Expanding their Product Capabilities and New Product Development

The global market comprises a few global and small & medium-scale players. New product development has been the major strategy adopted by major players in the market. Apart from that, collaboration is another major strategy utilized by key players in the global market such as ABB and Siemens. Other major players include Mitsubishi Electric, Rockwell Automation, Schneider Electric, Fuji Electric Co. Ltd., Powell, WEG, Eaton, and Ingeteam S.A.

List of Top Motor Control Center Companies:

- ABB (Switzerland)

- Mitsubishi Electric (Japan)

- Siemens (Germany)

- Schneider Electric (France)

- WEG (U.S.)

- Fuji Electric Co., Ltd. (Japan)

- Powell (U.S.)

- Rockwell Automation (U.S.)

- Eaton (Ireland)

- Marine Electricals (India)

- Ingeteam S.A. (Spain)

KEY INDUSTRY DEVELOPMENTS:

- December 2023 - Renesas Electronics Corporation (TSE:6723), a foremost supplier of advanced semiconductor solutions, introduced a family of motor driver ICs for brushless DC (BLDC) motor applications today. These devices implement Renesas’ new, patent-pending technologies that enable full torque from motors without sensors at zero speed, an industry first.

- June 2023 - Amrita Hospital Faridabad launched India’s first Human Motor Control Centre dedicated to patients with neurological disorders. The specialized centre, the first in the country, is specifically planned for the treatment of patients battling various neurological conditions, including Parkinsonism, hyperkinetic movements, epilepsy, and functional neurological disorders.

- November 2022 - Rockwell Automation, Inc. announced the completion of its planned acquisition of CUBIC, a company specializing in modular systems for producing electrical panels. CUBIC, established in 1973, serves the fastest-growing industries such as renewable energy, infrastructure, and data centers. This acquisition is likely to strengthen Rockwell's motor control portfolio.

- August 2022 - ABB announced that it agreed to acquire Siemens' low voltage NEMA motor division. This acquisition provides a highly regarded product portfolio, a devoted North American customer base, and experienced operations, sales, and management team with manufacturing operations in Mexico.

- July 2022 - Siemens Industry Inc. launched combination motor/drive packages, allowing OEMs and end-users to choose the best solution for a wide range of heavy-duty industrial motion control applications from a single source with a three-year warranty.

REPORT COVERAGE

The research report presents a comprehensive industry assessment by offering valuable insights, facts, industry-related information, competitive landscape, and historical data. Several methodologies and approaches are adopted to make meaningful assumptions and views to formulate the global market analysis.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.93% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Voltage

|

|

By Type

|

|

|

By Component

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 6.57 billion in 2025.

The global market is projected to grow at a CAGR of 7.93% over the forecast period.

The market size of Asia Pacific stood at USD 2.77 billion in 2025.

Based on end-user, the oil & gas segment holds the dominant share in the global market.

The global market size is expected to reach USD 12.91 billion by 2034.

The key market driver is the increasing demand for industrial automation, mechanization, and intelligent motor control centers.

The top players in the market are ABB, Siemens, Eaton, and Fuji Electric Co., Ltd., among others.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us