Outdoor Power Equipment (OPE) Market Size, Share & Industry Analysis, By Type (Lawn Mowers {Walk-behind Mowers, ZTR Mowers, Riding Mower, Robotic Mower, and Lawn & Garden Tractor}, Trimmers {Hedge Trimmer, Brush Cutter & Trimmer, Edge Trimmer/Edger, and Others}, Blowers {Snow Blower and Leaf Blower}, Chainsaw, Pressure Washer, Tillers & Cultivators, and Others), By Power Source (Gasoline Powered, Battery Powered, and Electric Motor/Corded), By Sales Channel (E-commerce and Direct Purchase), By Application (Residential/DIY and Commercial), and Regional Forecast, 2026-2034

Outdoor Power Equipment Market Size

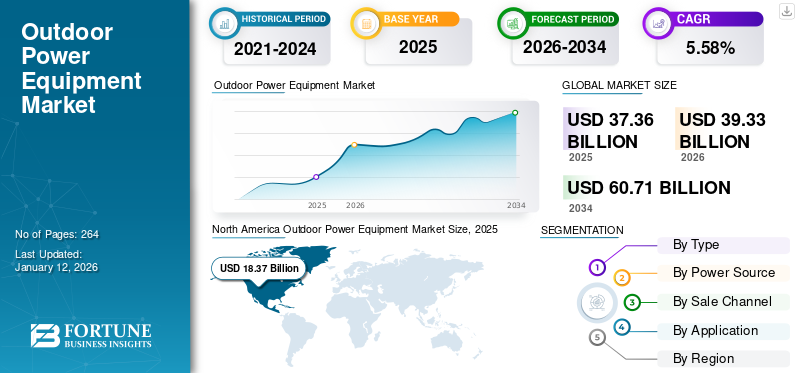

The global Outdoor Power Equipment (OPE) market size was valued at USD 37.36 billion in 2025. The market is projected to grow from USD 39.33 billion in 2026 to USD 60.71 billion by 2034, exhibiting a CAGR of 5.58% during the forecast period. North America dominated the global outdoor power equipment market with a share of 49.16% in 2025.

The outdoor power equipment market in the U.S. is projected to grow significantly, reaching an estimated value of USD 24.94 billion by 2032, driven by the rising demand for battery-powered equipment for landscaping and gardening services.

Outdoor Power Equipment consist of small motors or engines primarily used for exterior service. The residential and commercial users use OPE for various tasks such as landscaping and maintaining lawns, gardens, and golf courses. The equipment is powered by a gasoline engine, electric unit, or batteries and is strong and effective, which is used more frequently. Moreover, the rising urbanization has required smart cities and infrastructure, leading to the demand for OPE for construction activities.

The global impact of the COVID-19 pandemic has shaken the world and affected various industry verticals due to travel restrictions and lockdown rules. However, this industry witnessed a buoyant demand for OPE despite the ongoing pandemic and continued positive activity in 2021. Factors, such as sales through e-commerce websites specifically for residential or DIY consumers boosted outdoor equipment sales. Additionally, various residential owners expanded their connections for living landscaping and invested in maintaining their outdoor spaces, lending to positive demand for OPE.

Outdoor Power Equipment Market Trends

Emergence and Adoption of Advanced and Smart Technologies to Spur Opportunities

Introducing a new product with emerging technology has always acted as a significant market driver and industry growth to capture more customers and meet the growing need. Hence, key players emphasize innovation and the development of new products with cutting-edge technologies to meet the diverse needs and preferences of the end-users to maintain their competitiveness in the market share.

For instance, in 2021, ECHO introduced a backpack blower with more power than models recently debuted from ECHO or any other manufacturer globally. The PB-9010 is unquestionably the most powerful backpack blower globally and is centered on power, lightweight, and greater productivity delivering excellence. In addition, end-users such as professionals or consumers prefer products with leading technology. They are willing to spend on products equipped with advanced features and new technologies that drive the growth of emerging technologies in the outdoor power industry.

Technological Advancements Coupled with Extensive Economic Growth will Support the Market

Introducing a new product with evolving technology has always been a crucial market and industry growth driver, allowing businesses to grab more customers and meet increasing demand. Manufacturers are focusing on delivering connected equipment as the adoption of IoT devices, and the popularity of smart and connected products grows. Technology advancements and the adoption of wireless networking techniques result in development of smart and connected tools. The manufacturing of smart and connected OPE is becoming more critical to leading manufacturers. For example, the constant expansion of robotic lawn mowers is anticipated to benefit the market due to technology improvements. Furthermore, the demand for battery-powered and cordless saws within the construction industry is the primary factor driving the segment growth.

Download Free sample to learn more about this report.

Outdoor Power Equipment Market Growth Factors

Increasing Household Activities and Gardening Activities for Do-It-Yourself Projects is Propelling Market Growth

Green spaces are not just for growing plants. They are also places for relaxation, focus, and connecting with nature and each other. Gardening now offers significant mental health benefits in our daily lives. The demand for landscaping services is booming, driven by homeowners wanting aesthetically pleasing homes and commercial users improving property appearances. Outdoor power equipment, including lawnmowers, blowers, hedge trimmers, and saws, plays a crucial role in various landscaping operations, such as lawn maintenance, hardscaping, tree care, and snow removal.

The evolution of the urban lifestyle has encouraged demand for outdoor equipment, especially in landscaping and gardening. As economies grow, about 70% of the global population is anticipated to live in or near cities, triggering increased urbanization activities. This urbanization trend is driving the need for smart cities, green spaces, new buildings, and the maintenance of public areas. Companies, such as Makita Corporation, are responding to this demand by offering alternatives to gas-powered equipment. They focus on continuous development, introducing a cordless OPE system with approximately 50 products, making tools user-friendly and sustainable, and meeting the needs of the aging population.

Increasing Focus on Technological Advancements to Support Market Expansion

OPE is often powered by gasoline engines, electric motors, or battery-powered motors and is used for lawn, landscaping, garden, golf course, or ground care. Due to the development of remote working, fluctuating gas prices, and focus on environmental protection, battery-powered equipment is witnessing one of the most extreme demands across diverse locations. Key market participants are advocating for more ecologically and user-friendly products and to provide clients with the best possible solution. Electrification is transforming society and is critical to achieving a low-carbon economy.

Husqvarna Group aspires to be the industry leader in this change. Their efforts to boost electrification will lower carbon dioxide (CO2) emissions from product use. They are on the cutting edge, developing and introducing electrified goods in sectors where excellent performance and endurance are essential. They provide customers with an even better experience by electrifying their items, which are more efficient, easy to use, and have lower noise and vibration levels. Makita Corporation has initiate a campaign to raise awareness about awareness of these battery-powered alternatives to gas equipment as autonomous solutions are becoming more practical, convenient, convenient affordable through media channels, from broadcast to digital platforms, Husqvarna Group's autonomous robotic mowers, such as CEORA, are a crucial strategic product in which they are the unchallenged market leader.

RESTRAINING FACTORS

High Maintenance Costs of Equipment and Fluctuating Raw Material Prices May Hinder the Market Growth

With rising infrastructure and urbanizations, OPE comprises tools widely used among household and commercial tools to maintain their spaces and achieve the smart and greener city concept. Equipment such as lawn mowers and trimmers are precision instruments. Many Outdoor Power Equipment parts, such as motors, air, and fuel filters, require routine maintenance. OPE must be recalibrated at regular intervals for exact operations. Sharpening, oiling, replacing parts, and other repairs are required for optimal tool operation. As a result, maintaining Outdoor Power Equipment is quite expensive. Consumers in developing countries are unwilling to spend significant money on equipment maintenance since garden-keepers are relatively cheaper. These maintenance and repair requirements also raise the cost of ownership of heavy outdoor machinery. Also, the availability of most of the large size equipment at lease can directly or indirectly affect the Outdoor Power Equipment market growth in the coming years for developing nations. Although, the technological advancement and presence of production base in different regions help reduce product prices to optimum levels.

Outdoor Power Equipment Market Segmentation Analysis

By Type Analysis

Lawn Mowers Type to Hold Dominant Market Share Due to Increase in Gardening Activities

The market is segmented by type into lawn mowers, trimmers, blower, chainsaw, pressure washer, tillers & cultivators, and others. The lawn mowers segment accounted for the highest market share of 35.49% in 2026, owing to the increasing affection of residential users for lawn and garden maintenance and activities and the expanding demand for landscaping services. Further, the trimmer segment also contributed a significant portion to the market owing to their wide use for edge cutting and creating boundary lines or separate lines in gardens and lawns for making walkways. These types of equipment are widely adopted owing to tackle and quick use during different tasks such as uncontrolled plant growth and effortlessly cutting thick undergrowth plants or tough grass.

By Power Source Analysis

Gasoline Power Source to Hold Dominant Market Share Due to its Acceptance in Heavy-duty Applications

By power source, the market is trifurcated into gasoline powered, battery powered, and electric motor/corded. The gasoline-powered segment holds the dominant market share of 69.84% in 2026, however it is expected to have a minor drop due to its loud sound output and carbon emission produced by using gasoline as fuel. Furthermore, the battery-powered segment holds significant share owing to the fact that they do not emit carbon and produce lesser noise compared to gasoline powered equipment. The battery-powered segment also accounted for the fastest-growing in the forecast period due to adoption of Outdoor Power Equipment owing to government regulations to reduce environmental impact. These are also driving the demand for electric-powered equipment in different regions.

To know how our report can help streamline your business, Speak to Analyst

By Sales Channel Analysis

Direct Purchase Sales Channel to Hold Dominant Market Share Due to the Presence of Store Division

Based on sales channel, the market is bifurcated into e-commerce and direct purchase through retail stores. The direct purchase segment led the market with a share of 89.58% in 2026, as most customers relied on direct purchases through retail outlets in North America, Europe, and Asia Pacific. The Outdoor Power Equipment sales through direct purchase are declining as manufacturers of lawn and garden products are increasingly finding success on e-commerce platforms such as Amazon and Home Depot. The e-commerce segment accounted for the second-largest segment in the market; due to the impact of COVID-19, sales through online platforms increased and are expected to grow in upcoming years.

By Application Analysis

Residential/DIY Application to Hold Dominant Market Share Largely Due to Increasing Gardening Activities

The market is segmented into residential/DIY and commercial applications. With the growth of Do-it-Yourself (DIY) projects and landscaping services, both sectors experienced an increase in demand. After a decline of two to three months following the outbreak of the novel virus, both the residential and commercial application made a strong comeback and began recovering at a faster rate. The residential/DIY segment led the market owing to significant growth in domestic purposes with a market share of 63.92% in 2026. The Outdoor Power Equipment in residential/DIY demand increased as the pandemic forced people to stay home and spend time upgrading garden and landscaping areas.

REGIONAL INSIGHTS

The market is distributed across North America, Europe, Asia Pacific, and the Rest of the World.

North America Outdoor Power Equipment Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America:

The North America region dominated the Outdoor Power Equipment market share as DIY and commercial lawns and parks are growing; furthermore, technological instruments to easily work highly influence the region. Major outdoor equipment used widely in this region are leaf blower, chain saw, and lawnmowers daily in the garden, parks, corporate, and residential sectors. Key players are expanding their product line to capture the rising demand from across the region. For instance, Ryobi expanded its 80V lawn tractor lineup. Ryobi, a leading manufacturer of power tools and outdoor equipment, has added two new 80V lawn tractors to its lineup. The new models offer a number of features, including a wider wheelbase, larger tires, and a more powerful engine. The U.S. market is projected to reach USD 17.46 billion by 2026.

Europe

Europe is highly influenced by automation and electronics; owing to this, there is diverse Outdoor Power Equipment such as IoT-based, which is connected with users' smartphones through Bluetooth and WiFi. Additionally, robotic lawnmower is another trendy product in Germany as the country has over 500 national parks and around 550 botanical gardens. The UK market is projected to reach USD 1.89 billion by 2026, while the Germany market is projected to reach USD 2.54 billion by 2026. Furthermore, countries in Europe are majorly focusing on reducing carbon dioxide emissions due to these activities. European countries focus on battery-based and electrical OPE markets.

Asia Pacific

The growing urbanization and the building industry in regional as well as global level are the prime reasons for the market growth in the region. The strategic investments by global corporations in Asia have provided a lucrative opportunity in the regions in recent decades. India, China, and Japan have been key emerging countries in the Asia Pacific region. The Japan market is projected to reach USD 0.78 billion by 2026, the China market is projected to reach USD 1.75 billion by 2026, and the India market is projected to reach USD 1.53 billion by 2026. Further, the movement of green infrastructure is gaining traction among organizations and consumers who are projected to support electric equipment in this market to offset the consequences of expanding urbanization and accompanying deforestation.

Key Industry Players

Key Participants are Concentrating on Enhancing their Product Capacities

The Outdoor Power Equipment market comprises various key players delivering scale products for numerous applications shaping the competitive landscape. The key players in the regional as well as global level are Alfred Karcher SE Co. Ltd, Yamabiko Corporation, Husqvarna group, Techtronic Industries Co. Ltd, MTD Products Inc, and TTI Group.

List of Top Outdoor Power Equipment Companies:

- Kaercher (Germany)

- Yamabiko Manufactures (Japan)

- Husqvarna Group (Sweden)

- Andreas Stihl Ag company Kg (Germany)

- Techtronic Industries (U.S.)

- Maruyama U.S., Inc. (U.S.)

- Stanley Black & Decker (U.S.)

- MTD Products (U.S.)

- Makita Group (Japan)

- Vb Emak (Italy)

- Toro Company (U.S.)

- Hikoki (Japan)

- Deere (U.S.)

- Jonsered (Sweden)

- Bosch (Germany)

- Honda (Japan)

- Cub Cadet (U.S.)

- Troy Blit LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – The Toro Company and Lowe's Companies, Inc. have revealed a strategic retail collaboration. As part of this partnership, Lowe's will stock Toro zero-turn riding mowers, walk mowers, portable power equipment, and snow blowers. These products will be available in both traditional gas-powered options and the increasingly popular battery-powered category.

- September 2023– DK2, a player in the residential outdoor power equipment sector, reveals ELITE ENERGY, its inaugural collection of large-scale battery-powered outdoor tools. This innovative line integrates proprietary LiFePO4 batteries and electronic vehicle (EV)-grade motors, providing an impressive 50% boost in power and convenience. The design not only ensures clean, quiet, and dependable power for consumers but also allows the battery to serve as an expandable backup power source for the home. Additionally, the battery seamlessly transfers to other ELITE ENERGY tools.

- July 2023 – Kress Commercial introduced its groundbreaking range of outdoor power equipment, now accessible at designated dealerships throughout the U.S. and Canada. Representing a pioneering move in the industry, Kress Commercial offers a line of battery-powered OPEs designed to meet the rigorous power and durability needs of professional landscapers.

- May 2023 - Husqvarna introduced the latest advancements tools with the release of the T540 XP Mark III and a fresh line of gear. As a key player in the outdoor power equipment industry, Husqvarna Group is renowned for its innovative products. These additions to their lineup form a comprehensive ecosystem of tools, empowering arborists to tackle their most challenging tasks with enhanced efficiency.

- April 2023 - DongCheng Tools, a well-known provider of power tools, recently launched its latest line of garden equipment that is designed to provide unmatched performance and ease of use. The company's new range of tools includes the 40Vfuel Brushless Cordless Leaf Blower and the 40VFuel Multi-Head String Trimmer, both of which are engineered to provide exceptional results for users' gardening needs.

REPORT COVERAGE

The report highlights leading regions worldwide to offer a better understanding TO the user. Furthermore, the research report provides insights into the latest industry trends and analyzes technologies that are being deployed at a rapid pace at a global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader to gain in-depth knowledge about the industry.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 5.58% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Power Source

By Sales Channel

By Applications

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 39.33 billion in 2026.

The global market is projected to grow at a CAGR of 5.58% over the forecast period.

North America dominated the global outdoor power equipment market with a share of 49.16% in 2025.

Based on Power Source, the Battery Powered segment holds a dominating share of the global market.

The global market size is expected to reach USD 60.71 billion by 2034.

Electrification is transforming society and is essential in the outdoor power equipment market, which is boosting Market Growth.

Alfred Karcher SE Co. Ltd, Yamabiko Corporation, and Husqvarna group. are some of the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us