Video Analytics Market Size, Share & Industry Analysis, By Application (Crowd Management, Facial Recognition, License Plate Recognition, Motion Detection, Intrusion Detection, and Others), By Deployment (On-premise, Cloud), By Enterprise Type (Large Enterprises and Small and Medium Enterprises (SMEs)), By Industry (BFSI, Government, Critical Infrastructure, Education, Retail, Travel and Transportation, Healthcare, and Others), and Regional Forecast, 2026-2034

Video Analytics Market Analysis - 2034

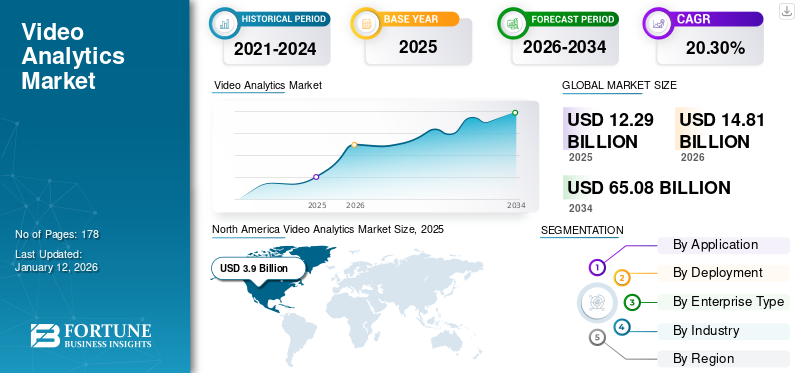

The global video analytics market size was valued at USD 12.29 billion in 2025 and is projected to grow from USD 14.81 billion in 2026 to USD 65.08 billion by 2034, exhibiting a CAGR of 20.30% during the forecast period. North America dominated the market with a share of 31.70% in 2025.

Video analytics uses an algorithm to read video signals for security-related tasks. The adoption of this software is increasing as it detects real-time actions and behavior, providing customers with exclusive alerts and insights. Furthermore, growing safety and security concerns are expected to boost the market expansion.

GLOBAL VIDEO ANALYTICS MARKET OVERVIEW

Market Size:

- 2026 Value: USD 14.81 Billion

- 2034 Forecast Value: USD 65.08 Billion

- Forecast CAGR: 20.30% (2026–2034)

Market Share:

- Regional Leader: North America dominated the market with a share of 31.70% in 2025.

- Fastest‑Growing Region: Asia Pacific is projected to grow at the highest CAGR during the forecast period

- Enterprise Type Leader: Large Enterprise segment dominated market adoption

- End‑User Industry Leader: Government/Public Safety segment had the highest share in 2024

Industry Trends:

- AI‑Driven Video Surveillance: Adoption of real-time video content analytics for event detection

- Facial & License Plate Recognition: Key application areas in public safety and transportation

- Cloud & Edge Deployment Growth: Increasing shift toward cloud and edge analytics platforms

Driving Factors:

- Rising Public Safety Concerns: Demand for proactive security and surveillance solutions

- Smart City Initiatives: Expansion of urban monitoring systems driving adoption

- Technological Innovation in Analytics: Integration of advanced AI and ML for faster and accurate detection

- Enterprise Infrastructure Upgrades: Government and infrastructure entities investing in intelligent video systems

- Scalability & Real-Time Monitoring Needs: Growing need for scalable platforms capable of real-time threat and anomaly detection

The need for these solutions is expected to gain traction due to rising smart city initiatives across major countries and growing investments in deploying analytics-based video surveillance systems. These systems can find robust usage across law enforcement, government, transportation, banking, and finance sectors. Furthermore, the improved proliferation of analytics platforms to minimize crime rates through timely alerts about suspicious or unusual activity is anticipated to fuel the market growth during the forecast period.

Market players such as Avigilon Corporation, Honeywell International Inc., Robert Bosch GmbH, and IBM are continuously focusing on innovating more advanced video analysis products/services to maintain their share in this competitive market.

IMPACT OF GENERATIVE AI

Implementation of Generative AI Capabilities to Fuel Market Growth

Generative AI is transforming video analysis by shifting from simple monitoring to the generation of intelligent, real-time insights. In the past, human intervention was necessary to analyze large volumes of footage. Now, with Generative AI, organizations can streamline and scale this task through advanced models that comprehend, interpret, and respond to video content instantly.

Generative AI empowers sectors such as healthcare, retail, transportation, and smart cities to operate with greater precision, security, and efficiency. For instance,

- In December 2024, VXG announced its incorporation and backing of Generative Artificial Intelligence (GenAI) within its Cloud Video Management System (VMS). This state-of-the-art advancement utilizes advanced AI to transform the physical security sector by offering smart video analysis, immediate insights, and natural language communication.

- In November 2024, Vantiq, IronYun, and Syllego collaborated to launch a GenAI-powered solution combining real-time data, video analysis, and system integration. This partnership focuses on developing a scalable solution that enables public safety, healthcare, and smart cities to function with unmatched intelligence and effectiveness.

Video Analytics Market Trends

Rising Number of Space & Drone Surveillance to Emerge as a Key Trend

Next-gen drone networks now process footage collectively by enabling coordinated tracking of objects across large areas. Security applications blend thermal, radar, and behavioural data to pinpoint threats with unprecedented accuracy.

Key innovations include ultra-compact processors for real-time airborne analysis and advanced imaging that reveals hidden environmental data. These systems now support vital operations - from protecting borders to monitoring pipelines - where instant insights matter most. For instance,

- In March 2025, iMOVE Australia used drone video analysis to study driver behaviour at 50+ Perth roundabouts for improved safety.

- In November 2024, Remark AI launched a real-time drone video analysis platform for military, police, and delivery use, offering advanced situational awareness via AI.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Rising Demand for Proactive Security Solutions to Drive Market Growth

In a world where global security challenges are becoming more intricate and unpredictable, conventional surveillance techniques that rely significantly on manual oversight and later review of footage are inadequate. Various organizations are moving away from passive video solutions to more proactive, intelligent surveillance systems that provide immediate threat detection, automated alerts for incidents, and predictive analytics.

This transition is fueled by growing concerns surrounding terrorism, organized crime, vandalism, and public safety issues, especially in high-risk areas with heavy foot traffic, such as airports, subway stations, sports arenas, schools, and densely populated urban areas. The focus has shifted from simply recording incidents to actively preventing them before they happen. For instance,

- In January 2025, Jaipur International Airport announced the implementation of the Perimeter Intrusion Detection System (PIDS). The PIDS is designed to prevent security violations along the airport's 15 km perimeter. It employs cutting-edge fiber-optic sensors, laser barriers, ground-based radar, video monitoring, and data analysis.

- In October 2024, LA Metro announced the expansion of its public safety efforts by piloting a concealed-weapons detection system and by enhancing video analysis across its transit network.

Market Restraints

Increase in Data Breach Risks Hinder Market Growth

The increasing reliance on analytics has exposed critical security vulnerabilities which creates barriers to the video analytics market growth. These risks are particularly concerning for governments, enterprises, and smart city projects, where data breaches can lead to financial losses, legal penalties, and reputational damage.

- Vulnerable IoT Devices: Easy Targets for Cyberattacks

Many IP cameras, drones, and IoT sensors used in video analysis have weak default passwords, unpatched firmware, and open ports, making them prime targets for:

Ransomware Attacks- Hacked traffic cameras disrupting city operations. For instance,

- In April 2024, A cyberattack shut down Kansas City Scout’s traffic system, which includes cameras and signs. It was a part of local cyberattacks.

Surveillance Hijacking - Hackers accessing live feeds from public CCTV networks. For instance,

- In May 2025, In Rajkot, hackers stole over 50,000 CCTV clips from schools, offices, factories, and homes over 9 months.

- Cloud Storage Risks: Unauthorized Access & Data Leaks

Many video analysis platforms store footage on cloud servers, which are vulnerable to :

Insider Threats- Employees/contractors leaking sensitive footage. For instance,

- In December 2024, Boeing paused its employee surveillance program after an employee leaked internal plans to install motion sensors and cameras in offices.

Third-Party Vendor Breaches- Cloud data got leaked due to a third-party vendor. For instance,

- In March 2025, StreamElements confirmed a data breach involving a third-party cloud provider, exposing the personal information of 210,000 customers.

Market Opportunities

Video Analytics in Healthcare Sector Creates New Market Opportunities

The healthcare sector is embracing video analysis technology to enhance patient safety and care quality. AI-powered solutions now enable automated fall detection in senior care, real-time infection control monitoring in hospitals, and seamless remote patient tracking through wearable integrations.

This creates a strong demand for privacy-conscious video AI systems that improve clinical workflows while maintaining compliance. For instance,

- In April 2025, SIMPPLE Ltd. launched SIMPPLE Vision, an AI video analysis platform for facility management, and secured a paid pilot with a major Singapore healthcare institution. The system uses existing cameras, supports cloud/on-prem setups, and could expand nationwide if successful.

SEGMENTATION ANALYSIS

By Application

Surging Need for Various Applications to Boost Facial Recognition Segment Growth

Based on application, the market is segmented into crowd management, facial recognition, intrusion detection, license plate recognition, motion detection, and others.

The facial recognition segment is leading the market with highest market share of 25.70% in 2026. Useful applications of this feature, such as criminal identification, fraud detection in passports & visas, and attendance tracking, will likely boost the market growth. Furthermore, the increasing adoption of these solutions in applications, such as intrusion detection, motion detection, license plate recognition, and others, is expected to drive market growth.

However, intrusion detection is expected to witness highest CAGR during the forecast period owing to the increasing need for proactive, real-time, surveillance amid rising security threats across critical infrastructure and public spaces. Advancements in AI and edge computing have enhanced the accuracy and speed of intrusion detection systems, making them more reliable than traditional monitoring. Additionally, stringent regulatory requirements in sectors like transportation and energy are accelerating adoption.

To know how our report can help streamline your business, Speak to Analyst

By Deployment

Rise in Cloud Investments to Propel Segment Growth

Based on deployment, the market is segmented into on-premise and cloud.

The cloud segment is expected to witness the highest growth during the forecast period due to the rising adoption of cloud-based software among SMEs and start-ups. The Cloud segment is anticipated to hold a dominant market share of 68.84% in 2026.

- In December 2024, Milestone Systems merged with Canon-owned BriefCam and Arcules to enhance its AI-powered video analysis and cloud solutions in India.

Thus, increased investment to adopt the cloud deployment model across organizations is expected to boost market growth.

On the other hand, the on-premise deployment model will show a sluggish demand in the coming years, owing to the growing adoption of cloud solutions across small and medium-sized enterprises.

By Enterprise Type

Rapid Integration of Emerging Technologies with Video Analytics Solutions among Large Enterprises Fueled Segment Growth

Based on enterprise type, the market is bifurcated into small and medium enterprises (SMEs) and large enterprises.

Large enterprises dominated the market with a share of 63.75% in 2026 and will likely incorporate their video analysis with emerging technologies such as cloud and Artificial Intelligence (AI) to provide enhanced services.

Small and medium enterprises (SMEs) are projected to be the fastest-growing segment in the market as they are increasing their investments in advanced video analysis technologies. Therefore, market contributors are focusing on building economical options that produce high-value and quality results.

By Industry

Government Segment Dominated Market Owing to Rising Need to Enhance Public Safety

Based on industry, the market is segmented into BFSI, government, critical infrastructure, education, retail, transportation, and others. The government segment is further divided into smart cities and law enforcement.

The government segment witnessed the largest share in 2024 due to the increasing need to enhance public safety, prevent and investigate crimes, manage traffic, respond to emergencies, monitor crowds, facilitate urban planning, and ensure regulatory compliance. The video analysis software enables government agencies to make data-driven decisions, improve operational efficiency, and enhance citizens' overall security and well-being.

The retail segment is expected to hold the highest CAGR throughout the forecasted period as businesses have started to enhance customer experience, improve operation efficiency, and make data-driven decisions by utilizing video analysis software.

VIDEO ANALYTICS MARKET REGIONAL OUTLOOK

Based on region, the market has been studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Video Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 3.9 billion in 2025 and USD 4.56 billion in 2026. Introducing new technologies and the presence of key companies, such as IBM Corporation, Honeywell International Inc., Cisco Systems, Motorola Solutions (Avigilon), and others, are expected to increase the demand for video content analytics solutions in the U.S. and Canada. End-users across the U.S. and Canada are taking active initiatives to adopt video content analytics integrated with emerging technologies. The U.S. market is projected to reach USD 3.22 billion by 2026.

Players in the market are engaged in partnerships and collaborations to strengthen their business and increase their customer base. For instance, in February 2020, Motorola Solutions, Inc. added the H5M Camera to its video security product line. It provides AI-powered Unusual Motion Detection (UMD) for outdoor security. It has variants in 2 megapixels and 5 megapixels and is available across the world.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is predicted to record an exponential growth rate during the forecast period. Smart city projects financed by the government and advanced surveillance projects for national security are some factors that are anticipated to boost the usage of video analysis solutions across the region. The retail industry and the significant developments anticipated in the ICT sector are driving market expansion in countries such as China and India. The Japan market is projected to reach USD 0.65 billion by 2026, the China market is projected to reach USD 0.86 billion by 2026, and the India market is projected to reach USD 0.49 billion by 2026. For instance,

- In August 2024, Staqu announced a partnership with Raymond to transform Raymond’s physical retail outlets by incorporating JARVIS, AI-powered video analysis, into their current CCTV systems to enhance their intelligence and insights.

Europe

Europe is predicted to hold a significant market share due to the presence of many leading video content analytics solutions and service providers. Across the European Union, large associations and organizations, such as law enforcement agencies, critical infrastructure owners, and video product & service vendors, are actively using the platform to improve security management. The UK market is projected to reach USD 0.77 billion by 2026, while the Germany market is projected to reach USD 0.86 billion by 2026.

European countries are concentrating on integrating ICT, mobility, and energy to produce sustainable technologies. Recent funding rounds by tech companies in the region to drive AI-powered solutions also support this trend. For instance,

- In January 2025, Intelex Vision, a firm located in London that focuses on AI-powered video analysis for live surveillance, secured USD 7.6 million in a Series A funding round.

South America and Middle East & Africa

South America and the Middle East & Africa markets are likely to experience rapid growth during the forecast period. One of the primary factors boosting the market expansion in these regions is the rising government investments in new technologies, such as big data, AI, cloud, IoT networking, 5G technology, and others. In addition, stronger data privacy and theft restriction features are expected to fuel the market growth in these regions.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Companies to Develop Enhanced Analytics Solutions to Strengthen Their Market Position

The major companies in this market are Robert Bosch GmbH, IBM Corporation, Honeywell International Inc., and Axis Communications AB. They aim to build intelligent video content analytics solutions using Machine Learning (ML), Artificial Intelligence (AI), and cloud technologies.

Major Players in the Video Analytics Market

To know how our report can help streamline your business, Speak to Analyst

The market is consolidated, with top market players such as Avigilon Corporation (Motorola Solutions, Inc.), IBM Corporation, NTT Data Group Corporation, Honeywell International Inc, and Robert Bosch GmbH, accounting for 41% of the market share. The key players focus on new product innovations, upgrades, portfolio expansion into new geographical areas, and collaborations with other players to expand their business presence across different regions.

List of Key Video Analytics Companies Studied

- Cisco Systems, Inc. (U.S.)

- Avigilon Corporation (Motorola Solutions, Inc.) (U.S.)

- Honeywell International Inc. (U.S.)

- Huawei Technologies Co Ltd. (China)

- Qualcomm Technologies, Inc. (U.S.)

- Claro Enterprise Solutions (U.S.)

- IBM Corporation (U.S.)

- Canon Inc. (Japan)

- Robert Bosch GmbH (Germany)

- Irisity AB (Sweden)

- NTT Data Group Corporation (Japan)

- Genetec Inc. (Canada)

- AllGoVision Technologies Pvt Ltd. (India)

- IntuVision Inc. (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS

- February 2025: Gorilla Technology Group, British Technology, and the Port of Tyne expanded their partnership to improve security protocols by implementing AI video analysis. The collaboration aims to implement Gorilla's video analysis platform, driven by AI, which is designed to oversee dangerous areas within the port.

- February 2025: Dialog Enterprise announced the expansion of its footprint in the field of Video Surveillance and Video Analysis by engaging in strategic partnerships with top technology companies alongside various other well-known physical security brands.

- December 2024: Greater Than, a worldwide provider of risk intelligence focused on road safety and climate effects, teamed up with Waylens, a company specializing in AI video telematics technology, to combine predictive insights into driver crash likelihood with video footage, assisting fleets in enhancing their safety initiatives.

- December 2024: Fujitsu introduced a video analysis AI agent designed for frontline work environments. This AI agent utilizes spatial video and image data from surveillance footage in workplaces, along with textual information, to generate reports and provide suggestions for enhancing workplace conditions.

- June 2024: Interface Systems unveiled the introduction of the Wobot AI-driven video analysis system tailored for the quick-service restaurant (QSR) and retail sectors. This groundbreaking solution leverages current security camera setups to provide immediate insights that allow clients to optimize operations and safeguard their assets.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Strategic investment in video analytics provides significant business opportunities to market players. It helps them to expand their business presence and diversify their operations. Additionally, it enables data-driven decision-making, leading to improved customer experiences and operational efficiency. Companies that prioritize such technologies are better positioned to gain a competitive edge and adapt to evolving market trends.

REPORT COVERAGE

The research report includes a thorough market study and highlights crucial aspects, such as product types, leading companies, and product applications. Moreover, it delivers insights into the latest market trends and covers major industry developments. In addition to the factors mentioned above, the report covers numerous points that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Application

By Deployment

By Enterprise Type

By Industry

By Region

|

|

Companies Profiled in the Report |

Cisco Systems, Inc. (U.S.), Avigilon Corporation (Motorola Solutions, Inc.) (U.S.), Honeywell International Inc. (U.S.), Huawei Technologies Co Ltd. (China), Qualcomm Technologies, Inc. (U.S.), Claro Enterprise Solutions (U.S.), IBM Corporation (U.S.), Canon Inc. (Japan), Robert Bosch GmbH (Germany), and NTT Data Group Corporation (Japan) |

Frequently Asked Questions

Fortune Business Insights says the market value stood at USD 14.81 billion in 2026.

By 2034, the market size is expected to reach USD 65.08 billion.

The market is expected to record a stellar CAGR of 20.30% over the forecast period of 2026-2034.

By enterprise type, the large enterprise segment led the global market.

Rising demand for proactive security solutions to drive market growth.

Avigilon Corporation, Honeywell International Inc., Robert Bosch GmbH, and IBM Corporation are the top companies in the market.

The government segment held the major market share in 2026.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us