Web Hosting Services Market Size, Share & Industry Analysis, By Type (Shared Hosting, Dedicated Hosting, Collocated Hosting, Virtual Private Server Hosting, Managed Hosting, Self-Managed Hosting, and Others), By Application (Public Website, Mobile Application, Intranet Site, and Online Application), By Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

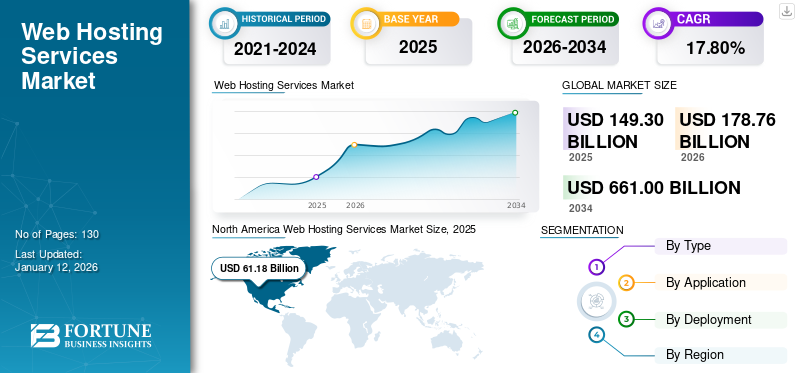

The global web hosting services market size was valued at USD 149.30 billion in 2025 and is projected to grow from USD 178.76 billion in 2026 to USD 661 billion by 2034, exhibiting a CAGR of 17.80% during the forecast period. North America dominated the global web hosting services market with a share of 41.00% in 2025. Additionally, the U.S. web hosting services market is projected to grow significantly, reaching an estimated value of USD 133.46 billion by 2032, owing to heavy investments and the adoption of cloud hosting services.

Web hosting is a service when a hosting vendor allots space on a web server for a website to store its files. These hosting providers typically require users to own a domain, or can help them secure a domain.

Global Web Hosting Services Market Overview

Market Size:

- 2025 Value: USD 149.30 billion

- 2026 Value: USD 178.76 billion

- 2034 Forecast Value: USD 661 billion, with a CAGR of 17.80% from 2026 to 2034

Market Share:

- Regional Leader: North America held the largest market share in 2025 at 41.00%, attributed to strong cloud infrastructure and adoption.

- Fastest-Growing Region: Asia Pacific, driven by rapid digital transformation and rising internet penetration.

- End-User Leader: IT & Telecom, driven by increased demand for cloud-based and dedicated hosting solutions.

Industry Trends:

- Accelerated adoption of multi-cloud hosting solutions

- Growing integration of AI technologies in hosting platforms

- Expansion of digital commerce and online services

Driving Factors:

- Rapid digitalization of SMEs

- Surge in cloud adoption across industries

- Expansion of e-commerce platforms

- Government-backed digital infrastructure initiatives

This report showcases a dedicated study on adopting and applying web hosting services across various sectors. In the research scope, we have considered hosting services offered by companies such as Google LLC (Alphabet, Inc.), Alibaba Cloud, Amazon Web Services, Inc., and GoDaddy Operating Company, LLC.

The adoption of web hosting services across small and medium-scale enterprises is a major driving factor for market growth. Additionally, government initiatives empowering SMEs and the increasing number of relevant partnerships among these SMEs is augmenting the web hosting services market share of companies.

The pandemic significantly impacted the adoption of hosting services. The shutdown forced businesses to shift their business operations to the cloud. With the rise in ownership of smartphones and internet penetration, it became essential for businesses to have an online presence. Companies adopted hosting services to target general customers for future growth plans. Further, the pandemic increased consumers' reliance on the internet for purchasing decisions. Businesses saw the pandemic as an opportunity to adopt hosting services and scale up their consumer services thus facilitating market proliferation.

Web Hosting Services Market Trends

Rising Popularity of Multi-cloud Hosting to Propel Market Augmentation

Companies have been focusing on adopting multi-cloud web hosting services, as it helps enterprises to avoid the downsides of single-vendor reliance. Multi-cloud hosting has been steadily increasing across all company sizes over the last few years, as it enables businesses to leverage multiple cloud providers simultaneously by providing them with flexibility and choice in selecting the best services and features from different providers. For instance, the multi-cloud adoption of Google Cloud Platform, AWS, and Azure is rising among large enterprises. This enables organizations to avoid vendor lock-in and tailor their cloud infrastructure to meet cost, specific performance, and compliance requirements. In the event of a service outage or downtime with one provider, organizations can failover to another provider seamlessly, ensuring high availability and minimizing disruption to business operations. Multi-cloud hosting enables businesses to optimize performance by deploying workloads closer to end-users or leveraging specialized services offered by different cloud providers. For instance,

- In November 2022, WP Engine extended its multi-cloud solution by implementing its Managed WordPress Platform on Microsoft Azure. This extension allows Microsoft customers to access the multi-cloud platform on Azure.

Thus, the increasing popularity of multi-cloud hosting solutions is expected to impact the web hosting services market growth positively.

Download Free sample to learn more about this report.

Web Hosting Services Market Growth Factors

Growing Number of SMEs to Increase the Demand for Web Hosting Services

Small and Medium Enterprises (SMEs) play an important role in every nation's economic growth. The existence of SMEs aids efficient consumption of nearby assets and augments economies across the globe.

According to Siteefy, there are 1.13 billion websites worldwide, with only 200,121,724 being actively visited and maintained in 2023. Companies have realized the importance of online presence, especially after the COVID-19 pandemic. This helps them reach a wider audience and stay competitive in today’s digital landscape.

Consumers are increasingly reliant on the internet to purchase, implying business success potential. Thus, small businesses have understood the importance of strong online presence and have made website hosting services a top priority for their growth plans. Additionally, web hosting service providers have targeted small and medium-sized enterprises to augment their business growth. For instance, in March 2021, DreamHost introduced a complete suite of professional web services to help its small business consumers enhance their growth and find success online. Thus, the rising number of small and medium-sized businesses and their need for web hosting services are driving market expansion in recent years.

RESTRAINING FACTORS

Challenges Associated with Ensuring Scalability and Maintaining Uptime Might Restrain Market Growth

The hosting services' high initial and implementation costs might hinder the service adoption. As demand from SMEs is a major driver of hosting services, the cost might restrain market growth. Moreover, challenges that arise while ensuring scalability and maintaining uptime might restrain this market. Maintaining uptime becomes crucial as consumers spend more time on websites that are easily available to them.

Web Hosting Services Market Segmentation Analysis

By Type Analysis

Rising Adoption of Shared Hosting Services among SMEs is Positively Impacting the Market Growth

Based on type, the market is categorized into shared hosting, dedicated hosting, collocated hosting, virtual private server hosting, managed hosting, self-managed hosting, and others. Shared hosting segment dominates the market with a share of 32.94% in 2026, as small and medium-scale enterprises prefer shared servers over other hosting types. SMEs prefer shared hosting services as they are cost-effective and work effectively with low traffic, as SMEs gain low traffic.

However, as companies start gaining traction, their traffic increases. This bids them to opt for other hosting services such as VPS and dedicated cloud hosting. In the coming years, dedicated hosting services are expected to grow significantly. Along with this, other features that have been updated in the services are increased uptime and high levels of security.

By Application Analysis

Public Website Application to Lead Backed by Ease of Accessibility

Based on application, the market is categorized into public website, mobile application, intranet site, and online application. In 2023, the public website segment was the most promising application segment, owing to its ease of accessibility contributing 48.69% globally in 2026. SMEs have been the prime adopters of web hosting services for public website applications as they aim to target the general population. In the coming years, online application segment is expected to grow at the highest CAGR due to rising internet penetration across the globe.

To know how our report can help streamline your business, Speak to Analyst

By Deployment Analysis

Rising Popularity of Public Cloud Hosting Services across SMEs to Gain Traction Further Augmenting the Market Growth

The pandemic accelerated the investments in cloud infrastructure services, which further augmented the shift of users into cloud hosting services. SMEs adopt a public cloud deployment for hosting services with a share of 50.18% in 2026, due to their easy manageability. Thus, in 2023, public cloud deployment of web hosting services accounted for the highest among other deployment types.

However, in the coming years, hybrid cloud deployment of hosting services is expected to gain popularity and grow at the highest CAGR over the forecast period.

REGIONAL INSIGHTS

The market is studied across North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further studied across leading countries.

North America

North America Web Hosting Services Market Size, 2025(USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is the most promising region, holding 41.00% of the global market share in 2025. North America dominated the global market in 2025, with a market size of USD 61.18 billion. The region holds the highest market share owing to its technologically advanced nature and early adoption of web hosting services. Moreover, heavy investments and the adoption of cloud hosting services will aid regional market proliferation. Amid the pandemic, cloud hosting services have gained popularity due to their advantages over other hosting services such as enhanced security, ability to handle vast amounts of data, and other additional features. The U.S. market is projected to reach USD 64.9 billion by 2026.

Asia Pacific

Furthermore, Asia Pacific will grow at the highest CAGR during the forecast period due to local and global companies shifting from offline to online platforms. These companies adopt this strategy to expand and keep their businesses in leading positions. Moreover, companies have been opening regional data centers to help their customers with seamless customer service. For instance, in January 2023, GreenGeeks, a green energy web hosting platform, announced its new data center location in Singapore. The Japan market is projected to reach USD 11.48 billion by 2026, the China market is projected to reach USD 16.36 billion by 2026, and the India market is projected to reach USD 5.11 billion by 2026.

Europe

Europe accounted for the second highest global market share owing to growing internet usage and traffic across the region. With this increase, the need for digital transformation became necessary for companies. According to the EIB Investment Survey (EIBIS) conducted from April to July 2021, 46% of companies changed their business operations to digital ones. The UK market is projected to reach USD 10.75 billion by 2026, and the Germany market is projected to reach USD 11.91 billion by 2026.

The below stats showcased the percentage of European enterprises to host their databases on the cloud in 2021.

Latin America and the Middle East & Africa

Moreover, Latin America and the Middle East & Africa regions are estimated to grow gradually during the forecast period owing to increasing digital population and technological advancements. In addition, increase in adoption of cloud computing services across both regions is expected to augment e market growth.

List of Key Companies in Web Hosting Services Market

Prominent Players have been Engaging into Relevant Partnerships to Strengthen Market Positioning

Key market vendors are engaging in relevant partnerships to develop new, advanced solutions aligned with customers’ requirements. They are also focusing on integrating their existing product portfolio with advanced technologies to provide flexible solutions with unique features. Additionally, government initiatives empowering SMEs to bring their online business fuel market growth.

LIST OF KEY COMPANIES PROFILED:

- GoDaddy Operating Company, LLC (U.S.)

- Google LLC (Alphabet, Inc.) (U.S.)

- Amazon.com (Amazon Web Services, Inc.) (U.S.)

- Namecheap (U.S)

- IONOS Inc. (Germany)

- Alibaba Cloud (China)

- Liquid Web, LLC (Germany)

- Hostinger International, Ltd. (Lithuania)

- WPEngine, Inc. (Texas)

- DigitalOcean, LLC (U.S.)

- DreamHost, LLC (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: CloudMinister Technologies Pvt. Ltd. launched new web hosting plans for SMBs small and medium businesses. This new plan was designed to provide scalable, reliable, and affordable web hosting solutions for online requirements.

- October 2022: UAE Telco DU partnered with GoDaddy, a U.S.-based web hosting company and internet domain registrar, with an aim to help small office home office (SoHo) entrepreneurs and SMEs to scale their digital presence.

- August 2022: WP Engine expanded its business by opening a new office in Singapore. WP Engine will ramp up development by launching new regional products and offerings in Singapore. The company will collaborate with APAC brands and agencies by innovating websites and digital experiences.

- June 2022: WP Engine, the WordPress technology company, expanded its global presence in the Nordics. With this acquisition, the company expects to target the growing number of popular brands and agencies in Northern Europe. These brands have been reimagining their digital footprints with WordPress.

- May 2021: GoDaddy launched its new integrated marketing campaign to empower small businesses with the right tools to help them succeed online.

REPORT COVERAGE

The research report covers the prominent areas worldwide to study the industry comprehensively. Additionally, the report provides insights into the most current market trends and an analysis of technologies being adopted globally. It also highlights some of the growth-stimulating economic indicators and restrictions, allowing the reader to gain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 17.80% from 2026 to 2034 |

|

Segmentation |

By Type

By Application

By Deployment

By Region

|

Frequently Asked Questions

The market is projected to reach USD 661 billion by 2034.

In 2025, the market stood at USD 149.3 billion.

The market is projected to grow at a CAGR of 17.30% over the forecast period (2026-2034).

By application, the public website segment is likely to lead the market.

Rise in small and medium-sized businesses to increase the demand for web hosting services.

GoDaddy Operating Company, LLC, Google LLC (Alphabet, Inc.), Amazon.com (Amazon Web Services, Inc.), and IONOS Inc. are the top players.

North America is expected to hold the highest market share.

The online application segment is expected to grow with the highest CAGR over the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us