Intelligent Vending Machine Market Size, Share & COVID-19 Impact Analysis, By Machine Type (Free-Standing Vending Machines and Wall-Mounted Vending Machines), By Product Type (Food & Beverages, Snacks, Tobacco, Confections, and Others), By Application (Quick Service Restaurant, Commercial Malls & Retail Stores, Offices, Public Transport, Shopping Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

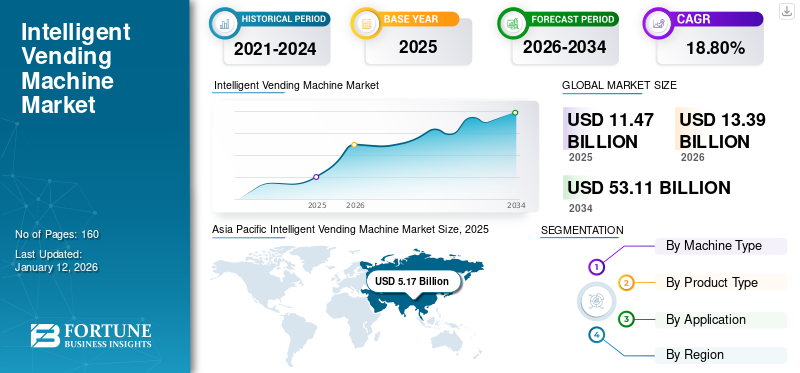

The global intelligent vending machine market size was valued at USD 11.47 billion in 2025. The market is projected to grow from USD 13.39 billion in 2026 to USD 53.11 billion by 2034, exhibiting a CAGR of 18.80% during the forecast period. The Asia Pacific dominated the intelligent vending machine market with a share of 45.10% in 2025.

An intelligent vending machine is a device that dispenses items stored within it in exchange for inserted coins or tokens. Smart vending machines are advanced vending machines that not only sell items but also engage shoppers using touchscreen controls, video, audio, scents, gesture-based interaction, and cashless payments. Smart vending machines are the next evolution in retail, enabling businesses to reach customers in new places and new ways. These machines work round the clock.

Intelligent vending machines serve customers easily and efficiently by simply displaying what these machines have in stock. Businesses no longer need to invest in expensive packaging. Intelligent vending machines use high-resolution touchscreen displays that show high-quality product photos and animations. These machines can complement a conventional UI, i.e., user interface to engage customers with interactive videos, commercials, and more. All of these features create a unique user experience that helps you increase your sales and attract more customers.

The COVID-19 pandemic negatively impacted the overall market growth due to supply chain disruptions and reduced demand from the end-users due to work-from-home models. However, the demand for food & beverages observed a huge growth but this has increased the scarcity of the supply chain owing to the panic buying from the population. During the pandemic, these kinds of machines were proven to be the next evolution in retail as they allowed businesses to reach customers in new places and in new ways.

In COVID-19 situation, to improve and enhance the service of traditional vending machines, AAEON, a vending machine company, provided intelligent solutions to facilitate their function. Ideally, these intelligent vending machines integrate seamlessly with key systems such as ERP, retail, inventory management, and operations. The industry is now growing toward API-driven mindless commerce that supports integration with all touchpoints. For instance, Brainy, a smarter solution, offers an extraordinary shopping experience. With the coming era of the Internet of Things (IoT) and its increasing penetration into everyday life, Brainy supports Intel real sense technology through AAEON's 'UP' board, a single-board computer the size of a credit card.

Intelligent Vending Machine Market Trends

Integration of the Internet of Things (IoT) and Technological Advancements in Vending Machines to Propel the Market

The vending industry is undergoing a fundamental transformation, using intelligent system technology to connect remote management software and touch screens to go far beyond just serving food and beverages. A smart vending machine is a vending machine with an LCD screen for interface and a large tabletop office vending machine with surface area enough to potentially support a 6" to 14" LCD screen. The incorporation of features such as facial recognition and voice that enable communication between vending machines and consumers is boosting the industry's growth prospects. These features add intelligence to the system by recognizing and responding to users, and providing visual experiences with collaborative promotions. Intelligent dispensing systems help gather information about consumer behavior and inclinations.

Intelligent vending machines are enhancements to traditional vending machines but integrate key features such as cashless systems, telemetry systems, LCD/touch screens, digital signage, Enterprise Resource Planning (ERP) systems, and voice recognition.

- For instance, in February 2022, Mars Wrigley, in partnership with Selecta, a Switzerland-based vending machine provider, developed intelligent vending machines for consumers in Europe. This smart machine is available with user-friendly touch screens and a smart payment processing method and provides detailed product information to the users.

Aggregated adoption of Internet of Things (IoT) and connected device technologies is expected to support the growth of the smart vending machine market during the forecast period. Increasing consumer acceptance of cashless and contactless payments when purchasing food and beverages continues to drive market growth.

Download Free sample to learn more about this report.

Intelligent Vending Machine Market Growth Factors

Increased Demand in Packaged Food & Beverages and Cashless Vending to Bolster the Market Growth

Due to their portability and quick delivery, these vending machines are a very convenient option for consumers who are looking to purchase groceries and beverages. In recent years, due to consumers' busy lifestyles and consumption behavior, urbanization has increased the need for easy-to-eat foods. This has dramatically accelerated the demand for smart vending machines, especially in offices, commercial spaces, and public areas. In addition, the demand for vending machines is increasing as they offer more digital payment options/cashless choices compared to traditional cash payments. Increasing payments using internet-enabled devices, smartphone adoption, and credit/debit cards are some of the factors driving the growth of cashless payments. Businesses have installed intelligent vending machines that can accept credit cards, debit cards, and mobile payments. This will help get the customer's attention and, as a result, it increases sales.

- For instance, in February 2024, Diggi24, a Baden-Wurttemberg-based vending machine operator, collaborated with Invenda Group and installed smart vending machines at hotels, shopping centers, and universities across Germany to develop innovative retail solutions for delivering better customer experience.

Furthermore, rising government rules and regulations, mobile payment options, augmented user interactivity, adoption of computing technology, abridged operating costs, payment flexibility, remote management, and software flexibility along with improved energy efficiency are further driving the market.

RESTRAINING FACTORS

Rise in Security Theft & Vandalism and High Initial Costs of Installation to Hamper the Market Growth

The upsurge in theft and vandalism is going to pose a major challenge to the smart vending machine market during the forecast period. The rise in smart vending machine vandalism is impacting the global industry. This is especially noticeable in developing countries. These are designed and developed for home operation and do not require a professional operator. These machines have lightweight bodies that are very easy for crooks to destroy.

In addition, increasing security issues are hampering the growth of the smart vending machine market as retail store owners continue to be concerned about protecting their products from theft and robbery. Potential security risks include system failures, system hacking, and outsourcing of consumer personal information.

Furthermore, high cost of smart vending machines and high maintenance and energy consumption costs are some of the key factors expected to hinder the market growth. Additionally, these machines are expensive to manufacture and deploy, which impacts dealer interest. This limits the adoption of smart vending machines.

Intelligent Vending Machine Market Segmentation Analysis

By Machine Type Analysis

Free-Standing Vending Machines Segment Expected to Hold Major Share Owing to Rising Demand in Food & Beverages Industries

Based on machine type, the market is classified into free-standing vending machines and wall-mounted vending machines.

Free-standing vending machines segment is anticipated to hold the highest share of 65.87% in 2026 owing to its surging demand across the food & beverage industry. The product features include images and content, remotely managed pricing, beverages, packaged food and snacks, inventory reporting, and cloud-based hosting. The utilization of the machines in various public places, such as shopping malls, roadsides, bus stops, railway stations, airports, and other high-rise residential buildings in public places, is further contributing toward the market growth.

Furthermore, the wall-mounted vending machines segment is predicted to show major growth in upcoming years. Wall-mounted vending machines are a space-saving substitute to huge floor-standing vending machines. Today's wall-mounted vending machines can be equipped with the same 21st-century integrations set up in floor-standing vending machines. A variety of products can be dispensed from beverages to snacks to toiletry items.

By Product Type Analysis

Food & Beverages Segment to Grow Significantly Due to Rising Demand in Instant Food Items

Based on product type, the market is divided into food & beverages, snacks, tobacco, confections, and others.

The food & beverages segment is expected to grow exponentially in the forecast period due to the significantly high preference among consumers for instant food items and innovative food products. The food & beverages segment dominated the market accounting for 37.12% market share in 2026. These smart vending machines are popular in public transportation such as airports, train stations, and bus stops. Customer loyalty is therefore likely to influence purchases of packaged food and snacks, further increasing demand for these machines from the food and beverage segment.

Snacks segment is expected to exhibit substantial growth over the forthcoming years. This is due to growing interest in healthier products, longer working hours, and innovative new product launches. Food acceptance is also increasing with the availability of snack products in convenient to-go packs and multi-layer sterile cartons.

The tobacco sector is also anticipated to account for a significant share due to the increasing adoption of computerized cigarette vending machines in industrialized regions. Advances in vending machine technology are the major growth drivers of the tobacco sector in the vending machine market. Placing machines in precise locations for premium tobacco products allows merchants to make generous profits.

Confections and others segments are expected to grow considerably in the forecast period due to the increased need for bubble gum, candy bars, caramel, carob, chewing gum, chocolate, chocolate bars, and other promotion items. The ability to deliver goods quickly has also contributed to their popularity, making them a convenient alternative for consumers.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Quick Service Restaurants to Have Major Development Owing to Changing Customer Buying Methods

Based on application, the market is divided into quick service restaurant, commercial malls & retail stores, offices, public transport, shopping centers, and others.

Quick service restaurant segment is projected to exhibit substantial growth in the coming years. In 2026, the Quick Service Restaurant segment is projected to lead the market with a 34.28% share. This is attributed to the growing popularity of vending machines in both developed and developing countries and the convenience offered to consumers in quick service restaurants are factors surging the demand for these types of vending machines. Also, the changing customer buying methods and demand for more convenient ways to purchase food and beverages are further driving the market growth.

In addition, commercial malls and retail stores are likely to have considerable growth. The retail sector is supply-driven and this is a good time for big grocers to reassess their long-term strategies. These vending machines are showing tremendous proportions as manufacturers enter the retail business. Amidst dynamic shifts in consumer behavior and labor shortages, the retailers are progressively revolving to edge retail solutions to enhance their omnichannel offerings. For instance, 22% of retailers have already implemented some form of edge retail, and 33% plan to install this technology this year.

Additionally, offices are expected to show a major development during the forecast period. This is attributed to the spread of contactless payment and the ease of use of vending machines. Therefore, the introduction of these technologically advanced machines in commercial offices is progressing. Increased consumption of beverages such as cold drinks, juices, and energy drinks is responsible for the growing application of beverage vending machines to provide consumers with a convenient shopping experience.

Moreover, public transport is projected to have a remarkable increase in the coming years. This is attributed to the installation of smart vending machines on public transport, such as buses and trains, to enhance the travel experience for commuters. The smart vending machine market is spurring greater opportunities for tourism and commuting due to public transportation.

Furthermore, increased disposition of these vending machines in shopping centers has aided the rapid expansion of the business in urban regions. This is attributed to the promotion of cashless transactions that has greatly facilitated the adoption of these kinds of vending machines. Advancements in the IoT networks have benefited the retail industry and created new opportunities for smart vending market participants. Remote management of smart vending machines is one of the most compelling arguments for companies to deploy such devices worldwide.

REGIONAL INSIGHTS

Based on region, the market is segmented into five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Asia Pacific Intelligent Vending Machine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

The Asia Pacific market occupies a significant share in the market. The Asia Pacific market is a hub of large-scale retail stores with advanced infrastructure, which has increased the demand for these vending machines. Retailers are focused on providing a robust infrastructure with technical capabilities to use advanced devices in contactless payment solutions. Increasing penetration of digitization in retail stores will drive the implementation of smart vending machines. Also, the adoption of high-end technology with high disposable income of consumers is further contributing toward increasing the market share. The Japan market is projected to reach USD 1.91 billion by 2026, the China market is projected to reach USD 1.67 billion by 2026, and the India market is projected to reach USD 1.19 billion by 2026.

For instance, since COVID-19, retailers in many countries check customers' temperatures at store entrances and also provide sanitizers. Retailers are using smart vending machines to dispose of masks and sanitizers for shoppers.

Specifically, in India, increasing investments in public infrastructure and development of the organized retail sector will continue to stimulate demand for vending machines in India in the coming years. The everyday application of these vending machines seen in India includes selling hot beverages such as tea, coffee, and selected soups. Pharmacy sales have also grown significantly due to the increased use of vending machines in hospitals and other healthcare centers due to the COVID-19 pandemic. Also, the rise of organized retail in India's malls and multiplexes, business processing outsourcing, information technology, and information technology enabled services industries will increase the demand for these kinds of vending machines.

To know how our report can help streamline your business, Speak to Analyst

North America

The North America market is expected to exhibit substantial growth in the coming years owing to development in communication technology, increased use of mobile payments, and faster internet connections. In addition, in the U.S. and Canada, government regulations to promote energy conservation are strict, which further accelerates the growth. Also, the strong presence of prominent global manufacturers in the region is aiding the growth of the market. Additionally, the growing efforts of these corporations regarding technical developments through strong investments in research and development activities, acquisitions, strategic partnerships, joint ventures, and collaborations are identified as pivotal factors boosting the development potential of the North America market. The U.S. market is projected to reach USD 2.58 billion by 2026.

Europe

The Europe market is projected to have fair growth with a noteworthy upsurge in the second half of the forecast period. Increased demand for on-the-go snacks and beverages due to consumers' busy lifestyles has increased the demand for these vending machines. The continuous increase in the number of coffee consumers in the region is estimated to drive the market growth. Growing adoption of coffee and expansion of the corporate sector in European countries are continuing to surge the product demand. According to the European Vending & Coffee Service Association (EVA), most vending machines in the region assist in serving hot beverages such as coffee, snacks, hot meals, and more. The UK market is projected to reach USD 0.6 billion by 2026, while the Germany market is projected to reach USD 0.87 billion by 2026.

Middle East & Africa

The Middle East & Africa is predicted to have steady growth during the forecast period.

The developing market for smart vending machines in the Middle East & Africa is expected to grow as organizations operating in the region have higher purchasing power and can afford to spend on smart vending machines, further stimulating product demand.

Latin America

Latin America is likely to grow moderately due to niche opportunities for the development of manufacturing industries However, the limited presence of global market players and underdeveloped distribution channels for the market are the factors responsible for the sluggish growth of the industry in Latin America. The growing usage of intelligent vending machines helps customers to change their mode of payment to cashless transactions. This method helps to deliver a completely cashless experience to customers present across the region.

KEY INDUSTRY PLAYERS

Manufacturer are Focusing on Standard Operational Efficiency to Strengthen Market Position

The global market is moderately competitive and major industry players are adopting various strategies such as product development, partnerships, acquisitions, agreements, and expansions to strengthen their market position. Most companies focus on expanding their operations across various geographies, expanding capabilities and building strong partnerships. This market has many prominent players such as Beta Automation, Vendstop, Cherise India, JP Vend Tech, Daalchini, Snaxsmart, Silcron, SandenVendo America, VendomaticIndia, and AAEON who deliver best-in-class vending machines to power the global arena. However, the vending machine market has many global startups making strides to meet the needs of the vending machine sector.

LIST OF TOP INTELLIGENT VENDING MACHINE COMPANIES:

- Azkoyen Group (Spain)

- Crane Co. (U.S.)

- FAS INTERNATIONAL S.R.L (Italy)

- Fuji Electric Co., Ltd. (Japan)

- Royal Vendors, Inc. (U.S.)

- Sanden Holdings Corporation (Japan)

- Rhea Vendors Group Spa (Italy)

- Seaga (U.S.)

- Jofemar Corporation (U.S.)

- Sielaff GmbH & Co (Germany)

- BIANCHI INDUSTRY SPA (Italy)

- N&W Global Vending S.p.A. (Italy)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Thundercomm, an IoT product and solutions provider, launched its new Smart Vending Machine Solution to CES 2023 for unmanned retail terminals. This machine can capture and analyze the purchasing process and identify the purchased goods using dynamic vision technology.

- June 2022 - Azkoyen Group, a leading Spanish technology multinational company that provides automated products and services that give people unique experiences in their daily lives, has unveiled a new version of its Nebular platform at the Venitalia Worldwide Vending Show.

- January 2022 - Fuji Electric announced to be the capital investor of Fuji Electric Tsugaru Semiconductor company for growth in the manufacturing of SiC power semiconductors.

- August 2021 - Azkoyen Group, an international Spanish technology company that offers automated goods and services, has partnered with eye-tracking technology developer Irisbond to launch a fully eye-controlled coffee machine.

- February 2021 - Dominus Capital, L.P. affiliates are engaged with Seaga Manufacturing, Inc., a leading platform of dispensing solutions and inventory vending for the water filtration, industrial, food and beverage, and healthcare laundry markets.

REPORT COVERAGE

The research report provides a detailed analysis of the type, application, and industries. It provides information about leading companies, their business overview, and the leading applications of their products. Besides, it offers insights into the competitive landscape, SWOT analysis, current market trends, and highlights the key drivers and restraints. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.80% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Machine Type

|

|

By Product Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 13.39 billion in 2026.

By 2034, the market is expected to be valued at USD 53.11 billion.

The global market is estimated to exhibit a noteworthy CAGR of 18.80% during the forecast period.

The Asia Pacific dominated the intelligent vending machine market with a share of 45.10% in 2025.

Within machine type, free-standing intelligent vending machines segment is expected to be the leading segment in the market during the forecast period.

Increase demand in packaged food & beverages along with cashless vending to bolster the market.

Azkoyen Group, Crane Co., FAS INTERNATIONAL S.R.L, Fuji Electric Co., Ltd., Royal Vendors, Inc., Sanden Holdings Corporation, Rhea Vendors Group Spa, Seaga, Jofemar Corporation, Sielaff GmbH & Co, BIANCHI INDUSTRY SPA, and N&W Global Vending S.p.A. are some of the leading companies in the market.

Quick service restaurant application is expected to drive the market.

The major players constitute approximately 40%-45% share in the market, which is majorly owed to their brand image and presence in multiple regions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us