Middle East and Africa Olive Oil Market Size, Share & COVID-19 Impact Analysis, By Type (Refined/Pure, Virgin, and Others), By End-user (Household/Retail, Foodservice/HoReCa, Food Manufacturing, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

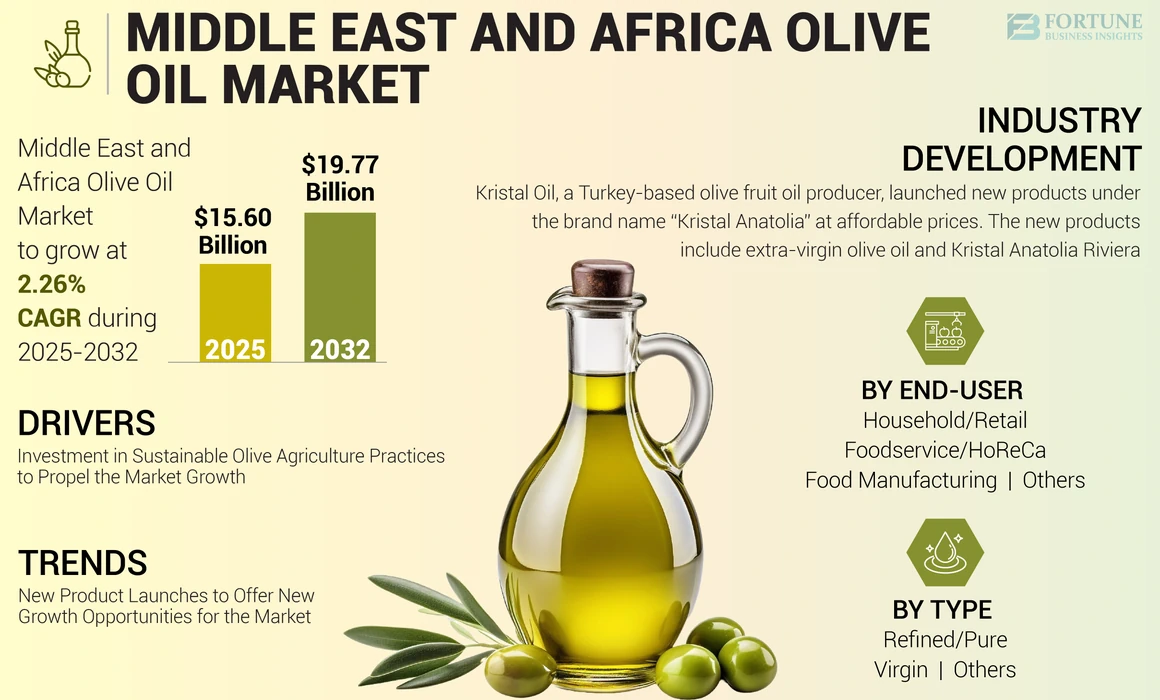

The Middle East and Africa olive oil market size is projected to grow at a CAGR of 2.26% during the forecast period. The global olive oil market size is projected to grow from USD 15.60 billion in 2025 to USD 19.77 billion by 2032.

The Middle East and Africa is an emerging region in the global olive fruit oil market, owing to its wide application in various household uses and growing awareness of fats and oils containing MUFAs due to their health advantages. Furthermore, the increasing use of this oil coupled with the growing application of the product in personal skincare products has surged its demand in the market. Several government initiatives to increase sustainable olive farming will propel the market growth.

Our Middle East and Africa olive oil market research report covers the following countries Turkey, Egypt, Tunisia, Saudi Arabia, Morocco, and the Rest of ME&A.

Middle East and Africa Olive Oil Market LATEST TRENDS

New Product Launches to Offer New Growth Opportunities for the Market

The product demand for cooking in households is rising in the Middle East and Africa due to growing awareness regarding the health benefits of the product. The rising olive cooking oil consumption in the region is shifting consumers to extra virgin olive fruit oil to include in their daily diet. It contains omega-3 and oleic acid, which helps to prevent lifestyle-related disorders, such as obesity and cardiovascular issues, thus propelling the demand for the product. The leading players in the market are increasingly emphasizing on new product launches to meet the increasing demand for extra virgin olive fruit oil.

- For instance, in March 2022, Znaidi Food Industries launched a new extra virgin olive oil brand, “Maria Bonomo”. The new products under the brand are extracted from Chetoui olives, a typical variety from northern Tunisia.

Middle East and Africa Olive Oil Market Growth FACTORS

Investment in Sustainable Olive Agriculture Practices to Propel the Market Growth

The countries surrounding the Mediterranean region are the major olive-producing areas. Olives and olive fruit oil are essential products and kitchen staples in Turkey, owing to massive olive fruit oil production in the country. According to the Turkish Ministry of Agriculture and Forestry Data, Turkish production of olive fruit oil increased by 32% in 2021 compared to the previous year. Therefore, government bodies are collaborating with prominent regional players with investment strategies to support sustainable olive agriculture in Turkey.

- For instance, in March 2022, the European Bank for Reconstruction and Development (EBRD) collaborated with Bunge Limited, one of the leading Turkey olive fruit oil producers. The bank provided USD 50 million in long-term loans to Bunge to finance the company’s working capital needs and capital investments at plants in Turkey. Furthermore, both organizations also collaborated on sustainability projects to develop certified organic olive production in Turkey.

RESTRAINING FACTORS

Quality Discrepancies and Adulteration to Limit the Market Growth

The product has gained worldwide popularity as part of the Mediterranean cuisine. The rising demand for such oils led to shortages in production and increased fraudulent cases due to several vulnerabilities in the supply chains. The main issue related to olive oil was reported to be the adulteration of olive fruit oil with other edible or less quality oil and mislabeling different quality grades. Several oil producers claim the sale of adulterated or fake products to be even more prevalent in Turkey’s market. The rise in such fraudulent activities hampers the Middle East and Africa olive oil market growth.

KEY INDUSTRY PLAYERS

Expanding Production Capacity Allows the Players to Fulfill the Rising Product Demand

In terms of the competitive landscape, Borges International Group, IFFCO Group, and GEA Group are the key players in the Middle East and Africa market. New product launches and extensive product portfolios help them to gain a competitive advantage and enter new markets.

Other prominent players, such as Leya Olive Oil and Deoleo S.A., also lead the market and focus on strategic mergers and acquisitions, partnerships, and investments. These companies are focused on local sourcing of raw materials, empowerment initiatives of local communities, and increasing their market share in the Middle East and Africa markets. The companies are expanding their business by establishing manufacturing facilities to meet increasing product demand for various purposes.

- For instance, in August 2022, Saraya Co., Ltd., a manufacturer of health and hygiene products and services, opened a new factory in Tunisia. The new facility would manufacture and market olive oil from olive varieties native to Tunisia.

List of Top Middle East and Africa Olive Oil Companies:

- Leya Olive Oil (Egypt)

- Wadi food (Egypt)

- Borges International Group (Spain)

- Bunge Limited (U.S.)

- IFFCO Group (U.A.E)

- Kristal Oil (Turkey)

- IKK Foods (Saudi Arabia)

- Baya Olive Oil (Tunisia)

- GEA Group (Germany)

- Deoleo S.A. (Spain)

KEY INDUSTRY DEVELOPMENTS:

- February 2022: Kristal Oil, a Turkey-based olive fruit oil producer, launched new products under the brand name “Kristal Anatolia” at affordable prices. The new products include extra-virgin olive oil and Kristal Anatolia Riviera.

- October 2021: The European Bank for Reconstruction and Development (EBRD) supported olive-oil production in Tunisia by providing a USD 7.15 million loan. The bank’s finances would support and promote regional integration, strengthen export competitiveness, and bolster national economic growth.

- March 2020: The European Bank for Reconstruction and Development (EBRD) collaborated with Al Dahra Morocco Factories with funding of USD 5.53 million. EBRD would finance the commissioning of a new olive oil factory and construction in the Fez-Meknes region in Morocco.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The report provides qualitative and quantitative insights on the market and a detailed analysis of the Middle East and Africa olive oil market share, size & growth rate for all possible segments in the market. Along with the market forecast, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are overview of the number of procedures, an overview of price analysis of types of products, overview of the regulatory scenario by key countries, pipeline analysis, new product launches, key industry developments – mergers, acquisitions & partnerships, and the impact of COVID-19 on the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 2.26% from 2025 to 2032 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type, End-user, and Country |

|

By Type |

|

|

By End-User |

|

|

By Country |

|

Frequently Asked Questions

Growing at a CAGR of 2.26%, the market will exhibit steady growth in the forecast period (2025-2032).

New product launches and investment in sustainable olive agriculture practices are the major factors driving the growth of the market.

Borges International Group, IFFCO Group, Del Monte Food Inc., and GEA Group are the major market players in the Middle East and Africa markets.

Turkey dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us