Mobile Advertising Market Size, Share & Industry Analysis, By Format Type (Search, Display, Digital Video, and Others), By Vertical (Retail & E-commerce, Media & Entertainment, Healthcare, BFSI, Education, Travel & Tourism, Automotive, and Others), and Regional Forecast, 2026-2034

Mobile Advertising Market Size

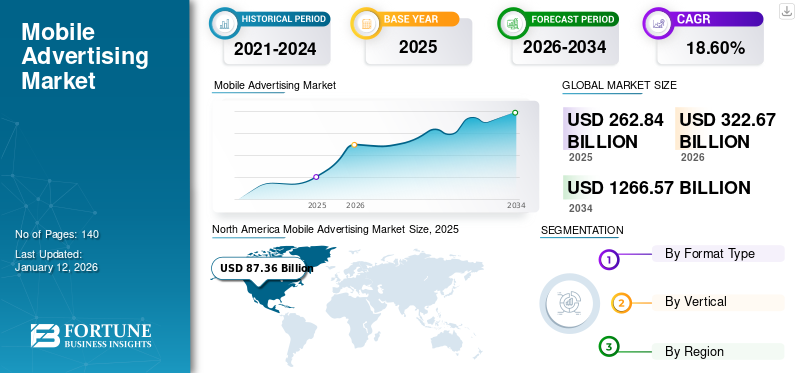

The mobile advertising market size was valued at USD 262.84 billion in 2025 and is projected to grow from USD 322.67 billion in 2026 to USD 1,266.57 billion by 2034, exhibiting a CAGR of 18.60% during the forecast period. North America dominated the global mobile advertising market with a share of 33.20% in 2025. Additionally, the U.S. mobile advertising market is projected to grow significantly, reaching an estimated value of USD 142.68 billion by 2032., driven by Rising Adoption of Location-based Technology.

The research report covers solutions such as Facebook app ads, Google’s YouTube ads, Chartboost’s advertising platform, and AppLovin’s software-based platform–in-app advertising. Advertisers rapidly adopt mobile ads to promote and run campaigns specifically designed for mobile devices. By accepting mobile advertising strategies, companies can promote their services and products to the targeted audience.

With the spread of COVID-19, e-commerce and media & entertainment verticals witnessed explosive growth attributed to the rising pay-per-click, click-through rate, and rising mobile internet usage across gaming, multimedia, music, news, and online shopping categories. However, with the decrease in cases, several countries permitted tourists to come, resulting in greater use of mobile apps and, as a result, increased demand for mobile ads. Mobile advertising appears to be an essential and cost-effective technique to ensure business continuation in the pandemic crisis. Thus, the global mobile ad market is expected to grow in the long term over the forecast period.

Mobile Advertising Market Trends

Incorporation of AR & VR with Mobile Advertising Platforms to Bolster Market Growth

Augmented Reality (AR) and Virtual Reality (VR) are often regarded as the two most important technology platforms worldwide for marketing enterprises. These platforms provide innovative ways for advertising techniques and improve employees' practical knowledge, allowing them to think creatively. Therefore, they are projected to become an important market trend in the future.

AR offers various opportunities for brands and advertising agencies to engage with their potential audiences. By making interactive and immersive experiences, these brands can reinforce the bond between their products and consumers. Augmented reality can aid enterprises in showcasing their products by letting customers visualize them in an actual-world scenario. The mechanism can also be used to gamify advertising campaigns, generating a more appealing experience for the audience. Thus, AR technology has become progressively popular in the e-commerce and retail sectors as it permits consumers to try on products virtually and test them in advance before actually buying them.

According to the May 2020 study by AR Insider, 19% of U.S. adult consumers have already tried VR. This number is up from 16% in 2019’s study. In addition, 31% of respondents say that they use virtual reality at least once a month, indicating that they use it frequently. This factor indicates that virtual reality is likely to see unprecedented adoption in the coming years.

VR plays a significant role in bridging the gap between experience and action while offering digital experience to promote products and services. VR changes the relationship between brands and consumers, as people seek VR brand experiences rather than using ad blockers, escalating the implementation of VR-based mobile advertisements in the global market. In May 2021, Meta Platforms, Inc. began testing ads in the Oculus mobile app to provide developers with a new method to promote their virtual reality applications.

Download Free sample to learn more about this report.

Mobile Advertising Market Growth Factors

Rising Adoption of Location-based Technology to Drive the Market Growth

The soaring adoption of location-based services is driving the growth of mobile advertising. Location-based marketing uses mobile device users’ past and current locations to show relevant content. The rising advertisement spending across the globe is the primary factor supporting the market growth. Brands and businesses are making huge investments in advertising & marketing activities to enhance their customer base and their brand awareness.

Location-driven marketing enables enterprises to target customers at a personal level with offline or online messaging, depending on their physical location. With the help of location data, advertising teams are capable of reaching customers based on criteria, such as closeness to a store, occasions happening in their location, and more. Various brands, such as Yelp, GasBuddy, Sephora, Uber, and many more have implemented location-based advertising for better retention of customers and to offer an enhanced customer experience.

- For instance, in 2022, Amazon Inc. spent around USD 42.0 billion in marketing & advertisement activities, increasing around USD 9.0 billion from the previous year. The growing advertisement spending by leading e-commerce companies is anticipated to drive the market in the coming years.

Higher Penetration of Social Media & E-commerce to Boost Market Growth

The rapidly growing e-commerce industry is driving the market growth. COVID-19 has positively impacted the global e-commerce industry, as consumers prefer online channels to purchase essential products rather than stepping out of the house. According to the May 2021 statistics by the United Nations Conference on Trade and Development, rapid growth of e-commerce in the face of COVID-19's movement restrictions boosted online retail sales' proportion of overall retail sales from 16% to 19% in 2020. This factor is likely to provide a significant opportunity for the market players.

Brands offering products on e-commerce websites offer significant discounts and coupons to attract customers and increase brand awareness & loyalty while boosting the adoption of mobile advertising in the near future.

RESTRAINING FACTORS

Privacy Concerns for Customer’s Confidential Data to Hinder Advertising Technologies Adoption

The growing cybersecurity attacks are leaking users' private information without their knowledge. For instance, in January 2021, Juspay, the company that processes payments for Swiggy and Amazon, reported a data leak of over 100 million credit and debit cardholders. The leak included the user’s name, e-mail, contact information, and credit and debit cards. Such privacy concerns regarding confidential data limit consumers’ preferences while hindering the global mobile advertising market share over the forecast period.

Mobile Advertising Market Segmentation Analysis

By Format Type Analysis

Search Segment to Hold Prominent Share Owing to Rising Popularity

Mobile advertising is done through various format types such as search, display, digital video, and others (lead generation, audio, and others).

The search format type segment held the highest market with a share of 36.95% in 2026 among all format types in 2026. Search ads are tailored to match key search terms (also known as keywords) entered into search engines. This targeting capability is responsible for the growing popularity of search advertising among advertisers. Consumers frequently utilize a search engine to locate and evaluate purchasing possibilities before making a purchase decision.

The digital video advertising segment is anticipated to record a leading CAGR during the forecast period. The segment is gaining traction owing to its capability to deliver interactive audio and video advertisements. YouTube is regarded as a leading platform for video advertising by advertisers. Further, many advertisers still use display ads for interactive banner ads and rich media ads. These are usually image-based, text-based, or video advertisements that encourage users to visit a landing page and take action (for example, make a purchase). Additionally, various advertising companies are using display video advertising to promote their brands for improved customer experience.

To know how our report can help streamline your business, Speak to Analyst

By Vertical Analysis

Retail & E-commerce Industry to Drive the Adoption of Mobile Ads

By vertical, the market is divided into retail & e-commerce, media & entertainment, healthcare, BFSI, education, travel & tourism, automotive, and others.

The retail & e-commerce segment is anticipated to record the highest CAGR due to increasing customer spending and the rising B2C market. Also, for retailers and e-retailers, mobile advertising provides the benefit of stimulating instant transactions. They can fulfil customer desires immediately. Such benefits add to the market’s growth in the retail and e-commerce sectors.

The media & entertainment segment accounts for the largest market revenue contributing 21.04% globally in 2026. For instance, in December 2022, Daily Yoga entered into a partnership with AppLovin. The partnership aimed to advertise Daily Yoga through AppLovin’s Appdiscovery to optimize the valuable funnel event subscriptions despite iOS challenges. Similarly, many content providers use mobile engagement platforms such as MoEngage for advertising.

The travel & tourism segment is also growing at a substantial growth rate. Tourism companies promote tourist destination videos that boost customer experience and help companies attract new customers and retain existing customers.

REGIONAL INSIGHTS

Geographically, the global market is studied across five major regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific. The regions are further categorized into countries.

North America

North America Mobile Advertising Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America generated the highest revenue share globally in 2024. North America dominated the global market in 2025, with a market size of USD 87.36 billion. Big corporations in the U.S., such as Google LLC and Facebook, Inc., are predicted to boost market revenue. In the U.S., digital channel spending is predicted to surpass television expenditures shortly. Also, greater implementation and acceptance of advanced technologies such as augmented reality and virtual reality in the region contributes to the region’s global market. The U.S. market is projected to reach USD 50.31 billion by 2026.

South America

To know how our report can help streamline your business, Speak to Analyst

Similarly, South America is also expected to show steady growth during the forecast period due to the rapid growth in the internet population and rising demand for online products in the region. For instance, according to March 2021 Internet World Stats, 78.8% of the population are Internet users in South America, compared to 65.6% globally.

Europe

The European market is likely to show moderate growth in the coming years. According to the May 2021 report by IAB Europe, the European-level industry group for the digital advertising and marketing ecosystem, it is estimated that digital advertising expanded by 6.3% in 2020. An increase in digital advertising was driven by mobile & social spending and out-stream video. The UK market is projected to reach USD 29.59 billion by 2026, and the Germany market is projected to reach USD 18.31 billion by 2026.

Asia Pacific

Asia Pacific is poised to emerge as the fastest-growing market with the highest CAGR during the forecast period. The rising smartphone market across India, China, and Southeast Asian countries is expected to boost internet usage in the forecast period. This factor is propelling the demand for mobile ads across the region. As per the GSMA 2021 research, around 1.6 billion individuals subscribed to mobile services in 2020, and by 2025, the number will reach 1.8 billion. Additionally, video advertisers, such as TikTok and Snapchat, and in-app ads across Facebook, Google, and others boost the market growth across the region. For instance, The Japan market is projected to reach USD 17.29 billion by 2026, the China market is projected to reach USD 25.54 billion by 2026, and the India market is projected to reach USD 13.15 billion by 2026.

- According to the Global Ad Spend Forecast report by Dentsu International, a digital marketing communication company, ad spending in Asia Pacific increased by 11.5% in 2022.

Middle East & Africa

The Middle East & Africa market is anticipated to grow significantly in the forecast period due to rising spending on digital ads across South Africa, Saudi Arabia, the UAE, and other countries. For instance, spending on digital advertising in Saudi Arabia was anticipated to reach around USD 1,309 million in 2023.

Key Industry Players

Key Players Adopt Acquisition and Collaboration Strategies to Expand their Market Share

Leading market participants continuously expand their operations through strategic acquisitions and partnerships with local & regional companies, along with collaborations, joint ventures, and licensing arrangements with SMEs. This factor helps them identify the targeted customers across existing and unattainable markets. For instance:

List of Top Mobile Advertising Companies:

- Meta Platforms, Inc. (U.S.)

- Alphabet, Inc. (Google) (U.S.)

- Chartboost (U.S.)

- AppLovin Corporation (U.S.)

- X Corp. (Twitter) (U.S.)

- InMobi (India)

- Smaato, Inc. (U.S.)

- Epom (Ukraine)

- Mobvista (China)

- Mintegral (Beijing)

KEY INDUSTRY DEVELOPMENTS:

- November 2023 – Amazon partnered with Meta for shopping advertising through Instagram and Facebook. The collaboration would make Meta more appealing to advertisers and allow Amazon to invite more potential customers from its external web store.

- July 2023 - Digital Turbine announced a collaboration with Connect Ads to bring innovative mobile advertising solutions to top brands and agencies in the Middle East and North Africa. Aleph’s Connect Ads would aid clients in the region in tapping into the prospects of awarded video marketing in mobile games, in which Digital Turbine is one of the major global players.

- July 2023 - AppLovin Corporation added new and advanced AI capabilities to its mobile UA (User Acquisition) platform, AppDiscovery. With the help of more robust models to improve the AXON engine in AppDiscovery, partners can accomplish their campaign objectives on a larger scale globally with better accuracy, enhanced performance, and higher speed.

- June 2023 – Google announced the launch of two new AI-driven features for advertisers that would mechanically find the best ad space for brands across the tech firm’s services. One of the new features, known as Demand Gen, would make use of AI to place a promoter's video and photo ads across various applications, such as the YouTube feed, Gmail, and Shorts.

- February 2023 – InMobi Commerce entered into a partnership with Point Pickup. The partnership provided product discovery and monetization solutions to Point Pickup’s grocery retail partners to maximize media-derived revenues.

REPORT COVERAGE

The research report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, software types, and major applications of the platform and services. Besides, the report offers insights into the mobile advertising market trends and highlights the competitive landscape. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Format Type

By Vertical

By Region

|

Frequently Asked Questions

The market value is projected to reach USD 1,266.57 billion by 2034.

In 2025, the market was valued at USD 262.84 billion.

The market is projected to record a CAGR of 18.60% over the forecast period.

By format type, the search format type segment will lead the market over the forecast period.

The higher penetration of social media & e-commerce and rising location-based technology adoption are some of the factors expected to drive the market toward a higher growth trajectory.

Meta Platforms, Inc., Alphabet, Inc. (Google), InMobi, Mobvista, Chartboost, AppLovin, Twitter, Inc., Smaato, Inc., Epom, and Mintegral are the major players in the global market.

North America held the highest revenue share in 2025.

Asia Pacific is expected to exhibit the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us