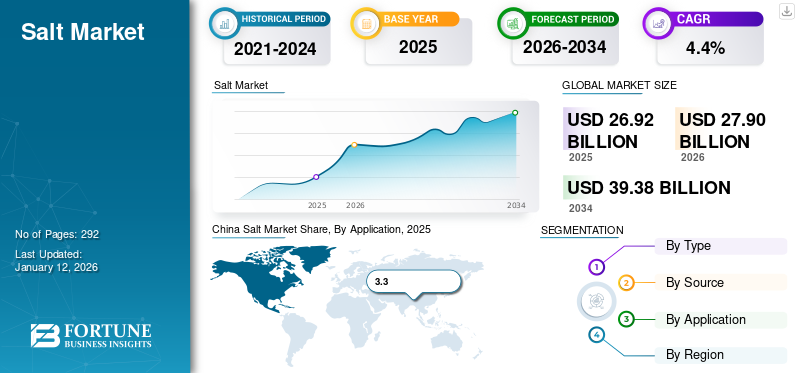

Salt Market Size, Share & Industry Analysis, By Type (Rock Salt, Salt in Brine, Solar Salt, and Vacuum Pan Salt), By Source (Brine and Salt Mines), By Application (Chemical Processing, De-icing, Water Treatment, Oil & Gas, Agriculture, Flavoring Agent, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global salt market size was valued at USD 26.92 billion in 2025. The market is projected to grow from USD 27.9 billion in 2026 to USD 39.38 billion by 2034, exhibiting a CAGR of 4.4% during the forecast period. Asia Pacific dominated the salt market with a market share of 46.5% in 2025.

Moreover, the U.S. salt market is projected to reach USD 4.91 billion by 2032, fueled by food-grade salt demand and growing use in industrial and de-icing applications. Cargill Salt, Compass Minerals International, Inc., and INEOS Enterprises Salt American Rock Salt, are some of the key players operating in the industry.

Salt is one of the inorganic compounds widely used across various industries and is one of the world's most valuable minerals. It is an essential element of food consumption. The product is a mixture of chlorine and sodium that undergoes a number of processing methods involving seawater evaporation, brine extraction, rock salt, and mining.

The market is driven by the rise in product demand from the chemical manufacturing industry, especially in chlorine-alkali chemicals production. In the chemical sector, the chlorine-alkali industry is a major user of the product due to a lack of economically viable alternatives. However, the process of extracting the substance from mines includes additional approvals and licenses from mining officials worldwide, which are supposed to curb production.

GLOBAL SALT MARKET OVERVIEW & KEY METRICS

Market Size & Forecast:

- 2025 Market Size: USD 26.92 billion

- 2026 Market Size: USD 27.9 billion

- 2034 Forecast Market Size: USD 39.38 billion

- CAGR: 4.4% from 2026–2034

Market Share:

- Asia Pacific led the global salt market in 2025 with a market share of 46.06%, driven by strong demand from the chemical processing industry, growing population, and expanding food sector. The region grew from USD 13.86 billion in 2023 to USD 12.01 billion in 2024, with China, India, and Australia as key contributors.

- By type, rock salt dominated the market in 2024 due to its wide use in de-icing, chemical processing, and food preservation.

- By source, salt mines held the largest share in 2024 owing to the abundance of underground salt deposits and well-established mining operations.

- By application, chemical processing accounted for the largest market share in 2024, with the de-icing segment projected to hold a 13.3% share due to strong demand in colder regions.

Key Country Highlights:

- United States: The salt market in the U.S. is projected to reach USD 4.91 billion by 2032, fueled by demand for food-grade salt, industrial usage, and extensive application in road de-icing. In 2024, the plastic fasteners segment is estimated to hold a 12.94% market share.

- China: A leading contributor in Asia Pacific, driven by large-scale consumption in the chemical industry and rising infrastructure needs. In China, the de-icing segment is expected to hold a 12.3% market share in 2024.

- Germany: Strong demand for salt in chemical manufacturing and de-icing supports market growth. Europe benefits from salt’s proven performance, safety, and availability as a preferred de-icing solution.

- Brazil: Market growth is supported by rising demand from the food and chemical industries. Government infrastructure initiatives are expected to further boost demand.

- Saudi Arabia: The salt market is growing due to increased use in oil & gas, agriculture, and water treatment applications. Water scarcity challenges are accelerating demand for salt in desalination and conditioning processes.

Salt Market Trends

Increasing Demand for Gourmet and Specialty Salt Is the Current Trend

In recent years, the culinary sector has witnessed a remarkable renaissance in the use of gourmet and specialty salts, reshaping how both chefs and home cooks enhance flavors in their dishes. Once merely a basic commodity, salt has now transformed into a fundamental element of gastronomy, celebrated for its diverse textures, colors, and distinct flavor profiles.

One of the most notable trends is the increasing consumer awareness of ingredient sourcing and quality. Just as organic produce and farm-raised meats have gained popularity, so too have artisanal salts. Sourced from natural salt flats, ocean waters, and mineral-rich deposits around the globe, gourmet salts such as Himalayan pink salt, Maldon sea salt, and fleur de sel are prized for their taste and for their aesthetic appeal. Home cooks are experimenting with these varieties to elevate their dishes, adding unique finishes that enhance both flavor and presentation. Asia Pacific witnessed a salt market growth from USD 13.86 billion in 2023 to USD 12.01 billion in 2024.

Flavored salts have also surged in popularity, offering exciting possibilities in culinary creativity. Infused with ingredients such as smoked paprika, black garlic, and truffles, these salts provide depth and complexity, allowing cooks to effortlessly incorporate sophisticated flavors to their meals. Sustainability is another driving force behind the gourmet salt trend. Consumers are increasingly leaning toward brands that prioritize eco-friendly harvesting practices, reflecting a broader movement toward mindful and sustainable food sourcing. Thus, the gourmet and specialty salt market is flourishing, fueled by a growing interest in quality, flavor diversity, and sustainability. As consumers continue to seek out unique culinary experiences, gourmet salts are poised to remain an essential ingredient in kitchens around the world, enhancing flavors and inspiring creative dishes.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Demand in Industrial Application to Aid Market Growth

The growing demand for salt in industrial applications is poised to boost the global market significantly. Salt, or sodium chloride (NaCl), is one of the most abundant minerals, and its versatile properties make it indispensable in various industrial processes. While salt is commonly associated with culinary uses, its importance in industrial applications far outweighs its domestic consumption.

One of the largest industrial consumers of salt is the chlor-alkali industry, where it serves as a crucial raw material for the production of chlorine, caustic soda (sodium hydroxide), and soda ash (sodium carbonate). These chemicals are essential for a wide range of downstream industries, including plastics, detergents, paper, and textiles.

The global population is expected to reach 9.7 billion by 2050, with the majority of this growth in urban areas. The increasing population and urbanization growth are expected to surge product adoption in various industries.

Governments around the world are also implementing various initiatives and regulations to ensure the safety and quality of products. For instance, the Food Safety and Standards Authority of India (FSSAI) has implemented various regulations to ensure the safety and quality of salt used in food products. These regulatory frameworks are expected to boost the salt market growth.

Rising Demand for De-icing Salt in Cold Regions Boosts Market Growth

The rising demand for de-icing salt in cold regions is a significant driver of the global market’s growth. De-icing salt, commonly known as road salt, plays a critical role in maintaining safe transportation networks during winter months by preventing ice formation on roads, highways, and sidewalks. The increasing severity and frequency of winter storms due to climate change, combined with the expansion of infrastructure in cold regions, have led to growing demand for de-icing salt. This increased reliance on salt for de-icing purposes, particularly in North America and Europe, is expected to boost growth.

De-icing salt is indispensable for winter road maintenance in cold regions. When applied to road surfaces, salt lowers the freezing point of water, preventing ice formation and making road surfaces safer for vehicles. Municipalities, governments, and private companies use de-icing salt extensively during winter storms to keep roads, highways, airports, and sidewalks clear of snow and ice. This practice is vital for maintaining traffic flow, reducing accidents, and ensuring public safety, which drives consistent demand for de-icing salt in cold regions.

In regions such as North America and Europe, de-icing salt is the most widely used material for winter road maintenance. For example, the U.S. alone consumes approximately 20 million tons of de-icing salt annually. The harsh winters in northern states such as Minnesota, Michigan, and New York make it essential for state and local governments to stockpile large quantities of road salt in preparation for winter storms. Similarly, Canada, with its long and severe winters, is a major consumer of de-icing salt, particularly in provinces such as Ontario and Quebec.

Market Restraints

Environmental Concerns Related to Production is Likely to Restrain Market Growth

Salt production can have a significant impact on the environment, particularly in regions where it involves material extraction from underground deposits or evaporation of seawater. These processes could raise concerns over the depletion of natural resources, water pollution, and other environmental issues.

The production process can be an energy-intensive activity that can lead to greenhouse gas emissions and contribute to climate change. The production of salt generates significant amounts of waste, including brine and other chemicals, which require appropriate management and disposal to prevent environmental contamination. These environmental issues pose challenges that could hinder market growth.

To address these environmental concerns, producers are increasingly adopting sustainable practices, such as using renewable energy sources, water conservation measures, and improving waste management systems. In addition, governments are implementing regulations and policies to ensure sustainable production and minimize its environmental impact.

Market Opportunities

Increasing Adoption of Industrial Salt in the Chemical Industry to Fuel Market Growth

The global chemical industry is rapidly expanding, particularly in emerging economies such as China, India, and Brazil. These regions are experiencing strong industrial growth driven by urbanization, infrastructure development, and increased consumer spending. As a result, the demand for industrial chemicals, including chlorine, caustic soda, and soda ash, is rising steadily. Industrial salt, a key raw material in the production of these chemicals, is expected to witness higher consumption alongside the expansion of the chemical sector in these regions.

China, for example, is the world’s largest producer and consumer of industrial salt, with its chemical industry being a major driver of demand. The country’s robust industrial base and rapidly growing middle class have led to increased production of chemicals for both domestic use and export.

Similarly, India’s growing chemical industry is contributing to higher consumption of industrial salt as the country ramps up its production capacity to meet both domestic and international demand. The rise of specialty chemicals, which are used in a wide range of applications such as agriculture, pharmaceuticals, and electronics, is also contributing to the increased use of industrial salt. As industries such as electronics and pharmaceuticals expand globally, the demand for chlorine and caustic soda, and thus industrial salt, is expected to rise.

While the demand for industrial salt is growing, the chemical industry is also increasingly focusing on sustainability and reducing environmental impact. This focus has led to innovations in the chlor-alkali process, such as the adoption of membrane cell technology, which is more energy-efficient and environmentally friendly. These advances could further boost the demand for industrial salt as producers seek to adopt more sustainable practices

Market Challenges

Issues Related to Brine Disposal and Contamination to act as a Challenge For Market

Brine disposal and contamination are significant environmental concerns, especially in industries like desalination, oil and gas extraction, mining, and chemical production. Brine is a highly concentrated saline solution often containing other contaminants, making its management crucial.

Discharge of brine into water bodies can increase salinity levels, causing osmotic stress to aquatic organisms. High salinity can reduce biodiversity, disrupt ecosystems, and lead to the death of salt-intolerant species. Additionally, brine discharge often leads to denser, saline water settling at the bottom of water bodies, potentially creating oxygen-depleted zones (hypoxia). This can affect benthic organisms and disrupt natural nutrient cycles. In some cases, brine is discharged at elevated temperatures, exacerbating environmental stress by altering local temperature regimes and further affecting aquatic ecosystems.

Moreover, improper disposal of brine on land can lead to soil salinization, reducing agricultural productivity and leading to desertification in extreme cases. Brine infiltration into groundwater can raise salinity levels, making water unsuitable for drinking and irrigation. This is particularly concerning in arid regions where groundwater is a primary water source. Brine may contain heavy metals (e.g., lead, mercury, arsenic) and other toxic compounds, posing serious health risks if it contaminates drinking water sources. Chronic exposure can lead to neurological, developmental, and cardiovascular issues.

Addressing these challenges requires strengthening environmental regulations and promoting best practices in brine management to ensure compliance and protect ecosystems. Addressing brine disposal and contamination requires a multi-faceted approach involving technological innovation, regulatory enforcement, and community engagement to mitigate its environmental and societal impacts

Impact of COVID-19

The global market faced challenges due to logistical restrictions caused by the COVID-19 pandemic and the closure of many small businesses, especially in the food sector. France and Italy, two of the hardest-hit European countries, implemented strict lockdown measures that led to temporary or mass closures of fine dining establishments, especially across Europe. Additionally, the trend toward healthier eating had gripped the market before the pandemic. Consumers increasingly avoided high levels of sodium, especially from fast food, while shifting toward more balanced dietary choices. Consumption of meat and poultry products declined, especially in Asia Pacific, driven by changing dietary preferences and concerns about health and safety during the pandemic. However, as economies began to reopen in late 2020 and 2021, the market experienced a resurgence in demand. The food industry gradually recovered, with restaurants reopening and consumers returning to normal purchasing habits.

Segmentation Analysis

By Type

Rock Salt Segment Dominated Due to Increasing Applications from Various End-Use Industries

Based on type, the market is segmented into rock salt, salt in brine, solar salt, and vacuum pan salt.

Rock salt accounted for the largest market share of 43.37% in 2026 and is expected to continue its dominance until 2032. Rock salt is extracted from underground mines, typically through drilling and blasting techniques. This segment is driven by growing demand for de-icing and road salt applications, particularly in regions with cold and snowy winters, as it helps to melt snow and ice on roads and highways. It is also used in other industrial applications, such as chemical processing, water treatment, and oil drilling. In the food industry, rock salt is used for curing meat and fish.

Solar salt is likely to witness significant growth during the forecast period owing to the growing demand for high-quality products across various industries. The food industry is one of the largest consumers of solar salt, as it is used in the production of processed foods, snacks, and baked goods. Increasing demand for organic and natural products, coupled with the growing awareness about the health benefits of high-quality salt, is driving the growth of the segment.

One of the key driving factors of the vacuum pan salt segment is its efficiency in producing high-quality salt at a relatively lower cost compared to other methods. Moreover, the ability of vacuum pan salt to meet stringent quality standards and regulatory requirements makes it a preferred choice for many consumers.

By Source

Salt Mines Segment Dominated Due to Availability of Underground Deposits

Based on source, the market is segmented into brine and salt mines.

The salt mines segment accounted for the largest salt market share in 2024 due to the availability of underground deposits. The production of salt from mines involves a series of processes to extract and refine salt from underground deposits. Specific methods and processes used in material production can vary depending on the type of deposit and the location of the mine. The segment is expected to dominate the market share of 73.72% in 2026.

Another production process is the extraction of salt from saline solutions, also known as brines. Brines are typically found in natural saltwater sources such as salt lakes, salt pans, and underground deposits. This segment is anticipated to forecast a CAGR of 3.92% during the forecast period..

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Chemical Processing Segment holds a Significant Share owing to Extensive Product Adoption

In terms of applications, the market is classified into chemical processing, de-icing, water treatment, oil & gas, agriculture, flavoring agent, and others.

The chemical processing segment accounted for the largest share of the market. Salt plays a crucial role in the chemical processing industry as it is widely used as a raw material and chemical reagent in various processes. The product demand from the chemical processing industry is driven by the production of key chemical compounds, industrial applications, and regional market dynamics. The segment is expected to dominate the market share of 52.51% in 2026.

The flavoring agent segment accounted for the second largest share of the market. The global appetite for flavor is fueling a surge in salt demand. Beyond its traditional role as a preservative, salt is increasingly sought after as a key ingredient in enhancing the taste profiles of prepared foods. From savory snacks and ready-to-eat meals to gourmet sauces and innovative culinary creations, the demand for sodium as a flavor enhancer is on the rise. This trend reflects a growing consumer preference for bold and complex flavors, driving manufacturers to incorporate salt more strategically in their product formulations.

De-icing segment is anticipated to forecast a CAGR of 4.27% during the forecast period. The de-icing segment is expected to hold a 13.3% share in 2024.

Salt Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Salt Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific holds the largest share and dominates the global market, with China being the leading contributor. The regional market value in 2025 was USD 11.08 billion, and in 2026, the market value led the region by USD 12.22 billion. The growth in the region is driven by rapid industrialization and population growth. China, India, and Australia are key players in the market. The chemical processing industry is a significant consumer of salt, especially for producing chlorine and other chemicals. The market value in China is expected to be USD 6.7 billion in 2026.

On the other hand, India is projecting to hit USD 1.5 billion and Japan is likely to hold USD 0.53 billion in 2026.

For instance, according to the India Brand Equity Foundation (IBEF), the demand for sodium and caustic soda is expected to grow at a CAGR of 10% reaching approximately USD 13 billion and USD 11.5 billion by 2040.

- In China, the De-Icing segment is estimated to hold a 12.3% market share in 2024.

China Salt Market Share, By Application, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

The North American market is expected to hit USD 5.53 billion in 2026 as the third-largest market. The market in North America has witnessed strong growth owing to the rising demand from the chemical processing sector, where salt is crucial for the production of chlorine and caustic soda. Additionally, the de-icing application is significant in northern states, where winter weather conditions necessitate the use of salt for road safety.

According to the U.S. Environmental Protection Agency (EPA), the most common substance used for deicing roads and highways is Sodium Chloride (NaCl) or table salt known as rock salt when spread on the road due to its much larger granules. The U.S. market size is expected to hit USD 4.89 billion in 2026.

Europe

Europe is anticipated to account for the second-highest market size of USD 5.76 billion in 2026, exhibiting the second-fastest growing CAGR of 3.71% during the forecast period. Europe holds a substantial share of the global market, with Germany, the Netherlands, and the U.K. being prominent producers. The chemical industry is a major driver, particularly in Germany, where salt is critical for producing various chemicals. The de-icing application is also significant, especially in northern and central European countries that experience heavy snowfall. The U.K. market size is likely to hit USD 1.27 billion, followed by Germany is projected to stand for USD 2.52 billion in 2026, France is likely to hit USD 0.595 billion in 2025.

According to EUSalt, salt outperforms other de-icing solutions based on safety, availability, and environmental impact. This substantially boosted the demand in Europe.

Latin America

Latin American countries such as Brazil and Chile are witnessing growth in the market driven by the chemical processing and food industries. Salt is essential for producing various chemicals, while the food sector utilizes it for preservation and flavoring. The region’s vast agricultural landscape also creates demand for salt as a livestock supplement.

Middle East & Africa

The Middle East & Africa market holds a considerable value of USD 2.44 billion in 2026 as the fourth-largest market. The oil and gas sector is a primary driver of salt demand, particularly in countries such as Saudi Arabia and the UAE, where salt is used in drilling operations and enhanced oil recovery. The agricultural sector is also significant, as salt serves as a mineral supplement for livestock and a soil conditioner. Water treatment applications are increasingly important due to the region’s water scarcity issues. The GCC market is expected to reach USD 0.981 billion in 2025.

Competitive Landscape

Key Players in Salt Market

To know how our report can help streamline your business, Speak to Analyst

K+S AG, Cargill Salt, Compass Minerals International, Inc, INEOS Enterprises Salt, and China National Salt Industry Group Co., Ltd are the top players in the market. The global salt market is fairly fragmented, with the top 5 players accounting for around 30% of the market share.

Key Players are Adopting Business Expansion Strategy to Maintain Their Position in Market

The manufacturers are expanding their businesses to gain competency in the industry and alleviate new entrants’ threats. Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing markets.

LIST OF KEY SALT COMPANIES PROFILED

- American Rock Salt (U.S.)

- Cargill Salt (U.S.)

- Compass Minerals International, Inc. (U.S.)

- INEOS Enterprises Salt (U.K.)

- K+S Aktiengesellchaft (Germany)

- China National Salt Industry (China)

- Chemetica (Poland)

- US Salt LLC (U.S.)

- Ahir Salt Industries (India)

- GHCL Limited (India)

KEY INDUSTRY DEVELOPMENTS

- December 2024: GHCL, a key salt manufacturer and part of the Dalmia Group, invested USD 40.44 million to create a salt field in Kutch. The Zara Zumara Salt Field will be developed in the Jara area of Kutch.

- May 2023: Cargill’s salt business signed an agreement with CIECH Group, a leading supplier of evaporated salt products. Through this agreement, Cargill extended its range of specialty and evaporated food salt solutions for European food manufacturers.

- April 2022: Tata Salt, one of India's most trusted brands and pioneers of the salt iodization movement, launched Tata Salt Immuno. This innovative product, a first of its kind in the Indian edible salt segment. Along with mandated iodization, the product has added zinc, which is known to support a healthy immune system.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and end-use industries. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years. This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

Growth Rate |

CAGR of 4.4% from 2026 to 2034 |

|

Segmentation |

By Type

|

|

By Source

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 26.92 billion in 2025 and is projected to reach USD 39.38 billion by 2034.

In 2025, the Asia Pacific market size stood at USD 12.51 billion.

Growing at a CAGR of 4.4%, the market will exhibit steady growth during the forecast period (2026-2034).

The chemical processing segment is expected to be the leading segment in this market during the forecast period.

The growing product demand from industrial applications is a key factor boosting market growth.

K+S AG, Cargill Salt, Compass Minerals International, Inc, INEOS Enterprises Salt, and China National Salt Industry Group Co., Ltd are major players in the global market.

Asia Pacific dominates the market by holding the maximum share.

A rise in product adoption in the chemical manufacturing industry, especially in chlorine-alkali chemicals production, is expected to foster the growth of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us