Self-Driving Bus Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), and Regional Forecast, 2025 – 2032

KEY MARKET INSIGHTS

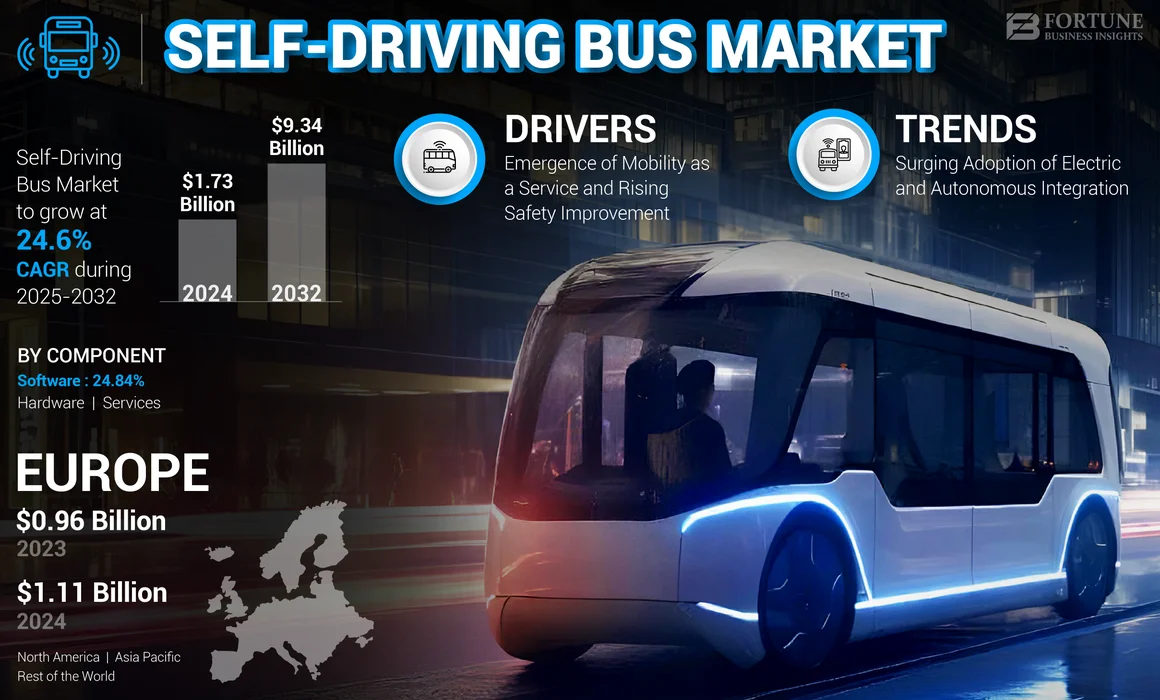

The global self-driving bus market size is expected to grow from USD 1.73 billion in 2024 to USD 9.34 billion by 2032, exhibiting a CAGR of 24.6% during the forecast period. Europe dominated the global market with a share of 55.49% in 2024.

A self-driving bus is also known as an autonomous or driverless bus. The market pertains to the sector dedicated to the development, production, and deployment of autonomous buses. The vehicle utilizes advanced technologies, including sensors and artificial intelligence, to navigate without direct human control. The aim is to provide efficient, intelligent, safe, and reliable public transportation solutions, by enhancing overall mobility in urban and suburban areas. The growth of the market is attributed to advancements in autonomous vehicle technologies, increased investment in research and development, and a growing emphasis on smart and sustainable transportation solutions.

Self-Driving Bus Market Trends

Rising Adoption of Electric and Autonomous Integration is an Ongoing Trend in the Market

The rising adoption of electric and autonomous integration is an ongoing trend in the market. Many autonomous buses are adopting electric propulsion systems to align with sustainability goals. This trend is environmentally friendly and also contributes to the reduction of operational costs and dependency on traditional fuel sources. Autonomous buses are increasingly leveraging AL algorithms to enhance the decision-making process. For instance, in August 2023, VDL signed a contract with Schaeffer to develop and produce a new generation of self-driving electric shuttles for public transport. As conveyed, the two companies were then in advanced negotiations with public transport authorities and operators about pilot projects. Such developments would drive market growth during the forecast period.

Download Free sample to learn more about this report.

Self-Driving Bus Market Growth Factors

Increasing Safety Improvement and Rise of Mobility as a Service to Propel Market Growth

The increasing safety improvement and rise of mobility as a service drive market growth. Autonomous buses have the potential to significantly reduce accidents caused by human error, such as distracted driving or fatigue. Advanced sensors and algorithms enhance the vehicle's ability to detect and respond to its environment, leading to a safer transportation system. This increasing safety engagement fuels the demand for autonomous buses.

The concept of mobility as a service, where transportation is viewed as a comprehensive and interconnected service, aligns well with the autonomous bus market. These buses can be integrated into larger urban mobility networks, providing seamless and efficient transportation options. Thus, the rise of mobility as a service (Maas) is anticipated to boost market growth during the forecast period.

For instance, in January 2023, ZF signed a partnership with Beep, Inc. to bring a new-generation autonomous Level 4 shuttle to the U.S. market. The agreement aimed to deliver several thousand shuttles to customers over the coming years. Furthermore, it intended to combine ZF’s ATS with Beep’s mobility services and service management platform into a single-source autonomous mobility solution.

RESTRAINING FACTORS

High Initial Cost and Infrastructure Limitations May Hamper Market Growth

The cost associated with autonomous driving technology electric propulsion systems is high compared to conventional driving technology. Many transit agencies/companies may find it financially challenging to invest and adopt these technologies. The need for clearer and standardized regulations for autonomous vehicles poses a significant obstacle. Government and regulatory bodies are working to establish guidelines. However, the technology makes it challenging to create universally accepted regulations. The adoption of autonomous buses/self-driving buses relies on advanced infrastructures, including smart traffic signals, dedicated lanes, and communication networks. The lack of such infrastructure can hinder the self-driving bus market growth. Although an autonomous vehicle transmits and accepts information, the system reacts to driving scenarios based on its prior experiences. Therefore, new or unexpected roadway or weather conditions can lead to system failures and accidents.

Self-Driving Bus Market Segmentation Analysis

By Component Type Analysis

Rising Communication and Connectivity Technology for Autonomous Buses are Driving Hardware Segment Growth

Based on component type, the market is segmented into hardware, software, and services.

The hardware segment holds the highest market share at the global level. The segmental growth is attributed to the rising development of communication and connectivity technology for autonomous buses. Effective communication between autonomous buses, infrastructure, and other vehicles is crucial for coordinated operations. Hardware components related to vehicle-to-everything (V2X) communication, including onboard communication modules, antennas, and connectivity hardware, drives the market growth by enabling seamless data exchange.

The software segment holds the second-largest market share. The growth is attributed to the increasing advanced perception and decision-making algorithms, machine learning and artificial intelligence, and real-time mapping and localization.

REGIONAL INSIGHTS

By region, this market has been studied across North America, Europe, Asia Pacific, and the rest of the world.

Europe Self-Driving Bus Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Europe market size stood at USD 0.96 billion in 2024 and will likely dominate the market. The regional growth is attributed to factors such as strong government support, robust infrastructure, regulatory framework promoting autonomous vehicle testing, and growing emphasis on sustainable transportation solutions. In addition, collaborations between technology companies and public transport authorities in Europe contribute to its leadership in the market.

Asia Pacific is the fastest-growing region. The regional self-driving bus market share is experiencing rapid growth due to the large and densely populated urban environment, increasing demand for efficient and sustainable public transport, and substantial investment in smart city initiatives. In addition, China and Japan, have been actively supporting the research and development of self-driving buses, fostering a conducive environment for the growth of the market in the region.

North America and the rest of the world's regional growth is attributed to increasing investment by companies and governments in technology, research and development, a supportive regulatory environment in certain states and provinces, and growing consumer acceptance of self-driving technology.

To know how our report can help streamline your business, Speak to Analyst

Key Industry Players

Companies Focus on a Wide Range of Product Offerings to Gain Competitive Edge

Key market players in the self-driving buses industry include AB Volvo, Proterra, and Hyundai Motor Company. These organizations focus on meeting customer demands for various vehicles worldwide, particularly in the development of self-driving type of buses. This development encompasses various stages and contributions from companies specializing in different aspects of the technology, such as sensor technology, artificial intelligence, mapping and localization, communication systems, among others.

Volvo Group is a company known for manufacturing and supplying automotive products including trucks, buses, engines, and construction equipment. Additionally, it provides insurance, rental, spare parts, repair and maintenance, and assistance services. In June 2023, Volvo Group announced its expansion in North America by establishing an office in Texas and initiating manual operations to prepare for commercial autonomous hub-to-hub transport.

List of Top Self-Driving Bus Companies

- AB Volvo (Sweden)

- Volkswagen AG (Germany)

- Proterra (U.S.)

- Hyundai Motor Company (South Korea)

- Hino Motors, Ltd (Japan)

- Apollo Baidu (China)

- MAN Truck & Bus (Germany)

- EasyMile (France)

- New Flyer (Canada)

- Toyota Motor Corporation (Japan)

- Yutong Group (China)

- Navyo (France)

- Novus Hi-Tech Robotic Systemz (India)

- COAST AUTONOMOUS, INC. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2023: Volkswagen announced plans to test autonomous vehicles in the U.S., starting with a driverless version of its I.D. Buzz electric microbus. The new fleet would be tested on Austin (Texas) public roads. The company had initially planned to use Argo’s tech for powering a fleet of self-driving I.D. Buzz microbuses. The plan constitutes vehicle testing in Austin, in addition to four other cities in the U.S., over the next three years, with the objective of introducing a robotaxi service in 2026.

- June 2023: Hyundai Motor introduced a pilot service of the RoboShuttle, a combination of artificial intelligence (AI) and autonomous driving technology, at the South Korean national assembly. Hyundai Motor and the national assembly secretariat held a commemorative test ride event for the driverless RoboShuttle. In addition, the self-driving integrated mobility platform "TAP!" developed by Hyundai Group's global software centre, 42dot, has been incorporated into the RoboShuttle.

- October 2022: EasyMile announced that the company is delivering a fleet of fully driverless shuttles for commercial service in tourist hotspots. The new service contains a complete transport system, validated security, and advancement to Level 4 of autonomous driving. The shuttles would cover a 2.5 km-long route that would connect the attractions of the Terhills Hotel to the Terhills Resort and the future cycling and walking bridge over the large lake.

- October 2021: Hyundai Motor announced plans to set up infrastructure for the development and test-run of self-driving vehicles at its R&D Center based in Namyang, Gyeonggi. The company would operate self-driving, on-demand buses within the R&D Center and develop a vehicle control system. Hyundai Motor has initiated operating four Level 4 autonomy technology-based self-driving buses. Level 4 self-driving vehicles can operate on their own under normal conditions.

- February 2021: Apollo Baidu launched a multi-modal Mobility-as-a-Service pilot program in Guangzhou, China. The company provides self-driving cars, shuttles, buses, vending machines, and police robots. The program would integrate many different autonomous vehicle platforms, all using the company’s Apollo ‘autonomous driving solution.’

REPORT COVERAGE

The global self-driving bus market research report provides a detailed industry analysis and focuses on key aspects such as leading market players, competitive landscape, and component type. Besides, the report includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2023-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Growth Rate |

CAGR of 24.6% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation

|

By Component

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 1.73 billion in 2024.

The market is set to grow at a CAGR of 24.6% over the forecast period (2025-2032).

By component type, the hardware segment is the leading segment in the market.

Europe held the largest share of the market in 2024.

The market size in Europe stood at USD 0.96 billion in 2024.

AB Volvo, Proterra, and Hyundai Motor Company are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us