Snake Antivenom Market Size, Share & COVID-19 Impact Analysis, By Type (Polyvalent Heterologous, and Monovalent Heterologous), By Application (Hospitals and Clinics), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

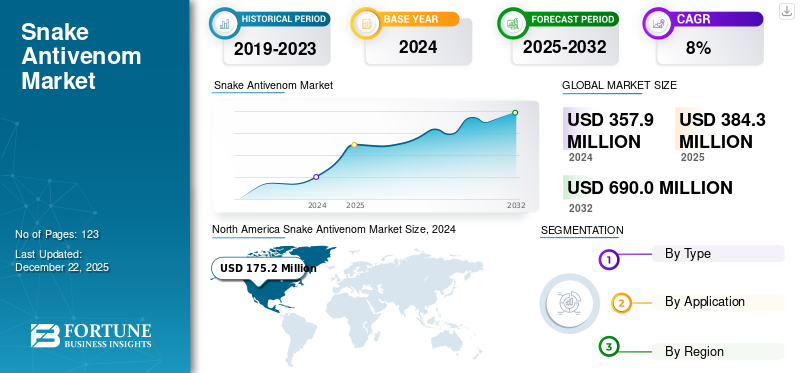

The snake antivenom market size was valued at USD 357.9 million in 2024. The market is projected to grow from USD 384.3 million in 2025 to USD 690.0 million by 2032, exhibiting a CAGR of 8.7% during 2025-2032. North America dominated the global market with a share of 51.01% in 2022.

Based on our analysis, the global market observed a decline of 2.3% in 2020 as compared to 2019. The global COVID-19 pandemic has been unprecedented and staggering, with snake antivenom experiencing lower-than-anticipated demand across all regions compared to pre-pandemic levels.

Snakebites are the most neglected health problem in tropical and subtropical regions. According to the World Health Organization (WHO), globally, an estimated 2.7 million cases of snake envenoming are reported each year. An estimated 81,000 to 138,000 deaths occur each year due to venomous bites. Geographically, there is a vast disparity in distribution of these encounters. Around 1.7 million snakebite encounters are reported each year in Asia alone. Countries in Latin America and Africa also witness a large number of snakebites annually. The rising cases of snake envenoming worldwide is one of the predominant factors that is surging the demand for innovative products.

Moreover, antivenom is the only effective treatment to reverse the effects of snake envenoming. Snake’s antivenom is included in the WHO ‘Essential Medicines List’ and is a part of primary healthcare. Additionally, various government and non-government organizations launched various projects and initiatives to raise awareness regarding snakebite treatment with the goal of reducing mortality due to snakebites. In May 2019, the WHO launched a strategy for prevention and control of snakebite envenoming with an aim to lower the disabilities and deaths caused by snakebites by the end of 2030. Such initiatives have helped these organizations create awareness and accessibility in the low-and-middle income countries.

Snake Antivenom Market Overview & Key Metrics

Market Size & Forecast:

- 2024 Market Size: USD 357.9 million

- 2025 Market Size: USD 384.3 million

- 2032 Forecast Market Size: USD 690.0 million

- CAGR: 8.7% from 2025–2032

Market Share:

- Region: North America dominated the snake antivenom market with a 51.01% share in 2022, driven by the rising incidence of venomous snakebites in the U.S., strong regulatory frameworks, presence of major market players like BTG International and Rare Disease Therapeutics, and high accessibility to antivenom treatments.

- Type: Polyvalent heterologous antivenom is expected to retain the largest market share, owing to its broad-spectrum efficacy against multiple snake species, increased production capacity by manufacturers, and wider adoption in clinical settings where identification of specific snake species is difficult.

Key Country Highlights:

- Japan: Rising public health awareness, growing collaboration with ASEAN nations on snakebite treatment, and increased focus on research-driven approaches are aiding demand for antivenom in the country.

- United States: Increased envenomation cases (approx. 8,000–10,000 annually), climate change effects, and healthcare policies that support high-value biologics have contributed to consistent demand. Manufacturers like BTG International continue to expand their supply and portfolio.

- China: Government-supported R&D and regional collaboration (e.g., Wuzhou TCM Hospital) are enabling growth in snakebite treatment infrastructure and access to antivenom products.

- Europe: Moderate but consistent growth is expected, supported by strategic initiatives from key manufacturers, rising awareness of snakebite dangers due to increased travel and rural exposure, and a structured healthcare delivery model.

COVID-19 IMPACT

Temporary Halt in Hospital Admissions and Supply Chain Disruptions Amid COVID-19 Pandemic Hampered Market Growth

The unprecedented COVID-19 pandemic had a negative impact on the global market. Many factors, such as delays in hospital admissions due to disruption in transportation and increased wait time in seeking snakebite treatment due to the imposition of stringent regulations, are a few factors that affected the market. Furthermore, disruption in demand and supply chain and diversion of healthcare facilities such as equipment, beds, and healthcare professionals toward managing the pandemic had an adverse impact on the market growth.

- According to an article published in NCBI in 2021, a tertiary hospital in Bangladesh with a dedicated snakebite treatment ward witnessed 25% reduction in the overall snakebite hospital admission in 2020 compared to the previous years.

Moreover, the reduction in the manufacturing capacity of antivenoms in many countries and the cancellation of orders by the endemic countries with no manufacturing facilities owing to logistical restrictions levied during the lockdown had declined the market growth.

- For instance, according to a survey published in NCBI 2021, ten laboratories in Latin America, including Instituto Nacional de Salud, Instituto Butantan, and others manufacturing snake antivenom reported a drop in their production. In addition, four laboratories also witnessed a reduction in the overall budget assigned to such antivenom producers.

However, due to the resumption of normal healthcare activities and the ease in restrictions imposed during the post-pandemic, the market regained normalcy and is expected to register a comparatively higher growth during forecast period.

LATEST TRENDS

Download Free sample to learn more about this report.

Rising Penetration by Market Players in Developing Nations

The exponential increase in snakebite incidents in the tropical and sub-tropical regions has increased the product demand among the countries in the region. In order to meet the growing demand, the manufacturers developing antivenom are continuously trying to increase their production capacity and the companies that have halted production are planning to resume production. Also, the government is taking various initiatives to improve the access to antivenom, and to cater to the rising product demand in the emerging nations.

- For instance, in March 2022, the Government of West Bengal, India, invited Expressions of Interest (EOI) from qualified and eligible manufacturers to supply snake antivenom prepared from the venoms of venomous snake specimens found in West Bengal.

Additionally, the governments of developing nations provide support to the manufacturers by entering into partnerships and granting funds to increase their antivenom production capacity.

- In September 2019, the Federal Ministry of Health, Nigeria, expedited the domestic production of snake antivenom through the Public-Private Partnership (PPP) Initiative to make the product available, accessible, and affordable to Nigerians.

SNAKE ANTIVENOM MARKET GROWTH FACTORS

Rising Incidence of Snakebites across the Globe to Boost Market Growth

Snakebite is a common public health issue causing various complications such as tissue damage, paralysis, limb amputation, fatal hemorrhage, and others among the population of many subtropical and tropical countries. Additionally, the rising incidence of snakebites in western countries due to climate change and the expansion of human settlement in humid regions like the southern part of the U.S., is bolstering the growth of the market.

- According to the World Health Organization, an estimated 5.4 million snakebites are reported yearly worldwide, with about 1.8 – 2.7 million cases of envenoming. Also, most snakebite encounters are reported in Asia, Africa, and Latin America.

- Further, according to America's Poison Centers 2020 annual report, in the U.S., copperhead envenomation increased from 2,216 cases in the year 2019 to 2,590 in the year 2020.

Moreover, the rising implementation of various initiatives by the government of developing nations and manufacturers to raise awareness regarding snakebite treatment is ultimately increasing the demand for snake antivenom.

- According to a study published in PLOS in 2022, approximately 80,000 – 200,000 snakebite envenoming instances were reported in the ASEAN region, out of which an estimated 25% to 30% victims received treatment.

Thus, the increasing number of snakebite cases across the globe along with growing initiatives to increase regarding treatment options is propelling the adoption of these products, thereby facilitating the global snake antivenom market growth.

RESTRAINING FACTORS

High Cost of Products and Snakebite Treatment is Likely to Hinder Market Growth

As there is limited reimbursement coverage in low-and-middle-income countries compared to developed nations, the high cost of such antivenom becomes a major factor hindering market growth. Further, in rural areas in sub-Saharan Africa and South Asia, national insurance schemes do not have high coverage and are restricted to only public employees. The schemes do not extend to farming communities, which are more prone to snakebites.

- According to an article published by the Congressional Research Services Report, in 2020, an estimated 91.4% of the total U.S. population was covered under either private or public insurance providers (Medicare and Medicaid). However, according to an online report published in 2021, about 97% of the Nigerian population is not covered under any health insurance.

According to the Global Snake Initiative, the cost of an antivenom vial ranges from USD 80 to USD 315 in Africa. Additionally, the treatment requires around 5 – 10 vials as an initial dose, making the single treatment to cost as much as USD 1,600. This coupled with limited reimbursement policies in emerging countries and other costs of treatment, such as inpatient admissions and hospital stays, makes the treatment less affordable in these countries.

Additionally, the lack of price regulations in a few countries results in a high price of products, often making it less affordable even in developed countries. For instance, in the U.S., the cost of snake antivenom can exceed USD 3,000 per vial in some places. Hence, the lack of adequate price regulation and reimbursement policy in developing nations, along with the high cost of antivenom, restricts market growth.

SEGMENTATION

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Advantages of Polyvalent Heterologous Type to Elevate the Market

Based on type, the market is segregated into polyvalent heterologous and monovalent heterologous. The polyvalent heterologous segment held a major market share in 2021. Polyvalent antivenom neutralizes the venomous bite of many snake species in a region and is preferred over monovalent antivenom as snake species are less frequently identifiable in clinical practice due to medical emergencies.

In addition to the advantage associated with polyvalent heterologous, many key players are increasing their production capacity for polyvalent products and receiving regulatory approvals to cater to different snake species in a region and improve access.

- For instance, in October 2018, Rare Disease Therapeutics, Inc. launched ANAVIP Crotalidae Immune F(ab')2 (Equine), an equine-based antivenin indicated for the management of patients with North American rattlesnake envenomation.

Further, the monovalent heterologous segment is projected to grow at a noteworthy CAGR during the forecast period. Certain specific advantages, including improved penetration into tissue, high affinity for venom antigen, specific to the snake species, and better efficiency are expected to increase their adoption, thus augmenting its segmental growth rate in the coming years.

By Application Analysis

Increasing Hospital Admission for Snakebite Treatment to Fuel Market Growth

On the basis of application, the market is categorized into hospitals and clinics. The growing number of hospital admissions for snakebite treatment is expected to surge the product demand, thereby contributing to high revenue generation. Furthermore, hospital facilities comprising extended stays in case of prolonged treatment, personalized care, focused treatment, and others increase the patient preference to seek treatment from hospitals.

- In 2021, out of around 3,000 cases that were reported due to snakebites in Australia, 500 victims required inpatient admission in hospitals.

Moreover, the clinics segment is anticipated to register considerable growth. The establishment of new clinics for treating snakebite patients is one of the factors responsible for segmental growth.

- For instance, in June 2022, doctors from the University of Alabama at Birmingham launched the first follow-up clinic for patients who encountered snakebites. The clinic provides follow-up treatment after snake envenomation.

REGIONAL INSIGHTS

North America Snake Antivenom Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

On the basis of region, North America generated a revenue of USD 150.4 million in 2021 and is predicted to dominate the market throughout the study period. The growing incidence of snake envenoming in the U.S. and Canada is one of the factors predominantly driving the market in the region. Moreover, the presence of key players in the region indulged in various strategic business activities to expand their product portfolio and a conducive environment provided to develop safe and efficient snake antivenom products for the market, among others are a few factors responsible for the growth of the market in the region.

- For instance, according to data published by Centers for Disease Control & Prevention in 2021 and other credible sources, approximately 8,000 – 10,000 people encounter venomous snakebites in the U.S. Thus, the rising snakebite incidence is expected to raise the demand for snakebite treatment, ultimately bolstering the demand for these products.

Asia Pacific is projected to exhibit lucrative growth during the forecast period. The rising number of snake envenomings in the region and the rising awareness regarding proper snakebite management are fueling the market growth. Additionally, the resumption in manufacturing facilities to produce snake antivenom to meet the growing demand in the regional and international market, increase in research and development to develop safe and effective products, and others are some of the other factors contributing to the market growth.

- For instance, in October 2018, healthcare professionals at Wuzhou Traditional Chinese Medical Hospital collaborated with ASEAN countries for extensive research on snakebite treatment.

Europe is anticipated to witness considerable growth during the study period. Presence of key manufacturers and their rising strategic initiatives to expand their product portfolio, increasing number of snake envenomings, and rising treatment rate in the region are a few factors responsible for the market growth.

Additionally, Latin America and the Middle East & Africa accounted for a comparatively lower market share in 2021. However, both regions are projected to observe a considerable growth during the forecast period. Increasing initiatives by the government to promote antivenom production in the region and rising grants in funds to manufacture products, among others are contributing to the growth of the market.

KEY INDUSTRY PLAYERS

BTG International Inc. Dominated the Market Owing to its Various Strategic Activities

The market is semi-consolidated in terms of the competitive landscape with a few players holding a noteworthy market share. The players are primarily dominating the market in the region where they have a significant presence. BTG International Inc. accounted for the highest market share due to its rising strategic business activities to increase the distribution of its products.

- In January 2019, the BTG International Inc. partnered with OMNY to improve accessibility of its snake antivenom CroFab using distributed ledger technology.

In addition, CSL Limited captured a prominent position in the global snake antivenom market share in 2021. The company’s collaboration with the government to export antivenom vials and rising investments to increase the antivenom production are factors supporting the company’s dominance in the market.

- In November 2020, CSL Sequris (a subsidiary of CSL Limited) invested around USD 601.5 million to construct a manufacturing facility in the Southern Hemisphere for the production of Australian antivenoms along with Q-fever vaccine and pandemic flu vaccine to meet the growing demand for antivenoms.

Other prominent players in the market include VINS Bio Products Limited South Africa Vaccine Producers, Micropharm, and others. Strong geographical presence of the companies, mainly in the snakebite endemic countries, and robust product portfolio of some companies are projected to strengthen their share in the global market during the forecast period.

LIST OF KEY COMPANIES PROFILED IN SNAKE ANTIVENOM MARKET:

- MicroPharm (U.K.)

- BTG International Inc. (U.S.)

- VINS Bioproducts Limited (India)

- Pfizer Inc. (U.S.)

- SEQIRUS (CSL Limited) (Australia)

- Inosan Biopharma (Mexico)

- South Africa Vaccine Producers (South Africa)

- Rare Disease Therapeutics, Inc. (U.S.)

- Incepta Vaccine Ltd. (Bangladesh)

- Bioclon Institute (Mexico)

KEY INDUSTRY DEVELOPMENTS:

- August 2022 - Bharat Serums and Vaccines Limited (BSV) partnered with Indian Institute of Science (IISc) to develop region-specific antivenom of snakebites in India.

- March 2022 - Ophirex, Inc. received the U.S. Fast Track Designation (FDA) to varespladib-methyl for the treatment of snakebite.

- April 2021 Rare Disease Therapeutics, Inc. announced new expanded FDA approved indication for Antivenom ANAVIP for treatment of North American Pit Viper Envenomation.

- March 2021 - SERB completed the acquisition of BTG International Inc. to become a global leader in critical care medicines.

REPORT COVERAGE

The research report provides qualitative and quantitative insights into market analysis, market size, and growth rate for all possible segments in the market. Along with this, the report provides global overview and an elaborative analysis of regional market dynamics and competitive landscape. Various key insights presented in the report are the incidence of snakebites – for key countries/regions, new product launches, key recent industry developments – mergers, acquisitions, and partnerships, and impact of COVID-19 on the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 384.3 million in 2025 and is projected to reach USD 690.0 million by 2032.

In 2024, North America stood at USD 175.2 million.

The market will exhibit steady growth at a CAGR of 8.7% during the forecast period (2025-2032).

Based on type, the polyvalent heterologous segment will lead the market.

The increasing number of snakebite cases across the globe and the growing initiatives to increase treatment awareness are the key drivers of the market.

BTG International Inc. and Pfizer, Inc. are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us