Sports Analytics Market Size, Share & Industry Analysis, By Solution (Video Analytics, Big Data Analytics, Real-time Analytics, Smart Wearable Technology, and Others), By Deployment (Cloud and On-premise), By Type (On-field and Off-field), By End-User (Team, Individual Athletes, Sports Association & Federation, and Event Organizers and Sponsors), and Regional Forecast, 2026-2034

SPORTS ANALYTICS MARKET SIZE AND FUTURE OUTLOOK

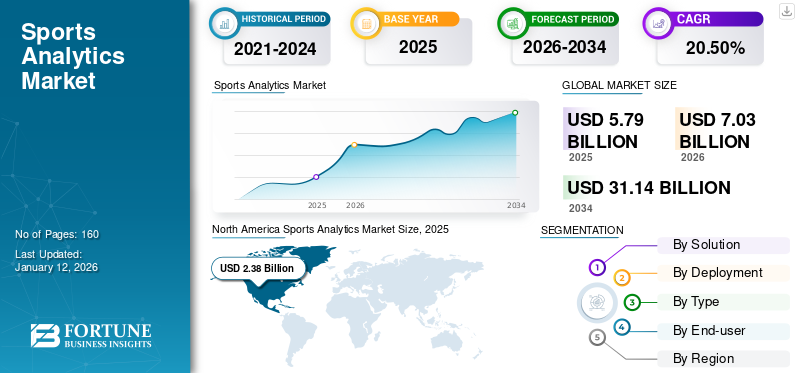

The global sports analytics market size was valued at USD 5.79 billion in 2025. The market is projected to grow from USD 7.03 billion in 2026 to USD 31.14 billion by 2034, exhibiting a CAGR of 20.50% during the forecast period. North America dominated the global market with a share of 41.20% in 2025.

Sports analytics tools provide insights that assist coaches, management, and athletes in improving their skills, strategies, and overall performance. These solutions provide advanced methods for analyzing data, enabling predictions of win-loss records to forecast the outcomes of upcoming sporting events.

Technology enhances performance, boosts commercial growth, and increases participation across the entire industry, highlighting the entertainment, social, and health benefits of sports. The startups play a crucial role in this ecosystem by introducing innovative ideas and addressing specific challenges within the industry.

List of early-stage companies that investors can target:

- Camb.ai:

- Location: UAE

- Funding Stage: Series A

Camb.ai provides a generative AI model that translates spoken commentary into over 100 languages, dialects, and accents in real time, preserving the original speaker's voice and tone. In 2024, the company raised USD 4 million in a seed round led by Courtside Ventures to support its continued expansion.

- 15 Seconds of Fame:

- Location: U.S

- Funding Stage: Series A

The company provides facial recognition technology that compiles clips from broadcast or in-venue video feeds. Fans can download these clips through partner applications, allowing them to share videos of themselves in the crowd or on social media. This not only increases awareness and engagement but also generates advertising revenue, which is shared between 15SOF and its partners. The company recently raised USD 15 million in a Series A funding round led by Shadowbox Studios.

- Hexis:

- Location: Ireland

- Funding Stage: Pre-seed

The company offers personalized nutrition plans specifically designed for athletes. By combining research with AI technology, it develops tailored strategies that cater to individual player needs and body types. These recommendations are delivered through an easy-to-use smartphone app, ensuring that athletes have the necessary information at their fingertips, thereby, increasing both awareness and effectiveness in their nutrition. In 2024, Hexis raised USD 2 million in a pre-seed funding round, backed by athlete-supported venture capital firm Apex, the owners of Southampton (Sport Republic), and several professional cyclists and Olympic medalists.

- Magic AI:

- Location: U.K.

- Funding Stage: Series A

The company offers an intelligent mirror that delivers personalized workout experiences without the need for a personal trainer. The mirror provides visual instructions and real-time feedback, utilizing sensors to track key performance metrics and the movements of the individual. It is equipped with a library of workouts, some tailored for specific sports which is presented by renowned athletes. Till date, users of the mirror have logged over 46,000 hours of training, and the company aims to quintuple this figure by the year 2025. Recently, the company raised USD 5 million in a Series; A funding round led by IW Capital, with participation from executives at Meta, TikTok, and Spotify.

MARKET DYNAMICS

Market Drivers

Increasing Investments from Sports Organizations is Fueling the Market Growth

Investors are progressively recognizing the value of sports analytics, resulting in substantial investments in technology enterprises specializing in data analysis, performance monitoring, and wearable devices. The rapid expansion is attributed to the adoption of modernized technologies, including digital signage, smart wearables, and infrastructure, intended to improve fan engagement and team performance. Prominent leagues such as the NBA, NFL, NHL, and MLB are progressively using analytics to make better strategic decisions and gain a competitive edge. The upsurge in franchise valuations, propelled by broadcasting media deals, has made direct ownership a bit more challenging, prompting investors to explore opportunities and associated technologies. For instance,

According to the European Football Marketing Partnerships 2023–24 Report –

- Rise in brand and sponsorship deals: The number of brand promoters in European football increased by 22% this season, more than twice last season's increase. In contrast, the five prominent professional sports leagues in the S have an average of a 10.5% rise in sponsorship agreements since 2022. The growth in European football was attributed to an amalgamation of new deals and enhanced retention of present deals, resulting in a total of around 6,000 deals.

Thus, the market showcases promising investment prospects, driven by technological advancements and data driven approaches to improve performance and fan engagement. Such investments are fueling the sports analytics market share.

To know how our report can help streamline your business, Speak to Analyst

The pie chart indicates the funding across different sports sectors from 2019 – 2023. Funding for Fans & Content that include content platforms, fan engagement, betting, and fantasy sports solutions ranks at the top in the North American market. The surge in funding creates various prospects for sports analytics solutions in the region.

Sports Analytics Market Trends

Integration of Digital Injury Prevention tools to Boost the Market Progress

Restoration after injuries can take months or years of reliable and well-ordered exercise. Professional athletes typically have rehab specialists or skilled physiotherapists in their team . However, this may not be the case for newly entered athletes who do not have sponsorship. Thus, the implementation of injury prevention tools can help the players defend against injury in advance, thereby enhancing their overall performance on the field. With the rising usage of artificial intelligence in healthcare, injury anticipation with the usage of AI is also trending .

These applications relate similar values to AI-driven coaches, leveraging human pose approximation and computer vision to trail precise motion and deliver feedback. Rehab implementations assist players in appropriate injury treatment and retrieval by presenting a set of exercises and proper practices. Also, players’ injuries can be monitored by providing biomechanics alterations . Similar systems develop in various types of sports. For instance,

- NBA collaborated with MedStar and GE HealthCare Health to implement injury prevention leveraging wearable sensors and data analysis. This refers to the concept of combining biomechanical, general health, and physiological data that will continue to progress in

Thus, integration of digital injury prevention tools to boost the sports analytics market growth.

Download Free sample to learn more about this report.

Market Restraints

Ethical and Security Concerns can Limit the Market Progress

Sports analytics involves collecting huge amounts of personal and professional data raising concerns regarding unauthorized access and potential misuse of player’s personal information. While tracking data can offer a valued understanding of player performance, there are apprehensions over player privacy and consent. Moreover , issues can occur owing to wrong data entry or technical issues. Such issues can impact the overall analysis of the team or player, thereby limiting its adoption across the end-users.

Market Opportunity

Immersive Broadcasting with Augmented Reality to Create New Market Opportunities

Sports broadcasting is one of the prominent sources of income for sports associations. The interruptions due to COVID-19 pandemic across sports events and shortening the attention span brought by TikTok forced an issue for presenters of long games. People spend less time watching the event. With the growing popularity of augmented reality (AG), the attractiveness of the technology is increasing across sports events and matches. The Viewer Engagement Survey emphasizes the prominence of adapting content for the younger generation’s viewing habits. Gen Z and Millennials aspire to watch engaging and shorter content.. They presume real-time data, augmented reality (AR) graphics, and advanced analysis to improve their immersion in the game. Any broadcaster not seeing these components within their content can lag. For instance,

- According to Vizrt Insights 2023, around 79% of sports fans surveyed stated that they were more interested in the sports content and thus, are probable to watch a sports match or event if virtual and graphics elements such virtual studios, augmented reality graphics, and replay and data analysis are present. Implementing virtual sets in sports commentary improves the viewing experience of 65% of millennials.

Thus, adoption of immersive broadcasting can create numerous opportunities for market players.

SPORTS ANALYTICS MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific and each region is further studied across countries.

North America

North America Sports Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America led with the maximum market share with a valuation of USD 2.38 billion in 2025 and USD 2.84 billion in 2026. The market is witnessing growth in the region due to increasing adoption of wearable devices and GPS/sensor tracking systems that are used to collect granular data on player movements, biometrics, and in-game events. According to industry experts, the number of wearable devices in North America has reached around 378.8 million, with U.S leading in the region.

In the U.S., the market is expected to experience a strong growth rate during the forecast period, driven by technological advancements and an increasing emphasis on data-driven decision-making across various sports disciplines. Sports organizations in U.S. are leveraging analytics to understand fan behavior and preferences, enabling the development of targeted marketing campaigns and personalized fan experiences, which boosts revenue growth. The U.S. market is poised to be valued at USD 2.09 billion in 2026.

Notable Investments and Developments in U.S :

- In January 2025, the National Basketball Association (NBA) participated in a USD 5 Million Series; A funding round for Springbok Analytics, a company specializing in artificial intelligence applications for sports performance.

- In April 2024, Gemini Sports Analytics secured an additional USD 3.1 million in funding, led by venture capital firm Will Ventures, to enhance its data analytics offerings.

Asia Pacific

The Asia Pacific region is expected to grow with the highest CAGR and market valuation of USD 1.17 billion in 2026. The countries, including Japan, China, and India, are expected to experience strong demand for their robust building of sports culture. China is projected to be valued at USD 0.39 billion in 2026.The key factors contributing to market growth includes increasing investments in sports, the establishment of numerous sporting leagues, and the ongoing digitalization trend. Notably, China dominated the market in 2025. India is predicted to reach a market value of USD 0.15 billion in 2026, whil Japan is set to be worth USD 0.28 billion in the same year.

Recent Development in Sports Industry in China:

- In November 2023, China National Sports Group and Singapore investment company, White Group signed a collaboration agreement to launch a new fund which is aimed at driving growth in the sports sector in China. The Sino-Singapore International Sports Industry Fund initially stands at USD 279 Million and is used to acquire the rights to top-tier international sporting events and to build the “Sino-Singapore International Sports City” in the Guangdong–Hong Kong–Macao Greater Bay Area. The collaboration will also extend to the development of sports training, the management of star athletes, platforms for esports research, digital sporting events, and operations, sports data research, and sports rehabilitation and training programs, among others.

Europe

Europe is expected to show significant market growth with a CAGR of 21.65% during the forecast period (2026-2034) and market share valued at USD 1.87 billion in 2026, as sports technology in Europe has been rapidly evolving over the past few years. The U.K. market is increasing and is expected to reach a value of USD 0.27 billion in 2026. This growth is driven by integrating a wide range of innovations from data analytics and wearables to advanced training tools and fan engagement platforms. Germany dominated the market in 2024. Germany is set to be valued at USD 0.27 billion in 2026, while France is estimated to be worth USD 0.33 billion in 2025.

Notable Investments in Startups in Germany:

- In 2025, the German Federal Ministry of the Interior and Community plans to allocate approximately USD 42 million to national sports federations. This funding will highlight the government's commitment to advancing sports infrastructure and performance, potentially benefiting analytics initiatives.

Middle East and Africa

Middle East & Africa is anticipated to grow at a healthy rate and with a valuation of USD 0.67 billion in 2026. Governments and private entities in the MEA region began investing more in sports development, leading to the establishment of sports technology incubators and funding for startups focused on analytics and performance technologies. The market in GCC is anticipated to reah a market value of USD 0.22 bilion in 2025.

South America

South American market is likely to register a steady growth rate over the forecast period. Professional sports teams, leagues, and governing bodies in South America are adopting analytics technologies to improve player performance, team strategy, and fan engagement.

IMPACT OF GENERATIVE AI

Generative Artificial Intelligence AI And Machine Learning ML Are Making Significant Advances In Sports Analytics

Use cases of Generative AI & ML in Sports Analytics

- Enhancement in Player Performance Analysis: Generative AI enables the development of advanced metrics that provide deeper insights into player performance, going beyond traditional statistics. In certain sports, such as football, AI models can predict match outcomes with over 60% accuracy by analyzing various factors, including formations, key passes, and goals.

- Injury Prevention and Health Management:Machine learning models analyze biomechanics to predict potential injuries. For example, AI can identify early signs of common injuries, enabling teams to adjust training stress

- Scouting and Recruitment: AI tools analyze video footage, statistics, and biometrics to identify and evaluate talent more effectively. By utilizing machine learning to examine player performance, data from leagues and competitions worldwide is collected and AI helps to identify promising players who might go unnoticed.

- Content Generation and Fan Engagement: Generative AI can quickly produce game recaps and other content, allowing sports journalists to focus on more creative storytelling. AI curates personalized highlights and content for fans, enhancing their engagement and overall experience with the sport.

SEGMENTATION ANALYSIS

By Solution Insights

Integration of Smart Wearable Technology In Training is Expected to Boost Its Growth

Sports analytics market has been further segmented into video analytics, big data analytics, real-time analytics, smart wearable technology, and others.

Among these, smart wearable technology is estimated to grow with highest CAGR during the forecast period. The granular data collected by wearables allow for the creation of personalized training programs. Integration of wearables in training has contributed to a reduction in injury rates by up to 15%.

Video analytics segment is anticipated to dominate the market in 2026 with a share of 27.78%, as video analytics plays a significant role in modern sports analytics. By capturing high-definition footage and tagging specific events, teams can quantify a player’s effectiveness. For instance, several NBA teams using systems like Second Spectrum have reported improvements in player efficiency metrics by up to 10%-15% after integrating video-based feedback into training programs.

By Deployment Insights

Increasing Adoption of Cloud based Solution is Driving its Growth

Based on deployment, the market is bifurcated into cloud and on-premise.

The cloud segment s expected to hold the largest share of 81.77% in 2026 and is expected to register a CAGR of 23.30% during the forecast period (2026-2034). Cloud platforms can scale up quickly to process large volumes of data from wearable devices, video feeds, and IoT sensors. Cloud platforms provide the computing power necessary to run complex algorithms and machine learning models. These models can uncover patterns from vast datasets, ranging from player biometrics to tactical movements, enabling teams to predict outcomes, prevent injuries, and refine game plans. Integrating AI with cloud-based analytics can improve decision-making accuracy by 15%–20% over traditional methods.

By Type Insights

Modifying Training Programs and In-game Strategies to Drive the Surge for On-field Analytics

By type, the market is segmented into on-field and off-field.

Among these, on-field dominated the market with a share of 56.66% in 2026, driven by advancements in technology and a deeper understanding of data's role in enhancing athletic performance. Teams utilize on-field analytics to monitor player metrics such as speed, endurance, and positional data. This information aids in modifying training programs and in-game strategies, leading to improved performance. For instance, real-time data analysis allows coaches to make informed decisions about player substitutions and tactical adjustments.

Off-field is expected to witness highest CAGR of 24.80% during the forecast period (2026-2034). Analytics enable teams to implement dynamic pricing models, adjusting ticket prices in real-time based on factors such as opponent strength, weather conditions, and historical attendance data. This approach maximizes revenue and ensures optimal stadium occupancy. Off-field analytics play a crucial role in CRM initiatives, helping organizations better understand and target existing and potential fans.

By End-User Insights

Rising Adoption of Sports Analytics Have Led to Its Dominance in Market

Based on end-user, the market has been segmented into team, individual athletes, sports association & federation, and event organizers and sponsors.

Among these, Sports Association & Federation dominated the market with a share of 42.17% in 2026 and is expected to grow with a CAGR of 24.70% during the forecast period (2026-2034). Sports associations and federations are increasingly adopting sports analytics to enhance performance, optimize operations, and gain a competitive edge. Over 75% of sports associations use real-time analytics during games to gain a competitive advantage.

Event organizers and sponsors are expected to grow with healthy growth rate in coming years. Event organizers use sports analytics to enhance scheduling, logistics, ticketing, security, and fan experience by analyzing attendance patterns, weather conditions, and real-time engagement metrics.

Sponsors rely on analytics to measure brand exposure, audience demographics, and return on investment (ROI).

To know how our report can help streamline your business, Speak to Analyst

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Sports analytics solution providers are associating and competing for better reach to sports fans and consumers, and they are acquiring smaller enterprises that deliver solutions and components in the sports sector. Companies form strategic alliances and collaborations to enlarge the business, products, technologies, and other offerings with year-on-year revenue growth. Partnerships and collaborations vary according to business requirements, such as the enlargement of the product portfolio, which helps to expand the global presence and acquire a new customer base.

List of Companies Studied:

|

List of Global Companies |

List of Start-ups |

List of Regional Players |

|

Oracle Corporation (U.S.) |

15 Seconds of Fame (U.S.) |

VNG Corporation (Vietnam) |

|

WHOOP (U.S.) |

ASB Glass Floor (Germany) |

YeuTheThao (Vietnam) |

|

SAP SE (Germany) |

Camb.ai (UAE) |

Teqball (Hungary) |

|

Catapult (Australia) |

Dibz (Canada) |

Cipher Sports Technology Group (Australia) |

|

Sportradar AG (Switzerland) |

Fanbase (U.K.) |

G42 (UAE) |

|

Kitman Labs (Ireland) |

Grandstand (U.S.) |

|

|

Stats Perform (U.S.) |

Hapana (Australia) |

|

|

Orecco (Ireland) |

Hexis (Ireland) |

|

|

Hudl (U.S.) |

Tonsser (Denmark) |

|

|

InStat Sport (Ireland) |

Zaptap (Switzerland) |

|

|

Performance Sports Technology (South Africa) |

Stupa Sports Analytics (India) |

|

|

Wyscout (Italy) |

Football Radar (Brazil) |

and more….

KEY INDUSTRY DEVELOPMENTS:

- October 2024 – Catapult signed a multiyear contract with the Premiership Rugby, Premiership Women’s Rugby, and Rugby Football Union. It brings Catapult’s inventive athlete monitoring mechanism and video incorporation to rugby union in England. The strategic collaboration advances athlete performance with the national England women’s and men’s rugby teams, Premiership Women’s Rugby, and Premiership Rugby.

- September 2024 – Hudl announced a partnership with the Romanian Football Association to get exclusive privileges for their competitions. The exclusive, four-year agreement extends from 2024–25 to 2027–28 and comprises all home matches. In this alliance, Hudl becomes the sole rights partner, gaining admittance to all linked data and video, which will be made accessible through Wyscout.

- August 2024 – Stats Perform announced the launch of AI-driven OptaAI Studio. This transformative platform helps teams, broadcasters, sportsbooks, and media to make more informed, data-associated storytellers with ease to attract more readers, viewers, subscribers, and customers. OptaAI Studio makes use of AI and Opta’s huge, profound, wide-ranging sports data engine to empower more impactful and distinctive sports storytelling over thousands of teams, games, and players.

- July 2024 – Genius Sports, in collaboration with X, announced the launch of Trend Genius, using actual conversations to fast-track ad responsiveness in moments. The new technology, developed by Genius Sports and empowered by X’s Ads and Trend APIs, enables advertisers to support the actual conversations trendy on the X platform over categories.

- October 2023 – Kitman Labs announced an alliance with the Premier League. The collaboration offers every Premier League club academy a centralized, completely incorporated ‘Football Intelligence Platform’ developed to combine and organize staff and player information across coaching, sports science, operations, medical, player care, and education.

REPORT COVERAGE

The market research report provides a detailed market analysis on market segments. It focuses on key points, such as leading companies, offerings, and applications. Besides this, the report offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, the report contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 20.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution, Deployment, Type, End-User and Region |

|

Segmentation |

By Solution

By Deployment

By Type

By End-User

By Region

|

|

Companies Profiled in the Report |

Oracle (U.S.), WHOOP (U.S.), SAP SE (Germany), Catapult (Australia), IBM Corporation (U.S.), SAS Institute (U.S.), Sportradar AG (Switzerland), Kitman Labs (Ireland), Stats Perform (U.S.), Orecco (Ireland), and Others. |

Frequently Asked Questions

The market is projected to reach USD 31.14 billion by 2034.

In 2026, the market was valued at USD 7.03 billion.

The market is projected to grow at a CAGR of 20.50% during the forecast period.

Video analytics segment is expected to lead the market in terms of market share.

Increasing Investments from Sports Organizations and Tech Giants to Fuel the Market Growth

Oracle, WHOOP, SAP SE, Catapult, IBM, SAS Institute, Sportradar AG, Kitman Labs are the top players in the market.

North America dominated the global market with a share of 41.20% in 2025.

By End-User, media & entertainment sector is expected to grow with a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us