Stand-up Pouches Market Size, Share & Industry Analysis, By Material (Plastics, Foils, and Paper), By Type (Aseptic Pouches, Standard Pouches, Retort Pouches, and Others), By Closure Type (Top-notch, Spout, and Zipper), By Design Type (Round Bottom, Flat Bottom, Corner Bottom, K-seal, and Others), By Capacity (Less than 50g, 50-100g, 101-500g, and More than 500g), By End-use Industry (Food, Beverages, Beauty & Personal Care, Healthcare, Chemical, Consumer Products, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

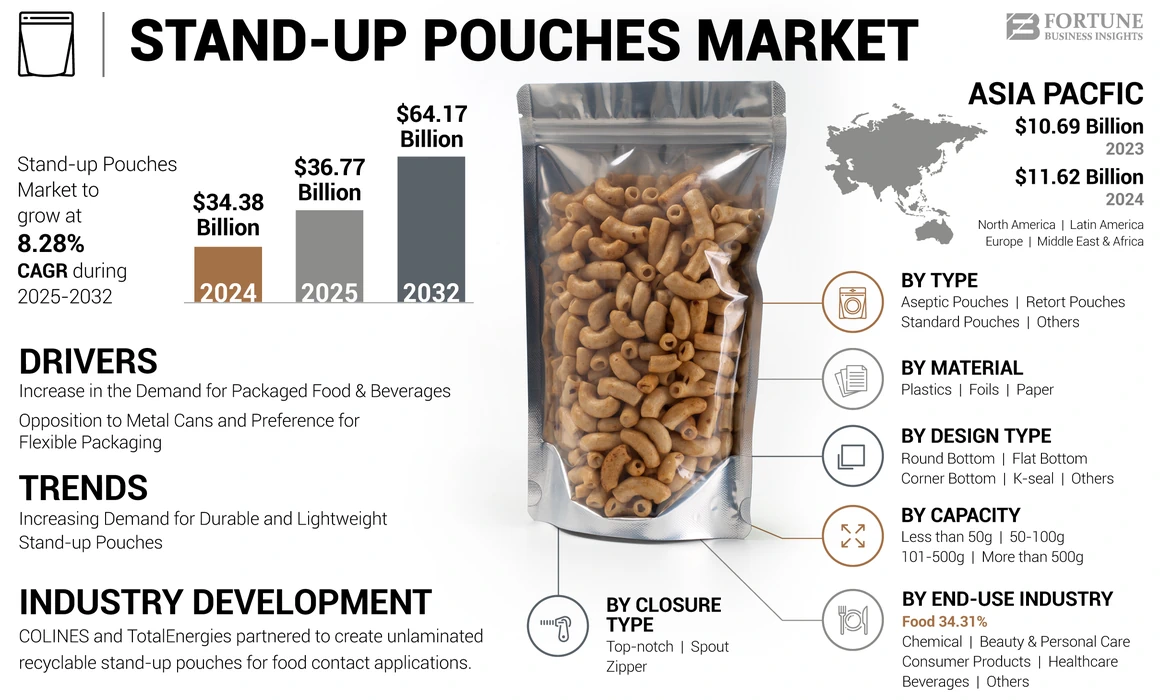

The global stand-up pouches market size was valued at USD 34.38 billion in 2024. The market is projected to grow from USD 36.77 billion in 2025 to USD 64.17 billion by 2032, exhibiting a CAGR of 8.28% during the forecast period. Asia Pacific dominated the stand-up pouches market with a market share of 33.8% in 2024. Moreover, the stand-up pouches market in the U.S. is projected to grow significantly, reaching an estimated value of USD 12.81 billion by 2032, driven by the increasing demand for on-the-go packged food among consumers.

Stand-up pouches are ideal containers to store liquid, solid, powdered, and non-food items that help the food stay fresh for a long period. Rising demand for various types of stand-up pouches from the food, beverage, and pharmaceutical industries are key factors driving the market growth. The increase in the demand for packaged food and packaging options due to features such as spouts and zippers, among others, which offer greater convenience and functionality, are the major factors driving the market growth. The increasing concern about sustainability drives manufacturers to use sustainable and recyclable pouches, and it is expected to witness capital investments in sustainable product innovation and expansion of the recycling sector.

In the early stages of the COVID-19 pandemic the market had a mixed impact, and the supply chain disruption impacted product sales. The manufacturers were disturbed due to the shutdown and shortage of raw materials supply. However, there was a notable rise in the consumption of packaged food items. In addition, a sizable portion of people chose ready-to-cook, ready-to-eat food, and packaged meal ingredients. Moreover, the market is anticipated to grow rapidly during the forecast period.

Global Stand-up Pouches Market Overview

Market Size & Forecast

- 2024 Market Size: USD 34.38 billion

- 2025 Market Size: USD 36.77 billion

- 2032 Forecast Market Size: USD 64.17 billion

- CAGR: 8.28% from 2025–2032

Market Share

- Asia Pacific dominated the stand-up pouches market with a 33.8% share in 2024.

- In the United States, the market is projected to reach USD 12.81 billion by 2032, driven by the rising demand for on-the-go packaged food.

Regional Insights

- North America: Leading region due to high demand for ready-to-eat meals, portability, and lower transportation costs.

- Asia Pacific: Fastest-growing region fueled by urbanization, lifestyle changes, and consumer spending.

- Europe: Significant growth expected as consumer preference rises for functional and portable packaging.

- Latin America: Moderate growth driven by packaging industry investment and middle-income expansion.

- Middle East & Africa: Expected steady growth due to urban expansion and rising packaged food demand.

Stand-up Pouches Market Trends

Increasing Demand for Durable and Lightweight Stand-up Pouches

The increasing popularity of the product among retailers, consumers, and traders is due to their recyclable and lightweight nature, lower transport costs, ease of use, and different benefits, boosting stand-up pouches market growth. These products are also made from 100% recyclable material, require less fuel due to their lightweight nature, and have less carbon footprint. Moreover, these pouches are made from extremely durable materials that cannot be damaged or crushed, such as glass or cardboard.

Download Free sample to learn more about this report.

Stand-up Pouches Market Growth Factors

Increase in the Demand for Packaged Food & Beverages to Propel Market Growth

The on-the-go lifestyle and increasing health awareness significantly contribute to the demand for packaged food and beverages, which compels the need for these pouches. Long commuting times, working hours, and consumer preference for convenience food drive the demand for snacks and ready-to-eat foods. These products offer greater shipping convenience compared to rigid bottles, glass jars, and cans, so several manufacturers widely prefer these pouches. Hence, the development of sustainable, user-friendly pouches is poised to increase the demand for the product.

Opposition to Metal Cans and Preference for Flexible Packaging is Increasing Product Demand

The metal cans used to store food and beverages are slowly being replaced by flexible products as consumers and manufacturers reject the metal cans packaging and favor pouches, which is increasing the demand for the product. Food metal cans are notoriously difficult to open, can be the heaviest form of packaging, and are responsible for a large carbon footprint. In addition, metal cans cannot alter design and shape, and all look similar on the shelf. These cans are also a risk to the environment and are old-fashioned. On the other hand, with stand-up pouches, the chances of spillage are also reduced considerably.

RESTRAINING FACTORS

Stringent Government Regulations on the Usage of Plastic May Hamper Market Growth

Stringent regulations imposed on the usage of flexible plastic packaging may restrain market growth. It may affect the manufacturer's profit even if there are minor flaws in packing, which can lead to product contamination. Packaging waste from plastic harms the ecosystem as it takes decades to decompose, and the sorting, separation, and recycling of flexible materials are challenging. In addition, multilayer packaging is typically not recyclable.

Stand-up Pouches Market Segmentation Analysis

By Material Analysis

Plastic Segment Dominates Due to its Cost-effectiveness and Lightweight Nature

Based on material, the market is segmented into plastics, foils, and paper. The plastics is the leading material segment in the market globally. Plastic is primarily used for broadly manufacturing laminates, films, and stand-up pouches. In addition, it is lightweight, cost-effective, and durable, owing to which it is generally used for manufacturing the product.

Foil is the second fastest growing segment in the market owing to changing lifestyle and food preferences among customers, coupled with changing food technology and biodegradable features which create demand in the market.

By Type Analysis

Retort Pouches Segment Dominates Due to their Ease in Zipper Re-closure

Based on type, the market is segmented into aseptic pouches, standard pouches, retort pouches, and others. The retort pouches is the leading type segment in the market globally. Standard pouches have numerous features, including strong shelf presence and zipper re-closure, as they also provide superior barrier properties with high clarity to the product enclosed within.

Standard pouches holds the second largest share of the market as several industries broadly use such pouches for their product packaging purposes. Also, these pouches provide high-clarity and superior barrier properties to the product.

By Closure Type Analysis

Zipper Segment Dominates Due to Ease of Closing and Better Aesthetic Appeal

Based on closure type, the market is segmented into top-notch, spout, and zipper. The zipper is the leading segment in the market globally due to its ability to pack various snacks, dry fruits, pulses, and others, requiring packaging that eliminates plastic or glass containers.

Spout closure type holds the second largest market share. The spout closure type provides better aesthetic appeal and eliminates food wastage, as consumers can utilize the content in the pouches with the option of re-closing of pouches.

By Design Type Analysis

Round Bottom Segment Dominates Due to their High Demand in the Retail Stores

Based on design type, the market is segmented into round bottom, flat bottom, corner bottom, K-seal, and others. The round bottom segment holds the largest share in the market. These pouches are used for the packaging of lightweight products, which are generally fragile and delicate, such as loose tea, specialty chips and crackers, and freeze-dried fruits, among others.

Corner bottom segment is the fastest growing in the market. It helps them stand securely in the stands and store shelves without falling over. Thus, the growing demand for corner-bottom pouches in retail stores is enhancing the segment growth.

By Capacity Analysis

More Than 500g Segment Dominates Due to Rising Demand in the FMCG Sector

Based on capacity, the market is segmented into less than 50g, 50-100g, 101-500g, and more than 500g. The more than 500g is the dominating segment in the market. These pouches are the most preferred in the food and consumer goods industries. Thus, the growing food industry globally is accelerating the growth of this segment.

101-500g is the second dominating segment in the market. Major players in the market have introduced various range and size of stand-up pouches as per the products for food and non-food applications, which offers better shelf-life and is more eco-friendly due to lesser weight.

By End-use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Food Segment Dominates Due to Surging Demand for Packed Food

Based on end-use industry, the market is segmented into food, beverages, beauty & personal care, healthcare, chemical, consumer products, and others. Food is the leading end-use industry segment in the market globally. The increasing demand for these pouches for the packaging of food products such as frozen food and ready-to-eat meals and also for liquid food products, including dairy, soups, and sauces, is leading to the dominance of the food segment.

The healthcare industry holds the second largest market share of the market. As the manufacturers in the market are focusing on introducing sustainable solutions and have been working on customer and market needs.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Stand-up Pouches Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global stand-up pouches market share due to the rising demand for packaged food, such as ready-to-eat meals, coupled with lightweight, portability, and less material usage than rigid packaging. Furthermore, there is an increase in use of stand-up pouches in this region due to its various features such as cost-effectiveness, extended shelf-life to products, reduced transportation expenses and many more.

Asia Pacific is projected to be the fastest growing region during the forecast period due to the changing lifestyle, increasing demand for convenient packaging, rapid urbanization, and increasing consumer spending power.

Europe is projected to witness considerable growth over the forecast period due to the growing acceptance of stand-up pouches by consumers due to their functionality, convenience, and portability, which is anticipated to boost demand in the region.

Latin America is anticipated to grow steadily during the forecast period due to the increasing development of the packaging industry and investment in plastic-based packaging. Overall demand for packaged food is projected to rise as the middle-income class grows, allowing the flexible packaging sector to expand.

The Middle East & Africa is projected to have moderate growth during the forecast period owing to the development of infrastructure, expansion of metropolitan areas, and the increasing demand for food and drinks across the region.

List of Key Companies in Stand-up Pouches Market

Key Participants Lead by Delivering Innovative Packaging

The global stand-up pouches market is highly fragmented and competitive. Regarding market share, the few major players dominate the market by offering innovative packaging in the packaging industry. These major players in the market are constantly focusing on expanding their customer base across the regions and innovation.

Major players in the market include Amcor, Mondi Group, Sealed Air Corporation, Smurfit Kappa, Sonoco, Coveris Group, ProAmpac, Berry Global, Inc., Huhtamaki, Constantia Flexibles, and others. Numerous other key players in the market are focused on delivering advanced packaging solutions.

List of Key Companies Profiled:

- Amcor (Switzerland)

- Mondi Group (U.K.)

- Sealed Air Corporation (U.S.)

- Smurfit Kappa (Ireland)

- Sonoco (U.S.)

- Coveris Group (U.K.)

- ProAmpac (U.S.)

- Berry Global, Inc. (U.S.)

- Huhtamaki (Finland)

- Constantia Flexibles (Austria)

KEY INDUSTRY DEVELOPMENTS:

- January 2024 – API Group and its subsidiary Accredo Packaging, which produces more sustainable packaging solutions for the food and consumer goods markets, announced that they are collaborating with Reynolds Consumer Products' Presto Products Fresh-Lock team. The collaboration is aimed to introduce the first friendly flexible stand-up pouch that uses more than 50 % Post-Consumer Recycled (PCR) - content suitable for packaging food in a complete package.

- March 2023 – COLINES and TotalEnergies partnered to create unlaminated recyclable stand-up pouches for food contact applications. The companies have developed full PE recyclable unlaminated stand-up pouches to decrease the packaging thickness.

- June 2022 – German face stock specialist Sihl launched premade printable stand-up pouches, Artysio. It is an innovative packaging film for individually printable, premade stand-up pouches, developed for ‘pack and print’ and ‘print and pack’ production methods.

- March 2021 – U.K.-based flexible packaging supplier JM Packaging partnered with microwaveable food manufacturer FEI Foods and launched a sustainable stand-up pouch. The two companies produced an advanced mono-material, which is retortable and recyclable.

- February 2021 – Toppan Printing has launched a vertical bag that consists exclusively of paper material. The new bag is part of Toppan's "SUSTAINABLE-VALUETM Packaging" line, which is part of the recently launched "TOPPAN S-VALUETM Packaging" line, which aims to create value for society and a fulfilling life.

REPORT COVERAGE

An Infographic Representation of Stand-up Pouches Market

To get information on various segments, share your queries with us

The report provides a detailed market analysis and focuses on key aspects such as prominent companies, competitive landscape, product/service types, Porters five forces analysis, market shares, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that have contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.28% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By Closure Type

|

|

|

By Design Type

|

|

|

By Capacity

|

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was at USD 34.38 billion in 2024.

The global market is projected to grow at a CAGR of 8.28% during the forecast period.

The market size of the Asia Pacific stood at USD 11.62 billion in 2024.

Based on application, the food segment dominates the global market share due to its significant usage among varied end-use industries.

The global market size is expected to reach USD 64.17 billion by 2032.

The key market drivers are an increase in the demand for packaged food & beverages, opposition to metal cans, and preference for flexible packaging is increasing the demand for stand-up pouches.

The top players in the market are Amcor, Mondi Group, Sealed Air Corporation, Smurfit Kappa, and Sonoco Products Company, among others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic