U.S. Condom Market Size, Share & COVID-19 Impact Analysis, By Product Type (Male Condom and Female Condom), By Material (Latex and Non-latex), By End-user (Men, Women, and LGBTQ+ Community), By Distribution Channel (Supermarket/Hypermarket, Drug Stores, Online Retail Stores, and Others), and State Forecast, 2025–2032

KEY MARKET INSIGHTS

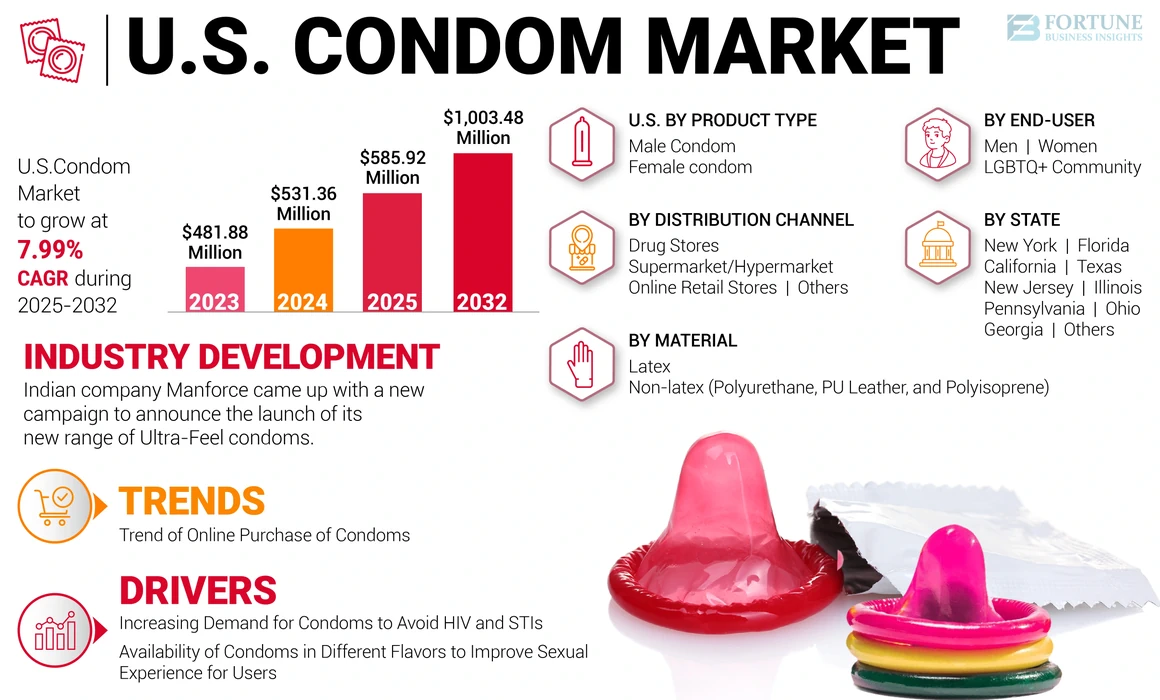

The U.S. condom market size was valued at USD 531.36 million in 2024. The market is projected to grow from USD 585.92 million in 2025 to USD 1,003.48 million by 2032, exhibiting a CAGR of 7.99% during the forecast period.

The rising need to reduce the spread of HIV and other Sexually Transmitted Infections (STIs) is a crucial factor accelerating the product demand. Using condoms as an essential method of birth control in the U.S. drove the market growth in 2022.

Also, growing awareness through government initiatives and comprehensive sex education programs to reduce the prevalence of Sexually Transmitted Diseases (STDs) is driving product sales in the U.S. Condoms are affordable and readily available in stores and online sales channels in the country, which was a significant factor that accelerated the U.S. condom market growth in 2022.

COVID-19 IMPACT

Pandemic Threatened Market Prospects Owing to Lockdown in the U.S

The pandemic significantly affected product sales in various states of the U.S. primarily due to lockdown and movement restrictions enforced by the government. Closure of manufacturing facilities, delays in processing shipments, and supply chain bottlenecks led to a slump in condom sales nationwide. This scenario increased the incidences of HIV and STIs among women and the young population in 2020. The pandemic also restricted social gatherings in the United States, severely impacting the U.S. condom market expansion. However, with the easing of COVID-19 restrictions in 2021, condom sales began to grow in the U.S.

LATEST TRENDS

Download Free sample to learn more about this report.

The trend of Online Purchase of Condoms to Propel Market Growth

The growing sales of condoms through e-commerce channels provided lucrative opportunities to the market players due to closed markets and travel restrictions during the COVID-19 pandemic. E-commerce is expected to exhibit the fastest growth over the forthcoming years. Separate delivery services and freedom to choose between various brands on e-commerce platforms are anticipated to fuel the growth of online channels, contributing to the increasing product sales in the U.S.

DRIVING FACTORS

Increasing Demand for Condoms to Avoid HIV and STI will Favor Market Expansion

Condoms provide protection against STIs and HIV and are readily available and affordable in the U.S. Condoms are easy to use, a key factor driving product demand. The growing use of lubricated condoms, which helps reduce friction during intercourse, will also propel the market growth. Additionally, the growing number of government initiatives to spread awareness about sexual well-being and safe sex will drive the demand for sexual wellness products in the U.S. For instance, in November 2021, the White House.gov, which is owned by the Federal Government of the U.S. updated the HIV National Strategic Plan for the U.S., which has targeted ending HIV in the U.S. by 2030. They aim to increase awareness of HIV among men, women, and the LGBT population and plan to expand and improve HIV prevention services to be easier to access in the U.S., which will prevent new infections.

In addition to preventing HIV, AIDS, and STIs, condoms also help enhance the duration of intercourse for men and women, which is a crucial factor boosting product adoption in the U.S. The increasing use of condoms among the LGBTQ+ community to decrease the risk of HIV and STI propelled the market growth in 2022.

The availability of Condoms in Different Flavors to Improve the Sexual Experience for Users is a Crucial Factor Propelling Market Growth

Flavored condoms are intended for oral sex. Condom manufacturers focus on providing a variety of flavors and textures to improve the sexual experience of users, which is an important factor in increasing the U.S. condom market share. Many flavored condoms are designed to make intercourse pleasurable with textures, such as ribbed, studs, and ultra-thin materials, augmenting their demand among American customers in 2022.

Flavored condoms are available in multiple flavors, such as chocolate, vanilla, banana, and strawberry, to enhance the oral sex experience. Their taste can amplify the experience for the user, which will improve their demand in the U.S.

RESTRAINING FACTORS

Tearing or Split of Condoms and Latex-related Allergies to Impede Market Growth

Condoms are generally made from latex materials that can cause some users' allergies, thereby hampering the market growth. Individuals allergic to latex usually experience itchiness and redness after using condoms. If the condom tears or comes off during intercourse, it increases the chances of pregnancy in a female, which can hinder the market prospects. Poor-quality condoms frequently tear due to excessive friction, restraining the product demand in the U.S.

SEGMENTATION

By Product Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Wide Availability of Different Flavors and Sizes and High Effectiveness will Bolster Sales of Male Condoms

Based on product type, the market is divided into a male condom and female condom. The male condom segment held the largest market share in 2022. Since these condoms can effectively reduce the risk of HIV, syphilis, and gonorrhea among the population, their demand will rise in 2022. According to the U.S. Centers for Disease Control and Prevention (CDC), male condoms are 98% effective when correctly used and are considered a highly useful contraceptive method in the U.S. Male condoms are available in different sizes and flavors according to user requirements, which can significantly contribute to the growing demand for male condoms in the country.

By Material Analysis

High Flexibility and Variety to Fuel Demand for Latex Condoms

The market is segmented into latex and non-latex (polyurethane, polyisoprene, and PU-leather) based on material. The latex segment is predicted to account for the largest market share. Latex is made from natural rubber and exceptionally flexible materials. The demand for latex condoms has increased in the U.S. as they are readily available and come in various shapes, sizes, thicknesses, and flavors. These condoms can stretch up to 800% and are available in various textures, such as ribbed and dotted, to make intercourse pleasurable. The factors mentioned above will propel the use of latex for making condoms.

By End-user Analysis

New Product Launches to Attract Male End-users

Based on end-user, the market is segmented into men, women, and the LGBTQ+ community. According to the U.S. Census Bureau, the country’s population is approximately 337.2 million, of which 116.5 million are male. Condom manufacturers are focusing on providing various products in terms of flavors and textures to improve the sexual experience of men and women, increasing the demand for male condoms in the U.S. They are also introducing new products for men to grow their sales. For instance, in March 2022, ONE condom, a U.S.-based brand, received FDA approval for three types of condoms labeled safe and effective for anal sex.

By Distribution Channel Analysis

Drug Stores Offer Different Condom Brands, Enhancing Product Sales

By distribution channel, the market is segmented into supermarkets/hypermarkets, drug stores, online retail stores, and others. The drug stores segment is anticipated to hold the largest market share in the U.S. Drug stores are potential condom vendors in the U.S., as they are located in critical locations across all states. However, the availability of multiple condom brands has increased the sales of condoms at drug stores in the U.S. A portion of the country’s population is reluctant to visit supermarkets or hypermarkets to buy condoms, which is why they prefer drug stores to purchase contraceptives.

The availability of various types of condoms in every price range, depending on the brand and package, favors product sales across drug stores. Numerous manufacturers also sell condoms at drug stores in combo packs to meet consumers' evolving preferences across the U.S.

STATE INSIGHTS

Supportive Government Policies to Boost Condom Sales in New York

The study provides market information on various states of the U.S. such as New York, Florida, California, Texas, New Jersey, Illinois, Pennsylvania, Ohio, Georgia, and others. New York is expected to be the fastest-growing state in the market.

The New York state government focused on providing the public with safe sex products during the COVID-19 pandemic in 2020, when easy access to these items was challenging due to restrictions. For instance, in June 2020, New York City's Department of Health launched a free home delivery service of safe sex products such as condoms and HIV self-test kits. The health department offers nearly 30 million male condoms, lubricant packs, and internal condoms to more than 3,500 nonprofit organizations and businesses nationwide annually through the NYC Safer Sex Portal. However, various organizations cut down their services in 2020 due to the COVID-19 pandemic. It prompted the Department to ramp up this program until supply chain operations returned to normalcy.

A pair of laws in Texas banned abortion with exemptions for pregnant women at risk of death—Senate Bill 8, which took effect in September 2021, outlaws abortion at six weeks gestation. In addition, the Trigger Ban, which has been in effect since August 2022, creates criminal penalties for doctors who perform abortions at all stages of pregnancy, with exemptions for the life and health of pregnant women. Implementing such laws will increase the demand for condoms as they help prevent unwanted pregnancies.

KEY INDUSTRY PLAYERS

Companies Focus on Marketing Campaigns to Gain Competitive Edge

Various companies in this market are focusing on marketing condoms through social media platforms, such as Twitter, Facebook, and Instagram, targeting specific age groups. Companies are focusing on launching innovative digital campaigns for both men and women to promote safe sex and enhance brand awareness. For instance, in February 2023, Manforce Condoms, an India-based company, launched a new digital campaign, “LoveUpWithManforce”, on Valentine’s day. The campaign aimed to strengthen the love bond between partners, thus encouraging couples to convey their wildest fantasies by participating in the challenge. The brand conducted activities in collaboration with creators such as Gaurav Kapoor and Satish Ray.

List of Key Companies Profiled:

- Church & Dwight Co. Inc. (U.S.)

- Reckitt Benckiser Group Plc (U.K.)

- Lifestyles (Australia)

- Okamoto Industries Inc. (Japan)

- Caution Wear Corp (U.S.)

- Mayer Laboratories Inc. (U.S.)

- Veru Inc. (U.S.)

- GLYDE Health Pvt. Ltd. (Australia)

- LELO (Sweden)

- Karex Berhad (Malaysia)

KEY INDUSTRY DEVELOPMENTS:

- April 2022: Durex, a brand by the U.K.-based Reckitt Benckiser, launched Durex Intense, its new condom product. According to the company, the new product contains Desirex Gel, a unique stimulant gel that enhances women's stimulation to make their experience more intense. The new product is designed to provide women with a cooling or tingling sensation to enhance their sexual experiences.

- June 2022: Lifestyles Healthcare, an Australian company, announced a product packaging refresh. The company’s major focus is to instill safety, confidence, and creativity in every user and enhance the sexual experience.

- September 2021: Epic Condoms is a new condom company in India that launched a new market campaign specifically focused on the Delhi region to enhance product visibility and brand awareness across multiple channels. The brand also focused on social media promotions to increase attention toward the e-commerce website.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on key aspects such as leading companies, product/service types, and other product attributes. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the abovementioned factors, the report encompasses several factors that have contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 7.99% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Material

|

|

|

By End-user

|

|

|

By Distribution Channel

|

|

|

By State

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 531.36 million in 2024.

The market is likely to grow at a CAGR of 7.99% over the forecast period (2025-2032).

The male condom segment is expected to lead the market as it effectively prevents unwanted pregnancy and Sexually Transmitted Infections (STIs).

Increasing spending on advertising to create awareness of condoms in the U.S. favors market growth.

Some of the top players in the market are Reckitt Benckiser Group LLC, Church & Dwight Co. Inc., Lifestyles, Karex Berhad, Okamoto Industries Inc., Mayer Laboratories, and Caution Wear Corp.

The increasing availability of product substitutes is hampering the U.S. market growth.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us