U.S. Geotechnical Services for Offshore Wind Market Size, Share & COVID-19 Impact Analysis, By Service (Cone Penetrating Testing (CPT), Pressuremeter Testing, Dynamic Probe Test (DPSH), and Others), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

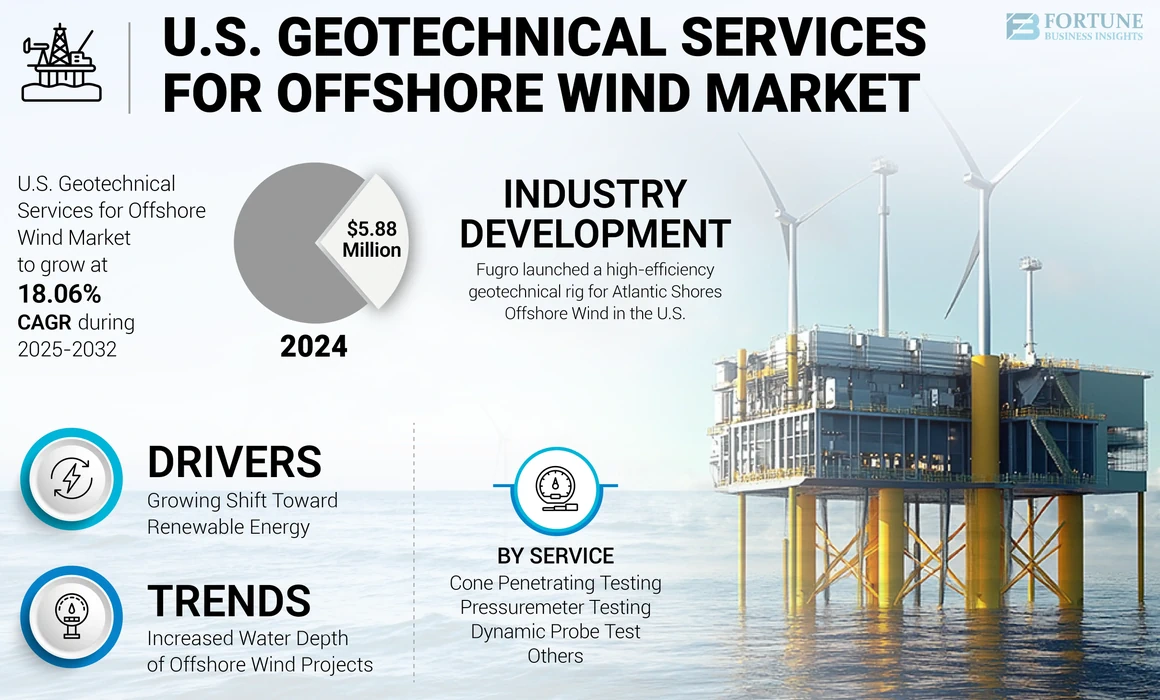

The U.S. geotechnical services for offshore wind market size was worth USD 5.88 million in 2024 and is projected to grow at a CAGR of 18.06% during the forecast period.

The geotechnical services play an essential role in the offshore wind operations. It delivers a significant study of the offshore environment, which can be the base for wind farms and other platforms. Geotechnical services for offshore wind is a sub-field of geotechnical engineering and civil engineering that deals in offshore planning, surveys, foundation design, construction, supply chain, maintenance, and decommissioning for human-made structures in the sea, which delivers huge market share in the parent market that is offshore market.

With the rising interest in offshore wind projects in the U.S., the demand for geotechnical services is anticipated to increase considerably. For instance, on June 29, 2022, according to the Global Wind Energy Council (GWEC), the U.S. witnessed an installation of 12 MW offshore wind energy, which contributed to the overall market size. As technology develops and project difficulties rise, geotechnical experts will continue to play a major role in offering accurate regional data and analysis.

COVID-19 challenged offshore geotechnical services during the pandemic. Numerous companies implemented a program to reduce capital expenditure and cost considerably as the multiple companies faced a downfall in growth and aimed to realize cash savings. For instance, Dutch geotechnical surveying company Fugro announced job cuts and a salary freeze due to the COVID-19 pandemic.

U.S. Geotechnical Services for Offshore Wind Market Trends

Increased Water Depth of Offshore Wind Projects Boosts Market Growth

The water depth is a significant aspect for determining the location of an offshore wind project, as the turbine's foundation must be specially designed for this depth to gather geotechnical data. For instance, the U.S. is conducting projects on the West Coast of the U.S. in deeper waters due to the steep continental slope and narrow continental shelf. In addition, East Coast projects might also wish to deploy further offshore to reduce competition with other marine uses while limiting the visibility of the offshore turbines from shore. This increase is due to reductions in installation costs and growth in the number of projects, improved turbine design, and the development of turbines with floating structures. This trend suggests that technological advances may enable economically contestable installation of offshore wind turbines in shallow waters.

U.S. Geotechnical Services for Offshore Wind Market Growth Factors

Growing Shift toward Renewable Energy is Boosting Market Growth

Several government bodies in the U.S. focus on reducing carbon emissions for environmental benefit. This is resulting in a shift toward renewable energy. For instance, the U.S. Department of Energy's Wind Energy Technologies Office funds research nationwide to permit the deployment of offshore wind technologies that can capture wind resources off the U.S. coasts and convert that wind into electricity.

Offshore wind projects are one of the major renewable sources for energy production and the primary factor that drives geotechnical services. For instance, the U.S. administration requested the building of 30 gigawatts of offshore wind energy by the end of 2030, which is enough to power over 10 million homes. The turbines would be fastened to the seafloor. Moreover, they aim to install another 15 gigawatts of floating wind turbines by 2035 to power 5 million homes.

RESTRAINING FACTORS

High Cost of Offshore Geotechnical Services Hinders Market Demand

One primary factor hindering offshore geotechnical services is the high cost of offshore geotechnical operations and surveys. The cost of geotechnical services for offshore wind is high due to the involvement of multiple services, such as offshore site investigations, renewables projects, geotechnical design, foundation design and installation analysis, turbine foundations cable route analysis, leg penetration analysis, offshore wind development, and planning. Furthermore, it also comprises complex activities, procedures, and costly surveys per location.

In addition, the cost of machinery and offshore gears is high due to the complex tools and technique procedures which may hamper the U.S. geotechnical services for offshore wind market growth. The offshore geotechnical services involve advanced software, sensors, and complex data acquisition systems.

U.S. Geotechnical Services for Offshore Wind Market Segmentation Analysis

By Service Analysis

By service, the market is segmented into cone penetrating testing (CPT), pressure meter testing, dynamic probe test (DPSH), and others. The cone penetrating testing (CPT) segment holds the largest market share. Data provided by cone penetrating testing helps to know the disturbed soil state. Additionally, data from a CPT test offers insight into the liquefaction ability. Understanding the soil's true properties is vital to constructing foundations for a wind turbine. It is also one of the most common techniques which helps with geotechnical site investigation processes.

- June 2022 - Geoquip Marine successfully tests a new cyclic cone penetration tool. As part of its ongoing commitment to providing dependable data securely, Geoquip Marine has been investigating improving the efficiency of its prevailing cyclic CPT systems, including testing a new cyclic CPT instrument downhole on board one of its integrated geotechnical survey vessels.

KEY INDUSTRY PLAYERS

In terms of the competitive landscape, the market represents the presence of established and emerging companies for geotechnical services for offshore wind. Fugro is one of the major companies in the U.S., driven by its expertise and high-tech machinery. Additionally, it handles extreme projects with marine specialists from several countries and holds a significant market size in the country.

- In November 2022 - Community Offshore Wind, a consortium between National Grid and RWE Renewables, awarded Fugro with an offshore survey contract to support concept design and site appraisal activities in the New York Bight. Fugro’s survey methodology will allow Community Offshore Wind to start geotechnical work ahead of standard development plans. Survey Geo-data and consultancy services for the project will be conducted via Fugro’s regional center of proficiency for offshore wind in Norfolk, Virginia.

Geoquip Marine is an established company in the U.S. and holds significant U.S. geotechnical services for offshore wind market share. The company supports marine projects for offshore renewable energy, nearshore construction, and oil and gas businesses by delivering services with demonstrable commercial and environmental benefits enabling the energy transition.

- In February 2020, Geoquip Marine secured an agreement for its newly acquired geotechnical vessel Geoquip Speer to support the development of an offshore wind farm. It will carry out seabed cone penetrating testing (CPT) work for a major offshore wind farm development in the U.S.

Other companies with a substantial existence in the U.S. market include Benthic (Acteon), Braun Intertec, Haley & Aldrich, Inc.

LIST OF TOP U.S. GEOTECHNICAL SERVICES FOR OFFSHORE WIND COMPANIES:

- MOTT MACDONALD (U.S.)

- Shoreline (U.S.)

- Geotill Inc. (U.S.)

- GEOSYNTEC (U.S.)

- Benthic (Acteon) (U.S.)

- Fugro (Netherlands)

- Geoquip Marine (Switzerland)

- ABL Group (Norway)

- Braun Intertec (U.S.)

- Haley & Aldrich, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2022 – Fugro brings a high-efficiency geotechnical rig to the U.S. for Atlantic Shores Offshore Wind. For three years, the company has been integrating site classification facilities for the New Jersey-based offshore wind farm. Geophysical and environmental scopes of work are ongoing, while geotechnical services will begin using a commissioned Fugro C30 mobile rig.

- November 2022 – Global offshore geotechnical specialist Geoquip Marine finished offshore investigations as part of an intensive contract for BP’s Beacon Wind development and Equinor offshore from Massachusetts, U.S. The geotechnical investigations gathered extensive data about subsurface conditions to notify project development, aiming to maximize safety and minimize environmental impacts.

- June 2019 – Geoquip Marine has again partnered with Vineyard Wind to begin geotechnical operations of the 501 North Federal Area. The location will be the eventual site of Vineyard Wind 1, an 804 megawatt (MW) plant that unevenly powers 400,000 households in Massachusetts. Geoquip’s first meeting with Vineyard in 2018 was for extensive geotechnical scope. Using two separate vessels, Geoquip Marine´s geotechnical experts gathered information on the ground conditions for prospective turbine and substation locations, providing necessary data for the project design.

REPORT COVERAGE

The market research report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements and the trend of geotechnical services for the offshore wind market in the U.S. Additionally, it includes key findings for geotechnical services for offshore wind, key industry developments such as mergers, partnerships, & acquisitions, and the impact of COVID-19 on the market. Besides this, the report also offers insights into the market trends and highlights key industry dynamics. In addition to the aforementioned factors, it encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.06% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Service

|

Frequently Asked Questions

Fortune Business Insights says that the U.S. market was worth USD 5.88 million in 2024.

The market is expected to exhibit a CAGR of 18.06% during the forecast period (2025-2032).

By service, the Cone Penetrating Testing (CPT) segment leads by holding a significant share.

Fugro and Acteon are some of the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us