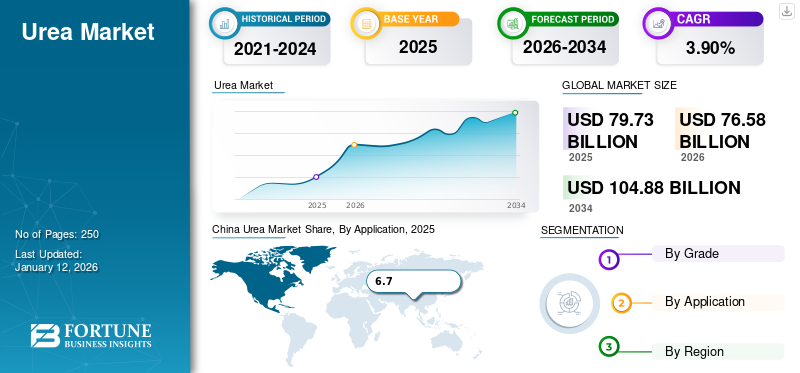

Urea Market Size, Share & Industry Analysis, By Grade (Fertilizer Grade, Feed Grade, and Technical Grade), By Application (Agriculture, Animal Feed, Chemical Synthesis, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global urea market size was valued at USD 79.73 billion in 2025. The market is projected to grow from USD 76.58 billion in 2026 to USD 104.88 billion by 2034, exhibiting a CAGR of 3.90% during the forecast period. Asia Pacific dominated the urea market with a market share of 61% in 2025.

Commercially, ammonium carbamate is produced by reacting ammonia with carbon dioxide. Further, ammonium carbamate is decomposed to yield urea (carbamide) in solid form. As the product is enriched with nitrogen, it has become a popular choice as a source of nitrogen in the fertilizer industry. Protein requirements in ruminant animals can be sufficiently met by feed grade. Industrially, urea is produced through the reaction of ammonia and carbon dioxide under high pressure and temperature, primarily as part of the Haber-Bosch process. It is also widely utilized in industrial applications, including the manufacture of resins, adhesives, plastics, and pharmaceuticals, as well as in environmental control systems such as diesel exhaust fluid (DEF) for reducing nitrogen oxide emissions. The market’s growth is driven by rising global food demand, increasing agricultural productivity needs, expansion of industrial uses, and regulatory measures promoting cleaner emissions. Furthermore, the market encompasses several major players with SABIC, Yara International, Nutrien, and others at the forefront.

During the progression of the COVID-19 pandemic, the lockdown critically challenged the trade of carbamide & related products across the globe. However, the agriculture industry and animal feed sector showcased resilience as compared to the industrial sector. Potential industrial applications, such as chemical manufacturing, fuel additives, and resins, were strongly impacted due to irregularities in production. However, in 2021, major countries, such as the U.S., China, India, and others, slowly revamped industrial operations, which started the recovery of the market.

GLOBAL UREA MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 79.73 billion

- 2026 Market Size: USD 76.58 billion

- 2034 Forecast Market Size: USD 104.88 billion

- CAGR: 3.90% from 2026–2034

Market Share:

- Asia Pacific led in 2025 with a 61% share, valued at USD 48.88 billion.

- By grade: Fertilizer grade dominated due to extensive use in agriculture.

- By end-use: Agriculture held the largest share, followed by animal feed and industrial applications.

Key Country Highlights:

- China: Highest production and consumption; animal feed segment ~14.5% share in 2024.

- India: Government subsidies support fertilizer adoption, boosting urea demand.

- U.S.: Steady growth driven by agriculture and industrial applications, including DEF/AdBlue.

- Europe: Imports carbamide from Asia; automotive and emission control boost demand.

- Middle East & Africa: Large-scale production and raw material availability fuel growth; GCC expansion in chemicals and automotive sectors.

- Latin America: Imports rising; potential for local manufacturing expansion.

Urea Market Trends

Technological Developments in Manufacturing Processes to Aid Market Growth

Developments in production technologies such as Blue Urea present lucrative opportunities for urea market growth. This innovative product is produced under attenuated reaction conditions. This is achieved by using water, nitrogen, and carbon dioxide as raw materials. The energy used in the production process is obtained from renewable sources such as wind turbines located at a point of use or closer to agricultural land. During the reaction, hydrogen is produced by the process of electrolysis. The equipment can be housed in a standardized ISO container at the point of use. This helps in the delocalization of production, eliminating costs and emissions associated with transportation. This technique also helps to overcome emissions of different pollutants associated with the conventional manufacturing process. Also, the composition of the product obtained by this technique is free of contaminants, making it ideal for use. Asia Pacific witnessed a growth from USD 51.29 billion in 2023 to USD 41.98 billion in 2024.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Demand from Agriculture as a Fertilizer and Animal Feed to Boost Market Growth

Urea is highly used in the agriculture sector as a fertilizer and animal feed across the globe. This material contains about 46% nitrogen, an essential nutrient for the growth and development of crops. Nitrogen is required by crops for green leafy growth, resulting in the healthy development of products necessary for obtaining higher crop yields. Decreasing soil fertility due to natural and anthropogenic factors and increasing population are further demanding the use of effective solutions to increase crop yield, resulting in increased product demand.

The decreasing availability of grazing land, coupled with the high cost of many high-protein grains and feed grains across the globe, has made urea a cost-effective source of protein for cattle's diet. This material has a crude protein value of about 281%. Cattle and other ruminants convert the product into protein through bacterial action. Therefore, the growing animal husbandry industry across the globe is expected to further push the rising product demand as a feed in the coming years.

Growing Demand from Industrial Applications to Drive Market Growth

Recently, there has been a huge rise in demand for carbamide from the industrial sector owing to its wide range of industrial applications. It has the ability to trap different organic compounds due to its property of forming interpenetrating helices by forming hydrogen bonds. This property makes it a suitable product for the separation of the mixture and to be used in the production of aviation fuels & lubricating oils. It is also used in the separation of paraffin. In the automotive industry, the product is used to reduce nitrogen oxide pollutants from the combustion of fuel. For instance, BlueTec solutions inject the aqueous solution into the exhaust system. After decomposition, ammonia converts nitrogen oxide emissions into water and nitrogen in a catalytic converter.

Technical grade is used as raw material in the manufacturing of urea-formaldehyde resins, adhesives such as urea-melamine-formaldehyde used in marine plywood, and stabilizers in nitrocellulose explosives. In the pharmaceutical and cosmetics industry, it finds a wide range of applications. It serves as a source of hydrogen in rehydration products as well as subsequent power generation in fuel cells. It is a key raw material for manufacturing different drugs and chemical intermediates, such as an ingredient in hair removers, hair conditioners, bath oils, skin softeners, lotions, disinfectants, and others. Other commercial applications include de-icers by airports, ingredients of yeast nutrients, flavor-enhancing additives for cigarettes, protein denaturants, and radioactive detectors in different diagnostic tests.

Market Restraints

Rising Awareness about Organic Farming to Hinder Market Growth

Prices of urea are increasing with the increasing prices of oil and gas across the globe. This has resulted in an increase in the import bill of the countries dependent on the import of oil & gas, such as India, Brazil, Japan, Australia, and others, for production. Carbamide is the major fertilizer used in agriculture, separately as well as in combination with other fertilizers. It has resulted in an increased cost of input for agriculture and increased emissions of ammonia and carbon dioxide. Ammonia released during application is harmful to human health as well as the ecosystem, and carbon dioxide is a potent greenhouse gas.

This has resulted in different governments across the world promoting different types of alternative farming practices, such as organic farming and zero-budget natural farming. For instance, the Government of India is promoting different types of chemical-free farming systems under the dedicated scheme of Paramparagat Krishi Vikas Yojana (PKVY). Such initiatives from major consumers may hinder the market growth.

Market Opportunities

Government Initiatives and Support to Act as an Opportunity

The global market, a cornerstone of agricultural productivity, is increasingly finding a robust growth catalyst in government initiatives and strategic support globally. Urea's critical role in ensuring food security, boosting agricultural output, and supporting rural economies has spurred governments to implement various policies that, in turn, create significant opportunities for the market. One of the most direct forms of government support comes through subsidies and farmer assistance programs. Recognizing the high cost of inputs, many nations provide direct financial assistance or price support mechanisms to make fertilizers, including urea, more affordable for farmers. For instance, India, a major urea consumer, offers substantial subsidies to farmers, significantly lowering the effective price of urea and promoting its widespread adoption across diverse crops. This consistent demand, buffered by government spending, provides stability and growth predictability for global suppliers.

Market Challenges

Environmental and Regulatory Pressures Could Lead to Several Market Challenges

Excessive use of urea-based fertilizers in agriculture contributes to nitrogen runoff, which leads to water pollution, eutrophication, and greenhouse gas emissions, particularly nitrous oxide—a potent climate-warming gas. Governments and environmental agencies across the globe are increasingly imposing restrictions on nitrogen fertilizer usage to mitigate these impacts. Policies such as carbon taxation, emission reduction mandates, and fertilizer application limits are forcing urea producers to adopt more sustainable production methods and promote efficient fertilizer usage among end consumers. Compliance with these environmental regulations often requires significant investment in cleaner production technologies, energy efficiency upgrades, and carbon capture systems, increasing operational costs. Additionally, public awareness about the environmental consequences of synthetic fertilizers is driving demand for alternative products, such as bio-based or slow-release fertilizers, creating competitive pressure.

Trade Protectionism and Geopolitical Impact

Trade protectionism, including the imposition of tariffs, export restrictions, and import quotas, can significantly disrupt the supply-demand balance in key urea-producing and consuming regions. For instance, major producers such as India, China, and Russia have periodically adjusted export policies to protect domestic supply, impacting global prices and availability. Such measures can result in sudden price volatility, forcing import-dependent countries to seek alternative suppliers at higher costs, thereby increasing operational and logistical challenges for farmers and fertilizer distributors. Geopolitical tensions further compound these challenges by creating uncertainty in supply chains. Conflicts in major producing regions can disrupt production, export, and shipping routes, as seen with events affecting Russian and Middle Eastern fertilizer exports. Political instability may also influence investment decisions in capacity expansion or greenfield projects, as companies hesitate to commit resources to high-risk regions.

Research and Development (R&D) Trends

The development of "green" urea production methods aims to reduce the environmental impact of traditional processes. For instance, plasma-ice interaction techniques utilizing gas mixtures like N₂ + CO₂ and NH₃ + CO₂ have shown promise in synthesizing urea in an energy-efficient and environmentally friendly manner. These methods leverage high-energy species to produce reactive intermediates, facilitating urea formation under milder conditions compared to conventional processes. Additionally, advancements in catalyst design are being accelerated through artificial intelligence (AI) workflows. By integrating large language models and Bayesian optimization, researchers can expedite the development of catalysts for ammonia production, a precursor to urea synthesis. This approach enhances the efficiency and precision of catalyst optimization, potentially leading to more sustainable and cost-effective urea production methods.

Segmentation Analysis

By Grade

Fertilizer Grade Led Market Due to Extensive Adoption as Key Nitrogen Fertilizer

Based on grade, the market is classified into fertilizer grade, feed grade, and technical grade.

In 2026, the fertilizer grade segment held the largest urea market share with a share of 71.57% in 2026, and was expected to retain its position during the foreseeable future. It can be attributed to the increased use of fertilizers to enhance the production of crops. Recent decades have seen a huge rise in population, especially in developing countries in Asia and Africa. This has resulted in a rise in food demand. Also, this has increased the burden on limited agricultural land, resulting in increased use of fertilizers.

Increased industrialization has led to a decrease in grazing and pasture land, creating the need for alternative feed sources for animals. This has led to an increase in feed-grade product demand to supplement the diet of cattle and other ruminants. Cattle and ruminants convert urea into protein by digestion through bacterial action. It helps in maximizing the feed benefits, especially in the dry season.

The technical grade segment is growing at the fastest rate on the backdrop of increasing industrialization throughout the world. Major technical applications include glue and resins, plastic manufacturing, metal treatment, the wood industry, tanneries, construction, and civil engineering. Also, technical-grade urea has a wide range of applications in health and beauty products.

By Application

To know how our report can help streamline your business, Speak to Analyst

Owing to Higher Demand, Agriculture Segment Accounted for Largest Revenue Share

Based on application, the market is classified into agriculture, animal feed, chemical synthesis, and others.

In 2026, the agriculture segment held the largest share with a share of 71.57% in 2026, the global market. It can be attributed to the large-scale use of carbamide as a fertilizer to increase crop yield. Granular and prilled forms make it easy for transportation and handling in agriculture applications. It is applied to the soil surface or mixed with soil. It can be applied manually or mechanically. It is used before the plantation as well as after the plantation, as per the requirements of the soil and crop.

The shortage of protein feeds and the high cost of supplementing proteins are making carbamide an alternative supplement for animal feed. Feed grade product comes with around 45% of nitrogen content, which is equivalent to 281% of crude protein. Decreased availability of pasture land and increasing prices of conventional animal feed are expected to push the growth of the animal feed segment.

The chemical synthesis segment is projected to indicate the fastest growth in the market. Technical grade products are widely used to prepare resins, pharmaceutical & cosmetic formulations, and other specialty chemicals. Other applications include the manufacturing of diesel exhaust fluid, research, and development, as a de-icing agent, flame-proofing agent, component of cloud seeding agent, plankton nutrient in ocean nourishment experiments, solubility enhancer, as a hydrogen source, separation of paraffin, and others. This wide range of applications in different end-use industries is driving the growth of the others segment. The animal feed segment is expected to hold a 13.3% share in 2024.

UREA MARKET REGIONAL OUTLOOK

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Urea Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size of the Asia Pacific region was USD 47.22 billion in 2026. There is a huge rise in population in the region, resulting in increased food demand. This has caused an increase in demand for fertilizers to increase crop yield per hectare of agricultural land. Also, increasing use in the animal feed industry is pushing the demand for feed-grade products in the region. All these factors have led to a rise in carbamide production to meet increasing demand. The high share of the region in the global market is attributed to the highest production and consumption in China, followed by India, ASEAN, Japan, and South Korea. Moreover, local governments in the region are assisting farmers by providing subsidies to purchase fertilizers to increase food grain production. For instance, the Government of India announced a subsidy of around USD 269.4 billion in the financial year 2022-2023. The ASEAN market is projected to reach USD 5.8 billion by 2026, the China market is projected to reach USD 55.86 billion by 2026, and the India market is projected to reach USD 36.25 billion by 2026.

- In China, the animal feed segment is estimated to hold a 14.5% market share in 2024.

China Urea Market Share, By Application, 2025

To get more information on the regional analysis of this market, Download Free sample

Europe

Europe considerably imports carbamide from Asia and the Middle East. Backed by strict regulations, technological developments in the product are expected to reduce carbon emissions as well as decrease input costs. The developed automotive sector in the region is propelling the market in the region. It is due to the increasing use of measures to reduce nitrogen oxide pollutants from fuel combustion. Increasing regulations for limiting greenhouse gases are expected to surge the demand from the automotive sector in the region. The France market is projected to reach USD 2.35 billion by 2026, while the Germany market is projected to reach USD 1.48 billion by 2026.

North America

North America is expected to be a steadily growing market during the forecast period. The growth in this region is mainly attributed to the higher demand for agriculture as well as the rising demand for industrial applications. Farmers use nitrogenous fertilizers to get a higher yield of corn, canola, wheat, and other crops. This demand is expected to rise in the foreseeable future, owing to increasing food demand in the region. The growth of the market in the U.S. is driven by the country's expansive agricultural sector, which relies heavily on nitrogen-based fertilizers for corn, soybean, and wheat production. Precision farming, advanced agronomy, and increasing crop yields are key demand boosters. Additionally, the industrial use of urea in resin manufacturing and automotive emissions control (DEF/AdBlue) contributes to consumption. The U.S. market is projected to reach USD 7.35 billion by 2026.

Latin America

Despite the sufficient availability of raw materials, Latin America imports a considerable portion of its total needs. For instance, in February 2022, the Brazilian government signed an agreement with the Iranian National Petrochemical Company to triple its shipments from Iran to meet rising demand in the country. Hence, there is considerable scope to expand and establish new manufacturing facilities in Latin America.

Middle East & Africa

The Middle East is one of the key manufacturers due to the presence of large-scale producers in the region. There is a rising demand from agriculture and the availability of raw materials at comparatively lower prices. This has led to the expansion and establishment of new manufacturing facilities in the region. GCC significantly contributed to the growth of the market in the region, owing to the developing chemical and automotive industries.

Competitive Landscape

Key Market Players

Leading Entities to Aim for Production Expansion to Meet Rising Demand

The presence of key players in this market is fairly fragmented in terms of production and supply chains. Largest producers, such as SABIC, Yara International, Nutrien, and others, are aiming to expand their production as well as distribution abilities through acquisition and merger strategies. As consumer-specific needs strongly influence this key market, these manufacturers are focused on ensuring a continuous supply in the market to obtain a competitive edge over competitors. Local players are also engaging in developing resilient distribution networks to compete against large players.

List of Top Urea Companies

- SABIC (Saudi Arabia)

- Qatar Fertilizer Company (Qatar)

- EuroChem (Switzerland)

- Yara International ASA (Norway)

- Nutrien AG (Canada)

- OCI N.V. (Netherlands)

- Acron Group (Russia)

- CF Industries Holdings (U.S.)

- HUBEI YIHUA CHEMICAL INDUSTRY CO., LTD. (China)

- China National Petroleum Corporation (CNPC) (China)

- Koch Fertilizer, LLC (U.S.)

- Coromandel International Limited (India)

KEY INDUSTRY DEVELOPMENTS

- July 2024: SABIC Agri-Nutrients Company has received approval from Saudi Arabia's Ministry of Energy to allocate the necessary feedstock for constructing its 6th plant in Jubail Industrial City. The facility will produce 1.2 MMTA of low-carbon blue ammonia and 1.1 MMTA of urea. This project aligns with Saudi Arabia's Vision 2030 to advance clean energy production and export.

- March 2023: SABIC announced that it is collaborating with two U.S.-based companies, BiOWiSH Technologies and ADM, to supply Bio-Enhanced Urea to farmers for 2023’s growing season to support sustainable agriculture.

- June 2022: Nutrien Ag announced that it is increasing its fertilizer production capability. This move is expected to enable the company to respond to changes in global energy, agriculture, and fertilizer markets.

- March 2022: EuroChem announced that it has entered into exclusive negotiations to acquire the nitrogen business of the Borealis group after having submitted a binding offer.

- March 2022: Egypt-based Misr Fertilizers Production Company (MOPCO) announced plans to improve its overall annual carbamide production capacity to 70 kilo tons. The company also announced an investment to build a new melamine plant. With this investment, MOPCO aimed to strengthen its position in Egypt and overseas markets.

REPORT COVERAGE

The market report provides qualitative and quantitative insights on the market share, size, growth rate, and trend analysis by different segments. Along with this, the research report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in this market analysis report are Porter’s five forces, recent industry developments, regulatory scenarios, and key industry trends. The report also highlights the competitive landscape between key players operating in this market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & MARKET SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Million Tons) |

|

Segmentation |

By Grade

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 76.58 billion in 2026 and is expected to reach USD 104.88 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 79.73 billion.

Growing at a CAGR of 3.90%, the market will exhibit considerable growth over the forecast period.

The agriculture segment dominated the market in 2025.

Increasing consumption from the chemical industries shall drive the growth of the market.

Asia Pacific currently holds the highest market share in terms of market revenue.

SABIC, Yara International, and Nutrien AG are the key players in the market and have adopted strategies, such as acquisition and capacity expansion, for their growth in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us