Resin Market Size, Share & Industry Analysis, By Type (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Acrylonitrile Butadiene Styrene, Polyamide, Polycarbonate, Polyurethane, Polystyrene, and Others), By End-use Industry (Packaging, Automotive & Transportation, Building & Construction, Consumer Goods/Lifestyle, Electrical & Electronics, Agriculture, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

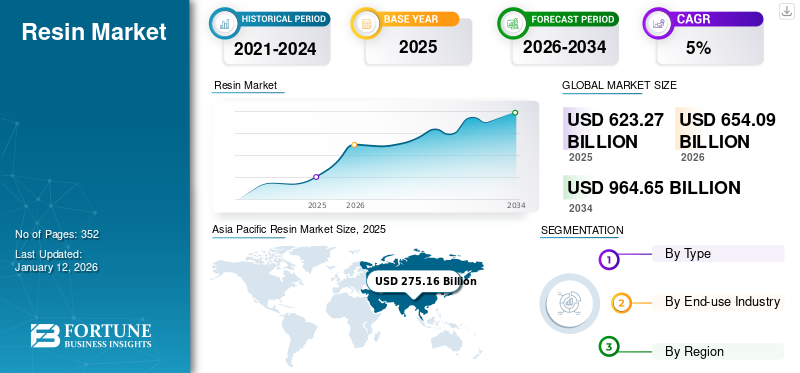

The global resin market size was USD 623.27 billion in 2025. The market is projected to grow from USD 654.09 billion in 2026 to USD 964.65 billion by 2034 at a CAGR of 5.0% during the forecast period. Asia Pacific dominated the resin market with a market share of 44% in 2025.

Resin is generally a solid or highly viscous substance, either derived from a plant source or manufactured synthetically in a laboratory. Naturally, resins and related resinous products are produced in plants during normal growth or secreted as a result of injury to the plants. Several processes are used in manufacturing the resinous materials and transforming them into final products. The rise in demand for such products from various end-use sectors is supporting market growth.

During the COVID-19 pandemic, manufacturers faced shortages of raw materials due to trade and transportation restrictions, mainly in countries such as China and India. This factor limited the companies’ manufacturing activities, further decreasing their production output. However, the large-scale production of face masks, gloves, face shields, and PPE kits increased consumption.

Global Resin Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 623.27 billion

- 2026 Market Size: USD 654.09 billion

- 2034 Forecast Market Size: USD 964.65 billion

- CAGR: 5.0% from 2026–2034

Market Share:

- Asia Pacific dominated the resin market with a 44% share in 2025, driven by strong manufacturing activities, presence of major consumer goods producers, and low production costs in countries such as China and India.

- By type, Polyethylene is expected to retain the largest market share in 2025 due to its widespread use in packaging and automotive applications, supported by its favorable mechanical and chemical properties.

Key Country Highlights:

- China: Acts as a global manufacturing hub for packaging, consumer goods, and automotive industries, making it the top contributor to resin demand in Asia Pacific.

- United States: Resin consumption is propelled by high demand in food packaging, home appliances, and automotive sectors, along with residential construction activities.

- India: Rapid industrialization, increasing population, and rising consumer demand are fueling resin usage across packaging, construction, and medical sectors.

- Germany: Growth in the European market is driven by rising demand for lightweight, high-performance resins in the automotive sector to improve fuel efficiency and reduce emissions.

Resin Market Trends

Adoption of Green Initiatives for Production is the Latest Trend in the Market

The rapid growth in the packaging, pharmaceutical, food & beverage, consumer goods, and e-commerce industries is offering lucrative opportunities for the market. In recent years, consumer requirements, legislature, and sustainability trends have increased the demand for sustainable raw materials. The market has witnessed a growing demand for high-solid and water-based products in recent years, thus significantly reducing volatile organic solvent emissions.

Moreover, the green international economy, sensitivity toward carbon footprint, increased focus on sustainable systems, and the development of product lifecycle analysis have taken many thermoset product manufacturers away from the oil and gas and toward the farm. Corn and soybeans are the most common harvests in the U.S. that provide feedstock for certain monomers employed to produce unsaturated polyester, replacing monomers derived from petrochemicals.

Furthermore, as part of new initiatives, many companies have introduced several new bio-based products for a wide variety of applications. For instance, in 2023, SABIC expanded its portfolio by launching bio-based versions of all NORYL, NORYL GTX, Flexible NORYL, and NORYL PPX resin grades to assist customers in meeting the growing, rigorous sustainability goals.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Growing Demand from End-use Industries to Fuel the Product Demand, Impelling Market Expansion

The market is growing rapidly due to increasing demand from several industries, such as automotive, construction, packaging, and medical. Owing to their properties, including lightweight, chemical resistance, moisture resistance, thermoforming, high flexural strength, and cost-effectiveness, these products are highly employed in multiple end-use sectors. For instance, polypropylene offers moisture and chemical resistance and can withstand extreme temperatures. This factor is creating demand in the medical industry, where Polypropylene (PP) is mainly utilized in various medical devices. Furthermore, the packaging sector is experiencing high growth owing to the growing e-commerce industry, due to the shifting preferences of customers, and the increasing trend of online shopping.

Moreover, growing demand for flexible packaging from a wide range of end-user industries is expected to influence resin market growth. Flexible packaging, such as pouches, seals, liners, and bags, is manufactured using foils, plastic films, and paper. They are predominantly used in the packaging of miscellaneous products, edibles, non-edibles, and others.

Market Restraints

Fluctuations in the Crude Oil Prices May Restrict Market Growth

A critical challenge affecting the market growth is the fluctuation in crude oil prices, which further impacts the overall prices of the product. Most plastic resins' petrochemical feedstock is generated as by-products of oil and natural gas production. The sharp fluctuation in oil prices highly impacts the cost of the feedstock. Several factors, including laws of supply and demand, natural disasters, and fluctuations in production costs, influence oil prices. This affects the overall price of the product, thus acting as a risk factor for market growth. The stringent environmental regulations passed by different governments to reduce plastic consumption are further poised to hinder market growth. According to the UN Environment Program (UNEP) association, more than 99% of plastics are made from chemicals obtained from oil, natural gas, and coal, all of which are polluting and non-renewable resources. This plastic impacts the environment and adversely affects humans, wildlife habitats, and wildlife.

Moreover, a ban on the overuse of non-renewable resources, including crude oil & petroleum, by governments is restricting the market growth as the product is produced from non-renewable resources. This is creating a supply-demand imbalance, leading to failure in meeting end-users' demands.

Market Opportunities

Shift of Consumer Preference to Online Shopping to Fuel Market Growth

The shift of consumer preference toward online shopping is expected to create unprecedented demand for plastic packaging solutions across various sectors, including food and consumer goods. In the food industry, the product consumption is increasing due to the need for flexible packaging, rigid containers, and protective films. These packaging solutions require different types of resins such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) to meet specific requirements for food safety, shelf life extension, and durability during transportation.

The increasing trend of purchasing consumer goods such as clothes, accessories, food storage containers, and home decor items using online portals will create growth opportunities for the market. The continued urbanization, changing lifestyles, and consumption patterns are expected to drive the need for convenient and packaged products, further stimulating the market growth.

Segmentation Analysis

By Type

Polyethylene Leads the Market due to High Demand from Packaging and Automotive Industries

Based on type, the market is segmented into polyethylene, polypropylene, polyethylene terephthalate (PET), polyvinyl chloride, acrylonitrile butadiene styrene, polyamide, polycarbonate, polyurethane, polystyrene, and others.

The polyethylene segment held the largest share of 35% in the global market in 2024, owing to its high demand from the packaging and automotive industries. In the packaging industry, polyethylene is used for making plastic films, bottles, containers, and food packaging trays. In addition, its properties, such as moldability, electrical & impact resistance, are boosting its demand in the automotive, pharmaceutical, and healthcare industries. The polyethylene segment is expected to grow considerably by the end of the forecast period.

Polypropylene held the second leading market share due to its adoption in food packaging films and automotive components. Its excellent heat and chemical resistance is anticipated to surge the demand in the construction and pharmaceutical industries.

The growth of the PET segment is associated with rising demand from the packaging industry due to its favorable physical characteristics. PET is a highly flexible material, can be molded into any shape and is highly recyclable, hence, the segment is expected to grow significantly during the forecast period.

Increasing demand for lightweight, durable, and insulating material from the automotive, electrical & electronics industries is boosting the demand for the polyvinyl chloride segment. Additionally, the increased use of polyvinyl chloride pipes in the agriculture and construction industries is expected to increase their demand considerably.

The consumption of acrylonitrile butadiene styrene (ABS) is growing gradually due to its wide usage in consumer goods and electrical & electronics industries, owing to its properties such as strength, rigidity, and dimensional stability.

Polyamide production is gaining traction due to its wide use in textiles, automotive, kitchen utensils, and sportswear for its high durability and strength properties. The increasing incorporation of advanced & high-performance materials in sportswear is anticipated to boost the polyamide segment growth significantly.

The preference for polyurethane in the furniture industry for bedding and cushioning is surging due to its availability in various forms, such as fibers, foams, and surface coatings. Growth in population and changing lifestyle choices drive the demand for furniture, thereby increasing the consumption of polyurethane.

Polystyrene is used in refrigerators, air conditioners, instrument panels, and disposable utensils such as cups, bowls, and plates. Moreover, it is also used in building insulation and cold chain packaging due to its heat resistance. These factors are anticipated to propel segment growth moderately during the review period.

Polycarbonate is a high-performance, amorphous, and transparent material and is used for applications requiring resistance to extreme temperatures. Its high impact strength, dimensional stability, and electrical insulation properties make it a favorable material for products such as safety helmets, bullet-proof glass, car headlamp lenses, roofing, and others. The rising usage in various applications will significantly drive the segment growth.

The others segment include epoxy, acrylic, and phenolic resins. These types are mainly used for applications in paints, coatings, adhesives, and sealants. The growth of the segment is associated with an increasing number of building & construction and infrastructure development activities globally.

By End-use Industry

To know how our report can help streamline your business, Speak to Analyst

Growing Need for Effective Packaging Solutions from Several Industries Led to the Segment Expansion

Based on end-use industry, the market is segmented into packaging, automotive & transportation, building & construction, consumer goods/lifestyle, electrical & electronics, agriculture, and others.

The packaging segment accounted for the largest share in 2024 in terms of both value and volume and is projected to retain its leading position throughout the forecast period. The rising need for effective packaging solutions from several industries, such as consumer goods, food & beverage, electrical & electronics, and construction, is driving the segment growth. Furthermore, increasing consumption of ready-to-eat and frozen foods also supports the segment's growth. This segment is anticipated to forecast a CAGR of 6.60% during the forecast period.

The building & construction segment accounted for a significant share in the market in 2024. The segment growth can be credited to the rising urbanization and infrastructural development activities in developing countries and the renovation of existing and old structures. Resins are used in the production of several building & construction products, such as flooring, countertops, roofing, pipes & fittings, coatings, and adhesives.

The growth of the automotive & transportation segment can be attributed to the rising incorporation of plastics in automobiles. Plastics are increasingly replacing metal parts & components in vehicles due to their lower weight and similar physical properties. The segment is expected to dominate the market share of 14% in 2025.

The use of resins in the electrical & electronics industry ranges from electrical insulation to electronic consumer products. PVC type is widely used for insulating electrical wiring, while thermoset products are used for making light fittings, handles, and switches.

The growth of the consumer goods/lifestyle segment is due to the rising disposable income of consumers and changing lifestyle choices. The increasing number of technological advancements in the sportswear industry is also contributing to the segment's growth. The launch of sports textiles, which regulate temperatures, boosts the demand for the product.

The agriculture segment is estimated to grow during the forecast period due to the rise in population and urbanization, propelling the demand for food. Moreover, the rising demand for organic and exotic vegetables & fruits globally is also expected to support the segment growth.

RESIN MARKET REGIONAL OUTLOOK

Regionally, the market is segregated into Latin America, Middle East & Africa, North America, Asia Pacific, and Europe.

Asia Pacific

Asia Pacific Resin Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in the Asia Pacific stood at USD 291.29 billion in 2026. The region held the highest resin market share in 2025 and is projected to maintain its prominent position throughout the forecast period. In 2025, the market value led the region by USD 275.16 billion. This dominance is primarily attributed to the presence of major plastic-producing and consuming countries such as China and India in the region. Furthermore, China, being the manufacturing hub for the consumer goods industry, holds a leading market share and contributes to regional growth. In addition, the availability of raw materials and low production costs have resulted in strong growth of the market in the Asia Pacific region. The market value in China is expected to be USD 110.74 billion in 2026.

On the other hand, India is projecting to hit USD 23.68 billion and Japan is likely to hold USD 30.3 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to account for the second-highest market size of USD 178.22 billion in 2026, exhibiting the second-fastest growing CAGR of 4.00% during the forecast period. The market growth in Europe can be credited to the increasing demand for plastics for applications in the automotive industry. Plastics such as polyethylene, polypropylene, and PET are preferred for use in automobiles due to their properties, such as corrosion inhibition, electrical insulation, excellent heat resistance, and favorable physical properties. The market value in U.K. is expected to be USD 16.95 billion in 2026.

On the other hand, Germany is projecting to hit USD 56.01 billion in 2026 and France is likely to hold USD 21.7 billion in 2025.

North America

North America region is to be anticipated the third-largest market with USD 106.34 billion in 2026. The region is estimated to witness significant growth during the forecast period. The growth is characterized by increasing demand for packaging from the food & beverage and cosmetics industries. Stringent regulations regarding the quality of plastic used for packaging food products are expected to support the market growth. The construction companies in North America rely on foams made from plastic resins for insulation applications. Therefore, the increase in the number of residential construction activities is poised to fuel consumption. The U.S. is expected to continue its dominance in the region throughout the forecast period, owing to the expansion of the packaging, automotive, and home appliance industries. The U.S. market value is projected to hit USD 106.34 billion in 2026.

Latin America

Latin America is estimated to witness a substantial growth rate during the 2026-2034 period. Factors such as rising urbanization and infrastructural development activities, increasing disposable income, and rising investments in the pharmaceutical industry are resulting in market growth in Latin America. Furthermore, many companies operating in the market have planned to improve the sustainability of their production processes and offerings, which shall be one of the key reasons for the growth of the market.

Middle East & Africa

The Middle East & Africa region is to be anticipated the fourth-largest market with USD 45.15 billion in 2026. In the Middle East & Africa, a key factor influencing the growth is the increasing demand for packaging from the textile and beverage industries. The region has a heavy dependency on bottled drinking water. Therefore, it experiences a high demand for bottle manufacturing. In addition, the rising demand for lightweight and feasible packaging solutions is aiding the rise in demand for the product. Saudi Arabian market is estimated to hit USD 30 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Players Expand Production Capabilities to Boost Their Regional Presence

The global market is highly fragmented. Key players are expanding their production capabilities for high-performance polymers and compounds to increase their regional presence. In addition, these players have adopted strategies such as new product developments, collaborations, agreements, and research activity expansions to gain dominance in the market.

LIST OF KEY RESIN COMPANIES PROFILED

- DuPont (U.S.)

- Arkema (France)

- BASF SE Germany)

- INEOS Holdings Ltd. (U.K.)

- Hexion (U.S.)

- Invista (U.S.)

- LyondellBasell (Netherlands)

- Mitsubishi Engineering-Plastics Corporation (Japan)

- Mitsui Chemicals (Japan)

- Nova Chemicals (Canada)

- Qenos (Australia)

- Radici Group (Italy)

- SABIC (Saudi Arabia)

- Repsol (Spain)

- Sumitomo Chemical Co., Ltd. (Japan)

- Teijin Limited (Japan)

- Tosoh Corporation (Japan)

- Toray Group (Japan)

KEY INDUSTRY DEVELOPMENTS

- November 2023 - LyondellBasell, one of the major licensors of polyolefin technologies, announced that Indian Oil Corporation Ltd. (IOCL) selected LyondellBasell’s Hostalen “Advanced Cascade Process” (Hostalen ACP) technology for a novel 200 kiloton per year (KTA) high-density polyethylene (HDPE) plant in Panipat, India.

- March 2023 – INEOS, one of the major players operating globally, through its subsidiary INEOS Styrolution, announced the commercialization of K-Resin KR21 by key domestic appliance manufacturers in Asia, particularly for refrigerator inliners.

- December 2022 – Arkema declared to double its production capacity of polyester resins in its facility located in Navi Mumbai, India, strengthening the Group’s place in the global powder coatings market and its pledge to develop low-VOC technologies.

- May 2022 – SABIC, a global manufacturer of chemicals, introduced a new product under the brand name LNP Elcrin WF0061BiQ. This innovative material utilizes ocean-bound polyethylene terephthalate (PET) waste flasks and bottles as a feedstock for chemical upcycling into PBT resin.

- February 2022: DuPont agreed to divest the majority of the mobility & materials segment to Celanese. This definitive agreement within the performance resins and advanced solutions business lines represents USD 3.5 billion of net sales. This development will help the company to create a market-leading portfolio and serve the consumer, automotive, and industrial markets with unmatched manufacturing capability, scale, and technical expertise.

REPORT COVERAGE

The research report provides a comprehensive market analysis and emphasizes crucial aspects such as leading companies, types, and end-use industries. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, and insights into market trends and highlights vital industry developments and competitive landscape. In addition to the abovementioned factors, the report encompasses various factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Million Ton) |

|

Growth Rate |

CAGR of 5.0% during 2026-2034 |

|

Segmentation |

By Type

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 654.09 billion in 2026 and is projected to reach USD 964.65 billion by 2034.

The Asia Pacific region held the largest share of the market in 2025.

Growing at a CAGR of 5.0%, the market is expected to exhibit rapid growth during the forecast period (2026-2034).

By end-use industry, the packaging segment led the market in 2026.

The rising demand from the various end-use industries is a crucial factor driving the market growth.

China held the highest share of the market in 2026.

Dupont, BASF, Arkema, INEOS, Toray Industries, LyondellBasell, and Mitsui Chemicals are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us