Wearable Robotic Exoskeleton Market Size, Share & Industry Analysis, By Technology Type (Powered and Passive), By Application (Rehabilitation, Assistive, Body Parts Support, and Sports), By Body Part (Lower Body, Upper Body, and Full Body), By Actuation Technology (Electric, Hydraulic, Fully Mechanical, and Others), By End User (Healthcare, Manufacturing, Defense & Aerospace, and Others (Commercial, etc.)), and Regional Forecast, 2026–2034

WEARABLE ROBOTIC EXOSKELETON MARKET OVERVIEW AND FUTURE OUTLOOK

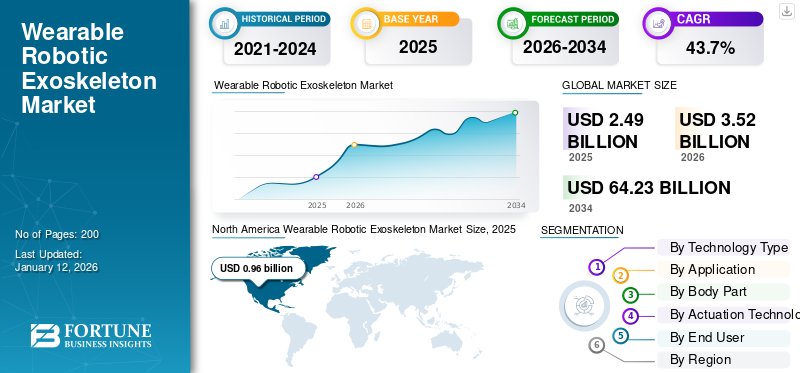

The global wearable robotic exoskeleton market size was valued at USD 2.49 billion in 2025. The market is projected to grow from USD 3.52 billion in 2026 to USD 64.23 billion by 2034, exhibiting a CAGR of 43.7% during the forecast period. North America dominated the global market with a share of 38.7% in 2025.

The wearable robotic exoskeleton market has experienced notable growth over the past decade, driven by advancements in robotics, the increasing need for rehabilitation technologies, and heightened emphasis on workplace safety. The market’s growth has been particularly robust in the healthcare and manufacturing sectors, where both assistive and powered exoskeletons are in high demand. Furthermore, the market’s expansion is propelled by technological innovations, with powered systems holding the largest wearable robotic exoskeleton market share due to their superior performance and adaptability.

Ongoing technological advancements, particularly in AI, sensors, and battery efficiency, are expected to drive further adoption across various sectors. The healthcare sector is anticipated to witness increased adoption of rehabilitation and assistive solutions. At the same time, the defense and manufacturing industries continue to seek solutions for enhancing human endurance and reducing injury risks. With strong growth projections, especially in emerging markets such as Asia Pacific, the market is expected to see continued investment and development over the forecast period.

The COVID-19 pandemic had a mixed impact on the wearable robotic exoskeleton market. While healthcare applications saw a rise in demand, the industrial sector faced delays due to supply chain disruptions. However, the crisis underscored the need for automation and technological advancements, further supporting market recovery and long-term growth.

MARKET DYNAMICS

Market Drivers

Increasing Rehabilitation Needs Boosts Demand for Mobility Assistance Technologies

The rising need for rehabilitation solutions, particularly for individuals recovering from injuries or surgeries, is significantly driving the demand for mobility assistance technologies. As global populations age and the incidence of neurological disorders, strokes, and spinal cord injuries increases, wearable robotic exoskeletons are being adopted as a key solution for restoring mobility. These exoskeletons offer enhanced support for patients undergoing physical therapy, helping them regain motor functions more efficiently and with fewer complications.

Additionally, technological advancements in sensors, artificial intelligence, and materials have made exoskeletons more adaptable and comfortable, improving their usability in clinical settings. The healthcare sector is increasingly recognizing the benefits of exoskeletons in accelerating recovery times, reducing the workload of caregivers, and enhancing the quality of life for patients. With growing investments in research and development and rising awareness among healthcare providers, the adoption of these mobility technologies is poised to increase, offering significant opportunities for manufacturers and developers.

Market Restraints

High Costs and Limited Insurance Coverage Restrict Widespread Adoption of Mobility Exoskeletons

The high cost of wearable robotic exoskeletons is a significant barrier to their widespread adoption, especially in healthcare and rehabilitation settings. These advanced technologies require substantial investments in development, materials, and precision engineering, making them expensive for both individual users and healthcare institutions. The initial purchase price, combined with ongoing maintenance and training costs, often exceeds the budget of many potential users, particularly in low- to middle-income regions. Furthermore, limited insurance coverage for exoskeletons poses an additional challenge, as most insurance providers classify them as experimental or luxury devices rather than essential medical equipment. This lack of financial support discourages patients and healthcare providers from integrating exoskeletons into rehabilitation programs. In the absence of comprehensive insurance reimbursement schemes, the market is limited to a smaller, more affluent customer base, thereby slowing its overall growth. Addressing these affordability and coverage issues will be crucial for expanding the accessibility and use of wearable robotic exoskeletons.

Market Opportunities

Expansion into Industrial and Military Applications Creates New Growth Opportunities

The growing interest in wearable robotic exoskeletons beyond healthcare, particularly in industrial and military sectors, presents significant growth opportunities. In industrial environments, exoskeletons are being explored for reducing worker fatigue, preventing injuries, and enhancing productivity by providing physical support during heavy lifting or repetitive tasks. This adoption can lead to increased workplace efficiency and reduced injury-related downtime, making these technologies highly attractive to manufacturing, logistics, and construction companies. Similarly, military applications are gaining traction, with exoskeletons being developed to improve soldiers' endurance, mobility, and load-carrying capacity in the field. These technologies not only enhance physical performance but also reduce the risk of musculoskeletal injuries. As research and development efforts continue to advance, exoskeletons are becoming more robust, lighter, and adaptable to different environments. This growing demand for wearable robotics in the industrial and defense sectors, combined with technological advancements, is creating a lucrative opportunity for manufacturers to expand their product offerings and cater to a broader range of applications beyond healthcare.

Market Trends

Integration of AI and Advanced Sensors Enhances Precision and Functionality of Wearable Exoskeletons

A key trend in the wearable robotic exoskeleton market is the integration of Artificial Intelligence (AI) and advanced sensor technologies to improve precision, functionality, and user experience. AI-powered exoskeletons are capable of learning and adapting to the user's movements, offering personalized assistance based on real-time data. This adaptive functionality is particularly beneficial in rehabilitation, where exoskeletons can adjust their support levels according to the patient’s progress, enhancing recovery outcomes. Advanced sensors, including pressure, motion, and biofeedback sensors, are enabling more intuitive control, allowing the exoskeleton to respond seamlessly to the user’s body movements. These innovations are improving the ease of use and reducing the cognitive load on users, making the technology more accessible and effective for a broader audience. As AI and sensor technology continue to evolve, the capabilities of wearable exoskeletons are expected to grow, driving higher adoption across various sectors, from healthcare to industrial applications.

SEGMENTATION ANALYSIS

By Technology Type

Increased Efficiency and Assistance Drive Dominance of Powered Exoskeletons

By technology type, the market is segmented into powered and passive.

Powered exoskeletons held the largest share of the market, which was 86.36% in 2026. This growth is driven by their ability to provide enhanced mobility and support through motors and batteries. These exoskeletons use actuators,

sensors, and electric power to amplify human movement, making them ideal for applications in rehabilitation, industrial work, and military operations. Powered exoskeletons enable users to perform tasks with greater efficiency and reduced physical strain, which is why they are the preferred choice in sectors where strength and endurance are crucial.

On the other hand, passive exoskeletons, which rely on mechanical structures and do not require external power, serve as lightweight, affordable options. They offer basic support by redistributing weight and providing joint stabilization but are less versatile compared to their powered counterparts. Although passive exoskeletons have a place in the market due to their cost-effectiveness and ease of use, they hold a smaller market share compared to powered systems, which offer superior performance and functionality.

By Application

Growing Need for Independence and Mobility Fuels Dominance of Assistive Exoskeletons

Based on application, the market is segmented into rehabilitation, assistive, body parts support, and sports.

Assistive exoskeletons hold the highest share in the market, primarily due to their ability to enhance mobility and independence for individuals with physical disabilities or reduced strength. These exoskeletons are widely adopted in the healthcare sector to help patients with spinal cord injuries, neurological disorders, and age-related mobility issues regain their ability to walk or perform daily activities with minimal assistance. The increasing elderly population and the growing focus on improving the quality of life for individuals with mobility challenges are key drivers of this segment’s dominance.

Rehabilitation exoskeletons are another important application holding a share of 38.64% in 2026, mainly used in physical therapy, to help patients recover motor functions after injuries or surgeries. These devices enable guided, repetitive movements, improving rehabilitation outcomes by enhancing muscle memory and motor skills recovery.

Body part support exoskeletons, designed to target specific areas such as the back, knees, or arms, are experiencing the highest CAGR of 52.26% during the forecast period (2025-2032). Their rising adoption in industries where workers need ergonomic assistance to prevent injuries and improve endurance is contributing to their rapid market expansion. Sports applications remain niche, focusing on enhancing athletic performance or injury recovery, but they hold a smaller share compared to other segments.

By Body Part

Enhanced Utility and Versatility Drive Upper Body Exoskeletons’ Highest Market Share

Based on body part, the market is classified into lower body, upper body, and full body.

Upper body exoskeletons dominate the market with a share of 45.74% in 2026, and is anticipated to grow at the highest CAGR of 47.82% in 2025, owing to their wide range of applications across various industries. These devices are primarily used to support the arms, shoulders, and back, making them highly effective for tasks that involve repetitive upper body movements, such as assembly line work, lifting, and construction. By reducing muscle strain and fatigue, upper body exoskeletons help prevent work-related injuries, which has led to their growing adoption in industrial and manufacturing settings.

Lower body exoskeletons, while essential for assisting with mobility and rehabilitation, hold a smaller share of 38% in 2025, compared to upper body systems. They are primarily used in healthcare settings to aid individuals with impaired mobility or lower limb injuries, providing support for walking and standing.

Full body exoskeletons, which provide support for both the upper and lower body, offer comprehensive assistance but remain a niche segment. They are typically used in highly specialized environments, such as military and industrial applications, where full-body support is required for heavy-duty tasks or prolonged endurance. Despite their potential, they hold a relatively smaller share due to higher costs and limited adoption in everyday use cases.

By Actuation Technology

Superior Precision and Control Propel the Electric Exoskeletons to Capture Major Market Share

Based on actuation technology, the market is segmented into electric, hydraulic, fully mechanical, and others.

Electric exoskeletons dominate the market with a share of 65.63% in 2025, due to their superior precision, control, and adaptability, making them the preferred choice across a wide range of applications. These systems use electric motors

and batteries to power movement, allowing for smoother, more controlled assistance in both rehabilitation and industrial environments. The flexibility and programmability of electric exoskeletons enable them to adapt to user needs, whether for assisting with mobility, enhancing physical performance, or supporting tasks that involve repetitive motions. Their widespread use in healthcare for rehabilitation and mobility assistance, as well as in industrial sectors to prevent worker fatigue and injuries, drives their large market share.

Hydraulic exoskeletons, which use fluid power to generate movement, offer greater strength and are ideal for heavy-duty applications such as military or industrial lifting tasks. However, their more complex and bulkier systems limit their widespread adoption compared to electric exoskeletons, resulting in a smaller market share. This segment is projected to grow at a CAGR of 40.95% during the forecast period (2025-2032).

Fully mechanical exoskeletons, which operate without any external power source, offer basic support by redistributing weight or providing joint stabilization. They are cost-effective and lightweight but lack the advanced functionality of powered systems, restricting their usage to simpler tasks.

The others segment includes pneumatic and hybrid systems, which serve specialized applications but remain niche due to their limited versatility and higher cost, contributing to a smaller market presence.

By End User

Increasing Rehabilitation and Mobility Needs Drive Dominance of Healthcare Exoskeletons

By end user, the market is segmented into healthcare, manufacturing, defense & aerospace, and others (commercial, etc.).

The healthcare segment is expected to hold the highest market share of 39% in 2025, due to the growing demand for solutions that aid in rehabilitation and mobility assistance. These devices are widely used in hospitals, rehabilitation centers, and home care settings to help patients recover motor functions after injuries, strokes, or surgeries. They play a crucial role in physical therapy, enabling patients to regain mobility through guided movements and muscle training. Additionally, exoskeletons are increasingly used for assisting individuals with spinal cord injury and neurological disorders, providing independence and improving their quality of life. The aging global population and the rising incidence of mobility-related health issues further drive the adoption of exoskeletons in healthcare, solidifying its leading position in the market.

In manufacturing, exoskeletons are gaining traction for their ability to reduce worker fatigue and prevent injuries, particularly in tasks that involve repetitive motions or heavy lifting. These exoskeletons enhance productivity and workplace safety, making them an attractive investment for industries such as automotive, construction, and logistics.

The defense and aerospace sector is witnessing the highest CAGR of 48.85% during the forecast period (2025-2032), as exoskeletons are increasingly used to enhance soldier endurance, mobility, and load-carrying capacity in the field. These sectors are investing heavily in advanced exoskeletons for military operations, driving rapid growth in this segment.

The others segment includes sectors such as commercial, sports and entertainment, where exoskeletons are used for performance enhancement and injury recovery, though adoption remains niche.

To know how our report can help streamline your business, Speak to Analyst

WEARABLE ROBOTIC EXOSKELETON MARKET REGIONAL OUTLOOK

North America

North America dominated the market with a share of USD 2.49 billion in 2025 and USD 3.52 billion in 2026, driven by significant investments in healthcare, military, and industrial applications. The region is home to several prominent exoskeleton manufacturers and benefits from advanced technological infrastructure and strong research and development efforts. The increasing use of exoskeletons in rehabilitation centers and hospitals, particularly for individuals with mobility impairments, is boosting market growth. Additionally, the region's defense sector is heavily investing in exoskeleton technology to enhance soldier performance and reduce physical strain. Favorable healthcare policies and government initiatives further support the widespread adoption of these technologies in North America.

North America Wearable Robotic Exoskeleton Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Download Free sample to learn more about this report.

The U.S. market is driven by extensive use in healthcare, industrial, and military applications. The country has a well-established healthcare infrastructure, with a high demand for exoskeletons in rehabilitation and mobility assistance for individuals with disabilities or injuries. The U.S. market is poised to hold the market share work USD 1.02 billion in 2026. The presence of major exoskeleton manufacturers, coupled with strong research and development initiatives, ensures that the U.S. remains at the forefront of innovation and adoption in this market.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the third largest market, estimated to reach a value of USD 0.99 billion in 2026. This growth is driven by the rapid adoption of advanced technologies in the healthcare, manufacturing, and defense sectors. Countries such as China, Japan, and South Korea are leading in terms of innovation and implementation of exoskeletons, particularly in rehabilitation and elderly care, given the region's aging population. China is predicted to hold the market share of USD 0.42 billion in 2026. Moreover, the industrial sector is increasingly utilizing exoskeletons to enhance worker productivity and reduce injury risks in labor-intensive industries. Government support for technological advancements and the growing focus on improving healthcare services are expected to fuel further market expansion in this region. India is expected to encounter a share of USD 0.15 billion in 2026, while Japan is poised to be valued at USD 0.22 billion in the same year.

South America

In South America, the market is growing steadily and is expected to reach a value of USD 0.04 billion by 2025, albeit at a slower pace compared to other regions. Economic constraints and limited access to advanced healthcare technologies have somewhat hindered the widespread adoption of exoskeletons. However, there is increasing interest in the potential of these devices for industrial applications, particularly in sectors such as construction and agriculture, where reducing worker fatigue and improving productivity are key concerns. Countries such as Brazil and Argentina are gradually embracing the technology, and improvements in healthcare infrastructure are expected to drive future market growth in the region.

Europe

Europe is the second largest market with a valuation of USD 1.09 billion in 2026 and is projected to exhibit a CAGR of 40.44% during the forecast period (2025-2032). This growth is driven by significant demand stemming from its advanced healthcare systems and strong focus on rehabilitation and elderly care. Countries such as Germany, France, and the U.K. are at the forefront of exoskeleton adoption, particularly in the healthcare sector, where these devices are used to aid in rehabilitation and mobility improvement. The U.K. market is increasing, anticipated to reach a value of USD 0.23 billion in 2026. Europe is also witnessing growing interest in exoskeletons for industrial applications as companies seek ergonomic solutions to enhance worker safety and productivity. Additionally, supportive government policies and increased funding for technological innovation are accelerating market growth across Europe. Germany is predicted to be worth USD 0.44 billion in 2026, while France is foreseen to expand with the value of USD 0.10 billion in the same year.

Middle East & Africa

The market in the Middle East & Africa is still in its nascent stage, with limited adoption compared to other regions. However, there is growing interest in exoskeleton technologies, particularly for industrial applications in sectors such as oil and gas, where worker safety is a critical concern. The healthcare sector is also beginning to explore the potential of exoskeletons for rehabilitation and mobility assistance, although high costs and limited healthcare infrastructure remain significant barriers to widespread adoption. As regional economies continue to develop, the demand for these technologies is expected to rise, particularly in countries such as the UAE and Saudi Arabia. GCC is foreseen to hold the market share valued at USD 0.01 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Technological Innovation and Strategic Collaborations Propel Leading Players to Their Market Dominance

The wearable robotic exoskeleton market is highly competitive, with key players focusing on technological innovation, product development, and strategic partnerships to strengthen their market position. Companies are investing heavily in research and development to create more advanced, efficient, and user-friendly exoskeletons for healthcare, industrial, and military applications. This emphasis on innovation is a significant driver of wearable robotic exoskeleton market growth. Collaborations between exoskeleton manufacturers and healthcare providers or industrial giants are becoming increasingly common, helping to drive adoption across different sectors. Additionally, many players are expanding their product portfolios to cater to a wider range of users, from those needing basic mobility assistance to high-performance exoskeletons for military or industrial use. The global market is also seeing increased participation from start-ups and emerging companies that are bringing unique solutions and pushing technological boundaries. As competition intensifies, key players are continuously focusing on differentiation through innovation and targeted marketing strategies.

List of Key Companies Profiled

- Auxivo AG (Switzerland)

- B-Temia Inc. (Canada)

- Bionik Laboratories Corp. (Canada)

- Ottobock (Germany)

- Fourier Intelligence (Singapore)

- CYBERDYNE, INC. (Japan)

- Ekso Bionics (U.S.)

- ExoAtlet (Luxembourg)

- Parker Hannifin Corporation (U.S.)

- ROAM ROBOTICS (U.S.)

- DIH Medical (Switzerland)

- Lockheed Martin (U.S.)

- ReWalk Robotics (U.S.)

- Rex Bionics Pty Ltd. (U.S.)

- Sarcos Corp. (U.S.)

- Wearable Robotics Srl (Italy)

- Trexo Robotics (Canada)

- Wandercraft (France)

- Technaid Sociedad Limitada (Spain)

KEY INDUSTRY DEVELOPMENTS:

- September 2024: German Bionic, known for its exoskeleton technology, partnered with Servco, an automotive distribution company. This collaboration focuses on introducing German Bionic's exoskeletons into industries such as manufacturing and healthcare, aiming to enhance workforce safety and productivity. The partnership also looks into expanding the use of their "Apogee" exoskeleton, which offers lifting assistance and reduces worker fatigue.

- January 2024: Ekso Bionics introduced new software called "GaitCoach" to complement its EksoNR exoskeleton. The software provides real-time feedback on a patient’s walking pattern, aiming to enhance rehabilitation processes for individuals recovering from strokes and other mobility-limiting conditions. The system is designed for hospital use to improve patient outcomes in neurorehabilitation.

- June 2023: Comau developed the MATE XB, a wearable exoskeleton, designed to assist workers with lifting tasks. It aims to reduce fatigue and improve safety in industrial settings. With its ergonomic design and intuitive controls, MATE XB offers a promising solution for enhancing productivity and reducing the risk of workplace injuries.

- March 2023: A Hyderabad-based firm, Svaya Robotics, in collaboration with DRDO labs, created India's first quadruped robot and exoskeleton. These innovations are expected to aid soldiers and disaster relief personnel by improving their mobility and load-carrying capacity. The exoskeleton is designed to enhance endurance, while the quadruped robot supports carrying equipment and handling rugged terrains.

- December 2022: Ekso Bionics completed the acquisition of the Human Motion and Control Business from Parker Hannifin. This acquisition is expected to expand Ekso's portfolio in exoskeleton technology by integrating Parker's innovative human motion technology, enhancing their offerings in rehabilitation and industrial applications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2033 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 43.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology Type, By Application, By Body Part, By Actuation Technology, By End User, and By Region |

|

By Technology Type |

|

|

By Application |

|

|

By Body Part |

|

|

By Actuation Technology |

|

|

By End User |

|

|

By Region |

|

Frequently Asked Questions

The market is projected to record a valuation of USD 64.23 billion by 2034.

In 2026, the market was valued at USD 3.52 billion.

The market is projected to grow at a CAGR of 43.7% during the forecast period of 2026-2034.

The healthcare segment holds the highest share of the market.

Increasing rehabilitation needs are driving the market growth for mobility assistance technologies.

Cyberdyne Inc., ReWalk Robotics Inc., Ekso Bionics Holdings Inc., and Sarcos Corporation are the top players in the market.

North America is expected to hold the highest market share.

By end user, the defense & aerospace is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us