Wireless Microphone Market Size, Share & Industry Analysis, By Type (Handheld, Bodypack, and Tabletop), By Frequency (Ultra-high Frequency, Very High Frequency, 2.4 GHz, and Others), By Application (Auditorium, Theaters, Studios; Shopping Malls, Hotels, Restaurants, Bars, Large Retails, Malls; Parking Lots, Airports, Bus Stations; Education Institutes and Universities; Offices, Conferences Rooms; Sports Venues, Stadium, Public Gatherings, Concerts, Stage Shows; and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

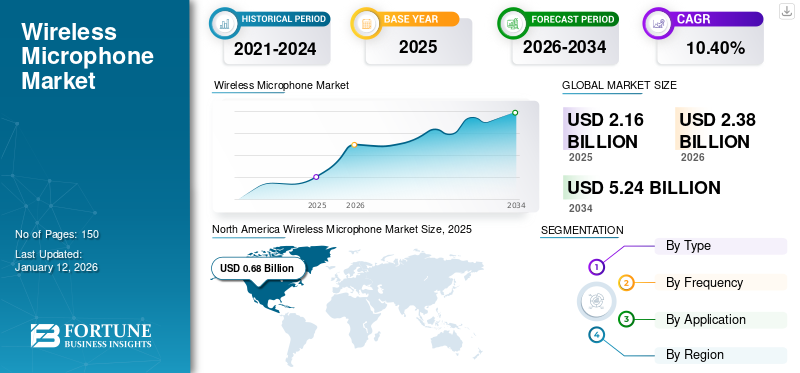

The global wireless microphone market was valued at USD 2.16 billion in 2025 and is projected to grow from USD 2.38 billion in 2026 and reach USD 5.24 billion by 2034, exhibiting a CAGR of 10.40% during the forecast period. North America dominated the global market with a share of 31.40% in 2025. Additionally, the U.S. wireless microphone market is predicted to grow significantly, reaching an estimated value of USD 898.2 million by 2032.

Wireless microphone systems convert audio signals captured by a microphone into radio signals. A wireless microphone receiver then picks up the signal sent by the transmitter as it travels through air and converts it into audio. Wireless systems typically consist of three components: a microphone, a wireless transmitter, and a wireless receiver. Filmmakers, broadcasters, and streamers prefer these systems, especially those with lavalier microphones. The most important benefit of these solutions is that they help keep the handheld mic's line of sight unobstructed and the frame clear.

Another advantage is that they allow freedom of movement. This is significant in education as it allows instructors and teachers to move freely and increases student engagement in the classroom. The systems are beneficial for both online courses and classroom teaching. The hands-free functionality of a wireless microphone set is a necessity for many stage performers. Its usage enables hands-free singing and dance that can help improve interaction with the audience. Additionally, a remote headset microphone increases development adaptability and reduces the risk of connection stumbles.

The COVID-19 pandemic caused various challenges to global supply networks. Several countrywide lockdowns continue to impede or even halt the movement of raw materials and completed goods, hampering manufacturing. However, the pandemic has not necessarily introduced new supply chain issues. It revealed previously unknown vulnerabilities in several sectors, and many companies have suffered worker shortages and losses due to COVID-19. However, it has expedited and exacerbated pre-existing supply chain issues.

Wireless Microphone Market Trends

Surging Need and Advancement of Compact Wireless Microphones to Entertain Market Trends

The increasing demand for wireless technology across sectors adds to the demand for audio communications and conferencing solutions in commercial and professional activities. This has revolutionized the communication business with many advancements and developments in wireless system technology.

The major companies in the market are trying to organize and invent advancements in these microphones, one of them being compact wireless technology. They provide compact microphones compatible with mobile devices, wind caps, and cameras. For instance,

- In March 2022, Godax, a lightning and audio company, launched two compact wireless microphone systems, UC1 and Godox MoveLink LT1. The UC1 is compatible with Android devices, and Godox MoveLink is compatible with iOS devices. The company also introduced the UC2 and LT2 dual-microphone versions. These microphones are compatible with smartphones and tablets. Furthermore, they can be used by content creators, YouTubers, vloggers, and mobile videographers.

Thus, the increased need and amplified advancement of compact microphones are expected to create lucrative opportunities for the market.

Download Free sample to learn more about this report.

Wireless Microphone Market Growth Factors

Increasing Developments of Advanced Microphones to Boost Market Growth

Rising developments of technologically advanced microphones across applications, such as shopping malls, hotels, restaurants, bars, large retail, malls, parking lots, airports, bus stations, education institutes, universities, offices, conference rooms, sports venues, stadiums, public gatherings, concerts, and stage shows, worldwide are surging the demand for the product. For instance,

- In April 2022, Shure Incorporated introduced KSM11, the state-of-the-art wireless microphone capsule that provides high-quality vocal clarity. This microphone is specifically designed for use in broadcast, simulcast, and live-streamed performances.

Similarly, a rise in the number of musical awards shows, events, and concerts drives the market. For instance,

- In May 2022, Billboard Music Awards took place at the MGM Grand Garden Arena in Las Vegas, U.S. Many microphones and audio systems were provided by Shure Incorporated for this event. Throughout the award show, the audio team entirely depended on Shure Axient Digital Wireless technology to provide clear and trustworthy audio.

RESTRAINING FACTORS

Inadequate Availability of Raw Materials Might Hinder Growing Market Growth

Poor raw material availability to meet microphone production demand is restraining the market growth. Voice coil, cable, and magnets are some raw materials for making these microphones. Shortage of these materials might hamper the production process in the market.

Wireless Microphone Market Segmentation Analysis

By Type Analysis

Growing Adoption of Handheld Microphones to Surge the Product Demand

Based on type, the global wireless microphone market is segmented into handheld, bodypack, and tabletop.

Among these, the handheld segment captured the highest market share of 47.06% in 2026. Bodypack microphones are expected to grow at a highest CAGR over the forecast period, as they are small in size, easy to carry, and have a headset microphone plugged into them. The popularity of bodypack microphones is significantly increasing among end-users. One of the significant advantages of these microphones is the ability to maintain a consistent distance between the speaker and the microphone. For example, Shure, Inc. offers a premier bodypack transmitter. With the transmitter’s enhanced RF performance, high-density mode, wide-tuning, and encryption, the micro-bodypack enables professional-quality wireless digital audio.

By Frequency Analysis

Hassle-Free Setup Drives the 2.4 GHz Segment

Based on frequency, the market is categorized into ultra-high frequency, very high frequency, 2.4 GHz, and others.

UHF segment captured the highest market share of 32.35% in 2026. Among these, the 2.4 GHz segment is anticipated to grow at the highest CAGR during the forecast period, as it provides limited channel bandwidth and a hassle-free setup. 2.4 GHz frequency provides a higher quality audio signal than the VHF and UHF. The main advantage of 2.4 GHz for wireless systems is that it is license-free worldwide and can be used in multiple countries and regions. These are some of the factors that would drive the adoption of 2.4 GHz wireless frequency systems.

- For instance, Sennheiser offers an XSW-D wireless audio system with a 2.4 GHz frequency spectrum for up to 75 meters of range. This wireless link can be used worldwide without a license.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Due to Increasing Live Performances, the Sports Venues, Stadiums, Public Gatherings, and Concerts Segment to Drive Market

Based on application, the market is categorized into auditoriums, theaters, studios; shopping malls, hotels, restaurants, bars, large retails, malls; parking lots, airports, bus stations; education institutes and universities; offices, conferences rooms; sports venues, stadium, public gatherings, concerts, stage shows; and others.

The sports venues, stadiums, public gatherings, and concerts segment held the major market share of 34.87% in 2026, and it is expected to grow at a significant CAGR during the projected period. A growing number of ongoing live performances, sports events, and several DJ professionals worldwide fuels the demand for these microphones across the globe.

REGIONAL INSIGHTS

Geographically, the market is divided into five key regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America Wireless Microphone Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 0.68 billion in 2025 and USD 0.74 billion in 2026. North America is home to the world’s biggest music market. As per the International Federation of the Phonographic Industry (IFPI), the value of recorded music in the U.S. accounts for one-third of the global market. Many recording artists and performers in the U.S. belong to either one of the key music unions such as the American Federation of Musicians (AFM) or the American Federation of Television and Radio Artists (AFTRA). The country has professional organizations such as the Recording Academy, the American Composers Forum, role-based groups such as the Songwriters Guild of America, and genre-related groups such as the Americana Music Association or the Gospel Music Association. The U.S. market is projected to reach USD 0.52 billion by 2026.

Asia Pacific

Asia Pacific witnessed a remarkable growth rate during the forecast period. A significant focus on the music industry is expected to create lucrative market opportunities in the region. Market leaders are focused to invest in R&D activities to develop technologically advanced and cost-effective microphones in the APAC region. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.3 billion by 2026, and the India market is projected to reach USD 0.15 billion by 2026. For instance,

- In November 2021, DJI introduced a novel DJI mic, a dual channel wireless audio system that comes in a dedicated charging case and supports omnidirectional audio. This audio system consists of a wireless mic, two transmitters, two receivers, and 8GB of internal memory that can record up to 14 hours of audio.

Europe

The Europe market is expected to hold a prominent global wireless microphone market share. The European market growth is owing to the region's increasing production capacities of these microphones. The key players are focusing on investing in their production sites to strengthen and expand their businesses. The UK market is projected to reach USD 0.1 billion by 2026, and the Germany market is projected to reach USD 0.11 billion by 2026. For instance,

- In May 2022, Sennheiser Group aims to focus fully on professional audio and grow this business sustainably. In accordance with this strategy, the company invested in its production sites to incorporate state-of-the-art manufacturing technologies in Germany and Romania locations.

Middle East and North Africa

Similarly, the Middle East and North Africa (MENA) governments are investing more in music to develop new initiatives to nurture their music sector. According to Forbes, in 2021, Saudi Arabia invested USD 64 billion in the entertainment industry to aid in turning the country into a top-tier destination for the industry, which is expected to create lucrative opportunities for the market.

The Brazilian music and entertainment industry has been showing tremendous growth in the past two years, and there is a lot of potential for new music companies to enter this market. For instance,

- In November 2020, Sony Music launched a new digital accelerator program in Brazil to accelerate the development of Machine Learning (ML) and Artificial Intelligence (AI) in the local music industry. The company is working with startup communities and development companies in Brazil to explore the opportunities these technologies can offer to help artists build their careers and enhance fan experiences.

Thus, South America is expected to witness great opportunities in the coming years.

Key Industry Players

Strategic Acquisition to Boost Market Expansion of Key Players

The key players are offering new microphones across all business segments. Major market players extend the scope to create novel solutions, upgrade their tools and technology, and strengthen their technology capabilities.

Also, through collaborations, companies are gaining expertise and expanding their business by reaching a mass customer base. The key players focus on market share expansion and customer reach through strategic acquisition.

List of Top Wireless Microphone Companies:

- Harman International (Samsung) (U.S.)

- Logitech International S.A. (Blue) (Switzerland)

- Sennheiser Electronic GmbH & Co. KG (Germany)

- Sony Group Corporation (Japan)

- Saramonic (China)

- Shure Incorporated (U.S.)

- Shenzhen Jiayz Photo Industrial., Ltd (China)

- Audio-Technica Ltd. (Japan)

- Rode Microphones (Australia)

- Samson Technologies Corp. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Hohem launched the wireless microphone Mic-01 at CES 2024. The Hohem Mic-01 is easy to use, portable, broadly compatible, and offers sound quality with high fidelity. It is the most helpful choice for field recordings, interviews, and video creation.

- January 2024: Shure expanded its SLX-D digital wireless family with the introduction of the portable SLX-D system. This includes the SLXD3 attachable digital wireless transmitter and SLXD5 digital wireless receiver. SLX-D Portable offers SLX-D expandability, superior digital audio, high-performance wireless connectivity, reliable RF performance, and convenient power management.

- October 2022: Panasonic Connect launched an addition to its next generation of wireless audio microphones and receivers. This provides crisp audio and connectivity options for added flexibility. This software integration enables Panasonic wireless microphones to activate presets across a suite of Panasonic PTZ cameras.

- May 2022: Audio-Technica Ltd. launched ATW-3255 3000 Series, a wireless in-ear monitor system designed to be an affordable and durable IEM solution delivering professional sound quality. It features all levels of venues and performers. Furthermore, it provides sonic performance and is modelled after Audio-Technica’s 3000 Series UHF wireless microphone system. It also provides ATH-E40 in-ear monitor headphones with registered dual-phase push and pull drivers.

- January 2022: JBL (a Harman International brand) launched JBL Quantum Stream, a USB microphone. It has a dual-condenser microphone, enabling crystal-clear communication. The JBL Quantum Stream is combined with the JBL Quantum TWS (wireless gaming headset), JBL Quantum 810, JBL Quantum 910, and JBL Quantum 610.

REPORT COVERAGE

The research report includes prominent areas across the globe to get a better knowledge of the industry. Furthermore, it provides insights into the most recent industry and market trends, as well as an analysis of technologies that are being adopted quickly on a global scale. It also emphasizes some of the growth-stimulating restrictions and elements, allowing the reader to obtain a thorough understanding of the industry.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Frequency

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 5.24 billion by 2034.

In 2025, the market size stood at USD 2.16 billion.

The market is projected to grow at a CAGR of 10.40% over the forecast period (2026-2034).

The sports venues, stadium, public gatherings, concerts, and stage shows segment is likely to lead the market.

Harman International (Samsung), Logitech International S.A. (Blue), Sennheiser electronic GmbH & Co. KG, Sony Group Corporation, Saramonic, Shure Incorporated, and Shenzhen Jiayz Photo Industrial., Ltd are the top players in the market.

North America dominated the global market with a share of 31.40% in 2025.

Asia Pacific is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us