Yoga Clothing Market Size, Share & Industry Analysis, By Type (Top Wear, Bottom Wear, and Others), By End-User (Male and Female), By Distribution Channel (Offline Stores and E-Commerce Stores), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

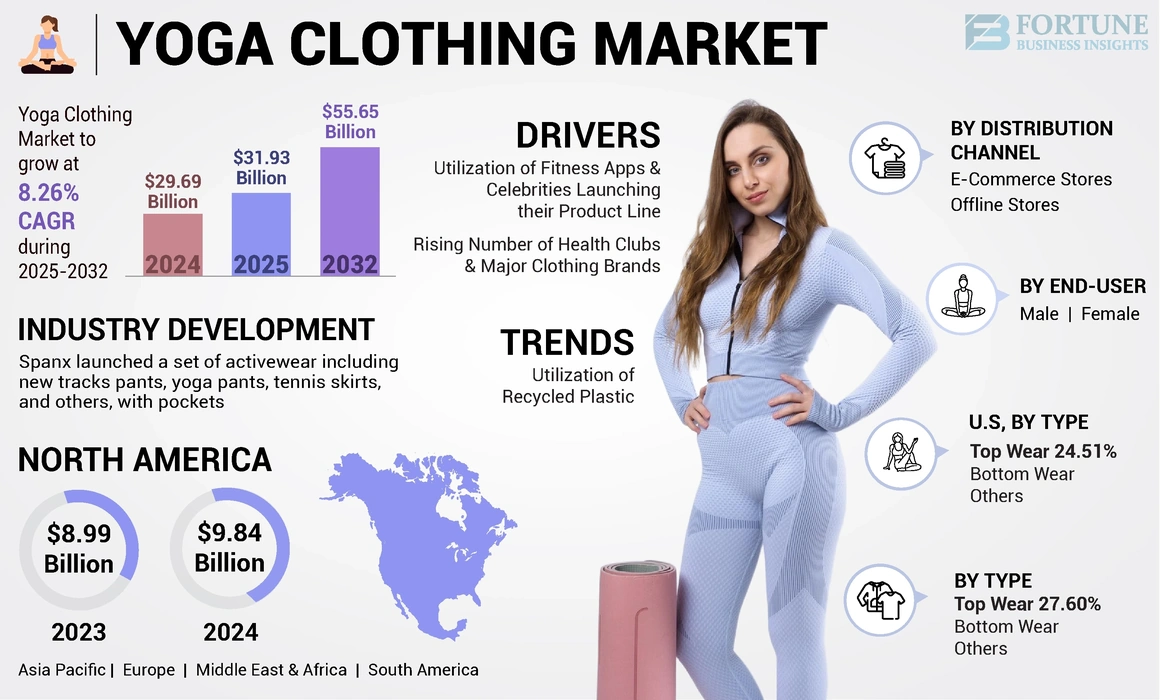

The global yoga clothing market size was valued at USD 29.69 billion in 2024. The market is projected to grow from USD 31.93 billion in 2025 to USD 55.65 billion by 2032, exhibiting a CAGR of 8.26% during the forecast period. North America dominated the yoga clothing market with a market share of 33.14% in 2024. Moreover, the yoga clothing market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 11.72 billion by 2032, driven by increasing focus by manufacturers towards producing advanced products to augment market size growth.

The global population progressively emphasizing adopting a healthier lifestyle plays a significant role in spiking the need for the product, especially among fitness enthusiasts. The product's ability to offer stretch ability which is beneficial in performing multiple types of yoga postures, and its capability to reduce muscle soreness and increase flexibility favors the yoga clothing market growth. Furthermore, the growing popularity of yoga worldwide is likely to pave a positive path in accelerating product demand. In January 2021, Yoga Earth, a London-based online magazine, mentioned that approximately 300 million individuals around the world were regularly practicing yoga.

Global Yoga Clothing Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 29.69 billion

- 2025 Market Size: USD 31.93 billion

- 2032 Forecast Market Size: USD 55.65 billion

- CAGR: 8.26% from 2025–2032

Market Share:

- North America dominated the yoga clothing market with a 33.14% share in 2024, driven by rising fitness awareness, increasing adoption of yoga practices, and a growing preference for performance-driven activewear, especially among women and young professionals.

- By type, bottom wear is expected to retain the largest market share in 2025, supported by its essential role in yoga practice, its rising popularity as casual wear, and consistent innovation in materials and comfort-focused designs.

Key Country Highlights:

- United States: The U.S. yoga clothing market is projected to reach USD 11.72 billion by 2032, bolstered by the rapid growth of fitness apps, e-commerce expansion, and high-profile product launches by celebrities and influencers.

- India: As the birthplace of yoga, India sees high local demand for yoga apparel, reinforced by government-led initiatives like International Yoga Day and Fit India Movement, fueling domestic consumption and brand emergence.

- Germany & U.K.: In Europe, countries like Germany and the U.K. are major contributors to market growth due to strong participation in physical fitness and higher per capita spending on wellness and activewear.

- Brazil: South America's growth is powered by urbanization and increasing health consciousness, with Brazil emerging as a key contributor to regional demand for functional and stylish yoga apparel.

- UAE & South Africa: Rising disposable incomes and a growing wellness culture in the Middle East & Africa are encouraging global yoga clothing brands to enter emerging urban markets such as the UAE and South Africa.

Besides, during the COVID-19 pandemic, there was an increase in demand for yoga clothing products. Many individuals turned to home workouts with the closure of yoga studios and fitness centers due to lockdowns and social distancing measures. Moreover, yoga instructors and studios quickly adapted to the pandemic by offering virtual yoga classes and sessions through online and social media platforms. As a result, consumers sought appropriate yoga attire for virtual classes, driving sales of yoga clothing in 2020.

COVID-19 IMPACT

The Pandemic Encouraged Consumers to Emphasize Physical Fitness

The COVID-19 pandemic encourages individuals to prioritize the maintenance of their health & fitness as they are forced to work from home and spend most of their time indoors. Spending long hours without much physical movement favors the adoption of physical exercise amid the pandemic, as it reduces back pain, eases arthritis symptoms, and lessens the stress level. Such factors play an important role in spiking the consumption rate. In addition, the popularity of online yoga classes being offered by professionals, especially during the COVID-19 lockdown boosted the market growth.

Yoga Clothing Market Trends

Key Brands Focusing on Utilization of Recycled Plastic to Augment Market Growth

Incorporating recycled plastic into yoga clothing contributes to developing a circular economy, where materials are reused and recycled to minimize waste and resource depletion. Brands focusing on recycled plastic innovation drive advancements in material development and textile engineering. Therefore, major brands are increasingly directing their focus toward utilizing recycled plastic for yoga apparel production. The rising public concern regarding the growing environmental pollution increases consumer preference for eco-friendly yoga wear among consumers worldwide. For instance, in September 2022, CorePower, a prominent yoga studio brand, partnered with Boxed Water, to eliminate the use of single plastic in over 200 yoga studios worldwide.

Download Free sample to learn more about this report.

Yoga Clothing Market Growth Factors

Utilization of Fitness Apps and Celebrities Launching New Product Line Fuels Product Demand

The widespread adoption of fitness apps for home workouts, including yoga sessions, increases consumer engagement with yoga and activewear. As consumers seek comfortable and stylish clothing for virtual workouts, the demand for yoga clothing grows. Therefore, the increasing adoption of fitness apps worldwide is playing a significant role in spiking the consumption rate. Moreover, celebrities and influencers play a significant role in shaping consumer preferences and influencing purchasing decisions. Hence, well-known personalities launching their yoga collections attract more consumers to the product, thus increasing the market expansion. In February 2021, Daily Mail, a prominent British Newspaper, stated that Teresa Giudice, a well-known U.S.-based celebrity, will be releasing her yoga clothing line for summer and spring 2021.

Rising Number of Health Clubs & Major Clothing Brands is Favoring Market Expansion

Health clubs are becoming increasingly popular worldwide owing to the rising health consciousness among consumers. A sizable number of health club attendees with a healthy and attractive bodies encouraging individuals to participate in fitness workouts contributes to the product demand. For instance, in August 2022, International Health, Racquet & Sportsclub Association, 21.8% of Americans have enrollment in health club studios in 2021, aggregating 66.5 million consumers, combining both young and old populations. In addition, the increasing number of internationally reputed clothing brands acquiring high-growth potential brands is likely to boost product demand throughout the forecast period. In August 2021, Levi Strauss, a U.S.-based clothing company, announced its acquisition of Beyond Yoga, a U.S.-based athletic and lifestyle apparel brand.

RESTRAINING FACTORS

Availability of Alternative Products Hampers Product Demand

Fitness brands have a robust market presence in countries worldwide. The availability and popularity of substitute products such as gym wear and jogger pants offered by prominent fitness clothing brands make it challenging for product growth. Moreover, many yoga practitioners, especially in developing and under-developed countries, prefer regular clothing or traditional attire, limiting product demand.

Yoga Clothing Market Segmentation Analysis

By Type Analysis

Bottom Wear Holds Dominant Share Given Popularity of Pants

The market is categorized into top wear, bottom wear, and others.

Bottom wear is projected to be the leading segment in the coming years as bottom wear is becoming increasingly popular as a mandatory outfit among a significant number of yoga practitioners worldwide. Bottom wear is commonly used as fashion apparel among the youth, and this factor is contributing significantly to the segment's growth.

To know how our report can help streamline your business, Speak to Analyst

The top wear segment is also anticipated to experience positive growth in the forecast years. Top wear is comparatively more comfortable than regular apparel. The rising preference for top wear over regular apparel is a key factor boosting product demand. The other segment includes gloves, armbands, and wristbands. These apparel categories are also gaining increasing traction among consumers as individuals across countries are increasingly focusing on enhancing their exercise performance, notably when it comes to hand-related activities.

By End-User Analysis

Women Prioritizing Their Menstrual Health Propels Favors Market Growth

By end-user, the market can be categorized into male and female.

The female segment is estimated to be the larger market shareholder throughout the market forecast period as many women use yoga to attain a healthier menstrual cycle and treat the menstrual problem. Additionally, brands are increasingly introducing attractive products to mainly attract female shoppers. The increasing focus among brands on offering yoga clothes for female consumers is likely to strengthen the expansion of the female segment in the coming years.

The male segment is also experiencing robust growth as key industry participants increasingly introduce men's clothing lines. Moreover, many men participating in sports are too likely to spike the product adoption rate.

By Distribution Channel Analysis

Simplicity of Physical Inspection at Offline Stores

Based on the distribution channel, the market can be classified into offline stores and e-commerce stores.

Offline stores are anticipated to be the prominent yoga clothing market shareholder during the forecast years. These stores offer shoppers the opportunity to physically verify a product's quality before purchasing it. In this respect, the trial of a physical product can be done in offline stores, thus escalating the preference for this distribution channel.

On the other hand, e-commerce stores are also expected to gain traction in the coming years. E-commerce platform providing simplicity and comfort to shop from home is hiking the use of this platform, especially among the busy working population. Moreover, online stores being beneficial in quickly finding the specific need of consumers also increases the use of this sales channel.

REGIONAL INSIGHTS

North America Yoga Clothing Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market can be fragmented into North America, Europe, Asia Pacific, South America, and the Middle East and Africa in terms of geography.

The market in North America was valued at USD 9.84 billion in 2024. The flourishing economic growth in this region is encouraging consumers to shop for the product. Women in North America increasingly spend on consumer products, including fitness clothing, which is expected to positively influence product demand. Furthermore, the North American e-commerce sector is witnessing positive development backed by increasing consumer preference for online shopping is fueling the consumption rate.

To know how our report can help streamline your business, Speak to Analyst

The European market is projected to hold a significant market share throughout the forecast period. A sizable number of Europeans participating in physical activities is expected to trigger the demand for the product in the coming years. Moreover, the youth of this region possess high purchasing ability owing to the low unemployment rate, and being highly health-conscious works in favor of market growth. For instance, according to the data published by Nordic Fitness Education, in 2021-22, Germany, the U.K., France, Spain, and Italy account for over 60% of the market share in the European fitness market, which boosts the revenue of the European market to ~ USD 14.38 billion in 2021.

The Asia Pacific is estimated to positively contribute to the global market throughout the forecast years. The increasing number of local brands in Asian countries that can cater to specific consumers' needs positively impacts market development. Moreover, a large number of individuals practicing yoga, especially in India, are projected to significantly influence the growing product demand. In June 2021, on International Yoga Day, the Union Ministers of Sports in India announced the opening of 25 Fit India Yoga Centers, established in various states in India.

South America is anticipated to experience significant progress in the foreseeable future. The thriving growth of the urban population makes individuals more conscious of their health & well-being. An expanding urban population adopting yoga for mental & physical well-being favors market expansion. For instance, according to World Bank, a global financial institution, stated that in 2021, Latin America & the Caribbean had 532,978,690 individuals residing in urban places.

Middle East & Africa is estimated to embrace moderate growth in the near future. The economic progress across the Middle East & African countries is anticipated to increase the adoption of yoga clothing in the near term. In 2021, Take-Profit.Org, a financial and analytical web portal, stated a significant rise in disposable incomes across Middle East & African countries. This factor is likely to encourage apparel brands, including yoga clothes brands, to penetrate emerging countries in the Middle East & Africa over the forecast period.

Key Industry Players

Key Players Emphasizing Usage of Technology to the Product to Augment Market Volume

Key market players are progressively shifting their attention toward producing smart yoga clothing designed to improve yoga practices by providing practitioners accurate feedback on their performances. In June 2022, Dress X, a fashion company, collaborated with Wearable X, a fashion technology company, to implement its first yoga pants, equipped with sensors, applications, and integrated technology.

LIST OF TOP YOGA CLOTHING COMPANIES:

- Adidas AG (Germany)

- Alo Yoga (U.S.)

- Athleta Inc. (U.S.)

- Hanesbrands Inc. (U.S.)

- Lululemon Athletica Inc. (Canada)

- Nike Inc. (U.S.)

- PUMA SE (Germany)

- Ralph Lauren Corp. (U.S.)

- Under Armour Inc. (U.S.)

- Outdoor Voices (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2022: Spanx launched a set of activewear, including, new tracks pants, yoga pants, tennis skirts and others with pockets and also expanded its existing product portfolio.

- September 2022: Puma launched a range of yoga wear collections, including, jackets, tops, and tights, manufactured with recycled materials such as certified polyester and cotton.

- July 2022: Follett Higher Education, the largest campus retailer in North America, announced the launch of its partnership with Beyond Yoga which would allow the campus members and students to enjoy the branded activewear from the popular yoga clothing brands.

- March 2022: Reebok launched a spring collection of activewear suitable for women, including, yoga bras, leggings, and hoodies.

- July 2021: Lululemon, an activewear retailer based out in Canada, partnered with Bolt Threads, to produce eco-friendly yoga clothing products, created from mushroom mycelium leather.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, end-users, and leading types. Besides this, the report offers insights into the current market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 8.26% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Type

|

|

By End-User

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights states that the global market size was USD 29.69 billion in 2024 and is projected to reach USD 55.65 billion by 2032.

In 2024, the North American market value stood at USD 9.84 billion.

The market will exhibit moderate growth of 8.26% CAGR during the forecast period (2025-2032).

The bottom wear segment is projected to be the leading segment during the forecast period.

The rising health-conscious population is one of the major factors driving the markets growth.

Adidas AG (Germany), Alo Yoga (U.S.), Athleta Inc. (U.S.), Hanesbrands Inc. (U.S.), and others are some of the key players functioning in the market.

North America dominated the market share in 2024.

The growing online promotional activity worldwide is expected to drive product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us