Anionic Surfactants Market Size, Share & Industry Analysis, By Type (Alpha Olefin Sulfonates, Linear Alkylbenzene Sulfonate (LAS), Lignosulfonates, Alkyl Ether Sulfates (AES), Alkyl Sulfates (AS), and Others), By Application (Household, Cosmetics & Personal Care, Agriculture, Textile, Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

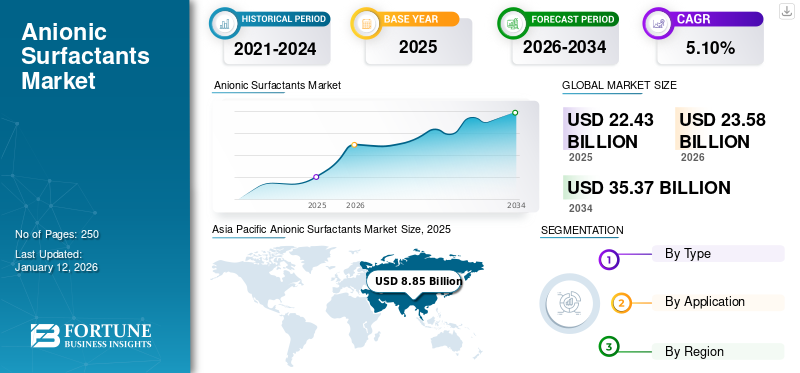

The global anionic surfactants market size was valued at USD 22.43 billion in 2025. The market is projected to grow from USD 23.58 billion in 2026 to USD 35.37 billion by 2034, exhibiting a CAGR of 5.10% during the forecast period. Asia Pacific dominated the anionic surfactants market with a market share of 40% in 2025.

Anionic surfactants are surface-active agents characterized by a negatively charged hydrophilic head, which allows them to effectively reduce surface tension between liquids and remove dirt, grease, and oils. These surfactants are widely used in detergents, shampoos, soaps, and other cleaning and home care products due to their excellent foaming, emulsifying, and cleansing properties. The anionic surfactant market is experiencing steady growth, driven by rising demand across the household, personal care products, and industrial cleaning sectors due to its excellent cleansing, foaming, and emulsifying properties.

The market expansion is supported by factors such as population growth, urbanization, improved living standards, and heightened hygiene awareness, especially in emerging economies. However, concerns over skin irritation and the environmental impact of petroleum-based variants are prompting a shift toward biodegradable and bio-based alternatives. The main players working in the market include BASF, Nouryon, Clariant, Dow, and Kao Corporation.

ANIONIC SURFACTANTS MARKET TRENDS

Technological Advancements in Surfactant Production Process to Boost Market Growth

The development of new technologies is enhancing the production processes of surfactants, as growing concerns over skin irritation caused by traditional sulfates are increasing. So, the manufacturers are investing in the development of sulfate-free anionic surfactants. New technology, such as producing milder surfactants using amino acids and sugar derivatives, is meeting consumer demand for gentle personal care products. This innovation is reshaping product lines in the cosmetics and dermatology sectors, particularly in developed markets.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Cleaning and Personal Care Products to Drive Market Expansion

The rising need for cleaning and personal care products is expected to drive the anionic surfactants market growth. As global urbanization continues to rise and disposable incomes grow, particularly in emerging economies, consumers are becoming more focused on cleanliness and personal hygiene. This keen awareness has resulted in the consumption of industrial and domestic cleaning supplies, including detergents, dishwashing liquids, and surface cleaners, all of which heavily rely on the product's effectiveness. Additionally, the demand for personal care products, including shampoos, body washes, toothpaste, and facial cleansers, is rising as anionic type of surfactants play a vital role in providing foaming, cleansing, and emulsifying properties.

MARKET RESTRAINTS

Growing Skin Irritation and Health Concerns Hinder Market Growth

A significant restraint in the market is that certain surfactants, such as Sodium Lauryl Sulfate (SLS), cause skin irritation and health concerns. While anionic surfactants are highly effective in cleaning and foaming, their harsh chemical nature can cause skin dryness, irritation, or allergic reactions, especially when used in high concentrations or over long periods. As consumers become more aware of the potential side effects of using products with certain surfactants, there is a growing demand for better alternatives.

MARKET OPPORTUNITIES

Rising Demand for Eco-friendly and Bio-based Products Could Serve as an Opportunity for Market

The significant opportunities in the market lie in the growing customer demand for eco-friendly and bio-based products. As ecological concerns continue to rise, there is a clear shift in the market toward sustainable, biodegradable alternatives to traditional petroleum-based surfactants. Consumers are increasingly choosing products made with natural ingredients, which has led manufacturers to explore renewable, plant-based sources such as vegetable oils, coconut, palm, and other bio-based raw materials to produce anionic surfactants. The increasing popularity of green products in personal care, household cleaning, and industrial applications presents a significant opportunity for companies that can innovate in the production of eco-friendly surfactants.

- According to the IBEF report, India’s cosmetic & personal care industry is going to reach USD 20.0 billion by 2025 with a CAGR of 25% driven by consumers' growing preference for natural and organic products. This growth offers a better opportunity for the anionic surfactants market as it is used in the cosmetics and personal care sectors.

MARKET CHALLENGES

Increasing Environmental Concerns and Biodegradability Issues Pose a Challenge to Market

One of the key challenges is the ecological impact associated with certain types of surfactants, particularly those that are not readily biodegradable. Many traditional anionic surfactants, especially those derived from petroleum-based sources, can assemble in aquatic environments and pose a significant risk to ecosystems. These surfactants may not break down quickly in nature, leading to pollution and harm to aquatic life. This growing concern over the ecological footprint of non-biodegradable surfactants is limiting the market's growth as consumers demand for more sustainable and eco-friendly alternatives.

Segmentation Analysis

By Type

Alpha Olefin Sulfonates Lead Market Due to Their Increased Adoption in Personal Care Industry

Based on type, the market is classified into alpha olefin sulfonates, linear alkylbenzene sulfonate (LAS), lignosulfonates, alkyl ether sulfates (AES), alkyl sulfates (AS), and others.

The alpha olefin sulfonates segment holds the largest anionic surfactants market share. This type is a highly effective, biodegradable surfactant widely used in the personal care industry, household cleaning products, and industrial applications due to its excellent foaming, emulsifying, and cleansing properties. It is also highly valued for its environmental compatibility, as it degrades readily, aligning with the growing demand for sustainable ingredients in consumer goods. Additionally, alpha olefin sulfonate exhibits excellent solubility and stability across a wide pH range, enabling its use in diverse formulations.

Linear alkylbenzene sulfonate (LAS) is widely used in various applications, particularly in household and industrial cleaning products. It is known for its high detergency, excellent foaming capabilities, and ability to perform effectively in hard water. The widespread adoption of linear alkylbenzene sulfonate in the cleaning industry is driven by its efficiency in removing dirt, oil, and grease.

Lignosulfonates are a type of anionic surfactant that comes from lignin, a polymer found in the cell walls of plants, particularly in trees. Lignosulfonates are produced as by-products during the sulfite pulping process of wood in paper mills. These surfactants are widely used in industrial applications due to their excellent dispersing, wetting, and emulsifying properties.

By Application

Household Segment Dominates Market Owing to High Demand for Cleaning and Personal Care Products

Based on application, the market is classified into household, cosmetics & personal care, agriculture, textile, construction, and others.

The household segment is the largest application in the market, primarily due to surfactants’ use in home care products such as detergents, cleaning agents, and dishwashing liquids. These surfactants offer excellent cleansing, emulsifying, and foaming properties, making them essential for removing dirt, grease, and stains from various surfaces. Linear alkyl benzene sulfonates and sodium lauryl sulfate are commonly used in laundry powders and liquid detergents due to their high effectiveness and affordability.

In the cosmetics and personal care industry, anionic surfactants play a crucial role due to their cleansing, foaming, and emulsifying properties. Products such as shampoos, facial cleansers, body washes, and toothpaste often contain surfactants such as sodium lauryl sulfate for effective dirt and oil removal. These compounds help in creating rich froth and ensuring proper dispersion of ingredients, which enhances the overall user experience.

The agriculture sector represents a growing application area for products, particularly in agrochemical formulations such as herbicides, pesticides, and fungicides. These surfactants serve as essential materials that improve the spreading, wetting, and penetration of active ingredients on plant surfaces, thereby enhancing the usefulness of crop protection products.

Anionic Surfactants Market Regional Outlook

By region, the market is categorized into Asia Pacific, North America, Europe, and the Rest of the World.

Asia Pacific

Asia Pacific Anionic Surfactants Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific holds the largest market share and is projected to witness the highest growth rate in the market, driven by the rapid expansion of industries and rising consumer demand in countries including China, India, Japan, and South Korea. This region is a home to a large consumer base, particularly in emerging economies such as India and China, where growing urbanization and an expanding middle class are driving demand for personal care, household cleaning, and industrial products.

- As per the Observatory of Economic Complexity (OEC), in 2023, China was the top producer & exporter of anionic surfactant agents, with an exporting value of USD 607.0 million, with a market share of 15.8%.

North America

North America is one of the key regions in the market, driven by the high demand for cleaning, personal care, and household products. In the U.S. and Canada, the demand for liquid anionic surfactants is particularly strong due to the widespread use of these surfactants in shampoos, detergents, and cleaning agents. The marketplace is likely to expand as consumers are increasing their focus on sustainability.

- According to the National Center for Biotechnology Information (NCBI), there is an increase in skin infections in the U.S. As per the study, approximately there are 5.4 million patients experience skin infections, which is due to a lack of cleanliness in households.

Europe

Europe represents a strong market, particularly due to the region’s well-established chemical industry and consumer goods sector. Countries such as Germany, the U.K., and France are key factors in market growth, fueled by the rising demand for personal care and household cleaning products.

- As per the Observatory of Economic Complexity (OEC), in 2023, Germany was a top importer and consumer of cleaning products, with an importing value of USD 3.30 billion with a market share of 7.37%.

Rest of the World

The rest of the world involves regions such as Latin America, Africa, the Middle East, and others, which are emerging as important markets. While these markets are smaller compared to the key regions, including North America, Europe, and Asia Pacific, they hold significant potential due to rising industrialization, improving infrastructure, and increasing consumer demand for products in personal care and household cleaning.

- In 2023, the Government of South Africa launched a plan named as National Water and Sanitation Master Plan (NW&SMP). The plan was launched to deliver water and sanitation services in the country until 2030.

COMPETITIVE LANDSCAPE

Key Industry Players

Adoption of Expansion Strategy by Key Companies Resulted in Their Dominating Position in Market

The market is highly competitive, with major players focusing on capacity expansion, sustainability, and mergers & acquisitions to strengthen their market presence. Key global companies include BASF, Nouryon, Clariant, Dow, Kao Corporation, and Galaxy. These companies compete based on product innovation, cost efficiency, and regional dominance, as consumers are moving toward cleanliness and hygiene. While global leaders dominate in developed markets, regional players are expanding aggressively in emerging economies, intensifying competition in the industry.

LIST OF KEY ANIONIC SURFACTANT COMPANIES PROFILED

- BASF (Germany)

- Nouryon (Netherlands)

- Clariant (Switzerland)

- Dow (S.)

- Croda International Plc (U.K)

- Stepan Company (U.S.)

- Kao Corporation. (Japan)

- Galaxy (India)

- KLK OLEO (Malaysia)

- Pilot Chemical Company (U.S.)

- Esteem Industries (India)

- NOF CORPORATION. (Japan)

KEY INDUSTRY DEVELOPMENTS

- January 2025: The Planet Chemical Company announced the expansion of its anionic surfactant production capacity at its Middletown, Ohio, manufacturing site. The expansion will help the company to double its alpha olefin sulfonate production and to supply it to the household, industrial and institutional, and personal care markets. The expansion project started in January 2025 and will be completed by 2027.

- June 2023: BASF announced that it has expanded its production capacity for bio-based alkyl polyglucosides in Asia Pacific and North America. The expansion will help the company to strengthen its position and serve customers even faster and more flexibly from the regional supply points.

- March 2022: BASF launched a new bio-based anionic surfactant called Plantapon Soy, derived from soy protein and coconut oil, designed for mild, rinse-off applications in personal care products. It's positioned as a sustainable alternative to traditional sulfate or ethylene oxide-based surfactants.

- September 2020: The Stepan Company completed the acquisition of Clariant’s Surfactant Business and Sulfate Production Equipment in Mexico. The acquisition will help the company to grow its business in Latin America.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.10% from 2026-2034 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 23.58 billion in 2026 and is projected to reach USD 35.37 billion by 2034.

In 2025, the market value stood at USD 8.85 billion.

The market is expected to exhibit a CAGR of 5.10% during the forecast period of 2026-2034.

By type, the alpha olefin sulfonates segment leads the market.

Increasing demand for cleaning products to drive the market growth.

BASF, Nouryon, Clariant, Dow, and Kao Corporation are some of the leading players in the market.

Asia Pacific dominated the anionic surfactants market with a market share of 40% in 2025.

Increasing demand for cleanliness, personal hygiene, and eco-friendly products is one of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us