Anticorrosion Coatings Market Size, Share & Industry Analysis, By Type (Epoxy, Alkyd, Polyurethane, Acrylic, and Others), By Application (Marine, Oil & Gas, Industrial, Construction & Infrastructure, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

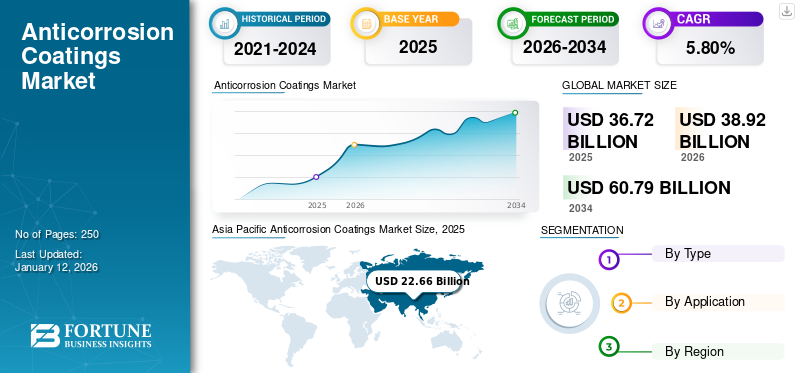

The global anticorrosion coatings market size was valued at USD 36.72 billion in 2025. The market is projected to grow from USD 38.92 billion in 2026 to USD 60.79 billion by 2034, exhibiting a CAGR of 5.80% during the forecast period. Asia Pacific dominated the anticorrosion coatings market with a market share of 62% in 2025.

Anticorrosion coatings are specialized protective coatings applied to surfaces to prevent or slow down degradation caused by environmental factors such as moisture, salt, chemicals, and industrial pollutants. These coatings form a barrier that protects metal components and concrete substrates from oxidation and chemical reactions that lead to corrosion. Broadly used across industries such as marine, oil and gas, infrastructure, and automotive, these coatings help extend the lifespan of assets while minimizing maintenance costs. They are formulated using various resins and technologies, including epoxy, polyurethane, and zinc-based solutions, each offering different levels of protection and performance.

Key players in the market include PPG Industries, AkzoNobel, Sherwin-Williams, Nippon Paints, RPM International, and Jotun.

Global Anticorrosion Coatings Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 36.72 billion

- 2026 Market Size: USD 38.92 billion

- 2034 Forecast Market Size: USD 60.79 billion

- CAGR: 5.80% from 2026–2034

Market Share

- Regional Share: Asia Pacific dominated the global anticorrosion coatings market with a 62% share in 2025, driven by large-scale infrastructure development, strong marine activity, expanding oil & gas operations, and industrial growth across China, India, and Southeast Asia.

- By Type: Epoxy coatings held the largest market share in 2024 owing to their strong adhesion, high durability, and excellent chemical resistance, making them widely used across marine, offshore, industrial, and infrastructure applications.

- By Application: The construction & infrastructure segment accounted for the largest share due to extensive use of anticorrosion coatings in protecting steel bridges, tunnels, pipelines, and industrial structures.

Key Country Highlights

- China: Leads regional consumption driven by rapid urbanization, large-scale infrastructure projects, expanding shipbuilding capabilities, and robust oil & gas activities.

- India: Strong demand from construction, energy, and industrial sectors due to heavy investment in transportation networks, refineries, and manufacturing plants.

- United States: High consumption driven by marine maintenance requirements, aging infrastructure, and steady demand from automotive, oil & gas, and industrial sectors.

- Germany: Major demand from automotive manufacturing and industrial equipment sectors, supported by strict environmental standards encouraging water-based technologies.

- Middle East (GCC): Oil & gas infrastructure expansion and offshore project development create strong demand for high-performance anticorrosive coatings.

ANTICORROSION COATINGS MARKET TRENDS

Rising Adoption of Eco-Friendly Water-based Coatings to Fuel Market Progress

One of the most significant trends in the market is the rapid shift toward water-based coatings due to increasing environmental concerns and stringent regulatory frameworks. These formulations offer a low-VOC alternative to traditional solvent-based products, aligning with global efforts to reduce emissions and improve worker safety. Technological advancements have enhanced the performance of water-based coatings, allowing them to meet durability and corrosion-resistance standards required in industries such as construction, automotive, and marine. As a result, companies are investing greatly in R&D to enhance the application efficiency, drying time, and adhesion capabilities of these eco-friendly coatings.

MARKET DYNAMICS

MARKET DRIVERS

Continued Investments and Innovations is Driving Market Growth

The marine sector is a key driver for the market due to its extensive use of metal structures exposed to harsh and corrosive environments. Offshore platforms, storage containers, and vessels are highly vulnerable to corrosion from saltwater, chemicals, and temperature fluctuations. With growing global trade, exploration, and production activities in regions such as the Middle East, North America, and Southeast Asia, the global shipbuilding industry needs regular maintenance with corrosion-resistant paints to ensure seaworthiness and ship quality. The marine industry operates under strict safety standards, making durable and effective coatings a top priority. Continued investments and innovations in this sector will drive the anticorrosion coatings market growth.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Rising Environmental Concerns Regarding Anticorrosion Coatings May Hinder Market Growth

Environmental concerns related to the making and use of anticorrosion coatings are becoming increasingly significant. Regulatory bodies such as the EPA, REACH, and other major bodies worldwide are making many stringent regulations regarding coatings production, putting significant pressure on manufacturers. To comply with these evolving standards, manufacturers are often required to reformulate traditional solvent-based coatings, which can lead to performance trade-offs or higher production costs. Additionally, obtaining regulatory approval for new formulations is often time-consuming and resource-intensive. In regions where environmental norms are rapidly evolving, companies must constantly adapt, potentially hindering innovation cycles. These regulations also influence transportation, storage, and application procedures, increasing overall operational complexity, which restricts the market growth.

MARKET OPPORTUNITIES

Growth in Nanotechnology-Based Coatings and Self-Healing Anticorrosion Coatings Creates New Opportunities for Market

The growing importance of nanotechnology and self-healing capabilities in anticorrosion coatings presents a powerful opportunity for market expansion. Nanotechnology enhances the structural integrity and protective performance of coatings by enabling ultra-thin, even layers with superior resistance to moisture, chemicals, and mechanical stress. Simultaneously, self-healing coatings autonomously repair micro-cracks and surface damage through embedded microcapsules or reversible chemical systems. These dual innovations significantly reduce maintenance needs and extend the operational life of industrial assets, especially in sectors such as oil and gas, marine, and infrastructure development. As industries increasingly seek smarter, longer-lasting solutions with lower total cost of ownership, these advanced coatings offer a strong value proposition. Together, nanotechnology and self-healing functionalities represent a disruptive shift in corrosion protection strategies, creating high-impact opportunities for manufacturers.

MARKET CHALLENGES

Fluctuating Raw Material Prices Pose a Challenge to Market Growth

The anticorrosion coatings industry is heavily dependent on raw materials such as epoxy resins, zinc, solvents, and additives, posing a significant challenge for market players. Many of these inputs are derived from petrochemical feedstocks, making them highly sensitive to changes in crude oil rates and global supply chain disruptions. Frequent price shifts affect manufacturers' ability to maintain stable profit margins, particularly for small and medium enterprises that operate on tighter budgets. Moreover, producers are often forced to either absorb additional costs or pass them on to consumers, which can reduce competitiveness. Additionally, geopolitical tensions, sanctions, and trade disputes can further impact the availability and cost of essential raw materials.

IMPACT OF COVID-19

The COVID-19 pandemic had a significant impact on the global market, disrupting supply chains, production, and demand across multiple industries. As countries imposed lockdowns and movement restrictions to contain the virus, industrial operations slowed or came to a complete halt, particularly during the early stages of the pandemic. Major end-use sectors such as marine, construction, and automotive experienced sharp declines in activity, leading to a direct reduction in the consumption of anticorrosion coatings. With construction projects postponed and the temporary shutdown of car purchases, the need for corrosion-protective coatings dropped considerably.

TRADE PROTECTIONISM AND GEOPOLITICAL IMPACT

Trade protectionism and geopolitical tensions are increasingly reshaping the market. Tariffs on raw materials such as zinc, epoxy resins, and titanium dioxide are disrupting supply chains and driving up production costs. Sanctions and export restrictions, especially on key chemicals from China, Russia, or the EU, are limiting cross-border trade and affecting coating formulation strategies. Geopolitical instability in oil-producing regions impacts infrastructure investments, particularly in the marine and oil & gas sectors, where anticorrosion coatings are critical. To mitigate risks, manufacturers are localizing supply chains and diversifying sourcing strategies. This shift also accelerates regional R&D and the adoption of alternative chemistries.

SEGMENTATION ANALYSIS

By Type

Epoxy Segment Held Largest Share Owing to Its Strong Adhesion and Mechanical Strength

Based on type, the market is segmented into epoxy, alkyd, polyurethane, acrylic, and others.

The epoxy segment held the largest market with a share of 44.99% in 2026. Epoxy coatings are widely used in industries due to their strong adhesion, chemical resistance, and mechanical strength. These coatings create a durable barrier that prevents moisture, salts, and chemicals from reaching metal surfaces, making them ideal for industrial, marine, and offshore applications. They are commonly applied to ship hulls, pipelines, and storage tanks. Epoxy coatings offer long-term protection and are often used as a primer layer in multi-coat systems.

The polyurethane segment is expected to register significant growth during the forecast period. These coatings are valued for their flexibility, UV resistance, and aesthetic finish, making them ideal for exterior applications. These coatings form a tough, abrasion-resistant layer that maintains color stability and gloss even under harsh weather conditions. Polyurethane is commonly used in automotive, infrastructure, and industrial structures where long-lasting visual appeal and surface protection are required.

By Application

To know how our report can help streamline your business, Speak to Analyst

Marine Segment to Display Fastest CAGR Due to Increasing Maritime Trade

Based on application, the market is classified into marine, oil & gas, industrial, construction & infrastructure, automotive, and others.

The marine industry is expected to grow at the fastest CAGR during the forecast period. The marine industry heavily relies on anticorrosion coatings to protect vessels, offshore structures, and ship components exposed to highly corrosive saltwater environments. These coatings offer resistance to rust and algae, ensuring longer service life and lower maintenance costs for marine assets. They are applied on hulls, ballast tanks, decks, and submerged equipment to prevent material degradation and structural failures. With increasing global maritime trade and the expansion of naval fleets, demand for high-performance coatings has surged.

The construction and infrastructure industry holds the largest with a share of 23.48% in 2026. They are extensively used to protect steel structures such as bridges, tunnels, railways, water treatment plants, and industrial buildings. Exposure to moisture, pollution, and chemicals can severely degrade unprotected structures, resulting in safety hazards and high maintenance costs. Corrosion-protective coatings enhance the lifespan and integrity of assets, ensuring long-term performance and compliance with safety regulations.

The oil and gas industry holds a significant share of the market due to the harsh operational environments in which exploration and production equipment operate. Pipelines, storage tanks, drilling rigs, and refineries are exposed to chemicals, moisture, and extreme temperatures, all of which accelerate corrosion. These coatings act as a critical protective barrier, enhancing operational safety, minimizing equipment downtime, and reducing maintenance costs. Moreover, safety regulations and environmental mandates are pushing oil companies to adopt more sustainable and long-lasting coating solutions.

ANTICORROSION COATINGS MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across Asia Pacific, Latin America, the Middle East & Africa, North America, and Europe.

Asia Pacific

Asia Pacific Anticorrosion Coatings Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is expected to dominate the market with a valuation of USD 24.16 billion in 2026. primarily driven by the strong demand from the construction and oil & gas sectors. Rapid urbanization and infrastructure development in countries such as China, India, and Southeast Asia are fueling demand for protective coatings to safeguard steel structures, bridges, and pipelines. The Japan market is projected to reach USD 0.46 billion by 2026, the China market is projected to reach USD 3.21 billion by 2026, and the India market is projected to reach USD 0.92 billion by 2026. The region's expanding oil & gas industry, encompassing both offshore and onshore operations, requires robust corrosion protection for equipment and facilities, further propelling market growth.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is experiencing notable growth, primarily driven by the marine and oil & gas sectors. The marine sector is expanding due to stringent regulations from bodies such as the International Maritime Organization (IMO), which mandate the use of high-performance coatings to protect vessels and offshore structures from corrosive marine environments. In the oil & gas industry, the extensive infrastructure, including pipelines, storage tanks, and offshore platforms, requires robust corrosion protection to ensure operational efficiency and safety, contributing to the overall market growth. The U.S. is the largest product-consuming country in North America. The growth in the U.S. market is associated with the rising product demand from the automotive and marine industries. The U.S. market is projected to reach USD 5 billion by 2026.

Europe

In Europe, the market is experiencing significant growth, driven by the automotive and shipbuilding industries. Germany, with its robust automotive manufacturing sector, leads regional consumption. The Germany market is projected to reach USD 1.15 billion by 2026. The marine sector in Nordic countries continues to generate demand for corrosion protection in shipbuilding and maintenance. Additionally, strict environmental regulations have increased the adoption of waterborne coatings, reflecting the region's commitment to sustainable solutions. The UK market is projected to reach USD 0.52 billion by 2026

Latin America and Middle East & Africa

Latin America and the Middle East & Africa regions are forecasted to grow moderately during the study period. The oil and gas sector remains a significant driver for the Middle East & Africa due to the region's extensive oil reserves and infrastructure. Additionally, large-scale construction projects and the development of manufacturing hubs are supporting the demand for corrosion protection solutions. Infrastructure and transport sectors, with countries such as Mexico and Brazil leading product demand in Latin America. The anticipated rebound in automotive sales and the adoption of new technologies are expected to further boost market expansion.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Enhancing Operational Efficiency to Boost Their Market Share

In terms of the competitive landscape, the market depicts the presence of established and emerging companies. PPG Industries, AkzoNobel, Sherwin-Williams, Nippon Paints, RPM International, and Jotun are some of the key players in this market. Top participants are investing heavily in advanced technologies to increase product output. Higher operational efficiency and novel technology improvement are key strategies used by key players to boost their market presence. Additionally, major players focus on acquisition and expansion activities to increase their market share.

List of Key Anticorrosion Coating Companies Profiled

- PPG Industries (U.S.)

- AkzoNobel (Netherlands)

- Sherwin-Williams (U.S.)

- Nippon Paint (Japan)

- RPM International (U.S.)

- Jotun (Norway)

- Kansai Paint Co., Ltd. (Japan)

- Axalta Coating Systems (U.S.)

- Hempel (Denmark)

- Chugoku Marine Paints, Ltd (Japan)

KEY INDUSTRY DEVELOPMENTS

- November 2024: AkzoNobel launched Interpon A5000, a range of powder coatings for commercial vehicles. These coatings are used to provide consistent and durable protection for chassis, bodywork, and commercial vehicle components in harsh environments.

- January 2024: Jotun launched Primax Coating Solutions, a CX-rated anticorrosive powder coating specifically engineered to protect steel equipment operating in the harshest environments.

- August 2023: An international developer and leading-edge anticorrosion coating provider, Greenkote, entered into a joint venture with Belgian coating company Duroc N.V. to increase its operational capabilities in the European region. The company offers anticorrosion coatings to automotive, construction, rail, and offshore applications.

- February 2022 – Sherwin-Williams acquired AquaSurTech, a Canadian company specializing in eco-friendly coatings for building products, to strengthen its sustainable solutions portfolio.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, types, and applications. In addition, it provides quantitative data regarding volume and value, market analysis, research methodology for market data, insights into market trends, vital industry developments, and the competitive landscape. In addition to the abovementioned factors, the report encompasses various factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kilotons) |

|

Growth Rate |

CAGR of 5.80% during 2026-2034 |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 36.72 billion in 2025 and is projected to reach USD 60.79 billion by 2034.

Growing at a CAGR of 5.80%, the market is expected to exhibit rapid growth during the forecast period.

In 2025, the Asia Pacific market value stood at USD 22.66 billion.

By type, the epoxy segment dominated the market in 2026.

By application, the construction & infrastructure segment dominates the market.

Increasing investments in offshore oil rigs, shipping, and naval projects are key factors driving market growth.

Asia Pacific dominated the anticorrosion coatings market with a market share of 62% in 2025.

Increasing demand from the marine industry, coupled with the growing need for oil & gas applications, is expected to drive product adoption in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us