ANZ CAD Software Market Size, Share & COVID-19 Impact Analysis, By Deployment (On-premise and Cloud), By Technology (2D and 3D), By Industry (Automotive, Aerospace and Defense, Manufacturing, Healthcare, Electronics and Semiconductor, and Others), and Country Forecast, 2025–2032

KEY MARKET INSIGHTS

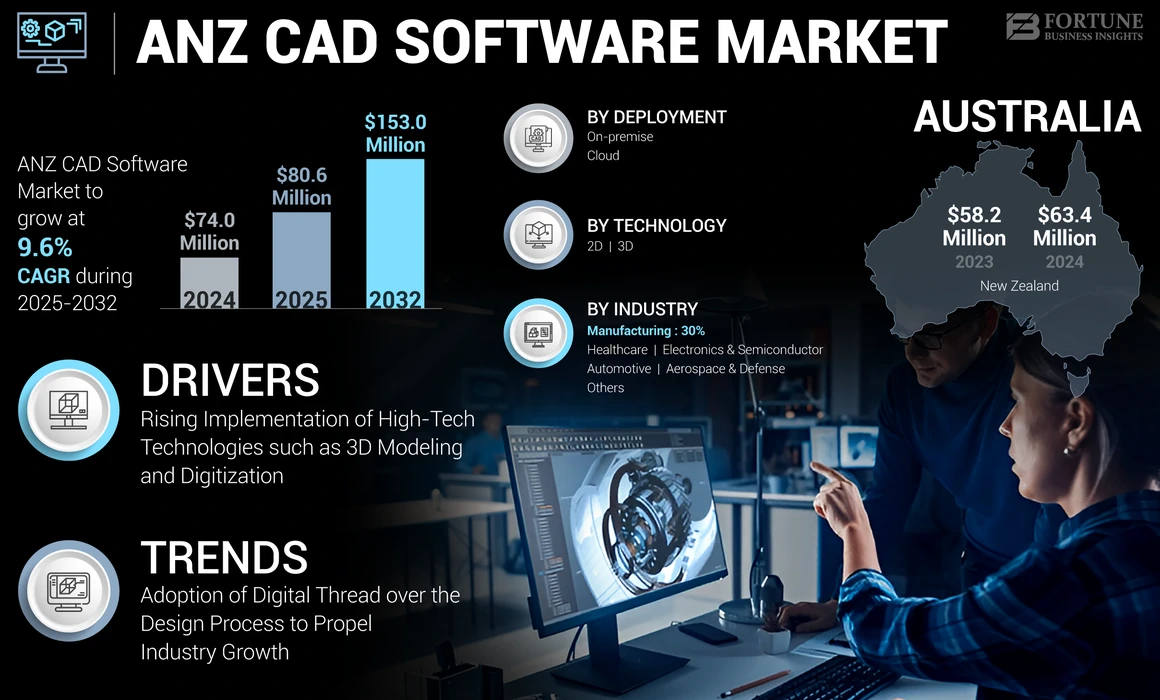

The ANZ CAD software market size was valued at USD 74.0 million in 2024. The market is projected to grow from USD 80.6 million in 2025 to USD 153.0 million by 2032, exhibiting a CAGR of 9.6% during the forecast period.

Computer Aided Design (CAD) uses computer-aided software to aid in design procedures. Different types of designers and engineers commonly use this software to make their designs more effective. Before producing and manufacturing, CAD generates 2D and 3D models of real products digitally.

The growing implementation of modernized technologies such as cloud computing, artificial intelligence, 2D/3D printing, and others for the digital transformation of businesses contributes toward the ANZ CAD software market growth. The demand for this software increases as more and more enterprises shift toward digitization and cloud adoption. For instance,

- May 2023: PTC announced the tenth version of Creo+, software as a service CAD solution. Creo+ combines Creo's proven functionality and power with advanced cloud-based tools to enrich design collaboration and streamline CAD administration. With the new version, customers will be empowered to design more easily, quicker, and collaboratively.

COVID-19 IMPACT

Rising Shift to Digital Transformation amid Pandemic Crisis Significantly Fueled Market Growth

The COVID-19 pandemic fundamentally impacted businesses and forced various industries to slow down. Owing to its application in fighting the effects of the COVID-19 pandemic, CAD software technology had a huge surge during the outbreak's peak. It facilitated work from home, automated manufacturing industries, diagnosing models using textual data and images, and tracking COVID-19 spread, among others.

The pandemic accelerated the use of Digital Technology (DT) as crucial and exceptional technology for various industries. The primary focus of businesses regarding investments was more pivoted to mature technologies such as analytics, automation, and cloud that helped them address the then business requirements by driving ROI and maintaining future trajectories.

Several companies planned to adopt work-from-home or hybrid work as part of their system. For instance, in a study by Apollo Technical, almost 30% of the employees across the globe would work permanently from home in 2022 and the number is expected to reach 35 to 40% in 2025.

Similarly, as enterprises shift toward a distributed work environment, cloud-based solutions empower the workforce to collaborate and stay connected. Various companies also emphasize enabling organizations to securely manage the data and support remote working during the COVID-19 pandemic.

LATEST TRENDS

Adoption of Digital Thread over the Design Process to Add Comprehensive Value to CAD Software and Drive Digital Business Growth

Connected data is predominantly important when enterprises such as cloud services vendors are labeled as "critical asset owners" by the government of Australia. Digitization of the process breaks down the tasks between the manufacturing, delivery, and maintenance stages, facilitating partners to work more accurately and efficiently with complete transparency into development over expected results.

A digital thread generates a closed loop between the physical and digital worlds to optimize products, processes, people, and areas, creating widespread access to individual sources and data. By applying the digital thread over the product development procedure, users efficiently remove data handoffs across incongruent tools, saving energy and time and eradicating errors.

Hence, various enterprises and organizations build fully associative deliverables that are easily efficient and reusable as designs progress through digital threads. For instance,

- In September 2022, Autodesk introduced cloud-based solutions to expand the digital thread and empower sustainability. The expansion came with various solutions such as Autodesk BIM Collaborate Pro, improved organization and association for Civil 3D and Autodesk sheets, AutoCAD web subscription, and many others.

These new upgrades and implementations augment the growth of digital thread over the design procedures.

Download Free sample to learn more about this report.

DRIVING FACTORS

Increasing Implementation of High-Tech Technologies such as 3D Modeling and Digitization to Propel Market Growth

Enterprises continuously seek ways to maximize productivity and effectiveness while decreasing the project design to get their solutions to market in the minimum time possible to keep up with the competitors. Hence, several companies have made or are moving from 2D CAD to 3D CAD.

3D CAD aids designers to visualize the final product and its components. This allows design faults to be identified quickly, limiting the design process, lowering costs, and reducing the project's overall time. Hence, these advanced technologies are widely used by enterprises across different industries, such as manufacturing, construction, electronics, and others.

For instance, as per Australian construction management software company Procore Technologies Inc., 24% of Australian construction companies plan to implement digital technologies, and in New Zealand businesses, 46% believe in BIM technology and plan to adopt the technology.

Various global and regional players expand their product offerings with innovations and upgrades in 3D CAD technology that can be implemented across various Australian and New Zealand industries.

- In December 2022, IronCAD expanded its CAD offering productivity by fast-tracking the product design process. The company released IRONCAD 2023, which comprises various benefits and improvements that aid customers in driving innovation and moving designs to production at a faster rate. The enhancements include better performance for 3D assemblies, 2D drawing views, 3D positional constraint categories, 3D curve constraints, and more detailing for 3D designs and 3D environments.

Such product enhancements and technological advancements contribute toward digital transformation and propel the ANZ CAD software market development.

RESTRAINING FACTORS

Complexity of the Product and Lack of Standardization Impede the Market Progress

CAD software comes with various features and tools, and with various integrating technologies, the software becomes complex to use. The complexity of software can be challenging to users, especially those who are new to using the software.

Several engineers and designers look for feature improvements that offer superior individual productivity and progress in their engineering design procedure proficiency. But intricacy makes the software difficult to learn and use for new beginners or people who do not have enough time or resources to invest in training.

Complexity makes the software less user-friendly due to the steep learning curve, increasing user difficulties. It also leads to generating more errors, which eventually costs a waste of resources and time as well as the potential of high-cost errors.

Such difficulties with less standardization require users to learn the software's operations and tools more thoroughly. Hence, enterprises need to spend an extra cost to train employees.

Thus, the complexity of software leads to various issues, such as system difficulties in user operations, storage issues, high-cost errors, and others, thereby hampering overall software usage and development.

SEGMENTATION

By Deployment Analysis

Cloud Segment to Grow with Highest CAGR Due to Flexibility of Use and Scalability

Based on deployment, the market is divided into cloud and on-premise.

The cloud segment is predicted to grow with highest CAGR as compared to on-premise deployment. The cloud-based deployment demand is increasing as it enables to operate the tools remotely on the vendor's server and remains vastly stable with the slightest downtime. It is offered on a subscription basis.

As per industry experts, global public cloud spending reached USD 332.30 billion, which increased by 23.1% from USD 270 billion as compared to 2020. This growth will continue to increase in upcoming years, especially in Asia Pacific countries, as the region is the most developing and has great adoption of advancements, among others. This will result in higher demand as more and more companies are shifting toward cloud deployment in this market.

The on-premise segment accounted for the market's highest share for 2024. The on-premise software is installed straight onto employer hardware, either a server, computer, or any private network. On-premise solutions are subscribed as one-time license fees, and the cost depends on coexisting users. Thus, it adequately serves the business requirements of enterprises for a longer time.

By Technology Analysis

Enhanced Productivity with 3D Technology Surges the Demand for 3D CAD Software in the Market

By technology, the market is distributed into 2D and 3D.

The 3D segment is expected to dominate the ANZ CAD software market share during the forecast period. As the implementation and adoption of advanced technologies such as 3D printing and 3D modeling are increasing the effectiveness of solutions, the requirement for 3D-enabled software is increasing. Hence, various key players are enhancing their product lines with 3D-enabled solutions in the market.

- In November 2020: PTC, a digital transformation software and solution provider, and Ansys, which delivers engineering simulation and 3D design software combined, launched CAD Creo Ansys Simulation that helps with cost-cutting and improvise the quality delivered to its customers.

2D CAD software also delivers enhanced design productivity with actual-time access to the most present design versions and any modifications. Various enterprises and organizations currently use 2D technology but are expected to shift to 3D technology with its proficiency and design effectiveness.

By Industry Analysis

Increasing Use of Emerging Technology and Government Initiatives to Drive the Product Demand in Manufacturing Sector

Based on industry, the market is categorized into automotive, aerospace and defense, manufacturing, healthcare, electronics and semiconductor, and others (construction, media and entertainment).

Implementing CAD software in manufacturing accounts for maximum market share. Australian institutes and universities partner with businesses to develop innovation precincts. Technological centers influence industry clusters in advanced manufacturing, healthcare, mining, and agriculture. New Zealand and Australian businesses are placed well to uphold their smart digital proficiencies to self-governing manufacturers, predominantly in these areas targeted for growth. The Australian government has a 20-year proposal to renovate the manufacturing industry in Australia to ensure end-to-end construction is possible without any human intervention.

To know how our report can help streamline your business, Speak to Analyst

COUNTRY INSIGHTS

The market has been studied across two countries, Australia and New Zealand.

The tech system in Australia is dynamic and smart. The country depicts proficiency in Software as a Service (SaaS), cyber security, quantum, digital games, and the technology spectrum. The government of Australia, territories, and states support the tech sector. Australia provides funding pools and generous incentives to progress the venture capital market. With effective tech skills, the country is one of the top investment destinations for Amazon, Google, NEC, and Microsoft, among others. With profound regional trade ties, the country is a springboard for development in the Asia Pacific region. According to Australia Digital Technology Report 2023, the tech sector in Australia is growing faster and has expanded by 80% in five years of tenure.

The modernized initiatives and advancements in New Zealand are contributing to the digital transformation in the country. As per the Microsoft Asia Digital Transformation Study, AI, robotics, next-generation interface Internet of Things, and AR/VR technology are the emerging technologies contributing to the GDP of New Zealand.

KEY INDUSTRY PLAYERS

Market Players’ Focus on Expansion through Strategic Alliances & Collaborations to Boost Market Growth

Companies form strategic partnerships and collaborations to expand the business, products, technological advancements, and other offerings for year-on-year revenue growth. Alliances and collaborations vary as per the business requirements, such as expansion into market economies, new alliances for better reach of customer base, and acquiring new customer base.

Various global players expand their reach in Oceania by forming strategies, alliances, and partnerships with local players, distributors, and resellers.

List of Key Companies Profiled:

- Autodesk Australia Pty Ltd. (U.S.)

- Dassault Systèmes Australia Pty Ltd. (France)

- SIEMENS (Germany)

- Bentley Systems, Incorporated (U.S.)

- PTC (U.S.)

- HCL Technologies Limited (India)

- Bricsys NV (Belgium)

- CAD-Manufacturing Solutions, Inc. (U.S.)

- CivilGEO, Inc. (U.S.)

- Metalix CAD/CAM Ltd. (Israel)

KEY INDUSTRY DEVELOPMENTS

- July 2023: LEAP Australia announced a seminar launch in Adelaide. Creo 10 would go on live, in-person launch events with the seminar. The new enhancements and features would be showcased and would provide users with a broader knowledge of PTC technologies and the success stories of local customers.

- June 2023: Dassault Aviation partnered with Dassault Systemes to leverage the 3DEXPERIENCE platform on the cloud to develop their next-generation fighter. The partnership aimed to establish a secure and streamlined European cloud with potential implications for various sectors.

- August 2022: CMS IntelliCAD announced the release of CMS IntelliCAD 11.0 PE Plus & PE CAD software. The new update focused on advanced view and visualization efficiency tools with section planes to imagine cross-sections of models. For mechanical users, CMS IntelliCAD 11.0 integrated ODA SDKs version 2022.12, Windows 11 SDK well-suited with Windows 11, and ACIS version 2022 of Spatial Technology. The upgrade license would be available as Lease or Perpetual individual seats, Renewable Subscriptions or Network floating seats, and USB dongle seats.

- July 2022: HCL Tech joined the ISV (Independent Software Vendor) Accelerate Program. Collaboration reassures mutual assurance from AWS and HCL Technologies to introduce appropriate HCL products that expand and enhance the competencies of AWS services. The co-sell program for enterprises that offer software solutions that process on or assimilate with AWS. HCL Tech solutions such as 1PLMCloud and Bigfix have been effectively onboarded.

- April 2021: Bricsys announced its partnership with BlackSpline Pty Ltd for reselling solutions in Australia's Engineering, Architecture, Operation (AECO), and Construction industry. BlackSpline aimed to improve brand awareness and further uphold the renowned BricsCAD brand in the region.

REPORT COVERAGE

An Infographic Representation of ANZ CAD Software Market

To get information on various segments, share your queries with us

The market research report provides a detailed market analysis and focuses on key aspects such as product/service types, leading companies, and product applications. The report provides knowledgeable insights into the market and highlights key industry advancements. In addition, the report incorporates various factors that contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.6% from 2025 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment

|

|

By Technology

|

|

|

By Industry

|

|

|

By Country

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 153.0 million by 2032.

In 2024, the market was valued at USD 74.0 million.

The market is projected to grow at a CAGR of 9.6% during the forecast period.

The increasing adoption of high-tech technologies such as 3D modeling and digitization is a key factor propelling the market growth.

Autodesk Australia Pty Ltd., Dassault Systemes Australia Pty Ltd., Bentley Systems, Incorporated, PTC, and Bricsys NV are the top players in the market.

Australia is expected to hold the highest market share.

By industry, the manufacturing segment is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic