The Japan market is projected to reach USD 46 million by 2026, the China market is projected to reach USD 75.5 million by 2026, and the India market is projected to reach USD 28.5 million by 2026.

Arbitrary Waveform Generators Market Size, Share & Industry Analysis, By Channel Type (Single-Channel, Dual-Channel, and Multi-Channel), By Technology (Direct Digital Synthesis AWG, Variable-Clock AWG, and Combined AWG), By Device Type (Benchtop, Modular, and Portable), By Bandwidth (Upto 1GHz, 1GHz to 5GHz, and Above 5GHz), By Application (Signal Testing & Generation, Component Testing, Systems Development & Testing, and Radar & Communications Systems), By End-Use Industry (Telecommunications, Consumer Electronics, Automotive, Healthcare, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

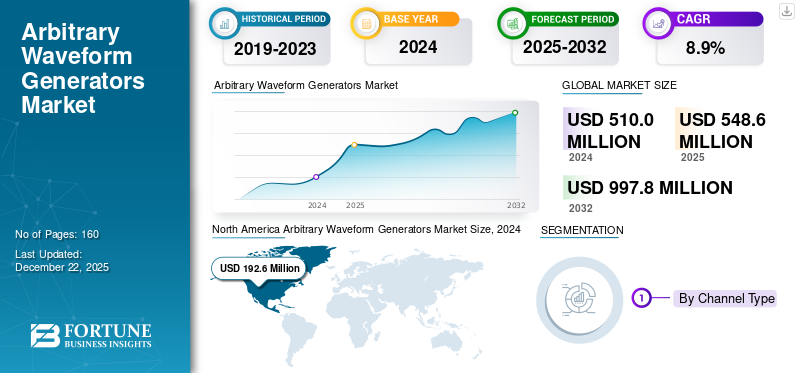

The global arbitrary waveform generators market size was valued at USD 548.6 million in 2025. The market is projected to grow from USD 592.6 million in 2026 to USD 1,158.20 million by 2034, exhibiting a CAGR of 8.70% during the forecast period. North America dominated the arbitrary waveform generators market with a market share of 37.30% in 2025.

An Arbitrary Waveform Generator (AWG) is a sophisticated signal source instrument that can produce custom, intricate voltage waveforms with amplitude, accurate timing, and frequency regulation. Major players in the market include TEKTRONIX, INC., Teledyne Technologies Incorporated, B&K Precision Corporation, Yokogawa Test & Measurement Corporation, Fluke Corporation, Keysight Technologies, NATIONAL INSTRUMENTS CORP, HIOKI E.E. CORPORATION, Rigol Technologies Inc., and Rohde & Schwarz.

Arbitrary waveform generators are witnessing significant market growth, due to the increased demand for complex signals generation in testing drives. Continuous advancements in quantum computing and semiconductor testing are expected to further expand market share. According to industry analysts, this trend is already occurring: quantum computing firms generated between USD 650 million and USD 750 million in revenue in 2024, with projections exceeding USD 1 billion in 2025.

The rapidly increasing Internet penetration across both developed and emerging economies, coupled with a sharp rise in demand for advanced communication technologies, is further increasing market growth. Furthermore, the growing utilization of automation systems is also expected to contribute to the market’s trajectory.

The COVID-19 pandemic had a substantial impact on the AWG market, due to extensive lockdowns and interruptions in manufacturing and supply chains. However, despite the temporary decline in production and demand in certain regions, the ongoing transition toward digital technologies and a rapid emphasis on healthcare applications have encouraged renewed growth in the post-pandemic period.

IMPACT OF RECIPROCAL TARIFFS

Reciprocal tariffs are imposed by countries in response to tariffs enacted by other countries. These measures affect the market for AWGs and electronic products, particularly when key components are imported from countries targeted by new tariffs. The result may include adjustments in supply chains, increases in prices, and possible shifts in manufacturing locations as a consequence.

MARKET DYNAMICS

Market Drivers

Rising Integration of AWGs with Enhanced Software Tools for Testing to Aid Market Growth

The combination of AWGs with software tools for automated testing improves their functionality, contributing to arbitrary waveform generators market growth. With the help of software, engineers can easily auto-generate waveforms and implement signal analysis, thereby making testing processes faster, improving test workflow speed, and the overall efficiency by using software-controlled AWGs.

Automated testing systems also use AWGs to generate complex RF signals needed for 5G network hardware with minimum manual intervention, thereby reducing human errors and increasing productivity. Hence, software-controlled AWGs are high in demand, particularly in electronics, telecommunications, and automotive sectors.

Market Restraints

Complexity in Operations of Waveform Generation and Testing to Hinder Market Expansion

The advanced functionalities of AWGs pose a significant challenge to the market. Users need to have expertise in developing waveforms and in understanding signal modulation and integrating these devices into their systems to use them effectively.

Market Opportunities

Emergence of Wireless Communications Standards to Create Lucrative Market Opportunities

The emergence of new wireless communication standards, notably 5G and subsequent versions, has significantly increased the demand for arbitrary waveform generators. These waveforms are essential for testing and validating operations of communication devices against high-frequency signals and complex modulation schemes employed in wireless networks.

Practical communication scenarios can be validated through performance validations, ensuring all stringent industry standards are met. In the development process for 5G networks, it is mobile phones, base stations, and network equipment that AWGs help test, so they support increased bandwidth and low latency.

Arbitrary Waveform Generators Market Trends

Rising Need for High-Quality Testing in the Electronics Sector to Emerge as a Key Market Trend

With the emergence of advanced technologies such as 5G, autonomous vehicles, and AI-based systems, there is a growing demand for highly accurate signal generation to test increasingly complex electronic devices. AWGs are instrumental in redesigning real-world scenarios for purposes of design and testing. For example, Keysight Technologies upgraded its AWG offerings to support the high-frequency, wide-bandwidth requirements.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Channel Type

Rising Need for Accurate Waveform Production and Less Complexity Boosted the Expansion of Single-Channel AWGs

Based on channel type, the market is segmented into single-channel, dual-channel, and multi-channel.

In terms of share, the single-channel segment dominated the market share of 43.46% in 2026. Tasks that need much accuracy in waveform generation prefer single channel AWGs (used for functional verification and signal integrity evaluation). These instruments are less expensive to purchase and operate, making them ideal for basic research applications and educational institutions.

The multi-channel segment is set to achieve the highest compound annual growth rate (CAGR) during the forecast period. Multi-channel AWGs enable the concurrent creation of multiple independent signals, making them essential for tasks such as differential signal testing and sophisticated signal analysis.

By Technology

Direct Digital Synthesis AWG Segment Dominated the Market Owing to Its Accuracy

Based on technology, the market is categorized into direct digital synthesis AWG, variable-clock AWG, and combined AWG.

In 2026, the direct digital synthesis AWG segment dominated the market share of 50.36% owing to its accuracy and ability to generate waveforms with minimal phase noise. These features make DDS AWGs essential for applications in telecommunications and electronics. Their ability to create specific bandwidth is beneficial for signal simulation and functional verification tasks, as they generate output frequencies that are accurate and stable.

The variable-clock AWG market segment is expected to exhibit the highest CAGR during the forecast period. The variable clock is a valuable technology that allows the real-time adjustment of output frequencies and timing. This benefit is crucial for adaptive waveforms and for ensuring accuracy in applications involving dynamic signal variations.

By Device Type

Rising Need for High-performance Equipment Boosted the Expansion of Modular AWGs

Based on device type, the market is segmented into benchtop, modular, and portable.

In terms of share, the modular segment dominated the market share of 40.38% in 2026 due to growing demand for high-performance, multi-channel, and easily upgradable test equipment.

The portable segment is set to achieve the highest compound annual growth rate (CAGR) in the forecast period, driven by the demand for compact, flexible test and measurement equipment. Increased adoption of portable AWDs in field applications, such as on-site diagnostics, maintenance, and rapid deployment, underscores their importance in environments where mobility is essential.

By Bandwidth

Rising Utilization of Low-Frequency Tasks Boosted the Expansion of the Upto 1GHz Bandwidth

Based on bandwidth, the market is segmented into Upto 1GHz, 1GHz to 5GHz, and above 5GHz.

The Upto 1GHz segment held the largest market share of 43.31% in 2026. AWGs in the Upto 1GHz range are used for low-frequency operations, testing audio, measuring fundamental circuit responses when used for academic considerations, basic academic signal generator systems, and other low-frequency tasks.

The above 5GHz segment is projected to witness the highest compound annual growth rate (CAGR) during the forecast period. Frequencies in the above 5GHz range have important functions and uses in the telecommunications, automotive, and healthcare sectors, where high frequencies may be required to evaluate the new systems.

By Application

Signal Testing & Generation Segment Dominated the Market Owing to its Rising Demand in High-Tech Fields

Based on application, the market is categorized into signal testing & generation, component testing, systems development & testing, and radar & communications systems.

In 2024, the signal testing and generation segment accounted for the largest share of the market, driven by the demand for precise and customizable signal simulation across various high-tech domains. In addition, this segment is also benefiting from the ability of the AWG to generate complicated and user-defined waveforms, which are necessary to test modern electronic devices and systems.

The systems development & testing segment is expected to record the highest CAGR during the forecast period, driven by the increasing demand for advanced test and measurement equipment across diverse industries. This growth is further fueled by the rising adoption of AWGs in commercial applications due to the superior integrity offered by Direct Digital Synthesis (DDS) integrated circuits.

By End-Use Industry

To know how our report can help streamline your business, Speak to Analyst

Telecommunications Segment Dominated the Market, Driven by Increasing Need for Testing High-Frequency Signals

Based on end-use industry, the market is categorized into telecommunications, consumer electronics, automotive, healthcare, industrial and manufacturing, and others.

The telecommunications segment captured the largest arbitrary waveform generators market share in 2024. As 5G networks are now being deployed and the evolution of wireless technology progresses, the use of AWGs for testing high-frequency signals has increased significantly. The telecommunication industry seeks systems that generate accurate waveforms and modulation to ensure that complex telecommunication networks will operate reliably.

The healthcare segment is likely to witness the highest CAGR during the forecast period, fueled by the need for advanced medical device development, biomedical research, and diagnostics. The increasing demand for high-precision testing and simulation in these areas is further accelerating the market's expansion.

ARBITRARY WAVEFORM GENERATORS MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, the Middle East & Africa, and Asia Pacific.

North America

North America dominated the market with a valuation of USD 204.9 million in 2025 and USD 219.3 million in 2026. Ongoing progress in the region's established electronics and semiconductor sector, along with the existence of several leading companies, has contributed to market expansion. Advances in electronic technologies, such as multiple-input multiple-output (MIMO) systems, have improved the functionality of AWGs, generating considerable product awareness among consumers in local economies.

North America Arbitrary Waveform Generators Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The U.S. is currently at the forefront when it comes to the rollout of 5G networks, investing heavily in infrastructure, driven by telecom giants such as Verizon, AT&T, and T-Mobile. Generators play a crucial role in emulating real-world signal environments, which is essential for designing and testing devices such as base stations and antennas, ensuring optimal performance and reliability. The U.S. market is projected to reach USD 166.5 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe will experience the second-largest market share throughout the study timeframe. The growth is driven by advancements in technology and the use of AWGs in automotive and industrial automation processes. The occurrence of AWGs in the development and testing of advanced driver-assistance systems (ADAS) and other types of automotive electronics is a significant emerging trend. The UK market is projected to reach USD 21.7 million by 2026, and the Germany market is projected to reach USD 19.9 million by 2026.

South America

Countries in South America are recognizing the importance of AWGs in enhancing the quality and effectiveness of testing and measurement across industries. A trend in the region is the upgrading of existing infrastructure with new testing technology (AWGs) to align with the international quality standards.

Middle East & Africa

The Middle East & Africa market is emphasizing employing AWGs for testing equipment and simulating signals to guarantee operational effectiveness and dependability. Assessments indicate that partnerships with global technology suppliers are promoting the exchange of knowledge and skills, helping to develop local competencies.

Asia Pacific

Asia Pacific is expected to register the highest CAGR during the forecast period. The robust growth of the electronics market in the region and the significant concentration of large electronics manufacturers (China, Japan, and South Korea) have led to increased adoption of AWGs in their testing and development cycles. Reference devices that will produce complex waveforms are not uncommon, for example, mobile phones, wearables, computing devices, and so on. Complex waveforms will be used for a variety of purposes, including signal modulation and high-speed communication. AWGs are vital instruments for maintaining quality and performance in electronic devices.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Focus on Implementing Strategic Strategies to Expand Business Reach

Key players present in this market are offering arbitrary waveform generators to provide users with high-resolution, multi-channel outputs and advanced modulation capabilities. They concentrate on holding contracts with small and local businesses in order to grow their business. Moreover, strategies such as mergers & acquisitions, partnerships, and investments will create a surge in demand for this technology.

List of Key Arbitrary Waveform Generators Companies Studied (including but not limited to)

- TEKTRONIX, INC. (U.S.)

- Teledyne Technologies Incorporated (U.S.)

- B&K Precision Corporation (U.S.)

- Yokogawa Test & Measurement Corporation (Japan)

- Fluke Corporation (U.S.)

- Keysight Technologies (U.S.)

- NATIONAL INSTRUMENTS CORP (U.S.)

- HIOKI E.E. CORPORATION (Japan)

- Rigol Technologies Inc. (China)

- Rohde & Schwarz (Germany)

- Stanford Research Systems (U.S.)

- DynamicSignals LLC (U.S.)

- Aplab Limited (India)

- Aim-TTi (U.K.)

- Tabor Electronics Ltd. (Israel)

- Pico Application (U.K.)

- Zurich Instruments (Switzerland)

- BERKELEY NUCLEONICS CORPORATION (U.S.)

- Focus Microwaves Inc. (Canada)

- Agilent Technologies, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- November 2024: Siglent announced the SDG1000X Plus AWGs. This new generation series of signals offers a new level of flexibility and performance to help meet the ever-changing requirements for signal generation.

- October 2024: Spectrum Instrumentation announced the first set of AWG cards for PCI Express. These new cards offer a powerful alternative to benchtop AWGs that often face difficulties uploading data for new waveforms.

- October 2024: Keysight Technologies announced two new analog signal generators. "These RF and Microwave RF models allow engineers to simulate up to 26 GHz.

- September 2024: Pico Technology introduced the Mixed-Signal Oscilloscope (MSO) variants of its PicoScope 3000E Series. The latest models provide a bandwidth of 500 MHz, allowing for high-fidelity signal capture in essential applications.

- September 2022: Keysight Technologies, Inc., a tech firm that offers innovative design and validation solutions to enhance innovation for global connectivity, introduced the new M8199B arbitrary waveform generator (AWG). This device supplies R&D engineers with a high-performance signal source for arbitrary signals, facilitating the creation of designs that utilize multi-level modulation formats at better speeds.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investment in this market is attractive due to technological innovation, expanding applications, and strategic policy support. AWGs are a critical component in next-gen electronics testing. As the complexity of electronic systems grows, especially in 5G, automotive, quantum computing, and advanced defense systems, the demand for flexible, precise waveform generators will increase. Companies such as Keysight and Teledyne offer stable exposure, while venture investments in niche or AI-integrated AWG startups provide higher risk-reward potential. Therefore, it presents a huge opportunity for the players operating in this market.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, and the leading end-use industry of the product. Besides, it offers insights into the arbitrary waveform generators market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.70% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Channel Type

By Technology

By Device Type

By Bandwidth

By Application

By End-Use Industry

By Region

|

|

Companies Profiled in the Report |

TEKTRONIX, INC. (U.S.) Teledyne Technologies Incorporated (U.S.) B&K Precision Corporation (U.S.) Yokogawa Test & Measurement Corporation (Japan) Fluke Corporation (U.S.) Keysight Technologies (U.S.) NATIONAL INSTRUMENTS CORP (U.S.) HIOKI E.E. CORPORATION (Japan) Rigol Technologies Inc. (China) Rohde & Schwarz (Germany) |

Frequently Asked Questions

The market is projected to reach a valuation of USD 1,158.20 million by 2034.

In 2025, the market was valued at USD 548.6 million.

The market is projected to record a CAGR of 8.70% during the forecast period.

By channel type, the single-channel segment led the market in 2026.

The rising combination of AWGs with software tools for automated testing is a key factor driving market growth.

TEKTRONIX, INC., Teledyne Technologies Incorporated, B&K Precision Corporation, Yokogawa Test & Measurement Corporation, Fluke Corporation, Keysight Technologies, NATIONAL INSTRUMENTS CORP, HIOKI E.E. CORPORATION, Rigol Technologies Inc., and Rohde & Schwarz are the top players in the Arbitrary Waveform Generators market.

North America dominated the arbitrary waveform generators market with a market share of 37.30% in 2025.

By end-use industry, the healthcare segment is expected to record the highest CAGR during the forecast period.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Semiconductor & Electronics

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us