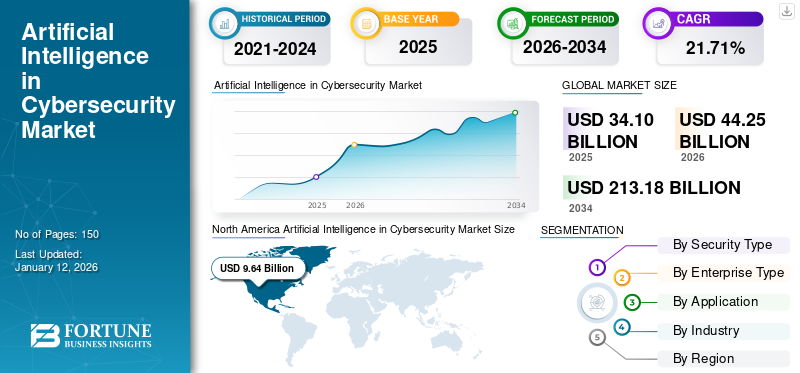

Artificial Intelligence in Cybersecurity Market Size, Share & Industry Analysis, By Security Type (Endpoint Security, Network Security, Cloud Security, Secure Web Gateway, Application Security), By Enterprise Type (Small & Mid-sized Enterprises, Large Enterprises), By Application (Identity & Access Management, Unified Threat Management, Vulnerability Assessment & Management, Fraud Detection, Risk & Compliance Management, Data Loss Prevention), By Industry (BFSI, IT & Telecom, Healthcare, Retail & E-commerce, Government & Defense, Manufacturing), & Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global artificial intelligence in cybersecurity market size was valued at USD 34.09 billion in 2025 and is projected to grow from USD 44.24 billion in 2026 to USD 213.17 billion by 2034, exhibiting a CAGR of 21.71% during the forecast period. North America dominated the market with a share of 34.90% in 2025.

Artificial intelligence in cybersecurity helps to detect, analyze, respond to, and monitor cyber threats in real time. As Artificial Intelligence (AI) algorithms analyze huge amounts of data to detect configurations indicative of cyber threats. Additionally, AI can scan complete networks for faults to help avoid common types of cyberattacks. AI predominantly monitors and examines activities and patterns. By leveraging a baseline of normal behavior, AI can identify anomalies and limit illegal access to systems.

Cybercriminal enterprises have already invested in automation, machine learning, and AI to introduce large-scale, directed cyberattacks against companies. The number of threats and the risk of ransomware attacks continue to increase. For instance,

- As per Crowdstrike’s Global Threat Report 2024, there was a 60% year-over-year rise in interactive intrusion movements in 2023, with a 73% growth in the second half compared to 2022.

To protect these evolving threats, market players such as Fortinet, Inc., Check Point Software Technologies Ltd., Tessian Limited, and Acalvio Technologies, Inc., are using modernized approaches such as behavior analysis with the help of artificial intelligence in cybersecurity to enhance threat detection and response.

IMPACT OF GENERATIVE AI

Leveraging Generative AI Capabilities to Detect Emerging Threats Creates Lucrative Market Opportunities

To protect their operations, enterprises need to develop a clear approach to incorporating AI and generative AI technologies into their present security systems. This involves continuously reevaluating the security setting to detect emerging risks and ensuring the necessary infrastructure is in place. Key components include advanced data management solutions, cloud computing resources, strong governance, and policies to safeguard data integrity and safety.

Additionally, companies invest in artificial intelligence and generative AI solutions that improve Security Operations Center (SOC) capabilities, offer comprehensive AI-based cybersecurity training for employees, and increase employee awareness of potential risks.

Generative AI models integrate inputs and leverage them to generate algorithms. For example, to fast-track AI powered security functions, GenAI can generate natural language summaries of ongoing threat tasks and recommend the next steps for analysts to take. For instance,

- As per Industry Experts, three in five employees consider AI necessary for efficient threat response, with several observing enhanced threat detection times. Approximately 60% of enterprises consider Gen AI as a long-term asset to reinforce cybersecurity efforts.

Thus, the usage of generative AI abilities can create various new opportunities for AI in the cybersecurity market.

ARTIFICIAL INTELLIGENCE IN CYBERSECURITY MARKET TRENDS

AI-driven Patch Management to Contribute to Market Progress

AI-driven patch management solutions can help prioritize, recognize, and even resolve susceptibilities with much less manual intervention than legacy systems. It enables security teams to minimize risk without increasing their workload. For instance,

- According to Action1’s 2023 State of Vulnerability Remediation Report, 47% of data breaches are caused by unpatched security susceptibilities, and 56% of enterprises still remediate security vulnerabilities manually.

An AI-driven patch management system uses artificial intelligence to spontaneously identify, prioritize, and implement security patches across an enterprise’s network. This approach enhances cybersecurity by proactively resolving vulnerabilities before attackers can misuse them, thus reducing the threat of data breaches and system conciliations. For instance,

Various applications of AI-driven patch management in cybersecurity include simplified vulnerability detection, automated patch development, real-time threat intelligence, advanced threat analytics, patch rollbacks and rollouts, and many other applications.

Thus, the usage and numerous applications of AI-based patch management contribute to the artificial intelligence in cybersecurity market growth.

MARKET DYNAMICS

Market Drivers

Rise in Number of Social Engineering Attacks to Increase Demand for Product

Social engineering is an approach leveraged by attackers to exploit human psychological vulnerabilities to gain access to sensitive information. It showcases a substantial risk to data protection. During the pandemic, several users found themselves in positions that made them susceptible to social engineering impacts. Social engineering outbreaks are rising, highlighting the growing vulnerability and complexity of the human element in cybersecurity. For instance,

- As per Verizon’s DBIR 2023 report, 74% of data breaches involved human error, which comprises social engineering attacks, misuse, or errors. The report also reveals that 8% of users are responsible for around 80% of security incidents.

Different types of social engineering attacks include phishing, smishing, spear phishing, honey trapping, baiting, whaling, and others.

AI-based behavioral analytics can efficiently identify manipulative, subtle cues that signal phishing and other deceptive tactics, significantly minimizing the occurrence of successful attacks.

Thus, the increase in different kinds of social engineering attacks augments the demand for artificial intelligence in cybersecurity solutions in the market.

Market Restraints

Rise of Adversarial Attacks can Hinder Market Development

Adversarial Attacks in Artificial Intelligence (AI) refer to manipulations that trick machine learning prototypes into improper outcomes, often misusing the way these prototypes learn and function. These manipulations are made with damaging intent, thereby compromising the system's effectiveness and reliability.

While adversarial attacks expose vulnerabilities within AI systems, their malicious usage poses threats to system integrity. Mitigating these attacks is challenging owing to the changing tactics implemented by attackers. Attackers can leverage adversarial AI to control autonomous vehicles, facial recognition systems, medical diagnosis systems, and other AI-related applications, resulting in terrible outcomes.

Market Opportunities

Real-time Threat Detection and Automation to Open up Numerous Market Opportunities

Real-time threat detection refers to the ability to detect and react to cyber threats as they occur, reducing potential disruption and damage. Continuous monitoring of systems, user activities, and networks empowers enterprises to remain vigilant and respond quickly to cyberattacks.

AI-powered solutions are increasingly adopted to offer real-time analysis and automated responses to evolving threats. This capability is crucial for mitigating the impact of today’s rapidly changing nature of attacks.

Various mechanisms used in real-time threat detection include behavioral analysis, Artificial Intelligence (AI) and Machine Learning (ML), deep learning, actual-time monitoring tools, and incorporation with present security infrastructure.

Following are the examples of real-time cybersecurity threat detection –

- Cloud account hijacking avoidance

- Interior network monitoring

- Internal threat detection

Based on the above factors, real-time threat detection and automation create several opportunities for AI to grow in the cybersecurity market.

USE CASE ANALYSIS

|

Challenge |

Solution |

Benefits |

|

An insurance solution provider faced the challenge of meeting clients’ strict security compliance requests with a small in-house team. The company needed to balance robust security practices with an innovative and agile startup culture. |

|

|

SEGMENTATION ANALYSIS

By Security Type

Growing End-user Spending Fueled Network Security Segment Progress

By security type, the market is divided into endpoint security, network security, cloud security, secure web gateway, application security, and others (operational technology security).

The network security segment accounted for the highest market share by 32.39% in 2026, owing to rising investments in holistic solutions that integrate emerging technologies such as secure browsers, AI Copilots, single-vendor SASE, and AI-based threat detection and response. Additionally, increasing enterprise spending on various information security solutions such as network security and related services is contributing to the segment’s growth.

The cloud security segment is anticipated to grow with the highest CAGR during the forecast period. As enterprises continue to shift to the cloud, industry analysts presume a rise in the adoption of cloud security solutions.

Download Free sample to learn more about this report.

Source: 2024 State of Cybersecurity Report | Ivanti

The above graph showcased the different security-type areas of investment in 2024. Cloud security and data security top the list with higher investments and increased enterprise spending across cybersecurity solutions.

By Enterprise Type

SMEs Segment to Display Highest CAGR due to Enhanced Capabilities of AI-driven Cybersecurity Solutions in Bridging Skillset-gap

Based on enterprise type, the market is characterized by Small and Mid-Sized Enterprises (SMEs) and large enterprises.

The small and mid-sized enterprises segment is projected to grow with the highest CAGR of 34.20% during the study period. AI is being leveraged to enhance cybersecurity by enabling rapid breach detection and adaptive learning, helping SMEs address skill gaps through not just classroom knowledge but also practical implementation. Additionally, various government policies and industry alliances are working to bridge the cybersecurity skills gap, further strengthening overall security.

- For instance, in March 2025, SailPoint announced the expansion of its MSP (Managed Service Providers) program to offer services to SMEs and large enterprises. It provides MSPs the capability to provide and manage the Identity Security Cloud of SailPoint for customers in global market.

The large enterprises segment is projected to account for the 62.22% of the market share in 2026. Their complex and multifaceted network infrastructure and vast amount of data, make them more susceptible to cyber-attacks and data breaches. Thus, the requirement for enhanced cybersecurity solutions with modernized technology, such as Generative AI, machine learning, and machine learning, also increases within large enterprises.

By Application

Fraud Detection Segment Dominated due to AI’s Rapid Detection Capabilities

By application, the market is divided into identity & access management, unified threat management, vulnerability assessment and management, fraud detection, risk & compliance management, data loss prevention, and others (user behavior analytics).

Fraud detection held the highest market share in 2024, owing to several benefits delivered by artificial intelligence in identifying fraudulent activities. AI identifies fraud in milliseconds, minimizes financial losses, reduces false positives, and efficiently analyzes millions of transactions simultaneously. Fraud detection segment is anticipated to capture 29.19% of the share in 2026.

- For instance, as per cybersecurity experts, the key advantages of leveraging artificial intelligence in cybersecurity are, 74% improvement in detection speed, 67% enhancement in predictive capabilities, and 53% reduction in errors.

Unified threat management is projected to grow with the highest CAGR of 36.20% from 2025 – 2032. Optimization and higher emphasis on security, password alternatives, security application coordination, automated incident response, and many other growing trends within unified threat management contribute to the segment growth.

By Industry

Rising Cyber Attacks within Retail & E-commerce to Augment Demand for AI-based Cybersecurity Solutions

By industry, the market is categorized into BFSI, IT & telecom, healthcare, retail & e-commerce, government & defense, manufacturing, and others (education, media, etc.).

To know how our report can help streamline your business, Speak to Analyst

The retail & e-commerce segment is anticipated to register the highest CAGR of 36.90% during the study period. The increasing popularity of online shopping and omnichannel retail shopping platforms has opened up new opportunities for cyberattacks. Additionally, the use of multiple payment gateways for online and other digital transactions has increased the need for secure and protected fraud identification solutions in the retail sector. Such factors are driving the demand for artificial intelligence in cybersecurity solutions in the market.

- According to Shopify Insights, in 2023, 69% of retail enterprises encountered ransomware outbreaks, with 71% of invaders effectively encrypting data. Just 26% of the firms were able to stop encryption during the attacks.

The IT & telecom segment held the highest market share in 2024. The rising number of cyberattacks and data breaches due to huge amounts of sensitive data within the IT sector has increased the demand for advanced cybersecurity solutions. By using AI technologies, telecom firms can improve their ability to detect, prevent, and reply to possible threats in real-time. The IT & telecom segment is predicted to capture the market share by 26.43% in 2026.

ARTIFICIAL INTELLIGENCE IN CYBERSECURITY MARKET REGIONAL OUTLOOK

North America

North America Artificial Intelligence in Cybersecurity Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America region led the market with size of USD 11.90 billion in 2025, and USD 7.97 billion in 2023. The region held the highest market share in 2024 due to the presence of high-tech enterprises across various sectors such as BFSI, IT & telecom, healthcare, and others. Additionally, the strong presence of market players such as Fortinet, Inc., Acalvio Technologies, Inc., BlackBerry Limited., CrowdStrike, and LexisNexis Risk Solutions, further contributes to the region’s leadership in artificial intelligence in cybersecurity market.

Download Free sample to learn more about this report.

The early evolution of advanced technology, such as generative AI, supervised machine learning, natural language processing, and large language models within security solutions significantly boosts the market growth in the U.S. Additionally, several government-led initiatives aimed at fighting cyberattacks also aid market progress. The U.S. market is projected to lead the market with USD 7.60 billion in 2026.

- For instance, according to Asee’s Cybersecurity Statistics Insights 2025, the U.S. government allocated USD 12.72 billion for cybersecurity initiatives in 2024, without the Department of Defense.

South America

South America is projected to grow at a significant CAGR during the forecast period. The rising adoption of technologies such as machine learning and AI in Brazil and Argentina contribute to the market growth.

- For instance, as per Tuvis insights 2025, AI has become a reality for Brazilian micro, small, and mid-sized enterprises (MSMEs). A recent study commissioned by Edelman Brasil and Microsoft found that 74% of enterprises already use artificial intelligence, a substantial rise from 61% in the previous year.

Europe

Europe is the second-fastest growing region with a market size of USD 9.14 billion, recording the second-largest CAGR of 33.30%, which holds a noteworthy market share, owing to the greater adoption of AI-based cybersecurity solutions across several European countries, such as Germany, the U.K., Italy, Spain, and France. Additionally, the EU AI Act represents a major advancement in regulating AI across various industries within the European Union. Its primary aim is to ensure that AI systems are used safely, responsibly, and transparently, thereby encouraging ethical AI practices.

The U.K. market is expected to attain a market size of USD 2.87 billion in 2026. The Germany market is projected to a significant market size of USD 2.59 billion in 2026 and France expecting to account for USD 1.41 billion in 2025.

- For instance, in March 2025, Cisco announced it would train 1.5 million individuals in the EU by 2030. The company has planned to train 5,000 instructors over the next five years to reinforce higher and vocational education by equipping teachers with AI, cyber-security, digital transformation, and networking knowledge.

Middle East & Africa

The Middle East & Africa is the fourth-largest region with a USD 4.74 billion in 2026 and projected to grow substantially during the forecast period. The rapid rise in cybersecurity threats has prompted several governments to implement cybersecurity standards, such as the National Cybersecurity Authority (NCA) regulation and the UAE’s Information Assurance Framework. These regulations mandate private and public organizations to comply with cybersecurity standards, thereby increasing the demand for artificial intelligence in cybersecurity solutions in the region. The GCC market size is estimated to hit USD 1.37 billion in 2025.

Asia Pacific

Asia Pacific market size is estimated to be USD 9.81 billion, making it the third largest market in 2026. Asia Pacific is estimated to grow with the highest CAGR from 2026 to 2034. Enterprises across the Asia Pacific region are accelerating the adoption of artificial intelligence (AI) in cybersecurity as a strategic response to the evolving nature of changing AI-powered threats. Moreover, various market players are advancing their solutions to deliver more robust, security-driven solutions for businesses. The market in China is expected to attain a market size of USD 2.97 billion in 2026. The Japan market is projected to a significant market size of USD 2.29 billion and India is expecting to account for USD 1.78 billion in 2026.

- For instance, in November 2024, Hitachi Systems and Cynamics announced a strategic collaboration to fortify cybersecurity in the Asia Pacific region using AI-powered solutions. The partnership aimed to boost cyber defense across the region's growing expertise in AI and IT.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Introducing Advanced Solutions to Expand their Portfolio

Players in the market, such as Fortinet, Inc., Check Point Software Technologies Ltd., Sophos Ltd., and IBM Corporation, are introducing new solutions to enhance their positioning by leveraging advanced technological augmentations, addressing diverse consumer requests, and attaining a competitive edge. Their strategic focus includes improving product offerings, forming strategic collaborations, and pursuing mergers and acquisitions to expand their portfolio. These progressive developments will help them maintain and increase their artificial intelligence in cybersecurity market share in a dynamic and competitive industry.

Major Players in the Artificial Intelligence in Cybersecurity Market

Fortinet, Inc., Check Point Software Technologies Ltd., Sophos Ltd., Tessian Limited, Acalvio Technologies, Inc., BlackBerry Limited., Darktrace Holdings Limited, CrowdStrike, LexisNexis Risk Solutions, and IBM Corporation, among other players, are the largest players in the market.

List of key Artificial Intelligence in Cybersecurity Companies Profiled:

- Fortinet, Inc. (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Sophos Ltd. (U.K.)

- Tessian Limited (U.K.)

- Acalvio Technologies, Inc. (U.S.)

- Cylance Inc. (BlackBerry) (Canada)

- Darktrace Holdings Limited (U.K.)

- CrowdStrike (U.S.)

- Palo Alto Networks (U.S.)

- LexisNexis Risk Solutions (U.S.)

- IBM Corporation (U.S.)

- Vectra AI Inc. (U.S.)

- Micron Technology, Inc. (U.S.)

- Cybereason (U.S.)

- SparkCognition (Austin)

- Cynet (U.S.)

- SentinelOne (U.S.)

- Symantec (U.S.)

- Cisco Systems, Inc. (U.S.)

- Arctic Wolf Networks (U.S.)

- NVIDIA Corporation (U.S.)

- Intel Corporation (U.S.)

…and more

KEY INDUSTRY DEVELOPMENTS:

- February 2025: Sophos announced the launch of AI Assistant in Sophos XDR. The AI Assistant is designed to support security professionals of all levels of skills throughout every stage of a case investigation, increasing proficiency to recognize and neutralize threats quickly.

- November 2024: Fortinet announced the expansion of its GenAI capabilities across its cybersecurity platform, introducing two new features aimed at streamlining operations. FortiAI now expands seven different Fortinet solutions with new GenAI incorporations for FortiNDR Cloud to fast-track threat handling analysis and Lacework FortiCNAPP to simplify investigation.

- August 2024: IBM introduced generative AI-driven cybersecurity assistance for response services and threat detection. Developed on IBM's Watsonx data and AI platform, the IBM Consulting Cybersecurity Assistant is built to accelerate and enhance the identification, response, and investigation of critical security threats.

- March 2024: Cybereason, in partnership with Observe, announced the launch of a new SDR solution, combining XDR and SIEM functionalities to modernize security with observability in the GenAI. This SaaS-based solution resolves issues of outdated SIEM architectures and improves SOC efficiency by automating the ingestion and enrichment of data across an enterprise’s digital footprint.

- January 2024: Check Point Software launched Infinity AI Copilot to transform cyber security with intelligent GenAI support and automation. By combining cloud technologies and AI, Infinity AI Copilot resolves the worldwide shortage of cybersecurity experts while enhancing the effectiveness and efficiency of security teams.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Prominent market players are planning to invest in research and development continuously. Investing in R&D to incorporate threat detection and response, breach and attack simulation, automated security control assessment, digital risk protection, and many others helps enterprises augment business progress. Also, various small and mid-sized enterprises are securing funding and investments to expand their business offerings and customer base. For instance,

- In February 2025, Dream, an AI firm offering cyber resilience for critical infrastructure and nations, secured a series B funding of USD 100 million led by Bain Capital Ventures at a USD 1.1 billion valuation. This funding fast-tracks the development of the company’s Cyber Language Model (CLM), which offers language models precisely trained for cybersecurity processes.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, service types, and leading applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.71% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Security Type, Enterprise Type, Application, Industry, and Region |

|

Segmentation |

By Security Type

By Enterprise Type

By Application

By Industry

By Region

|

|

Companies Profiled in the Report |

Fortinet, Inc. (U.S.), Check Point Software Technologies Ltd. (Israel), Sophos Ltd. (U.K.), Tessian Limited (U.K.), Acalvio Technologies, Inc. (U.S.), Cylance Inc. (BlackBerry), Darktrace Holdings Limited (U.K.), CrowdStrike (U.S.), LexisNexis Risk Solutions (U.S.), IBM Corporation (U.S.), Micron Technology, Inc. (U.S.), Cybereason (U.S.), etc. |

Frequently Asked Questions

The market is projected to reach USD 213.17 billion by 2034.

In 2025, the market was valued at USD 34.09 billion.

The market is projected to grow at a CAGR of 21.71% during the forecast period.

By industry, the retail & e-commerce segment is expected to lead the market with the highest CAGR.

Rise in number of social engineering attacks is a key factor driving market growth.

Fortinet, Inc., Check Point Software Technologies Ltd., Sophos Ltd., Acalvio Technologies, Inc., Darktrace Holdings Limited, and CrowdStrike are the top players in the market.

North America held the highest market share in 2025.

By application, unified threat management is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us