Cybersecurity Mesh Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Deployment (Cloud and On-premises) By Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), By Layer (Security Analytics and Intelligence, Distributed Identity Fabric, Consolidated Policy and Posture Management, and Consolidated Dashboards), By Industry (BFSI, Retail & E-commerce, Healthcare, IT & Telecom, Government and Defense, Manufacturing, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

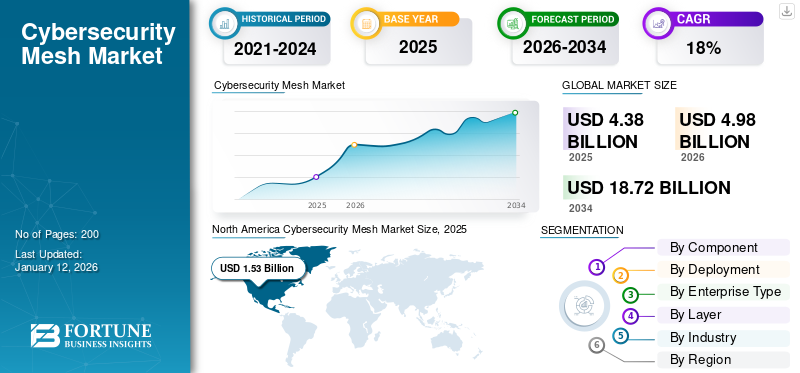

The global cybersecurity mesh market size was valued at USD 4.38 billion in 2025. The market is projected to grow from USD 4.98 billion in 2026 to USD 18.72 billion by 2034, exhibiting a CAGR of 18% during the forecast period. North America dominated the cybersecurity mesh market with a market share of 35% in 2025.

Cybersecurity mesh means a flexible, disparate sort of security architecture set out to guard digital assets across complex and decentralized IT environments. Organizations use this system to enforce identity-centric security policies uniformly across any location, supporting hybrid cloud, multi-cloud, or edge computing critical infrastructure paradigm. The market is growing at a fast pace, due to an increase in cybersecurity threats, adoption of Zero Trust models, and the need for adaptive threat detection and response in real time.

Major players dominating this market include IBM, Palo Alto Networks, Cisco Systems, Fortinet, Forcepoint, and F5. Their leadership is supported by broad portfolios, continuous innovation, strategic partnerships, and expanding global presence. These companies focus on delivering integrated security platforms that combine threat intelligence, endpoint protection, and identity management to address evolving cyber risks effectively.

IMPACT OF AI

Implementation of AI Assists Organization to Protect Data with Flexibility and Precision

AI is playing a pivotal role in reshaping the cybersecurity mesh market by enabling intelligent, adaptive, and efficient security frameworks. It enhances threat detection, automates responses, and supports real-time decision making, for managing today’s complex and distributed IT environments.

- In February 2025, OpenText launched Core Threat Detection and Response, an AI-powered cybersecurity solution on Microsoft Azure. It integrates with Microsoft Defender, Entra ID, and Security Copilot to detect and respond to threats quickly. The platform uses adaptive AI to tackle insider and external threats, helping organizations improve security without overhauling existing systems.

As organizations shift toward Zero Trust and cloud-based infrastructures, AI-driven cybersecurity mesh offers the flexibility and precision needed to protect diverse digital assets. While high costs, integration challenges, and talent shortages remain obstacles, the growing need for smarter security solutions continue to rise.

MARKET DYNAMICS

MARKET DRIVERS

Rising Cybersecurity Threats Propels Demand for Cybersecurity Mesh among Leading Firms

The number and complexity of cyber threats continue to increase at an unprecedented rate, and traditional security has been unable to keep pace. As the number of devices and usage of the cloud continue to rise, there are more points of attack or potentially vulnerable points.

- According to Viking Cloud, by 2025, cybercrime is projected to cost businesses as much as USD 10.5 trillion, with potential losses escalating to USD 15.63 trillion by 2029.

Cybersecurity mesh enhances traditional security by offering a flexible, consistent, and coordinated defense to help organizations detect and respond to evolving cyber threats better. It allows security controls to lean on each other across all security environments, enabling fewer security gaps to offer more comprehensive coverage across the organization.

MARKET RESTRAINTS

Absence of Standard Protocol or Framework May Limit Adoption of Security Tools

A major problem adopting cybersecurity mesh architectures is the number of systems available to work with, including cloud services and on-premises environments, IoT devices, and older legacy infrastructure.

- According to recent research by Palo Alto Networks, nearly 64% of the U.K. organizations say that complex technology and poor interoperability are the biggest barriers to strengthening their security posture.

All companies are using different technologies, making it difficult to interface. The absence of standard protocols or frameworks between the security tools from different vendors, compounds the issue. Lack of consistent interoperability results in limited visibility, data silos overall lower security effectiveness

MARKET OPPORTUNITIES

Cybersecurity Mesh’s Uniform Protection amplifies its Adoption Across Industries

The expansion of data protection regulations around the globe is leading organizations to tighten their security strategies and adopt more holistic frameworks. Cybersecurity mesh provides a consolidated perspective that guarantees uniform protection across all environments from on-premises to cloud to remote locations.

Its capabilities in real-time detection and response to threats enable organizations to quickly respond to risks and maintain compliance, ultimately decreasing the chances of data breaches and penalties. Cybersecurity mesh is increasingly becoming an important solution to meeting compliance regulatory demands while enabling flexible business initiatives.

MARKET CHALLENGES

Resistance to Organization Change Due to Unclear Benefits May Hamper Market Growth

Transitioning to a cybersecurity mesh model requires more than just technology changes; it demands a shift in organizational mindset and culture. This involves adopting Zero Trust principles that focus on continuous verification and strict access control, which can be unfamiliar and challenging for many. Stakeholders, including leadership and security teams, may resist due to concerns about complexity, disruption, or unclear benefits.

CYBERSECURITY MESH MARKET TRENDS

Rise of Zero Trust Security Models to be a Key Trend in the Market

The rise of zero-trust security models is driving the adoption of cybersecurity mesh by enabling identity-based, decentralized security across hybrid and cloud-native environments. As organizations move toward cloud-first strategies and complex IT infrastructures, traditional perimeter-based defenses are no longer sufficient.

- According to IBM, 41% of organizations have already deployed a zero-trust architecture.

Download Free sample to learn more about this report.

Segmentation Analysis

By Component

Solutions Segment Dominates with Advanced Threat Detection and Response Capabilities

In terms of component, the market is categorized into solutions and services.

The solution segment captured the largest share of 68.76% in 2026. In 2025, the segment is anticipated to dominate with a 69.1% share. This is due to organizations prioritizing investment in comprehensive security tools that provide threat detection, access control, and policy enforcement. The demand for integrated and effective cybersecurity solutions continues to drive the cybersecurity mesh market growth. Additionally, the increasing complexity of cyber threats push enterprises to adopt advanced solution offerings that can deliver real-time protection and automated response capabilities.

The services segment is expected to grow at a CAGR of 19.70% over the forecast period.

By Deployment

Predominance of Cloud Deployment Fuels Growth in the Market

Based on deployment, the market is segmented into cloud and on-premises.

The cloud segment will account for 64.32% market share in 2026. By deployment, the cloud segment held the share of 63.20% in 2025 as more organizations adopt cloud-first strategies and require adaptive security solutions that can protect dynamic and hybrid infrastructures effectively. Additionally, recent product upgradation by tech companies also supports this trend.

- In May 2025, Tigera’s free tier for Calico Cloud strengthened Kubernetes security by improving visibility, policy control, and microsegmentation, which are core elements of a cybersecurity mesh. It provides real-time traffic insights and secure inter-cluster communication with WireGuard, enabling more adaptive and integrated protection across workloads without extra cost.

The cloud segment is set to flourish with a growth rate of 20.40% across the forecast period.

By Layer

Security Analytics and Intelligence Layer Commands the Market Owing to Increase in Cyberattacks

Based on layer, the market is segmented into security analytics and intelligence, distributed identity fabric, consolidated policy and posture management, and consolidated dashboards.

In 2024, security analytics and intelligence held the majority share of the market. This layer is crucial for detecting, analyzing, and responding to threats in real time, enabling organizations to gain deeper insights into security events. The increasing volume and sophistication of cyberattacks drive demand for advanced analytics and intelligence tools, making this layer a key focus area for strengthening overall cybersecurity posture. Furthermore, the segment is set to hold a 29.6% share in 2025.

In addition, distributed identity fabric is projected to grow at a CAGR of 22.40% during the study period.

By Enterprise Type

Large Enterprises Propel the Market with Accelerated Adoption and Investment

Based on enterprise type, the market is segmented into large enterprises and small & medium-sized enterprises.

In 2024, large enterprises held the major share of the market due to their greater need for robust and scalable security frameworks to protect extensive and complex IT environments. The Large Enterprise segment will account for 72.39% market share in 2026. Large organizations often have more resources to invest in advanced cybersecurity solutions and prioritize comprehensive protection against sophisticated threats. Furthermore, the segment is set to hold a 72.8% market share in 2025.

In addition, SMEs are projected to grow at a CAGR of 19.80% during the study period.

By Industry

To know how our report can help streamline your business, Speak to Analyst

High Demand for Cybersecurity Mesh in BFSI Contributed to Segmental Growth

On the basis of industry, the market is classified into BFSI, retail & e-commerce, healthcare, IT and telecom, government and defense, manufacturing, and others.

The Banking, Financial Services, and Insurance (BFSI) sector holds the largest cybersecurity mesh market share due to the sector’s high vulnerability to cyber threats and strict regulatory requirements for data protection.

- According to the Hindu, The Economic Survey 2024-25 highlighted that banks are the most impacted by cybersecurity incidents, with nearly 20% of all reported cyberattacks targeting financial institutions.

Cybersecurity Mesh Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Cybersecurity Mesh Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025 valuing at USD 1.53 billion and also took the leading share in 2026 with USD 1.72 billion. The factors fostering the dominance of the region include strong adoption of advanced cybersecurity frameworks, presence of key market players, increased investments in digital infrastructure, and stringent regulatory requirements aimed at enhancing data protection. In 2025, the U.S. market is estimated to reach USD 1.42 billion.

Europe and Asia Pacific

Europe and Asia Pacific are anticipated to witness notable growth in the coming years. During the forecast period, Europe is projected to record the growth rate of 20.00%, which is second highest amongst all the regions and touch the valuation of USD 1.43 billion in 2025. This is primarily due to the increasing adoption of Zero Trust architectures, growing cloud migration, and rising awareness about cybersecurity resilience leading to high demand for mesh security solutions. Backed by these factors, the U.K. anticipates to record the valuation of USD 0.43 billion, Germany to record USD 0.36 billion in 2026, and France to record USD 0.24 billion in 2025. After Europe, Asia Pacific is estimated to reach USD 0.91 billion in 2025 and secure the position of third-largest region. India and China both are estimated to reach USD 0.15 billion and USD 0.42 billion respectively in 2026. The Japan market is projected to reach USD 0.28 billion by 2026.

Over the forecast period, Latin America and the Middle East & Africa would witness moderate growth. Latin America market in 2025 is set to record USD 0.12 billion. Rising digital transformation initiatives, growing cyberattack incidents, and increasing government focus on cybersecurity frameworks are expected to drive demand in these regions. In the Middle East & Africa, GCC is set to attain USD 0.09 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Wide Range of Product Offerings with a Strong Distribution Network Reinforces Leading Position of Key Players

A wide range of product offerings combined with strong global distribution networks has helped key companies maintain their leading positions. The market exhibits a semi-consolidated structure, with several major players alongside numerous smaller firms driving innovation and expansion.

IBM, Palo Alto Networks, Forcepoint, Cisco Systems, Fortinet, and F5 are some of the dominant companies in this space. These players distinguish themselves through comprehensive solutions that integrate advanced threat detection, identity management, and automated response capabilities. Their global reach, extensive partner ecosystems, and ongoing investments in research and development enable them to deliver scalable and adaptive security frameworks to a diverse set of industries.

LIST OF KEY CYBERSECURITY MESH COMPANIES STUDIED

- IBM Corporation (U.S.)

- Palo Alto Networks (U.S.)

- Forcepoint (U.S.)

- Microsoft (U.S.)

- Check Point Software Technologies Ltd (Israel)

- Cisco Systems, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Appgate (U.S.)

- Sophos Ltd (U.K.)

- SonicWall (U.S.)

- Aryaka Networks, Inc. (U.S.)

- F5, Inc. (U.S.)

- Mesh Security, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Bitdefender has agreed to acquire Mesh Security, a provider of advanced email security solutions. The acquisition will enhance Bitdefender’s GravityZone XDR and MDR platforms, boosting protection against phishing, BEC, and other email threats. Mesh’s MSP-friendly, dual-layered approach combines secure email gateways and mailbox-level defense, offering scalable and efficient threat protection.

- May 2025: Naoris Protocol, a decentralized cybersecurity mesh platform, raised USD 3 million in a strategic funding round led by Mason Labs, with backing from Frekaz Group, Level One Robotics, and Tradecraft Capital. The oversubscribed round follows six months of technical due diligence and signals strong institutional interest in quantum-resistant blockchain security.

- April 2025: Fenix24, a cyber-disaster recovery firm, has acquired appNovi to strengthen its Argos99 incident response platform with cybersecurity mesh architecture (CSMA). This follows its earlier acquisition of vArmour, enhancing attack surface mapping, asset visibility, and securing operational resilience.

- December 2024: Axiad has launched Axiad Mesh, the world’s first identity risk management solution, designed to unify identity sources and automatically detect, quantify, and remediate identity risks across enterprises. Using machine learning, Axiad Mesh provides visibility into identity threats, assigns risk scores, and integrates with tools such as Microsoft Entra ID and CrowdStrike.

- November 2024: Mesh Security has launched Mesh CSMA 1.0, a Cybersecurity Mesh Architecture (CSMA) platform designed for modern, cloud-first enterprises. The platform unifies security tools, data, and infrastructure into an autonomous defense system, offering real-time threat detection, predictive analytics, and automated risk remediation.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 18% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Solutions · Services |

|

By Deployment · Cloud · On-premises |

|

|

By Enterprise Type · Small and Medium Enterprises (SMEs) · Large Enterprises |

|

|

By Layer · Security Analytics and Intelligence · Distributed Identity Fabric · Consolidated Policy and Posture Management · Consolidated Dashboards |

|

|

By Industry · BFSI · Retail & E-commerce · Healthcare · IT & Telecom · Government and Defense · Manufacturing · Others (Energy & Utilities, etc.) |

|

|

By Geography · North America (By Component, Deployment, Enterprise Type, Layer, Industry, and Country) o U.S. o Canada o Mexico · Europe (By Component, Deployment, Enterprise Type, Layer, Industry, and Country) o U.K. o Germany o France o Italy o Spain o Russia o Benelux o Nordics o Rest of Europe · Asia Pacific (By Component, Deployment, Enterprise Type, Layer, Industry, and Country) o China o India o Japan o South Korea o ASEAN o Oceania o Rest of Asia Pacific · Middle East & Africa (By Component, Deployment, Enterprise Type, Layer, Industry, and Country) o Turkey o Israel o GCC o North Africa o South Africa o Rest of MEA · South America (By Component, Deployment, Enterprise Type, Layer, Industry, and Country) o Brazil o Argentina · Rest of South America |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 4.98 billion in 2025 and is projected to reach USD 18.72 billion by 2034.

In 2025, the market value stood at USD 1.53 billion.

The market is expected to exhibit a CAGR of 18% during the forecast period of 2026-2034.

The BFSI segment led the market by industry.

Rising cybersecurity threats is a crucial factor driving market growth.

IBM Corporation, Palo Alto Networks, Forcepoint and Fortinet, are some of the prominent players in the market.

North America dominated the market in 2026 by holding the largest share.

The healthcare segment is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us