Asia Pacific Artificial Intelligence Market Size, Share & Industry Analysis, By Component (Hardware, Software, & Services), By Deployment (On-premise & Cloud), By Enterprise Type (Large, Small & Medium-sized Enterprises), By Technology (ML, NLP, Computer Vision, Robotics & Automation, & Expert Systems), By Function (HR, Marketing & Sales, Product/Service Deployment, Service Operation, Risk, & Supply-chain Management), By Industry (Healthcare, Automotive, BFSI, Retail, Manufacturing, Agriculture, Government, IT & Telecom, Energy & Utilities, & Education), & Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

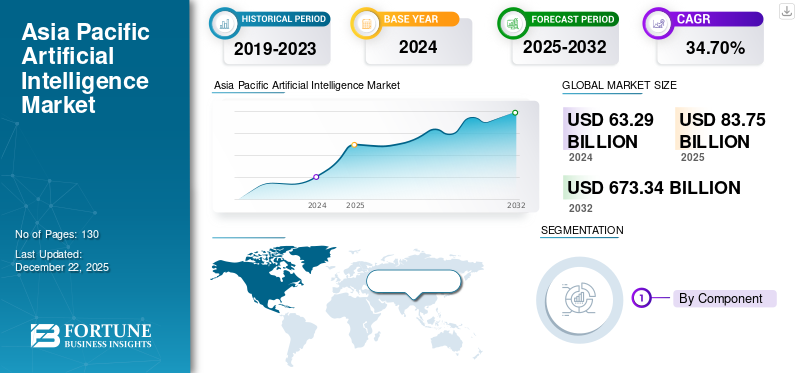

Asia Pacific artificial intelligence market size was valued at USD 63.29 billion in 2024. The market is projected to grow from USD 83.75 billion in 2025 to USD 673.34 billion by 2032, exhibiting a CAGR of 34.70% over the forecast period.

Asia Pacific is rapidly advancing as a key regional player in artificial intelligence market, driven by a focus on innovation, ethical use, and technological independence. The region is moving from pilot projects to widespread AI implementation across vital industries like healthcare, finance, transportation, and manufacturing. Supported by strong government policies, world-class research centers, and growing investments from both public and private sectors, Asia Pacific is building a responsible and inclusive AI environment. In 2025, the region made significant strides in bringing AI solutions to market while enhancing its leadership in AI regulation, infrastructure development, and international partnerships.

Impact of Generative AI

Generative artificial intelligence is fundamentally changing the artificial intelligence landscape in the Asia Pacific through innovation, productivity, and digital transformation across industries. Consumers and businesses have reacted rapidly to the potential applications for generative AI technologies, utilizing it for purposes including, but not limited to, content generation, automation of customer service, personalized marketing, and coding. For instance,

- According to Infosys, over half (55%) of companies in the Asia Pacific region are already deploying generative AI technologies or generating business value from their generative AI initiatives.

The demand for generative AI has spurred both large tech firms and startups to develop versions aimed towards the region, understanding diverse languages and various cultural contexts.

Impact of Reciprocal Tariffs

Reciprocal tariffs, or tariffs imposed on each country that have matching trade duties, can have a large impact on economies emerging from reciprocal tariffs as they create disruptions in supply chains, increase costs of production, and cause shifts in global trade. In Asia Pacific, these tariffs will increase the price of imported technologies while decreasing the competitiveness of exports, especially in sectors such as electronics and artificial intelligence. For instance, If India were to impose a 20% tariff on AI hardware imported from South Korea, and if South Korea were to respond with matching tariff on Indian AI software exports, the economies of both the countries would either be forced to try and bear these costs internally and cap their margins or delay their innovative plans.

Asia Pacific Artificial Intelligence Market Trends

Rapid Enterprise Adoption to be the Key Driver for Market Growth

One of the most significant trends underpinning growth in India's AI market is its rapid adoption by businesses across various industries (healthcare, finance, education, and retail) in a variety of applications. Businesses are rapidly adopting AI technologies through cloud-delivered services and AI-based applications. For instance,

- According to Microsoft, over half of organizations in the Asia Pacific region (53%) are already using agents to fully automate workflows or business processes, surpassing the global average of 46%.

This is primarily due to the cost, scalability, and ease of implementation that cloud technologies provide. Even small and medium enterprises can take advantage of advanced AI technology without the need to make a large capital investment.

Key takeaways

· The Asia Pacific Artificial Intelligence Market is projected to be worth USD 673.34 billion in 2032.

· In component segment, software accounted for around 46.5% of the Asia Pacific artificial intelligence market in 2024.

· In deployment segment, cloud is projected to grow at a CAGR of 36.1% in the forecast period.

· In enterprise type segment, large enterprises accounted for around 58.9% of the market in 2024.

· In function segment, risk segment is projected to grow at a CAGR of 37.7% in the forecast period.

· In the technology, machine learning accounted for around 40.6% of the market in 2024.

· In the industry segment, healthcare is projected to grow at a CAGR of 42.4% in the forecast period.

· The artificial intelligence market in the China was worth USD 21.63 billion in 2024.

· By region, China is projected to grow at a CAGR of 39.0% in the forecast period.

Asia Pacific Artificial Intelligence Growth Factors

Strong Government Support and National AI Strategies to Boost Market Growth

Governments throughout the Asia Pacific region are an important catalyst for faster AI adoption due to national AI strategies and policies, many of which involve substantial funding for AI R&D, support startups and technology companies, establishment of innovation hubs and AI research institutes, and innovate while addressing ethical issues, data privacy, and security. For instance,

- In June 2025, China plans to invest up to USD 98 billion in AI 2025, which is a 48% increase from 2024, with government funding leading at USD 56 billion and major tech firms contributing worth USD 24 billion. The focus is on building data centers and energy infrastructure to support AI, differing from the U.S. emphasis on semiconductor

There are governments, such as China, Singapore, South Korea, and India, with explicit AI roadmaps to roll out AI technology into strategic sectors, including healthcare, manufacturing, smart cities, and finance. For instance,

- In January 2025, South Korea launched a five-year AI healthcare roadmap (2023-2028) to boost research, drug development, and medical data use. The plan targets rapid growth in AI healthcare, focusing on emergency care, cancer, and new drug discovery.

Asia Pacific Artificial Intelligence Market Restraints

Infrastructure Limitations Hinder the Market Growth

Infrastructure limitations are a major constraint on Asia Pacific artificial intelligence market growth. While there are many developing countries in the region, many are experiencing the dual challenges of limited digital connectivity and uneven distribution of data centers, which are limiting the accessibility and cloud computing.

Additionally, digital and power disruptions limit the scaling and deployment of AI technologies in rural geographies and less urbanized areas where reliable access to the Internet can be disrupted. Also, limited local supply and access to high-performance computing hardware, such as GPUs or chips designed for AI, limit innovation, along with the ability to process large and complex data.

Asia Pacific Artificial Intelligence Market Segmentation Analysis

By Component

Based on component, the market is divided into hardware, software, and services.

The software segment is anticipated to dominate market share as a result of growing adoption of AI applications and platforms across the healthcare, finance, retail, and manufacturing sectors. Moreover, cloud-based AI platforms and solutions are appealing to businesses and are a growing, predominant option for businesses. Additionally, recent product launches by tech giants in the region also support this trend. For instance,

- In August 2025, Huawei introduced a new AI software solution called Unified Cache Manager (UCM) that optimizes memory usage across HBM, DRAM, and SSDs to boost AI performance. UCM reduces AI inference latency by up to 90% and increases throughput by up to 22x, helping offset China's limited access to advanced memory chips due to US sanctions.

The hardware segment is expected to experience the highest growth (CAGR) during the forecast period. The continued development of smart city projects, IoT projects, and automation initiatives in the region is driving demand for AI hardware adoption. Additionally, the emerging economies in the region are increasingly focused on developing their own local hardware manufacturing capabilities, which is expected to accelerate growth in the segment. For instance,

- India’s IndiaAI Mission has scaled up to 34,333 GPUs after onboarding more cloud service providers in its second round, significantly boosting the country’s AI compute power.

By Deployment

Based on deployment, the market is bifurcated into on-premise and cloud.

The cloud segment is expected to hold the majority share and grow with the highest CAGR, as it can provide business with on-demand resources and easy scalability through a variety of delivery methods to allow businesses of all sizes (e.g., startups, small businesses, or large enterprises) to address their need. The ongoing growth of high-speed internet availability and overall government initiatives to support an increase in digital infrastructure are key factors responsible for uptake of cloud technologies. For instance,

- In June 2025, Alibaba Cloud announced it to launch its second data center in South Korea by the end of June 2025 to meet rising demand for AI and cloud services. The expansion will improve cloud performance, resilience, and disaster recovery while supporting local businesses with advanced AI tools like Qwen and Wan.

By Enterprise Type

Based on enterprise type, the market is segmented into large enterprises and SMEs.

Large enterprises holds the largest market share due to their strong financial ratios, developed digital infrastructure, and early adoption of advanced technologies. These corporations are leveraging an enterprise-wide deployment of AI for automation, predictive analytics, and customer experience in multiple sectors, including banking, telecommunications, and manufacturing.

Small and medium enterprises are expected to grow with the highest CAGR due to the increasing availability of low-cost AI solutions, cloud-based tools, and government support programs for digital transformation. As AI becomes more available to SMEs, they are using it to increase competitiveness, improve decision-making, and scale their businesses more efficiently.

By Function

Based on function, the market is segmented into human resources, marketing & sales, product/service deployment, service operation, risk, supply chain management, and others.

The service operation function is expected to have the majority share of the AI market in the Asia Pacific, mostly due to businesses using AI more and more to provide customer support, automate processes, and offer personalized experiences. For instance,

- Globe Telecom used Salesforce’s AI tools to automate support workflows, resulting in a 28% drop in ticket volume, 34% less agent workload, over 80% accuracy in case classification, and 60% automation of operations.

On the other hand, the risk function is expected to grow at the highest CAGR due to demand for AI-enabled fraud detection, cybersecurity, regulatory compliance, and predictive risk analytics, especially in regulated environments such as banking, insurance, and public safety. Digital transformation continues to accelerate, and as a result, so too will demand for intelligent, proactive risk management solutions.

By Technology

Based on technology, the market is segmented into machine learning, natural language processing, computer vision, robotics and automation, and expert systems.

Machine Learning holds the majority share and is expected to grow with the highest CAGR. This is due to its flexibility and wide range of applications across sectors such as manufacturing, finance, retail, and healthcare, making it the essence of most AI-enabled solutions in the Asia Pacific region. The rapid availability of large datasets, the fast-paced growth of the cloud, and the ever-increasing need for automation are driving the adoption of machine learning technologies rapidly. For instance,

- According to Rockwell Automation, 94% of manufacturers in the Asia Pacific region have either already invested or plan to invest in AI, machine learning, and generative or causal AI technologies within the next five years.

By Industry

Based on industry, the market is segmented into healthcare, automotive, retail, BFSI, manufacturing, agriculture, government and public sector, IT & telecom, energy and utilities, and education.

The Banking, Financial Services, and Insurance (BFSI) sector has the majority share of the AI market in the Asia Pacific. Financial institutions are increasingly looking to adopt AI for use cases in fraud detection, customer service automation, credit scoring, and algorithmic trading. For instance,

- According to Global Finance, approximately 26% of banks in the Asia-Pacific region report that AI delivers the greatest business value in fraud detection, highlighting its critical role in enhancing security and operational efficiency.

The healthcare sector is expected to have the largest compound annual growth rate (CAGR) due to demand for AI, specifically in areas like diagnostics, medical imaging, remote patient monitoring, and personalized treatment, which is a fast-tracking adoption in places like hospitals, research centres, and health-tech start-ups.

By Country

Based on country, the market is segmented into the China, India, Japan, South Korea, ASEAN, Oceania, and Rest of Asia Pacific.

China has the largest Asia Pacific artificial intelligence market share, aided by its significant government expenditure, powerful tech ecosystem, and large digital population data and processing access. It is leading in AI research, smart cities, facial recognition, and industrial automation, making it the strongest player in the regional AI market. For instance,

- As per Techwire Asia, AI research has surged from under 10,000 papers in 2000 to 60,000 in 2024. China now matches the combined AI output of the US, UK, and EU-27, capturing over 40% of global citations—four times more than the US or EU alone, and 20 times more than the UK.

India is expected to have the highest growth rate due to its digital transformation, cloud adoption, scene, startup ecosystem, and government support through initiatives like the IndiaAI Mission. With a rise in adoption across sectors, including healthcare, agricultural, education, and fintech, India is emerging as a vital growth engine of AI in the region. For instance,

- According to the Stanford AI Index 2024, India ranks first globally in AI skill penetration with a score of 2.8, surpassing the US (2.2) and Germany (1.9), as AI talent in India has grown by 263% since 2016, making it a major AI hub.

List of Key Companies in the Asia Pacific Artificial Intelligence Market

The Asia Pacific AI market is rapidly evolving, led by innovative companies shaping a distinct regional identity. ByteDance is expanding beyond consumer apps by offering enterprise AI solutions tailored for Southeast Asian markets through its scalable model platforms. Moonshot AI, a fast-emerging Chinese startup, is gaining global attention for its long-context generative AI models and strong focus on open-source innovation.

In India, Infosys is advancing ethical AI adoption with open-source toolkits and productivity-focused platforms, while TCS has formed a dedicated AI unit to lead enterprise transformation. These companies represent Asia Pacific’s growing focus on self-reliant, domain-specific AI development services driven by local ecosystems, skilled talent, and responsible innovation.

LIST OF KEY COMPANIES PROFILED

- Bytedance (China)

- Moonshot AI (China)

- Baichuan AI (China)

- Beijing Knowledge Atlas Technology (China)

- Minimax (China)

- Infosys Limited (India)

- TATA Consultancy Services Limited (India)

- Wipro (India)

- Persistent Systems (India)

- Dk Techin Corp (South Korea)

- Clova X (South Korea)

- Preferred Networks, Inc. (Japan)

KEY INDUSTRY DEVELOPMENTS

- August 2025: Upstage and AWS have formed a strategic partnership to expand generative AI market across Asia Pacific and the U.S., using AWS’s cloud to scale Upstage’s Solar language models. AWS has also made a minority investment in Upstage. Their collaboration aims to deliver secure, efficient AI solutions for government and public sectors, helping organizations automate and improve productivity.

- August 2025: Accenture announced to acquire CyberCX to enhance its cybersecurity in Asia Pacific with a strong focus on AI-driven security platforms. This acquisition combines Accenture’s advanced AI capabilities with CyberCX’s regional expertise, helping clients build resilience against evolving cyber threats in an increasingly AI-dependent world.

REPORT COVERAGE

The Asia Pacific artificial intelligence (AI) market report provides a comprehensive analysis of the region’s rapidly growing AI landscape, spotlighting emerging trends, investment activity, and strategic initiatives by leading enterprises. It covers the accelerated adoption of AI across sectors such as telecom, retail, finance, and government, with a strong emphasis on generative AI, responsible AI frameworks, and industry-specific innovation. The report also highlights the rise of homegrown AI startups, expanding R&D ecosystems, and increasing collaboration between public and private sectors to drive digital transformation and regional AI leadership.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 34.70% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component · Hardware · Processors (GPU, FPGA, ASIC and CPU) · Memory Systems · Storage Devices · Software · Services · AI Strategy Advisory/Consulting Services · System Integration and Deployment · AI Model Development · Process Automation and Optimization · AI Training · AI-powered Customer Experience · Support & Maintenance |

|

By Deployment · On-premise · Cloud · Public Cloud · Private Cloud · Hybrid Cloud |

|

|

By Enterprise Type · Large Enterprises · Small and Mid-sized Enterprises (SMEs) |

|

|

By Technology · Machine Learning · Supervised Learning · Unsupervised Learning · Reinforcement Learning · Natural Language Processing (NLP) · Speech Recognition · Text Analytics · Language Translation · Computer Vision · Image Recognition · Object Detection · Robotics and Automation · Expert Systems · Rule-based Expert System · Knowledge-based System |

|

|

By Function · Human Resources · Marketing & Sales · Product/Service Deployment · Service Operation · Risk · Supply-Chain Management · Others (Strategy and Corporate Finance) |

|

|

By Industry · Healthcare · Diagnostic AI · Clinical AI · Hospital Management System · Automotive · Autonomous Vehicle · AI in Mobility-as-a-Service · BFSI · Fraud Detection · Risk Management · Algorithmic Trading · Retail · Customer Analytics · AI-powered Marketing and Sales · Supply Chain Automation · Manufacturing · Predictive Maintenance · AI-driven Robotics and Automation · Agriculture · Smart Farming · Yield Monitoring and Optimization · Crop Disease Detection · Government and Public Sector · Smart City Initiatives · Law Enforcement AI · Disaster Management · IT & Telecom · Network Optimization · AI Chatbots · Intelligent Call Routing · Energy & Utilities · Grid Management · AI in Renewable Energy Management · Education · Adaptive Learning Platform · AI-assisted Learning Tools |

|

|

By Country · China · India · Japan · South Korea · ASEAN · Oceania · Rest of Asia Pacific |

Frequently Asked Questions

Fortune Business Insights says that the Asia Pacific Artificial Intelligence market was worth USD 63.29 billion in 2024.

The market is expected to exhibit a CAGR of 34.70% during the forecast period.

By industry, the BFSI industry is set to lead the market.

Bytedance, Moonshot, Infosys, and TCS are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us