Asia Pacific Fried Chicken Market Size, Share & Industry Analysis, By Type (Deep Fried, Shallow Fried and Others), By Product (Drumsticks, Nuggets, Wings, and Others), By End User (Foodservice and Household) and Country Forecast, 2025-2034

Asia Pacific Fried Chicken Market Size and Future Outlook

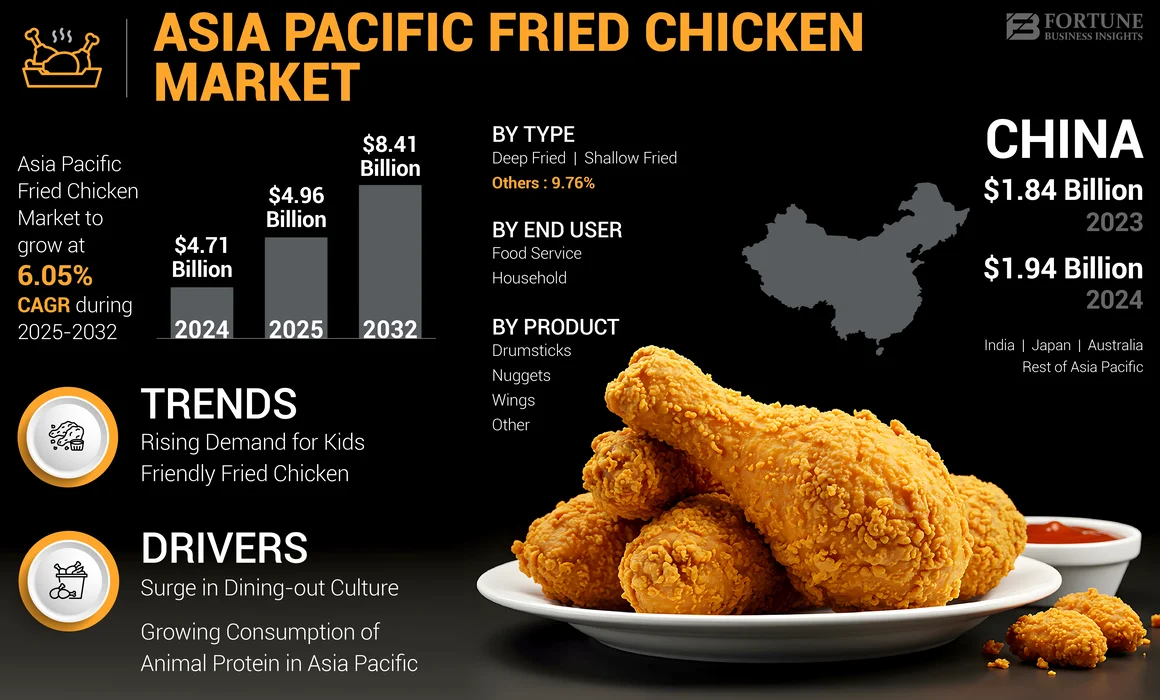

The Asia Pacific fried chicken market size was valued at USD 4.71 billion in 2024. The market is projected to grow from USD 4.96 billion in 2025 to USD 8.41 billion by 2034, exhibiting a CAGR of 6.05% during the forecast period. A few of the key players in the Asia Pacific industry include NH Foods Group, Maruha Nichiro Corporation, Nichirei Foods Inc., ITOHAM YONEKYU HOLDINGS INC., CJ CheilJedang, among others

Fried chicken refers to meat products that are seasoned and coated with spices and other ingredients and cooked methods such as pan-frying and deep-frying. Chicken meat is one of the most popular and widely consumed meat in Asian countries. It is one of the most common consumed poultry meats and has been integrated into different cuisines due to its relatively low production cost and widespread availability. The taste of the meat depends on various factors, including breed, age, chicken diet, and the method of preparation. It is one of the healthier alternatives to other meat products available in the market.

Asia Pacific Fried Chicken Market Overview

Market Size & Forecast:

- 2024 Market Size: USD 4.71 billion

- 2025 Market Size: USD 4.96 billion

- 2034 Forecast Market Size: USD 8.41 billion

- CAGR: 6.05% from 2025–2034

Market Share:

- China dominated the Asia Pacific fried chicken market in 2024, supported by high chicken consumption due to its affordability and nutritional value, along with a rise in at-home meal preparation post-COVID-19.

- By type, the deep-fried segment led the market in 2024, favored for its crispier texture, faster preparation time, and suitability for high-volume foodservice operations.

Key Country Highlights:

- China: Fried chicken consumption is driven by home cooking trends and the availability of affordable protein sources like chicken.

- Japan: Growth is fueled by the expansion of Western-style fast-food chains and the rising popularity of Japanese Karaage among a broad consumer base.

- India: Rising middle-class population and urbanization are boosting demand for convenient and affordable fried chicken snacks.

- South Korea: Increasing youth preference for fried chicken in quick-service restaurants is elevating market growth.

- Australia: The trend of protein-rich diets and dining out contributes to growing fried chicken sales, especially among health-conscious consumers.

- Rest of Asia Pacific: Urban expansion and rising disposable incomes drive fast food consumption, enhancing demand for fried chicken across the region.

MARKET DYNAMICS

Market Drivers

Surge in Dining-out Culture Bolsters the Product Demand

The culture of dining out with family and peers is a key factor driving the rising consumption of fried chicken. Most Asians view dining out as a socializing activity, allowing them to explore new flavorful cuisines. As a result, this socializing culture drives more visits to foodservice outlets, boosting fried chicken sales. Other than this, the growing tourism culture also adds up to the growth of the market. Majority of the tourists actively seek and explore local authentic food items during their visits. This spike in tourist improves the revenue of the foodservice industry and further drives the consumption of fried-chicken.

Growing Consumption of Animal Protein in Asia Pacific to Propel Market Growth

Asia Pacific has witnessed a significant spike in the consumption of livestock-based product consumption, driven by health and nutrition considerations. Compared to plant proteins, animal-based protein is known for its superior quality and is easily digestible. Moreover, the consumption of animal proteins provides all essential amino acids required by the human body. As a result, the growing preference for animal proteins has contributed to increasing demand for fried chicken across the region. In recent few years, awareness of the importance of protein in a balanced diet has significantly influenced dietary habits, leading to a shift in demand for protein-rich foods. Owing to such awareness, the intake of animal protein is also rising at the household level, as the majority of individuals are trying to fulfill their daily requirements of proteins by consuming animal-based products. As a result, this incorporation of animal products into daily diets is expected to drive the consumption of fried chicken products among Asian consumers.

Market Restraints

Rising Inclination Toward Veganism To Limit Market Growth

One of the pivotal factors hampering Asia Pacific fried chicken market growth is the increasing shift toward veganism. In today’s evolving health-conscious era, the consumer preference toward plant-based meat is increasing. As veganism involves abstaining from all animal-sourced products, including fried-chicken, this trend contributed to a dip in product’s sales. Moreover, growing ethical concerns regarding animal welfare are prompting more consumers to turn toward vegan meat. As a result, this shift toward plant-sourced meat limits the consumption of fried-chicken.

Market Opportunities

Introduction of Low-Fat Fried Chicken Paves the Way for Further Growth Prospects

Increasing health concerns and the surging inclination toward a healthier lifestyle are unlocking enormous growth opportunities for the launch of low–fat fried chicken items. In today’s health-conscious environment, the majority of the Asian population is gravitating toward low-fat products as they are perceived to be healthier and nutritionally beneficial. Likewise, consumers are in search of low-fat fried chicken items with minimal calories and fat content. However, fried chicken is still at its nascent stage in the Asia Pacific compared to other developed nations, yet its demand is rising rapidly in the nation. As a result, manufacturers operating in the fried chicken focusing on launching “minimal-fat based fried Karaage, to cater to health-centric individuals while enhancing product delivery services.

Market Challenges

Underdeveloped Cold Chain Infrastructure To Hinder Market Growth

The cold chain network in Asian countries is considered underdeveloped and fragmented, which acts as a restraint in the industry. Compared to developed nations, Asian countries face a lag in cold storage technology, with the majority of the facilities struggling with old-fashioned practices and lacking advanced equipment. As a result, such challenges hinder the Asia Pacific fried chicken market’s growth in the region.

Asia Pacific Fried Chicken Market Trends

Rising Demand for Kids Friendly Fried Chicken is the Current Industry Trend

Parents play a considerable role in shaping their children’s eating habits, with one of their pivotal concerns being their children’s health. With the rising disposable incomes, many parents are including animal-sourced products into their children’s diet, as these products provide high quality of protein, micronutrients, probiotics, and others. Additionally, animal-based items are recommended for young children, as they support bone health and aid in proper growth. As a result, this growing preference for animal-centric products presents opportunities for growth in the fried-chicken industry.

- For instance, in December 2024, Famichiki, a brand of Family Market, a convenience store in Japan, announced its participation in public school meals programs to celebrate its anniversary. Famichiki’s fried chicken fillets were provided to eight junior high schools and 15 elementary schools in Sayama’s public school system. This breaded boneless chicken was cooked in school kitchen for a special one-day meal and served on December 19th and 20th, 2024.

Download Free sample to learn more about this report.

Impact of COVID-19

Fried chicken is utilized in the food service sector to prepare a range of dishes due to its versatility and convenience. However, during the COVID-19 pandemic, many Asian consumers stopped visiting the HoReCa sector, leading to the closure of food service facilities. Additionally, consumption dropped due to fear of contracting the virus, as it was perceived to be a source of infection. As a result, out-of-home dining, including fried chicken consumption, significantly negatively food service sales across the region.

- According to the United States Department of Agriculture, a government agency, China’s Hotel, Restaurant, and Institutional (HRI) sector observed net sales of USD 573 billion in 2020, which shows a drop of 15.40% compared to 2019.

SEGMENTATION ANALYSIS

By Type

Deep Fried Segment Accounted for the Highest Market Share Owing to Fast Preparation

Based on type, the market is segmented into deep fried, shallow fried, and others.

The deep fried segment held the lion’s share in 2024, securing the leading position in the Asia Pacific region. Deep fried-chicken is preferred over other types due to its crispier texture and uniform cooking. Additionally, deep frying allows for faster preparation compared to shallow frying, making it more beneficial for large batches.

Shallow fried is ranked second in the market and is expected to maintain steady growth in the coming years. In comparison to deep frying, shallow frying has emerged as a healthier substitute, for the long-term deep frying method.

To know how our report can help streamline your business, Speak to Analyst

By Product

Nuggets Accounted For the Largest Market Share Owing to their Convenience

On the basis of product, the market is distributed into drumsticks, nuggets, wings, and others.

The nuggets segment held the maximum share of the fried chicken market in 2024. Nuggets are highly popular amongst Asians consumers due to their convenience and versatility. Since these nuggets are pre-breaded, which saves cooking efforts, and can be conveniently baked or fried before serving.

Others secured the second position and is predicted to experience significant growth in the upcoming years. This category includes fried chicken fingers, chicken breasts, and others, which are also gaining huge popularity in the Asia Pacific region, as they are easily accessible and are a healthier alternative. Among these, fried chicken fingers can be quickly cooked and is a budget-friendly option for Asian consumers. These factors are expected to drive the sales of such products across the Asia Pacific region.

By End User

Foodservice Sector Segment Accounts for the Largest Market Share Owing to its Cost Effectiveness

By end user, the market is segmented into food service and household.

The food service segment leads the market and generates the maximum share. Frozen fried chicken is experiencing a high demand in the food service sector, majorly due to its cost-effectiveness and convenience. With its prolonged shelf life, frozen fried chicken is an appropriate choice for the HoReCa sectors to serve large volumes of orders.

The household segment is ranked second in the market and is projected to witness significant growth during the study period. Post-COVID-19 pandemic, the Asian population has been engaged in home cooking and is trying to replicate their favorite dishes at home. Owing to this, the players in the market are working toward launching “ready-to-cook” fried chicken, which can be purchased and easily prepared at home.

Asia Pacific Fried Chicken Market Regional Outlook

Geographically, the Asia Pacific market is studied across China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. China is the leading consumer of fried chicken in the Asia Pacific market.

China

In China, chicken is one of the most economical and widely consumed sources of protein, making it staple for consumers seeking to fulfill their daily protein requirements. Additionally, since the pandemic, the trend of home cooking has grown significantly, with more consumers preferring homemade meals or opting for online ordering. As a result, producers in the industry should consider launching retail packs of ready-to-cook fried chicken, allowing consumers to enjoy their favorite flavors conveniently at home.

Japan

The growing number of Western-style fast food chain outlets across Japan is one of the critical factors responsible for boosting the consumption of fried chicken. Popular fast food chains, such as McDonald's, Sukiya, and Mos Burger, prominently feature fried chicken on their menus, introducing it to a broad audience. As individuals become more exposed to innovative food products, their dietary patterns are shifting toward consuming Karaage, driving market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players Focus on Innovation to Gain a Competitive Edge

The Asia Pacific fried chicken market is highly fragmented, with several multinational companies and regional players competing for market share. Base expansion and new product innovation are the main strategies adopted by key Asian players to gain a competitive advantage in the market. For instance, in January 2023, CJ ChielJedang Corporation, a South Korean food producer, announced the plans to expand its K-food manufacturing facilities across Malaysia, Thailand, and Indonesia.

Major Players in the Asia Pacific Fried Chicken Market

To know how our report can help streamline your business, Speak to Analyst

Some of the leading manufacturers of such products in the region include NH Foods Group, Maruha Nichiro Corporation, Nichirei Foods Inc., ITOHAM YONEKYU HOLDINGS INC., CJ CheilJedang which has gained fast growth due to the surging popularity of fast casual dining and increasing inclination toward on-the-go meals. The market is fragmented, with the top 5 players accounting for around 15.80% of the Asia Pacific fried chicken market share.

List of Key Fried Chicken Companies in Asia Pacific Profiled:

- Ajinomoto Co., Inc. (Japan)

- Nichirei Corporation (Japan)

- NH Foods Ltd. (Japan)

- Tyson Foods, Inc. (U.S.)

- JBS S.A. (Brazil)

- CJ CheilJedang Corporation (South Korea)

- Maruha Nichiro Corporation (Japan)

- Godrej Industries Limited (India)

- ITOHAM YONEKYU HOLDINGS, INC. (Japan)

- Prasuma (India)

KEY INDUSTRY DEVELOPMENTS:

- December 2024: NH Foods Ltd. announced its partnership with a Thailand-based food producer, Charoen Pokphand Foods Public Company Limited. Through this partnership, NH Foods Ltd. aimed to strengthen its presence in the Asian market by exporting processed food products from Japan to Hong Kong, Singapore, Thailand, and other regions.

- November 2024: CJ ChielJedang Corporation launched a new frozen fried-chicken, “Sobaba Chicken,” across Japan. This fried-chicken is easily available at all Costco outlets in the Japanese market catering to growing consumer demand for convenient meal options.

- November 2024: Tyson Foods, Inc. announced the opening of its new production plants in Thailand and China. This expansion adds over 100,000 tonnes of fully cooked poultry capacity, reinforcing Tyson’s position as a leading protein provider across Asian countries.

- February 2024: Godrej Yummiez, a brand of ready-to-cook frozen products, introduced Yummiez Crispy Fried Chicken, which is a convenient crunchy snack and can be easily prepared at home. This product is available across modern trade, e-commerce platforms, and general trade channels in India.

- February 2020: JBS S.A. finalized a deal with WH Group, a Hong Kong-based meat processor, to expand access to retail outlets in China for its poultry, beef, and pork products.

Investment Analysis and Opportunities

Labor costs continue to grow across the Asia Pacific region; hence, the use of technology is recognized as one of the appropriate solutions for companies to reduce their expenses. Moreover, the adoption of advanced technology helps key players improve consumer experiences, enhance efficiency, and unlock new market opportunities for growth.

REPORT COVERAGE

The Asia Pacific fried chicken market report analyzes the market in-depth and highlights crucial aspects such as market trends, market analysis, prominent companies, segmentation by type, product, end user and country. Besides this, the report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2034 |

|

Historical Period |

2021-2023 |

|

Growth Rate |

CAGR of 6.05% from 2025 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By End User

|

|

|

By Country · China · India · Japan · Australia

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 4.71 billion in 2024 and is anticipated to reach USD 8.41 billion by 2034.

At a CAGR of 6.05%, the Asia pacific market will exhibit steady growth during the forecast period.

By type, the deep fried segment led the market.

A surge in dining out culture is a key factor driving the market.

NH Foods Ltd., Nichirei Corporation, CJ CheilJedang Corporation, Maruha Nichiro Corporation, ITOHAM YONEKYU HOLDINGS, INC. and others. are the key players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us