Atomized Aluminium Powder Market Size, Share & Industry Analysis by Method (Gas Atomized and Air Atomized), By Application (Automotive, Aerospace & Defense, Building & Construction, Electronics & Semiconductors, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

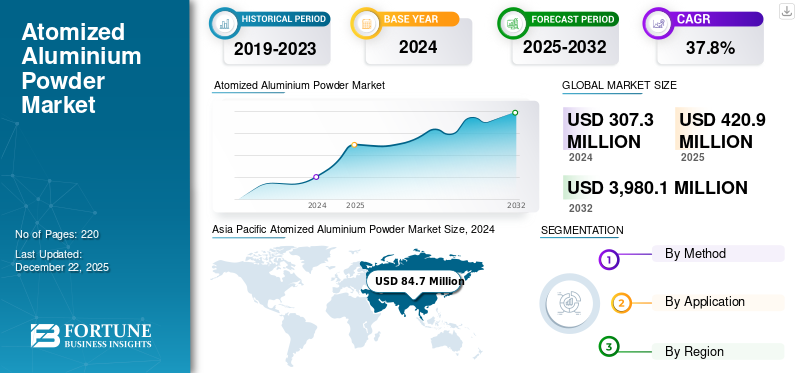

The global atomized aluminium powder market size was valued at USD 1.14 billion in 2025 and is projected to grow from USD 1.19 billion in 2026 to USD 1.68 billion by 2034, exhibiting a CAGR of 4.40% during the forecast period. Asia Pacific dominated the atomized aluminium powder market with a market share of 46% in 2025.

Atomized aluminium powder is a fine metallic powder produced by spraying molten aluminium into a high-pressure gas or liquid stream, resulting in spherical particles. It is widely used in industries such as aerospace, automotive, construction, and pyrotechnics due to its high reactivity, light weight, and excellent thermal conductivity. The market is witnessing substantial growth owing to an increasing demand for lightweight materials in automotive and aerospace sectors, rising adoption in additive manufacturing (3D printing), and growing usage in explosives and conductive inks. Additionally, expanding construction activities and advancements in powder metallurgy processes are expected to propel market growth during the forecast period. The major manufacturers operating in the market include MMP Industries Limited, MEPCO, AMG Advanced Metallurgical Group NV, Stanford Advanced Materials, and United States Metal Powders, Inc.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand across Automotive, Aerospace, and Additive Manufacturing to Accelerate Product Adoption

The increasing application of atomized aluminium powder in key industries such as automotive, aerospace, and additive manufacturing is significantly driving its demand. With the automotive and aerospace sector emphasizing lightweight materials to enhance fuel efficiency and performance, aluminium powder has emerged as a vital component due to its high strength-to-weight ratio. Additionally, the expanding use of aluminium powder in 3D printing technologies for producing intricate components is accelerating adoption across industrial and consumer markets. As industries shift toward sustainable and efficient production methods, the role of atomized aluminium powder in enabling advanced manufacturing and high-performance solutions continues to strengthen. As a result, these factors are expected to drive the global atomized aluminium powder market growth.

MARKET RESTRAINTS

High Manufacturing Costs and Technical Challenges in Ensuring Particle Consistency to Restrain Market Expansion

The production of atomized aluminium powder involves advanced processes that require precise control over particle size, shape, and purity, making the manufacturing process both complex and costly. Ensuring consistent particle size distribution and maintaining high purity levels is essential for applications in aerospace, additive manufacturing, and electronics, where quality standards are stringent. As a result, the process becomes energy-intensive and demands significant capital investment, leading to high manufacturing costs. Additionally, maintaining product consistency across large volumes adds to the technical challenges. These factors collectively make the product less accessible for smaller players and limit its widespread adoption, which is likely to impact the market growth over the forecast period.

MARKET OPPORTUNITIES

Growing Global Shift toward Sustainable Materials and Eco-friendly Manufacturing to Open New Market Opportunities

The increasing global focus on sustainability is creating significant opportunities for market players. Aluminium is highly recyclable and retains its properties even after multiple reuse cycles, making it an ideal choice for industries aiming to reduce their environmental footprint. As governments and industries worldwide implement stricter environmental regulations and promote circular economy models, the demand for eco-friendly materials is expected to rise. This shift toward greener manufacturing practices is likely to boost the product’s adoption across automotive, aerospace, and consumer goods industries over the coming years.

- According to the U.S. Geological Survey, in 2024, the U.S. recovered approximately 3.6 million tons of aluminium from scrap. Of this, about 56% came from new scrap and 44% from old scrap. The amount recovered from old scrap alone equaled roughly 37% of the country’s total aluminium consumption, highlighting the growing role of recycling in supporting sustainability.

ATOMIZED ALUMINUM POWDER MARKET TRENDS

Advancements in Particle Size Control and Precision Manufacturing to Fuel Market Growth

A key trend in the market is the growing innovation in particle size control and distribution. Manufacturers are increasingly investing in advanced atomization techniques to produce powders with highly uniform and ultra-fine particles. These innovations are critical for a wide range of industrial applications such as additive manufacturing, aerospace, and electronics, where consistent particle morphology directly impacts product performance and reliability. Technologies such as plasma atomization and inert gas atomization are enabling greater precision in particle engineering, resulting in improved flowability, packing density, and sintering behavior. This focus on precision and quality is setting new industry standards and driving the adoption of atomized aluminium powder in high-performance sectors.

MARKET CHALLENGES

Environmental Regulations and Substitution by Advanced Materials Create Challenges for the Market

The production of atomized aluminium powder involves energy-intensive processes that contribute to greenhouse gas emissions and particulate pollution, drawing attention from regulatory bodies. Stringent environmental regulations regarding air quality, waste management, and energy consumption are compelling manufacturers to adopt sustainable production practices. In addition, the increasing availability of advanced and cost-effective alternative materials such as composite powders and nano-engineered substitutes is challenging the demand for conventional aluminium powder. These factors are prompting manufacturers to innovate and enhance production efficiency to maintain their edge amid market competition.

Download Free sample to learn more about this report.

Segmentation Analysis

By Method

Gas Atomization Method Dominated the Market Due to High Purity and Spherical Particle Formation

Based on method, the market is segmented into gas atomized and air atomized.

The gas atomization segment held a dominant global atomized aluminium powder market share in 2024 due to its ability to produce high-purity, spherical particles with uniform size distribution. These properties make it ideal for high-performance applications in aerospace, automotive, and additive manufacturing where precision and material consistency are essential. This method uses high-pressure inert gas to break molten aluminium into fine droplets, minimizing oxidation and enhancing quality. The resulting powder offers excellent flowability and is widely used in powder metallurgy and 3D printing. Growing demand for lightweight components and technological advancements in atomization processes continue to support the growth of this segment.

The air atomization segment holds a significant share, driven by its cost-effective nature and high-volume production capabilities. This method produces irregular-shaped aluminium particles that are well-suited for applications such as paints, coatings, pyrotechnics, and chemical formulations. Its widespread use in industries requiring large quantities of powder at lower costs (such as construction, defense, and metallurgy) continues to support its demand across the market. Additionally, the method’s ability to deliver consistent output with relatively simpler equipment makes it a preferred choice for bulk manufacturing processes.

By Application

Automotive Segment Led the Market with Rising Demand for Lightweight and Fuel-Efficient Components

Based on application, the market is segmented into automotive, aerospace & defense, building & construction, electronics & semiconductors, and others.

The automotive segment held a dominant global atomized aluminium powder market share in 2024, primarily due to the global push for lightweight and fuel-efficient vehicles. It is extensively used in powder metallurgy to produce structural parts such as gears, pulleys, and housings that offer high strength and low weight. The growing adoption of electric vehicles, stringent fuel economy, and emission regulations is accelerating the demand for aluminium-based parts. Furthermore, continuous innovation in sintering techniques and the need for affordable, long-lasting automotive components are further supporting the segment’s expansion.

The aerospace & defense segment is witnessing significant growth due to the increasing use of the product in manufacturing high-performance components for aircraft, defense systems, and space applications. Its lightweight nature, high thermal conductivity, and excellent reactivity make it ideal for use in rocket propellants, explosives, and additive manufacturing of aerospace-grade parts. Growing investments in defense modernization, space exploration, and advanced aviation programs are further driving the demand for high-purity aluminium powder across this application.

The building & construction segment holds a substantial share of the market. This is mainly due to its extensive use in lightweight construction materials such as autoclaved aerated concrete (AAC) blocks, reflective paints, and insulating products. Rapid urbanization and rising infrastructure development are boosting the demand for efficient building solutions. There is also a growing emphasis on sustainable construction practices. It improves thermal insulation and reduces structural weight. These benefits make it a preferred material in modern building applications.

Atomized Aluminium Powder Market Regional Outlook

By geography, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Atomized Aluminium Powder Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region dominates the global atomized aluminium powder market with with a size of USD 0.53 billion in 2025, driven by rapid industrialization, urbanization, and expanding manufacturing activities in countries such as China, India, Japan, and South Korea. The increasing demand for lightweight materials in the automotive and aerospace industries significantly boosts the consumption of the product. Moreover, the rising adoption of additive manufacturing technologies, growing defense expenditure, and government support for domestic metal processing industries further propel market growth. Strong industrial output, favorable trade policies, and foreign investments in advanced manufacturing ensure sustained demand across the region.

North America

The market in North America is experiencing steady growth, primarily driven by advancements in the aerospace, defense, and automotive industries. In the U.S., robust investments in aerospace manufacturing, rising adoption of electric vehicles, and the country’s leadership in additive manufacturing technologies are creating strong demand for atomized aluminium powder. The region’s strong focus on lightweight and high-performance materials fuels the product demand, especially in countries such as the U.S. and Canada. Government investments in defense modernization, electric vehicles, and additive manufacturing technologies further enhance market expansion. Additionally, increasing adoption in construction, explosives, and 3D printing applications supports consistent consumption across the region.

Europe

In Europe, the market is driven by a strong product demand from advanced manufacturing sectors such as aerospace, automotive, and defense. The region’s emphasis on sustainability and lightweight material innovation supports the growing use of aluminium powder in electric vehicles and additive manufacturing. Countries such as Germany, France, U.K. are leading the adoption of metal powders for 3D printing and high-performance component production. Additionally, strict environmental regulations and a shift toward energy-efficient technologies are promoting the use of aluminium-based solutions across the region.

Latin America

In Latin America, the market is experiencing moderate growth, fueled by rising urbanization, infrastructure development, and growing demand from the automotive, construction, and defense sectors. In countries such as Brazil and Mexico, the increasing use of aluminium powder in applications such as lightweight components, explosives, and metal fabrication is driving market expansion. In addition, the gradual adoption of additive manufacturing technologies and government efforts to enhance domestic manufacturing capabilities are further supporting market growth across the region.

Middle East & Africa

In the Middle East and Africa, the market is expanding driven by infrastructure investments, industrial development, and growing demand from the defense, construction, and automotive sectors. In countries such as South Africa, large-scale construction projects, advancements in transportation, and increased focus on lightweight materials are fueling product demand. In addition, the region’s push toward economic diversification, local manufacturing growth, and the adoption of emerging technologies is further contributing to the expansion of the market.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies Invest in Sustainable Extraction Technologies to Gain an Edge over Competitors

The global atomized aluminium powder market is highly competitive, with key players focusing on technological advancements, mergers & acquisitions, and capacity expansion to increase their market presence. Global companies include MMP Industries Limited, MEPCO, AMG Advanced Metallurgical Group NV, Stanford Advanced Materials, and United States Metal Powders, Inc. These companies are competing on the basis of purity levels, cost-effective processing techniques, integration of supply chain, and regional dominance. They are also investing in sustainable extraction technologies for addressing environmental concerns. While globally leading players dominate in developed markets, regional companies depict aggressive growth in emerging economies, intensifying industry competition.

LIST OF KEY ATOMIZED ALUMINIUM POWDER COMPANIES

- MMP Industries Limited (India)

- MEPCO (India)

- KOMAL ATOMIZER PVT. LTD. (India)

- AMG Advanced Metallurgical Group NV (Netherlands)

- BN Industries (India)

- Zouping Weijia New Material Technology Co., Ltd. (China)

- Stanford Advanced Materials (U.S.)

- Island Pyrochemical Industries (IPI) (U.S.)

- United States Metal Powders, Inc. (U.S.)

- VALIMET, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- December 2024: United States Metal Powders, Inc. revealed plans to expand its production capacity by adding a new aluminium powder manufacturing line at its Ampal Inc. (subsidiary) facility in Palmerton, Pennsylvania, with operations scheduled to begin by mid-2025. The new line would enhance the company’s capability to produce both nodular and spherical aluminium powder.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.40% from 2026-2034 |

|

Unit |

Value (USD Million) and Volume (Kiloton) |

|

Segmentation |

By Method · Gas Atomized · Air Atomized |

|

By Application · Automotive · Aerospace & Defense · Building & Construction · Electronics & Semiconductors · Others |

|

|

By Geography · North America (By Method, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Method, By Application, and By Country) o Germany (By Application) o U.K. (By Application) o Italy (By Application) o France (By Application) o Spain (By Application) o Rest of Europe (By Application) · Asia Pacific (By Method, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o South Korea (By Application) o Southeast Asia (By Application) o Rest of Asia Pacific (By Application) · Latin America (By Method, By Application, and By Country) o Brazil (By Application) o Mexico (By Application) o Rest of Latin America (By Application) · Middle East & Africa (By Method, By Application, and By Country) o GCC (By Application) o South Africa (By Application) · Rest of the Middle East & Africa (By Application) |

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 1.14 billion in 2025 and increased to USD 1.19 billion in 2026, with the market projected to reach USD 1.68 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 0.53 billion.

The market is expected to exhibit a CAGR of 4.40% during the forecast period of 2026-2034.

The key factors driving the market are the rising demand from various industries, including automotive, aerospace, and additive manufacturing.

MMP Industries Limited, MEPCO, AMG Advanced Metallurgical Group NV, Stanford Advanced Materials, and United States Metal Powders, Inc. are the top players in the market.

Asia Pacific dominates the global market in terms of share.

Rising demand for lightweight and high-strength materials, growing usage in additive manufacturing and powder metallurgy, and increasing product application across automotive, aerospace, and construction industries are some of the key factors expected to favor the adoption of atomized aluminium powder.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us