Audio AMPs and Codecs Market Size, Share & Industry Analysis, By Product Type (Audio AMPs [Class D Amplifiers, Class AB Amplifiers, Class G/H Amplifiers, Linear Amplifiers, Integrated Amplifiers] and Audio Codecs [Hardware Audio Codecs, Software Audio Codecs, Analog-to, Digital Converters, Digital-to-Analog Converters]), By Technology (Audio AMPs [Analog, Digital, and Hybrid Amplifiers] & Audio Codecs [Lossy Compression Codecs, Lossless Compression Codecs, Adaptive Audio Codecs]), By Application (Consumer Electronics, Automotive, Gaming), & Regional Forecast, 2026 – 2034

AUDIO AMPS AND CODECS MARKET SIZE AND FUTURE OUTLOOK

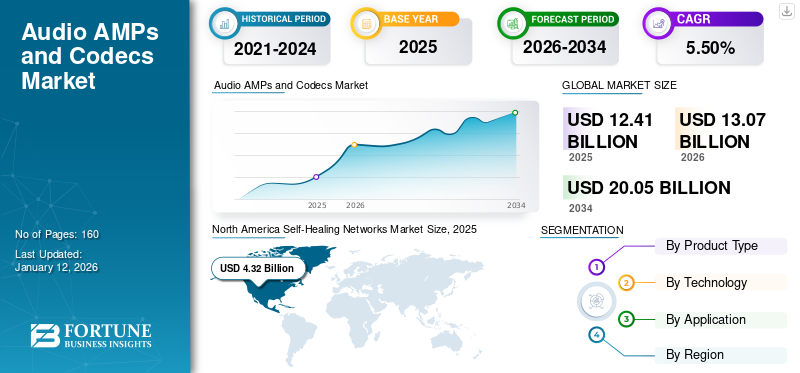

The global audio AMPs and codecs market size was valued at USD 12.41 billion in 2025 and is projected to grow from USD 13.07 billion in 2026 to USD 20.05 billion by 2034, exhibiting a CAGR of 5.50% during the forecast period.

Audio amplifiers (AMPs) are responsible for boosting audio signals in speakers, delivering high-quality sound across various applications. The market encompasses a wide range of products, from consumer-grade amplifiers used in home entertainment systems to professional-grade amplifiers utilized in concert venues and recording studios. Audio codecs are essential technologies that facilitate the encoding and decoding of digital audio signals, optimizing the storage and transmission of audio data. They are crucial in the multimedia ecosystem, enabling efficient audio fidelity to reduce file sizes while maintaining satisfactory sound quality.

The market is driven by a combination of evolving consumer preferences and technological advancements. The swift change in the audio consumption landscape has increased the demand for high-quality audio codecs across multiple sectors. In the coming years, emerging markets, such as Asia Pacific will experience an increase in disposable incomes and the middle-class population that demands high-quality sound output. The consumer shift toward superior sound in entertainment and communication has encouraged companies to target these markets with tailored products and competitive pricing strategies. This trend is likely to continue, further propelling the market’s expansion.

The COVID-19 pandemic temporarily impacted the market owing to supply chain problems and reduced production in the consumer electronics and automotive industries. However, the demand for home entertainment systems, remote communication tools, and gaming devices spurred the market’s recovery.

Download Free sample to learn more about this report.

AUDIO AMPS AND CODECS MARKET TRENDS

Increasing Adoption of Audio AMPs and Codecs in Automotive Infotainment Systems to Propel Market Growth

Audio AMPs and codecs are being increasingly adopted in automotive infotainment systems. This is one of the major trending factors in the market. As consumers prefer high-quality audio in their vehicles, automotive manufacturers are heavily investing in advanced audio systems. This includes incorporating advanced audio amplifiers and codecs that can deliver enhanced sound quality to consumers. The instance below indicates that the market for in-car technologies is growing at an accelerated pace.

- As per Intive, the in-car entertainment technologies market is estimated to be around USD 21.5 billion by the end of 2026.

To address this growing demand, market players are developing customer-centric audio amplifiers that are intended for the automotive sector. For instance,

- April 2022: The TDA7901 automotive amplifier developed by STMicroelectronics incorporates a buck controller for class-G power switching and supports high-quality audio. The amplifier is ideal for use in several in-vehicle infotainment systems, such as smart cockpit systems, head units, and external amplifiers.

Moreover, class-D amplifiers are also preferred in the automotive sector, particularly in electric vehicles, which will positively impact the market’s growth. Thus, currently, the growing trend of automotive infotainment systems fuels the adoption of audio AMPs and codecs, further accelerating the audio AMPs and codecs market growth.

MARKET DYNAMICS

Market Drivers

Rising Demand for Consumer Electronics and Growth in Wearables are Key Driving Factors

In recent years, there has been a surge in the use of consumer electronics, such as laptops and smartphones, among end users across the globe. These end users often expect immersive audio experiences in their devices, further driving the demand for advanced audio AMPs and codecs. Consumers have been investing more in high-performance consumer audio products, such as smart speakers and sound bars. Market players are encouraged to address this rising demand, which will further positively impact the market’s growth. They are also investing in solutions that integrate advanced amplifiers and codecs with features such as noise cancellation and spatial audio.

Moreover, the increasing popularity of wearable devices has also accelerated the market’s growth in recent years. The popularity of wearables, such as fitness trackers and wireless earbuds, has grown rapidly owing to consumer demand for compact and energy-efficient devices.

- As per a study by the Health Information National Trends, nearly one-third of surveyed Americans make use of at least one wearable device, such as a smart band or watch. These individuals use this watch to track their fitness and health. In addition, approximately 80% of people feel comfortable about sharing the data from their device with their doctor for health check-ups.

- According to industry experts, the global shipment of watches, hearables, wristbands, and other wearables is expected to reach over 543 million units in 2024. These statistics are expected to showcase a 6.1% Y-o-Y increase as compared to 2023.

Thus, increasing demand for consumer electronics and the inclination of end users toward wearable devices are the key factors propelling the market.

Market Restraints

High Power Consumption and Cost Associated with Advanced Audio Amplifiers and Codecs to Hinder Market Growth

One of the significant challenges slowing the demand for audio AMPs and codecs is the high power consumption rate of a few of these devices. Advancements in audio AMPs and codec solutions have minimized energy usage, but audio amplifiers, in particular use cases, still consume high power. This concern is majorly found in battery-operated devices such as wearables, further limiting the adoption of certain amplifiers.

Furthermore, the cost associated with advanced audio amplifiers and codecs due to their high-quality performance is another restraining factor in the market. This factor directly impacts the pricing and limits access for consumers and manufacturers who have budget constraints.

Thus, the high-power consumption rate of certain audio amplifiers and the cost associated with the advanced versions of these amplifiers and codecs can create a negative impact on the market’s growth.

Market Opportunities

Increasing Demand for Digital Amplifiers to Create Lucrative Opportunities for Market Players

The market is witnessing an increasing demand for digital amplifiers from end users across the globe. Digital amplifiers are becoming popular owing to their compact design, efficiency, and high-quality sound output. The companies operating in the market have experienced positive responses from their sales of these amplifiers. In addition, these companies expect to increase their investments in digital amplifiers and focus on catering to the expanding customer base. The below instances indicate the same:

- According to Billboard reports, Marshall Group has revealed its intention to increase its investment in digital amps and other tools. The company will be strategically formulating its plan with its digital tools and amplifiers.

- April 2024: Russound introduced the D-Series Multichannel Digital Amplifiers, comprising three models: the D1290, D1675, and D890. These new launches are intended to expand the company’s audio systems into more zones or rooms. In addition, these amplifiers will have features such as multichannel power and source & control flexibility.

Thus, these instances indicate that there is an increasing demand for digital amplifiers, which will create lucrative opportunities for market players to develop customer-focused digital amplifier solutions.

SEGMENTATION ANALYSIS

By Product Type

Audio Codecs Led Market With Rising Demand for High-Quality Wireless Sound

By product type, the market is divided into audio AMPs and audio codecs.

The audio codecs led the market in 2026 with a share of 55.82%, owing to its role in compressing and decompressing audio files, thereby ensuring advanced sound quality and reduced data loss. This approach is important for devices, such as smartphones, headphones, and streaming platforms. In addition, the surge in demand for wireless audio devices and streaming services is the reason for the growing demand for high-quality audio codecs.

Audio AMPs are anticipated to experience substantial growth over the forecast period. This growth is due to the increasing adoption of premium audio systems in consumer electronics, automotive, and home entertainment systems.

By Technology

Growing Need for Effective Audio Compression and Transmission Boosted Audio Codecs Segment Expansion

By technology, the market is distributed into audio AMPs and audio codecs.

The dominance of audio codecs in the audio amplifiers and codecs market is driven by their critical role in enabling efficient audio compression and transmission across various consumer electronics and communication devices. The increasing adoption of advanced audio streaming services, wireless communication technologies, and high-definition audio formats further accelerates their market growth.

Audio AMPs are expected to grow at the highest CAGR due to the rising demand for high-performance audio solutions in consumer electronics, automotive infotainment systems, and smart home devices. The increasing integration of AI-driven voice assistants, home automation, and premium sound systems further drives the adoption of advanced audio amplification technologies.

By Application

To know how our report can help streamline your business, Speak to Analyst

Massive Demand for High-Quality Audio Drove Product Use across Consumer Electronics Segment

Based on application, the market is divided into consumer electronics, automotive, gaming & virtual reality, and others. The others segment is further divided into telecommunication devices and enterprise communication systems.

The consumer electronics segment captured the highest market share in 2024. The segment’s dominance is due to the high integration of audio AMPs and codecs in devices, such as smartphones, TVs, laptops, and wearables, which dominate global electronics sales. In addition, the rising demand for enhanced audio quality in compact, portable devices will drive the segment’s growth. the segment is expected to expand with a share of 48.91% in 2026.

The same segment will also showcase the highest CAGR of 6.58% in the coming years due to the growing popularity of wireless audio devices, such as smart speakers and earbuds, and the rising demand for advanced home entertainment systems.

AUDIO AMPs AND CODECS MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America

North America Self-Healing Networks Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 4.32 billion in 2025 and USD 4.53 billion in 2026, due to its advanced technology infrastructure and widespread adoption of audio devices in industries, such as automotive, entertainment, and consumer electronics. The presence of key market players and high disposable income levels further drive the demand for premium audio solutions in this region. Additionally, the region’s focus on innovation and integration of advanced audio technologies in smart devices will strengthen its market leadership.

The U.S. leads the North American market due to its advanced technological infrastructure and high affinity among consumers for premium audio experiences. The demand for audio codecs for high-quality audio experiences, the presence of major industry players, and a strong focus on innovation will further drive the country’s dominance in this market. The U.S. market is estimated to reach a market value of USD 2.64 billion in 2026.

Asia Pacific

Asia Pacific is the second largest market. The region is poised to achieve the highest CAGR of 7.38% during the forecast period and is anticipated to gain USD 3.60 billion in 2025, due to rapid urbanization and the increasing adoption of consumer electronics in countries, such as China, India, and South Korea. China is foreseen to gain USD 1.12 billion in 2026. The region’s large population, coupled with rising disposable incomes and growing demand for smartphones and IoT devices, contributes significantly to the market’s growth. Furthermore, the presence of major manufacturing hubs and investments in technological advancements will support the expansion of the market in this region. India is set to reach USD 0.73 billion in 2026, while Japan is poised to hold USD 0.89 billion in the same year.

Europe

Europe is the third leading region, expected to hold USD 2.6 billion in 2026, due to its established automotive sector, which incorporates advanced audio systems. The region’s focus on high-quality audio experiences and increasing adoption of smart home devices are key drivers of the market’s growth. The U.K. market is set to reach a market value of USD 0.63 billion in 2026. Additionally, stringent regulations on audio quality and environmental standards encourage the development of efficient and innovative audio solutions. Germany is predicted to hold USD 0.53 billion in 2026, while France is projected to be valued at USD 0.46 billion in the same year.

Middle East & Africa and South America

The Middle East & Africa is the fourth leading region, expected to attain USD 1.38 billion in 2026. The MEA and South America are anticipated to grow at an average rate due to the moderate adoption of audio technologies and varying levels of technological development across these regions. Economic constraints and limited access to high-end consumer electronics will affect the growth trajectory in these markets. However, increasing urbanization and the gradual adoption of smart devices and automotive technologies will provide growth opportunities in the coming years. The GCC market is likely to gain USD 0.41 billion in 2025.

KEY INDUSTRY PLAYERS

Strategic Alliances and Investments Pave the Way for Business Growth of Key Players

Top providers of audio AMPs and codecs are upgrading their existing products and developing new products to meet the changing customer requirements. New innovations, expanding present portfolios, and new integrations will help businesses increase their product expertise, deliver better user experience, and determine measurable evaluations and analyses for marketers. In addition, strategic agreements, partnerships & collaborations, and mergers & acquisitions are prominent fundamental business strategies adopted by every market player to expand their business operations and geographical presence. These strategies will aid in market development and expansion.

Major Players in the Audio AMPs and Codecs Market

To know how our report can help streamline your business, Speak to Analyst

The top 5 players capture around 45 - 50% of the market share owing to their strong brand reputation and established client loyalty. Their substantial investments in research and development facilitate rapid innovation, allowing them to adapt to technological advancements and shifting consumer needs. This strategy will also help them stay ahead of their competitors.

List of Audio AMP and Codec Companies Studied:

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- Monolithic Power Systems, Inc. (U.S.)

- STMicroelectronics N.V. (Switzerland)

- Cirrus Logic, Inc. (U.S.)

- Awinic Technology Co., Ltd. (China)

- Asahi Kasei Microdevices Corporation (Japan)

- On Semiconductor Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Yamaha Corporation (Japan)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- Microchip Technology Inc. (U.S.)

- Realtek Semiconductor Corporation (Taiwan)

- ESS Technology, Inc. (U.S.)

- Broadcom (U.S.)

- Nvidia Corporation (U.S.)

- Synopsys, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

June 2024: Cirrus Logic expanded its Pro Audio product series with additions, such as an audio CODEC and a range of digital-to-analog converters. These new solutions cater to the requirements of live performers, recording artists, and audiophiles by setting a new standard for the professional and prosumer audio sectors.

February 2024: AUDAC, a Belgian pro audio designer, unveiled a new series of compact two-channel power amplifiers intended for commercial applications. The SCP Series half-rack amplifier can be utilized in bridge or stereo mode. The five models from the range are accessible, with power grades ranging from 120W-1000W.

January 2024: Analog Devices presented its enhanced ADAU1797, the audio processor, and low-power ANC codec. The newly launched device is incorporated with FastDSP and HiFi 3z cores, enabling advanced front-end audio processing with features, such as noise reduction and beamforming. It also supports neural network ASR processing.

January 2023: Infineon Technologies AG unveiled its series of MERUS multilevel Class D audio amplifiers. Various partners of the company showcased their support to help clients with their design-in efforts. With this, the company expected to speed up the adoption of the technology. The audio amplifiers offer high-quality sound playback with an enhanced Class D modulation of up to 5 diverse output voltage levels.

August 2023: CyrusOne introduced Intelliscale, an AI workload-specific data center solution particularly designed to meet the increased demand for AI applications and services.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market presents lucrative investment opportunities driven by advancements in wireless audio technology, increasing demand for smart consumer electronics, and growth in the automotive infotainment sector. Investments in energy-efficient amplifiers and high-definition audio codecs are poised to yield significant returns as these technologies have gained widespread adoption. Additionally, the rise of IoT devices and expanding streaming devices will create further opportunities for market’s growth.

REPORT COVERAGE

The report covers an overview of the market and centers on key characteristics, such as main players, their product/service types, and their use cases in the market. Besides, it offers insights into the market trends and highlights current market-related improvements. In addition, the report covers the competitive landscape of the market. It also comprises several factors that have backed the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, By Technology, By Application, and Region |

|

Segmentation |

By Product Type

By Technology

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach a valuation of USD 20.05 billion by 2034.

In 2026, the global market was valued at USD 13.07 billion.

The market is projected to record a CAGR of 5.50% during the forecast period.

By application, the consumer electronics segment led the market in 2026.

Rising demand for consumer electronics and growth in the adoption of wearables are the key driving factors for the market.

Texas Instruments Incorporated, Analog Devices, Inc., Monolithic Power Systems, Inc., STMicroelectronics N.V., Cirrus Logic, Inc., Awinic Technology Co., Ltd., Asahi Kasei Microdevices Corporation, On Semiconductor Corporation, Qualcomm Technologies, Inc., and Infineon Technologies AG are the top players in the market.

North America held the highest market share in 2025.

By application, the consumer electronics segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us