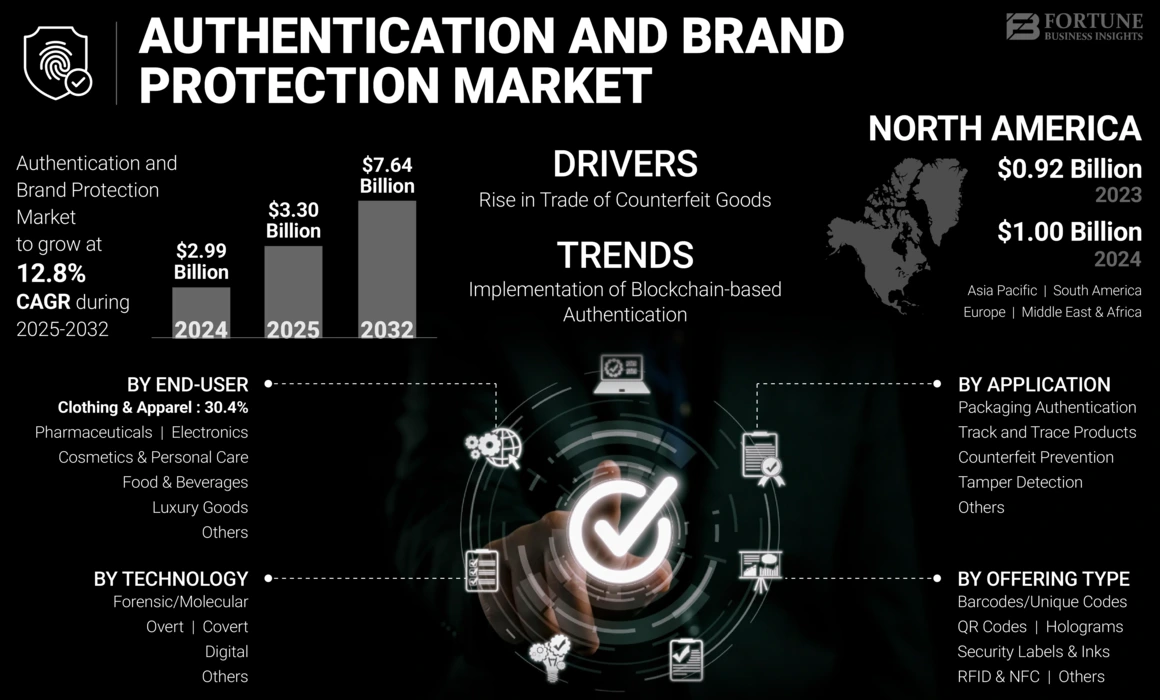

Authentication and Brand Protection Market Size, Share & Industry Analysis, By Technology (Overt, Covert, Forensic/Molecular, Digital, and Others), By Offering Type (QR Codes, RFID & NFC, Holograms, Security Labels & Inks, Barcodes/Unique Codes, and Others), By End-user (Clothing & Apparel, Pharmaceuticals, Electronics, Cosmetics & Personal Care, Food & Beverages, Luxury Goods, and Others), By Application (Track and Trace Products, Counterfeit Prevention, Tamper Detection, Packaging Authentication, and Others), and Regional Forecast, 2025 – 2032

AUTHENTICATION AND BRAND PROTECTION MARKET SIZE AND FUTURE OUTLOOK

The global authentication and brand protection market size was valued at USD 2.99 billion in 2024 and is projected to grow from USD 3.30 billion in 2025 to USD 7.64 billion by 2032, exhibiting a CAGR of 12.80% during the forecast period.North America dominated the market with a share of 33.44% in 2024.

Authentication and brand protection are comprised of validating product authenticity and protecting brand integrity against unauthorized and counterfeit usage. It helps to ensure brand reputation and consumer trust.

Authentication mechanisms help to detect and inhibit counterfeit goods, safeguarding consumers from getting genuine products from confidential brands. Brand protection technologies protect logos and trademarks, certifying authentic demonstration across physical and digital platforms.

With the changing market conditions and innovations, businesses face risks in the digital world, such as counterfeit goods, unauthorized sellers, and intellectual property theft. For instance,

- In 2023, Amazon Marketplace stopped 700,000 counterfeit businesses. Acviss Research shows that over 5% of the market share will be apprehended by counterfeit products by 2030.

Such factors increase the need to develop and advance authentication and brand protection tools in the market. Various market players, such as Authentix, AlpVision SA, and Infineon Technologies AG, are using advanced technologies to deliver modernized tools.

IMPACT OF GENERATIVE AI

Gen AI-driven Counterfeit Goods to Hamper Business Progress

Brand owners invest substantial resources in building and safeguarding their brand uniqueness. Generative AI poses a challenge to brand authenticity by allowing the development of counterfeit designs, content, and products that closely imitate genuine brands. It tempers brand value and corrodes consumer trust, making the identification of authentic and fake items difficult.

For example,

- Counterfeiters leveraged generative AI mechanisms to develop counterfeit Gucci products, such as clothing, handbags, and footwear. These counterfeit goods mimic Gucci’s iconic motifs, including the animal prints and double-G logo, resulting in brand dilution and income loss for the authentic brand.

Such counterfeit incidents hamper the reputation and overall revenues of the authenticated brands.

Impact of Reciprocal Tariffs

Reciprocal Tariffs can Affect Overall Operations and Supply Chain of Authentication Solutions across Different Nations

The reciprocal tariffs imposed by the U.S. government on more than 60 countries across the globe can impact the overall trade agreements globally. Various impacts on the market include disruption in the supply chain, lower market penetration, and an increase in operational costs, among others.

Authentication of electronic devices, luxury products, and other goods usually depends on RFID and NFC chips, specialized security inks, security substrates and labels, and others. Importing these chips from different countries, such as China and Taiwan, can increase the overall costs of the goods that are to be sold in the market.

A rise in tariffs on raw materials can impact the trade relations between nations, thereby affecting business expansion across new countries. Businesses will have to face the loss of new prospects in countries such as China, Vietnam, Cambodia, Taiwan, and others with higher tariffs.

The increase in tariffs may lead to the growth of local manufacturing, wider usage of domestic brands, along localization of authentication units. Businesses can collaborate with regional firms for packaging and labeling, as well as QR codes that are compliant with regional governments. For instance,

- A pharmaceutical company based in Japan expands its setups to avoid tariffs and invests in regional authentication dealers.

Thus, these reciprocal tariffs can have both negative and positive impacts on the market growth.

AUTHENTICATION AND BRAND PROTECTION MARKET TRENDS

Implementation of Blockchain-based Authentication to Propel Market Growth

Blockchain authentication mechanism records the entire product cycle from being made to being sold. This distributed ledger ensures that goods can be tracked. Thus, blockchain technology is essential in authenticating products across various sectors, from luxury goods to electronics.

By implementing blockchain-based verification systems, brands can protect their products while providing unprecedented consumer transparency. Various new developments and advancements are helping to deliver better product security and authentication. For instance,

- In December 2024, Genuine Marketing Group Inc. added Carbon Intensity scoring to its ZPTAG platform by incorporating carbon influence into its product authentication platform. ZPTAG is a solution for the FDA Food Safety Modernization Act (FSMA 204 Regulation). The tool bridges the gap between consumer transparency and environmental accountability. The platform is built to use IBM blockchain and the suitability of multi-device communication.

- The Aura Blockchain Consortium was founded in 2021. In the years since its establishment, the consortium has been developing and enhancing the adoption of blockchain-driven “Digital Product Passports,” or DPPs, within the luxury sector. Aura’s DPP is helping to set new standards to gain consumer trust.

Blockchain-driven advancements and innovations are anticipated to propel the demand for authentication and brand protection.

MARKET DYNAMICS

Market Drivers

Rise in Trade of Counterfeit Goods to Increase Demand for Authentication and Brand Protection Tools

Counterfeits don’t just damage the quality of the goods of the particular company, but they also tarnish the brand’s reputation. Counterfeiting isn’t just an economic problem. It can also have an adverse impact on public health. From counterfeit pharmaceuticals to fake electronics, substandard goods can have harsh consequences. For instance,

- According to the Corsearch Report 2024, counterfeit goods accounted for 3.3% of worldwide trade in 2023 and would rise to 5% by the year 2030, meaning USD 1 in every USD 20 spent across the globe on products could be expended on counterfeit goods.

- The overall expatriate economic movement from counterfeiting in 2022, explicitly the cost to brands and manufacturers, equaled USD 1.1 trillion, incurring a loss of USD 174 billion to global sales tax income, affecting up to 5.4 million jobs.

In addition to the negative economic impact of counterfeiting across the globe, fake goods damage the reputation of brands, decreasing customer trust, and endangering consumer safety. Thus, to safeguard consumer purchases and brand reputation, the need for enhanced authentication solutions increases. This factor drives the authentication and brand protection market growth.

Market Challenges

Management of Foreign Counterfeit Operations Can be Complex and can Affect Business Progress

Managing the international counterfeit processes is more intricate. Counterfeiters operate in countries where there are no robust protections for intellectual property. This makes it challenging for brands to prevent illegal activities. Operating with local officials or taking legal action against counterfeits in foreign courts may require a longer period. Brands need to keep an eye on worldwide markets to deal with the fabricating of goods.

Also, each country has its own IP laws. Hence, ensuring these rights are obeyed in other countries can be complicated. The brands have to depend on that specific country’s laws and regulations of trade and other consumer laws. This means brands rely on international treaties such as the Madrid Protocol to safeguard themselves in diverse countries. However, enforcing this protection can vary.

Such challenges can hamper the overall development of brands across foreign countries.

Market Opportunities

Integration of IoT Device Authentication Can Open up Numerous Market Opportunities

The Internet of Things (IoT) is increasingly being implemented to monitor the truthfulness of goods across the supply chain. IoT devices, such as sensors implanted in packaging, can track humidity, temperature, and location, assuring that goods are handled and managed appropriately and remain genuine.

This level of oversight helps enterprises to keep their supply chains transparent. It also ensures that authenticated products are delivered to the customers in ideal condition. Thus, organizations across various industries leverage IoT to enhance operational proficiency and obtain more value from their decisions.

Various implementations of IoT authentication devices include prevention of unauthorized access, regulatory compliance, mitigation of security risks, and data integrity, among others. Such applications can help businesses to provide product transparency and reliability and safeguard their brand reputation.

Thus, the incorporation of IoT device authentication can create various market opportunities.

SEGMENTATION ANALYSIS

By Technology

Overt Segment Led the Market Due to Its Enhanced Security Features

Based on technology, the market is categorized as overt, covert, forensic/molecular, digital, and others (semi-overt, etc.).

Overt accounted for the highest market share of 35% in 2024, owing to its enhanced security features. These features are visible and decipherable. Applications of overt technology, such as color-shifting inks, holograms, and security threads, are visible and are hard to recreate, hence they are hard to replicate, indicating the wider usage of the technology among brands.

The digital segment is anticipated to progress with the highest CAGR in the coming years. As online platforms become more essential to businesses, the risk of phishing, brand impersonation, and fraud rises. Brand protection technologies such as social media tracking and domain monitoring help identify and avoid unauthorized usage of a brand’s logo, name, or online presence. This increases the demand for digital technologies for brand protection in the market.

By Offering Type

QR Codes Dominated the Market Due to Their Increased Usage Across Different Industry Applications

Various offering types of authentication and brand protection include QR codes, RFID & NFC, holograms, security labels & inks, barcodes/unique codes, and others (security printing, etc.).

QR codes held the highest market share in 2024, owing to their growing usage across various industry applications. This segment is expected to capture 32.6% of market share in 2025. Some applications include supply chain & inventory management, security & authentication, payments & transactions, sustainability & paper reduction, healthcare & patient information, and other applications. These implementations help businesses with better security, operations, proficiency, and customer experiences. For instance,

- According to Uniqode Insights, 43% of businesses leverage QR codes for logistics tracing and 39% for enhancing inventory management.

RFID & NFC are estimated to grow with the highest CAGR of 16.80% during the forecast period (2025-2032), due to their ability to deliver high precision and enhanced accuracy in identifying product authenticity. NFC verification provides high precision while reading data from an NFC chip, providing an accuracy of over 99.9%.

By End-user

Higher Losses of Fake Fashion Products Boosted Demand for Authentication Tools in Clothing and Apparel

Various end-users of the market include clothing & apparel, pharmaceuticals, electronics, cosmetics & personal care, food & beverages, luxury goods, and others (sports goods, automotive, etc.).

The clothing & apparel segment dominated the market and is expected to capture 31% of market share in 2025. The rise in the number of counterfeit products across clothing and apparel increases the need for authentication tools in this sector. The lucrative fake fashion sector costs fashion brands millions and billions each year. Besides the immediate loss, counterfeiters are also accountable for lasting damage to brand image, as customers lose faith when faced with forged products.

- As per AlpVision Insights, for fashion brands, counterfeits signify illicit competition that leads to over USD 50 billion losses in sales each year.

The pharmaceuticals segment is projected to grow with the highest CAGR of 15.40% during the forecast period (2025-2032). Falsified and substandard medical products pose substantial threats to public health across the globe. They can be unproductive at treating the disease, as they may encompass improper ingredients or inappropriate dosages. Thus, it is necessary to prevent the production of such fake products and ensure the reliability of products with different authentication tools. For instance,

- According to CBP Insights 2023, CBP seizes several counterfeit products at the U.S. borders to safeguard the livelihood of citizens in America. In FY 2023, forged pharmaceuticals accounted for approximately half (47.9%) of the total safety and health products seized.

To know how our report can help streamline your business, Speak to Analyst

By Application

Rise in Counterfeit Goods to Aid Progress of Counterfeit Prevention in Market

The market is categorized by various applications such as track and trace products, counterfeit prevention, tamper detection, packaging authentication, and others (customer awareness, etc.).

The counterfeit prevention segment accounts for the highest market share of 36% in 2025 and is anticipated to progress with the CAGR of 14.90% during the forecast period (2025-2032). Counterfeit products are one of the prominent threats that hamper business revenues across various sectors. Surging threats of product forgery and counterfeiting have accompanied the digital age. These factors have made brand assimilation of authentication and brand protection solutions even more essential. For instance,

- As per the Brand Protection Report, Amazon seized 15 million counterfeit goods in 2024. The e-commerce firm emphasized the role of AI (Artificial Intelligence) in improving its fraud detection competencies, stopping these fake items from reaching customers or rematerializing somewhere else in the supply chain.

The packaging authentication segment is projected to grow at a significant rate during the study period. Tamper-proof shipping packaging enables businesses to protect their products and gain other benefits across every step of the supply chain. Various benefits of packaging authentication include a reduction in the risk of damaged products, better quality control, simplified quality management, enhanced customer loyalty, and improved financial gains, among other benefits. Such factors contribute to the growing authentication and brand protection market share.

AUTHENTICATION AND BRAND PROTECTION MARKET REGIONAL OUTLOOK

By region, the market is studied across North America, Europe, Asia Pacific, South Africa, and the Middle East & Africa.

North America

North America dominated the market with the highest share valued at USD 0.92 billion in 2023 and USD 1.00 billion in 2024. The region’s eminence in the pharmaceutical and food & beverage industries, along with the presence of prominent players and a huge consumer base, boosts its market share in the region. Also, investments in inventive authentication and brand protection mechanisms further emphasize the region’s market position.

North America Authentication and Brand Protection Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America Authentication and Brand Protection Market Size, 2019-2032 (USD Billion)

The prominence of U.S.-manufactured goods in several countries is noteworthy and has led to the rising emphasis on brand protection over product authentication. U.S.-based goods makers are investing considerably to ensure the authenticity of their goods. For instance,

- In 2023, Amazon invested over USD 1.2 billion and engaged more than 15,000 individuals, including software developers, machine learning scientists, and expert investigators, keen to protect brands, customers, selling partners, and stores from fraud, counterfeits, and other forms of abuse.

Download Free sample to learn more about this report.

South America

South America is predicted to grow with a considerable CAGR during the study period, owing to the greater number of counterfeit goods imported from Brazil. Weekly, thousands of counterfeit goods are seized in Brazil. With the largest concentration of economic influence in the country, São Paulo is the major center for the supply of goods in the country.

Europe

Europe is the second largest market, anticipated to progress with a substantial CAGR of 13.70% from 2025 – 2032. The region is expected to capture a market share valued at USD 0.93 billion in 2025. Regulatory actions aimed at shortening counterfeit goods further encourage market growth in Europe. The U.K. market continues to grow, projected to be valued at USD 0.19 billion in 2025. Across Europe, countries including Germany, Italy, Spain, France, and Austria are the most affected by the losses of counterfeit goods, together accounting for approximately USD 8.33 billion (EUR 8 billion) in decreased sales of genuine goods. For instance,

- In July 2024, the International Olympic Committee (IOC) put strong anti-counterfeiting measures in place to safeguard consumers and maintain athletes to aid the Paris 2024. With the aid of the appropriate authorities, they are taking robust action to fight against Intellectual Property (IP) infringements, such as counterfeit Olympic-proprietary merchandise.

Germany is set to be valued at USD 0.22 billion in 2025, while France is projected to reach a market value of USD 0.15 billion in the same year.

Middle East & Africa

The Middle East & Africa is the fourth leading region and is predicted to capture a share valued at USD 0.34 billion in 2025. Increasing demand for protection against counterfeit goods and brand protection in Middle East & Africa countries drives the market growth in the region. Also, rising consumer awareness regarding product authenticity and demand for the integration of new technologies for product authenticity propels the market growth. The GCC market is anticipated to grow with a valuation of USD 0.13 billion in 2025.

Asia Pacific

Asia Pacific is the third leading region, poised to grow with a valuation of USD 0.71 billion in 2025. This rise can be attributed to the region’s economic evolution and the expanding manufacturing sector. Also, the pharmaceutical industry, in particular, is set to experience faster growth, particularly in countries such as India and China. The market in China is expected to capture a share valued at USD 0.23 billion in 2025. Also, the increased consumer awareness amongst businesses regarding authentication and brand protection inventions, along with governmental regulations, is contributing to the region’s progress. For instance,

- In February 2025, Thailand launched an awareness campaign on fake and counterfeit products to stop its sales in the country. The initiative intends to inform consumers, business owners, and vendors regarding intellectual property rights and the threats of purchasing fake goods.

India is projected to reach a market value of USD 0.13 billion in 2025, while Japan is expected to be valued at USD 0.17 billion in the same year.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Key Players Emphasize Presenting Progressive Tools and Solutions to Magnify Business Presence

Players such as Authentix, AlpVision SA, Avery Dennison Corporation, 3M, and De La Rue plc, among others, are introducing new tools to enhance their positions in the market. These players are using advanced technological augmentations, addressing varied consumer demands, and attaining a competitive edge. They prioritize improving product offerings and strategic collaborations, mergers, and investments to reinforce their portfolio. Such progressive product progressions will aid them in maintaining and improving their market share in a dynamically evolving industry.

Major Players in the Authentication and Brand Protection Market

Authentix, AlpVision SA, Avery Dennison Corporation, 3M, Nabcore Pte Ltd, Giesecke+Devrient GmbH, Infineon Technologies AG, and De La Rue plc, among others, are the largest players in the market.

List of Key Authentication and Brand Protection Companies Profiled:

- Authentix (U.S.)

- AlpVision SA (Switzerland)

- Avery Dennison Corporation (U.S.)

- 3M (U.S.)

- De La Rue plc (U.K.)

- All4Labels Global Packaging Group. (Germany)

- Honeywell International Inc. (U.S.)

- Brady Worldwide, Inc. (U.S.)

- Nabcore Pte Ltd (Singapore)

- Bytescare Inc. (U.S.)

- Ennoventure, Inc. (U.S.)

- Giesecke+Devrient GmbH (Germany)

- Infineon Technologies AG (Germany)

- Acviss (India)

- Digital-Link, LLC (UAE)

- Mayr-Melnhof Karton AG (Austria)

- WISeKey (Switzerland)

- Bolster, Inc. (U.S.)

- Allure Security Technology (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2025: AlpVision launched a mobile application to safeguard goods against counterfeiting autonomously. AV-Check aids AlpVision’s anti-counterfeiting technologies, such as Cryptoglyph, Secured QR Code, and AlpVision Fingerprint. Users can protect goods directly by leveraging AlpVision Fingerprint by taking images of goods with their smartphone, disregarding the requirement for extra hardware.

- October 2024: Digimarc launched the Digimarc Validate mobile app, a brand protection application to combat counterfeiters. Digimarc Validate empowers examiners with real-time product authentication, protecting brands, protecting revenue, and reducing costs.

- July 2024: Authentix completed the Asset Purchase Agreement for the acquisition assets of Nanotech Security Corp. The acquisition extends Authentix’s product offering in the currency, banknote, and brand protection business sectors. Furthermore, it complements and uses other business lines, including security printing.

- May 2024: 3M, in collaboration with JRTech Solutions, launched a progressive digital tracking and documentation solution at the 3M Brockville, Ontario, manufacturing site. The system is explicitly developed to authenticate product specifications, design strictures, and process details, recording this vital data straight into an SQL database and modernizing bin labels with present production information in real-time.

- June 2023: Giesecke+Devrient and Versasec collaborated to bring together Versasec’s credential management system with G+D’s StarSign authentication solutions. The partnership empowers businesses to simplify their authentication procedures, minimize operational costs, and reinforce security against increasing threats by offering end-user customers more alternatives for their device authentication.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Key market players are planning to invest constantly in research and development. Investing in R&D to integrate authentication and fake detection of products, digital risk protection, automated security control assessment, and several others aids enterprises in expanding business progress. Also, numerous small and mid-sized businesses are securing funding and investments to extend their business offerings and customer base. For instance,

- In November 2024, Ennoventure secured funding of USD 8.9 million in Series A to enhance worldwide market expansion and innovation in brand production mechanisms. Led by Tanglin Venture Capital, the funding round reinforces Ennoventure's position in AI-driven brand protection and authentication.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the solution and services. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 12.8% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

Technology, Offering Type, End-user, Application, and Region |

|

Segmentation |

By Technology

By Offering Type

By End-user

By Application

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to record a valuation of USD 7.64 billion by 2032.

In 2024, the market was valued at USD 2.99 billion.

The market is projected to grow at a CAGR of 12.8% during the forecast period of 2025-2032.

The pharmaceuticals segment is expected to lead the market with the highest CAGR.

The rise in the trade of counterfeit goods increased the demand for authentication and brand protection tools.

Authentix, AlpVision SA, Avery Dennison Corporation, 3M, Nabcore Pte Ltd, Giesecke+Devrient GmbH, and Infineon Technologies AG are the top players in the market.

North America held the highest market share in 2024.

By application, counterfeit prevention is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us