Automotive Filter Market Size, Share & Industry Analysis, By Vehicle Type (Hatchback/Sedan, SUV, Light Duty Vehicle, Heavy Duty Vehicle, and Two Wheeler), By Propulsion Type (ICE, EV, and HV), By Sales Channel (OEM & Aftermarket), By Filter Type (Oil Filter, Air Filter, Fuel Filter, Cabin Air, and Others), By Material (Metal, Foam, Synthetic Fiber, Activated Carbon, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

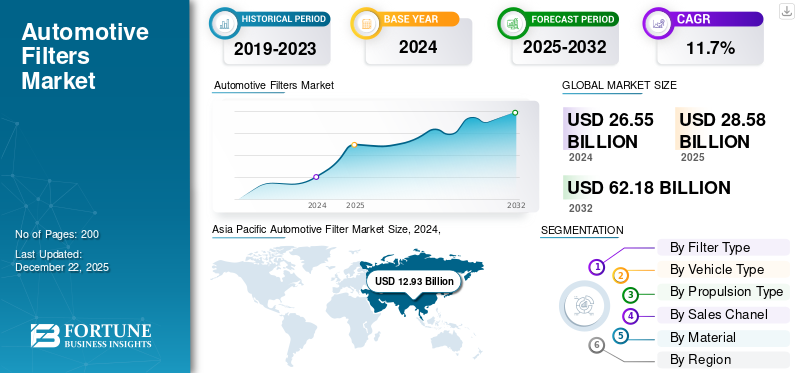

The global automotive filter market size was valued at USD 28.58 billion in 2025 and is expected to grow from USD 31.02 billion in 2026 to USD 73.06 billion by 2034, exhibiting a CAGR of 11.3% during the forecast period. Asia Pacific dominated the global market with a share of 48.94% in 2025.

The automotive filter market plays a crucial role in ensuring vehicles' smooth operation and longevity. Filters are important components that safeguard the engine and various systems within a vehicle by removing contaminants from air, fuel, and oil. The demand for high-quality automotive filters has surged as the automotive industry continues to develop with technological advancements and increasing regulatory requirements focused on emissions and sustainability.

Automotive filters are devices integrated into vehicles to eliminate contaminants from fluid or air, thereby enhancing the performance and efficiency of the vehicle. The primary types of filters:

- Air Filters: These filters clean the air entering the engine, which is vital for optimal combustion. A clean air filter ensures better fuel efficiency and reduces harmful emissions.

- Oil Filter: These components filter out impurities from engine oil. Clean oil is essential for minimizing engine wear and prolonging the life of car engines.

- Fuel Filter: The fuel filters are critical for removing impurities from fuel before it reaches the engine. They ensure that the engine receives clean fuel, leading to improved performance and reduced emissions.

- Cabin Air Filters: These filters clean the air that enters the vehicle's interior, enhancing passengers' comfort and protecting them from dust, pollutants, and others.

The automotive filter market is characterized by its broad application across various vehicle types, including passenger cars (hatchback/sedan & SUV), commercial vehicles (light commercial vehicle and heavy commercial vehicle), and electric vehicles (EVs). As the global automotive landscape shifts towards increasing electrification and hybrid technology, the demand for specialized filters will increase during the forecast period.

The competitive automotive filter market includes numerous players, from large multinational corporations to smaller niche companies. The major players in the market include Mann+Hummel, Bosch, and Mahle Gmbh.

- Mann+Hummel: A global leader in filter solutions, Mann+Hummel provides a comprehensive range of automotive filters. The company emphasizes innovation and sustainability, focusing on developing environmentally friendly filtration products through its advanced R&D initiatives and strong presence in emerging markets.

Automotive Filter Market Trends

Adoption of Electric Vehicles are Fueling Market Growth

The increasing demand for electric vehicles presents a new challenge and opportunity for automotive filter manufacturers. While the electric vehicle does not require all traditional filters, the demand for specialized filtration solutions such as cabin air filters and other thermal management systems filters drive the demand for the automotive filter market.

As electric vehicles penetrate the market, the demand for advanced and specialized filters is rising. Electric vehicles focus heavily on passenger comfort and interior air quality. Advanced filters with HEPA, activated carbon, and antibacterial coating are in demand. The major electric vehicle players, such as Tesla, BYD, NIO, and others, are adopting advanced filters (cabin air filters).

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Increasing Vehicle Production to Drive Market Growth

The growing number of vehicles on the road globally, especially in Asia Pacific and Europe, drives the demand for replacement filters. Passenger cars, commercial vehicles, and two-wheelers require periodic filter maintenance. Emerging markets such as India, Southeast Asia, Brazil, and Africa are experiencing rapid industrialization, rising disposable income, and surges in demand for personal mobility and commercial transport. This development drives the automotive filter market.

Vehicle Production and Filter Deman

|

Vehicle Type |

Filter Installed During Production |

|

Passenger Cars |

Air Filter, Oil Filter, Fuel Filter, Cabin Air Filter, Transmission Filter etc. |

|

Commercial Truck |

Heavy-duty air, oil, fuel, hydraulic filters |

|

Two-Wheelers |

Air filter, oil filter& fuel filter |

|

Electric Vehicle |

Cabin air filter, battery cooling filter and HVAC filter |

Market Restraints

Regulatory complexity of Filter May Limit Market Growth

Regulatory challenges and compliance requirements are hampering the growth of the automotive filter market, as manufacturers must continuously adapt to evolving emission norms, air quality standards, and passenger safety regulations that vary across regions. Adhering to frameworks such as Euro 7 in Europe, US EPA guidelines, and other national directives demands frequent redesign of filter technologies, stricter quality checks, and higher production costs. These complexities not only increase the financial and operational obligations on manufacturers but also slow down time-to-market, making it difficult for companies to remain competitive while meeting diverse global compliance standards.

Key Raw Material for Filters

|

Filter Component |

Raw Materials |

|

Filter Media |

Cellulose, synthetic fibers (polyester, nylon), micro glass, nanofiber |

|

Housing & Frame |

Plastics (polypropylene, polycarbonate), rubber, metal (aluminum, steel) |

|

Adhesive & Sealants |

Polyurethane, silicone- based adhesives |

Market Challenges

Supply Chain Disruption and Material Shortage Significantly Challenge Market Growth

Automotive filters such as oil, fuel, air, cabin and hydraulic filters depend on a complex global supply chain for sourcing raw materials, manufacturing and delivery. This supply chain is vulnerable to disruption at multiple stages including, raw material extraction & processing, manufacturing & assembly (tier-2, tier 3 suppliers), global transportation & logistics and regional warehousing and distribution. Thus the supply chain disruption and material shortage significantly challenge the market growth.

Market Opportunities

Rising Demand for Commercial and Off- Highway Vehicle Filters is a Key Opportunity for Market

The growing demand for filters in commercial and off-highway vehicles presents a significant opportunity in the global market. Increasing urbanization, e-commerce boom, and infrastructure development drive commercial vehicle demand. The number of trucks, buses, and vans used for goods and passenger transport is rapidly expanding across developed and emerging markets. Thus, the increasing demand for commercial vehicles directly increases the demand for automotive filters. Commercial vehicles typically operate for longer hours and cover more distance, leading to more frequent replacement cycles for air, oil, fuel, and cabin filters compared to passenger vehicles.

Segmentation Analysis

By Vehicle Type

The SUV Segment led due to Rising Urbanization and Personal Mobility Demand

By vehicle type, the market is classified into hatchback/sedan, SUV, light duty vehicle, heavy duty vehicle and two wheeler.

The SUV segment held the largest market share of 31.44% in 2026. The segmental growth is attributed to increasing urbanization and personal mobility requirements. Rising disposable income, improving road infrastructure, and a growing urban population fueled SUV passenger vehicles, particularly in emerging markets. This trend contributes to continuous increase in new vehicle registration, especially in developing nations such as India, Indonesia, Brazil and Southeast. This development drives the market growth during forecast period.

The hatchback/sedan segment held the second-largest market share in 2024. The segmental growth is attributed to the large and growing aftermarket base, which drives the market growth. The aftermarket sector is highly active for hatchback and sedan passenger vehicles, with frequent filter changes throughout the vehicle lifecycle.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Type

Availability of Major Global On-road ICE Vehicle Fleet Fueled Segment Dominance

Based on the propulsion type the market is divided into ICE, EV and HEV.

The ICE propulsion type segment held the largest share of 75.64% in 2026. Despite the growth of electric vehicles, ICE vehicles still account for the vast majority of vehicles on the road. Emerging markets such as India, Southeast Asia, Latin America and Africa are heavily dependent on ICE vehicles due to their affordability, fuel ability, and existing infrastructure. With millions of ICE vehicles sold annually, this development increased the demand for the automotive filter market.

The EV (electric vehicle) segment held the second largest and fastest growing segment during the forecast period. The segmental growth is attributed to the rapid adoption of electric vehicles globally. This development increased the demand for high performance and specialized filtration systems.

By Sales Channel

High Replacement Rate of Filters Boosted Aftermarket Segment growth

Based on the sales channel type the market is bifurcated into OEM and aftermarket.

The aftermarket segment held the largest share of 69.55% in 2025. Filters such as engine oil, air, cabin air, and fuel filters require regular replacement to maintain vehicle performance and emission standard. Millions of vehicles on the road (both and new) regularly enter the replacement cycle, fueling the demand for the aftermarket segment.

The OEM segment held a significant market share in 2024. The segmental growth is attributed to new vehicle production. OEM filters are installed in the new vehicles during manufacturing, the volume is directly tied to new vehicle production. Thus the rising new vehicle production drives the automotive filter market growth during the forecast period.

By Filter Type

Air Filter Segment Dominated due to High Volume and Replacement Rate

Based on the filter type the market is segregated into oil filter, air filter, fuel filter, cabin air and others.

The air filter segment held the largest share of 25.90% in 2026. The segmental growth is attributed due to high volume and replacement rate of air filter. Every vehicle requires at least one air filter. Air filters are typically replaced every 12 to 24 months, depending on environment and usage, this development increased the aftermarket demand for air filters.

The cabin air filter held a significant share in 2024. The segmental growth is attributed to OEMs' rising adoption of cabin air filters. For instance, in April 2023, Tenneco announced a strategic partnership with Toyota to develop next-generation cabin air filters incorporating smart technology for real-time air quality monitoring. This collaboration aims to give drivers insights into cabin air conditions, promoting better health and safety. This development fueled the demand for cabin air filters.

By Material Type

High Durability and Strength of Metal Propelled Segment Growth

Based on the material type the market is categorized into metal, foam, synthetic fiber, activated carbon and others.

The metal segment held the largest share in 2024. The segmental growth is attributed to its durability and strength. Metal filter housings are widely used owing to their high mechanical strength, making them suitable for high-pressure environments and harsh operating conditions (heat, vibration, corrosion). Metals such as aluminum, stainless steel, and steel offer excellent thermal resistance and structural stability, which is essential in engine and transmission filters.

The activated carbon material type held a significant share in 2024. The segmental growth is attributed to the rising demand for carbon air quality. Consumers are increasingly aware of in-cabin air pollution, which includes dust, allergens, and harmful gases such as NOx, ozone, and volatile organic compounds (VOCs). Activated carbon cabin air filters can absorb odors and toxic gases, offering superior filtration compared to standard particulate-only filters.

Automotive Filter Market Regional Outlook

By region, the market is studied across Europe, Asia Pacific, North America, and the rest of the world.

Asia Pacific

Asia Pacific Automotive Filter Market Size, 2025, (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 13.99 billion in 2025 and USD 15.26 billion in 2026. The Asia Pacific region held the largest automotive filter market share. High vehicle production drives the demand for products for all vehicle types. Countries such as China, India, Japan, and South Korea are leading automotive manufacturers, increasing the demand for vehicle filters. However, growing aftermarket sales drive the demand for filters, and rising vehicle ownership and maintenance awareness contribute to aftermarket filter sales. The Japan market is projected to reach USD 1.72 billion by 2026, the China market is projected to reach USD 9.25 billion by 2026, and the India market is projected to reach USD 1.4 billion by 2026.

North America

North America holds a significant share of the automotive filter market. The U.S. Environmental Protection Agency (EPA) and California Air Resources Board (CARB) enforce tough emission standards, boosting demand for high-performance filters. The U.S. and Canada have a large vehicle fleet, ensuring steady replacement demand for filters. The presence of major automotive aftermarket players (e.g., Mann+Hummel, Donaldson, Fram) supports market growth. The U.S. market is projected to reach USD 5.06 billion by 2026.

Europe

Europe held a significant market share in the automotive filter market. The region’s market is driven by innovation and sustainability. European Union standards mandate low-emission vehicles, increasing demand for advanced air and fuel filters. Companies including MANN-FILTER, Mahle, and Sogefi develop eco-friendly, long-lasting filters. Germany, France, the U.K., and Italy are major contributors, with Germany leading due to its strong automotive OEM presence. The UK market is projected to reach USD 1.05 billion by 2026, and the Germany market is projected to reach USD 1.53 billion by 2026.

Rest of the World

The rest of the world holds a notable market share. UAE, Saudi Arabia, and Qatar have high disposable incomes, increasing premium vehicle sales, and filter demand. The Gulf Cooperation Council (GCC) countries dominate the Middle East & Africa market, while South Africa and Nigeria show potential due to urbanization and industrialization, which drives market growth.

Competitive Landscape

KEY INDUSTRY PLAYERS

Various Strategic Initiatives by Key Players in Industry are Driving Growing Market Competition

Key players in this market continuously innovate to meet evolving industry demands, expand their product offerings, and strengthen their market presence through strategic collaborations and acquisitions.

Several prominent companies dominate the automotive filter market, leveraging advanced technologies, extensive distribution networks, and strong brand recognition. The major players in the market include Mann+Hummel, Bosch, and Mahle GmbH.

Mann+Hummel Group: Mann+Hummel provides high-performance air, oil, fuel, and cabin filters for automotive and industrial applications. The company focuses on innovation and sustainability, developing eco-friendly filters with extended service life. To expand its market reach, it also engages in strategic acquisitions with WIX filters.

List of Key Automotive Filter Companies Profiled

- Robert Bosch GmbH (Germany)

- MAHLE GmbH (Germany)

- MANN+HUMMEL (Germany)

- Sogefi SpA (Italy)

- Ahlstrom-Munksjö (Finland)

- Hengst SE (Germany)

- K&N Engineering, Inc. (U.S.)

- Donaldson Company, Inc. (U.S.)

- Cummins Inc. (U.S.)

- Denso Corporation (Japan)

- Parker Hannifin Corporation (U.S.)

- ACDelco (U.S.)

- Valeo SA (France)

- Toyota Boshoku Corporation (Japan)

- UFI Filters (Italy)

- Freudenberg Filtration Technologies (Germany)

- Clarcor Inc. (U.S.)

- Champion Laboratories, Inc. (U.S.)

- WIX Filters (U.S.)

- Filtration Group Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- In July 2025, Energizer Holding and Assurance Intl Limited introduced a new product Line of STP Lubricants, Oils, Filters, and Batteries. In addition to the lubricants and oils, the launch will also include air, cabin oil, and fuel filters, as well as batteries and inverters for a variety of auto and household needs.

- In June 2024, Uno Minda, launched its latest range of cabin air filters for the Indian aftermarket. This launch addresses the pressing issue of air pollution, particularly in metro, Tier 1, and Tier 2 cities, which poses significant health risks. The new filters are designed to enhance air quality inside vehicle cabins, mitigating the adverse effects of pollutants, nitrogen oxides, carbon monoxide, and volatile organic compounds.

- In December 2023, Uno Minda introduced an aftermarket filter range for commercial vehicles. Pollutants such as dirt, dust, and debris can easily corrode an automobile's engine and other costly internal components. The air filters act as an effective barrier against them, ensuring the efficiency and longevity of the engine and other critical components.

- In January 2023, the MANN+HUMMEL Group announced that the company had made a strategic investment in M-Filter Group. The company's majority of growth investment will be used to drive product expansion and allow it to invest in sales and operational capabilities. The agreement would help strengthen the European footprint and unlock growth opportunities in Scandinavia and the Baltic states.

- In January 2023, K&N Engineering announced that its new industrial group was created to bring high-performance, sustainable air filtration solutions to providers of mission-critical infrastructure, including data centers and other industrial applications and markets. K&N Engineering's proprietary air filtration technology saves money, lowers energy costs, and provides significant sustainability benefits for data centers and other industrial applications everywhere.

REPORT COVERAGE

The automotive filter market research report provides a detailed market analysis and focuses on key aspects such as leading market participants, competitive landscape, and type. Besides this, it includes insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.3% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Vehicle Type

|

|

By Propulsion Type

|

|

|

By Sales Channel

|

|

|

By Filter Type

|

|

|

By Material

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market was valued at USD 28.58 billion in 2025.

The market is poised to grow at a CAGR of 11.3% during the forecast period (2026-2034).

By Vehicle type, the SUV segment captures the largest share.

The market size in Asia Pacific stood at USD 13.99 billion in 2025.

The major players in the market include Mann+Hummel, Bosch, and Mahale GmbH.

Asia Pacific held the largest share of the market in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us