Automotive Labels Market Size, Share & Industry Analysis, By Material (Polyethylene, Poly Vinyl, Polycarbonate, Polyester, and Others), By Type (Pressure Sensitive Labels, Glue Applied Labels, Sleeve Labels, In-mould Labels, and Others), By Application (Interior, Exterior, and Underhood), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

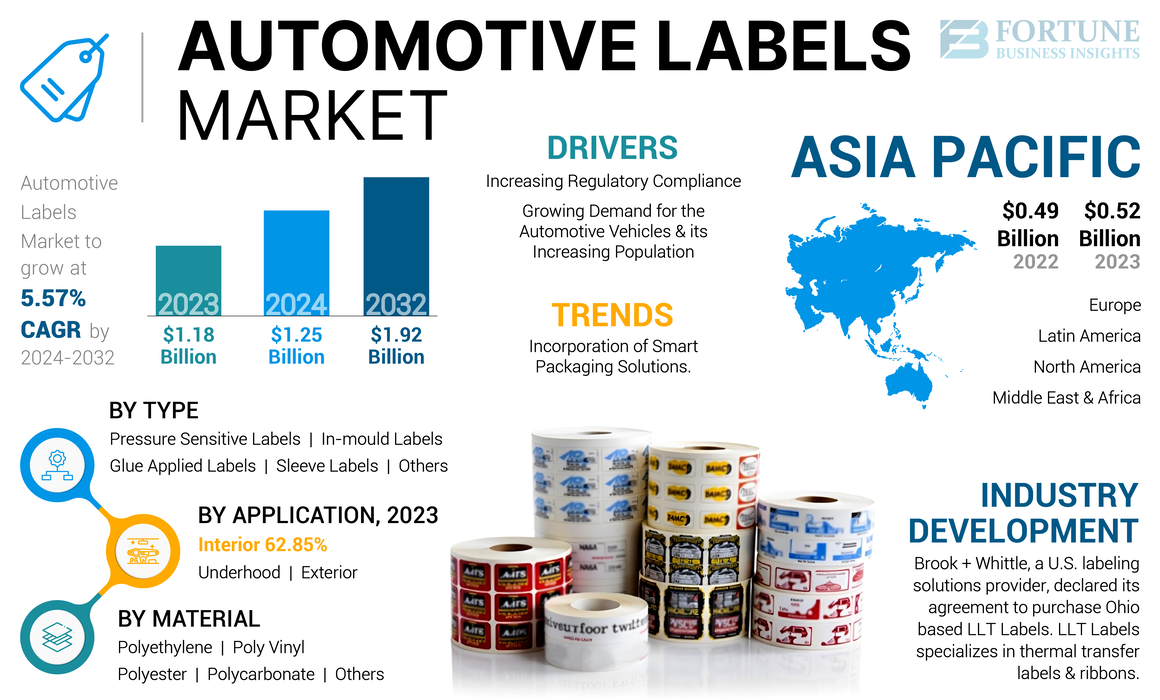

The global automotive labels market size was valued at USD 1.25 billion in 2024. The market is projected to grow from USD 1.31 billion in 2025 to USD 1.92 billion by 2032, growing at a CAGR of 5.57% during the forecast period. Moreover, the automotive labels market in the United States is anticipated to grow steadily, reaching USD 325.30 million by 2032. This growth is fueled by the increasing need for durable, high-performance labeling solutions that enhance traceability, safety, and compliance in the automotive industry. Asia Pacific dominated the automotive labels market with a market share of 44.07% in 2023.

Automotive labels are vital elements in vehicles that provide important information for identification, safety, and upkeep. The labels are of different types, such as compliance labels, safety labels, and instructive labels and some of them contain the information of the manufacturers and distributors. The growing demand for automotive vehicles across the world and the demand for safety concerns bolsters the market growth. Moreover, rising utilization of glue applied labels in the automotive sector contributes to the increasing market share.

The initial stages of the COVID-19 pandemic observed a significant drop in automotive sales due to lockdowns, social distancing, and economic uncertainties, which greatly reduced consumer demand. The situation worsened after dealership closures and disruptions in supply chains. Additionally, economic instability and job losses reduced consumers' purchasing power, mainly affecting high-cost items such as new vehicles. All such factors led to the declining demand for the vehicles.

Global Automotive Labels Market Overview

Market Size:

- 2024 Value: USD 1.25 billion

- 2025 Value: USD 1.31 billion

- 2032 Forecast Value: USD 1.92 billion, with a CAGR of 5.57% (2024–2032)

Market Share:

- Regional Leader: Asia Pacific held 44.07% of the market in 2023, driven by strong automotive production in China, India, Japan, and South Korea, alongside rising industrialization and disposable income.

- U.S. Market Forecast: Expected to reach USD 325.30 million by 2032, fueled by demand for durable and high-performance labeling to ensure traceability, safety, and regulatory compliance.

- Application Leader: Interior segment dominated in 2023, driven by safety regulations and the need for readable, instructional, and maintenance labels inside vehicles.

Industry Trends:

- Smart Labeling Adoption: Integration of QR codes and RFID tags for real-time part tracking, inventory control, and interactive consumer engagement.

- Durable Materials Innovation: Shift toward polyester and poly vinyl labels to withstand extreme temperatures, chemicals, and abrasion in modern vehicles.

- Increased Customization: Growing use of versatile, pressure-sensitive labels for diverse applications and ease of updates or replacement.

Driving Factors:

- Regulatory Compliance: Stricter global vehicle safety and emission standards fuel demand for compliant and accurate labeling systems.

- Rising Vehicle Production: Growing automotive output, especially in emerging economies, increases the need for a variety of labels per unit.

- Urbanization & Population Growth: Expanding cities and rising disposable incomes contribute to vehicle demand, boosting label requirements.

- Global Automotive Industry Expansion: Automakers operating across multiple regions require region-specific, multilingual labels, enhancing global demand.

Automotive Labels Market Trends

Incorporation of Smart Packaging Solutions is the Leading Market Trend

The adoption of smart packaging solutions, such as QR codes and RFID technology, is greatly boosting the automotive labels market growth. QR codes are now commonly found on vehicle labels, providing easy access to detailed information about various car parts, serial numbers, maintenance schedules, and safety features. This allows both car owners and mechanics to quickly find useful information by scanning the code with a smartphone.

- Asia Pacific witnessed a automotive labels market growth from USD 0.49 billion in 2022 to USD 0.52 billion in 2023.

Furthermore, RFID technology works a bit differently. It involves placing tiny electronic tags on labels that can be read by specialized scanners. These tags can wirelessly store and transmit information, making them more versatile than traditional barcodes. In car manufacturing, RFID tags are used to track parts and components throughout the production line. Such real-time tracking helps manufacturers keep better control of their inventory, reduce mistakes, and improve efficiency. For instance, in a large car assembly plant, RFID tags ensure that the right parts are used in the right order, which helps avoid production delays and improves the quality of the final product, thus contributing to the market growth of automotive labels.

Additionally, these smart packaging solutions also help engage customers, as QR codes can link to extra content such as virtual factory tours or special promotions, making the customer experience more interactive and enjoyable.

Download Free sample to learn more about this report.

Automotive Labels Market Growth Factors

Increasing Regulatory Compliance is thriving the Market’s Growth Globally

The increasing production of vehicles globally is a significant driver of growth in the automotive label market. As automotive manufacturers ramp up their output to meet rising consumer demand and market expansion, the need for a diverse array of labels grows in tandem.

Regulatory compliance is a key driver behind the demand for automotive labels. Governments around the world impose stringent regulations to ensure vehicle safety, environmental protection, and consumer information. For example, safety compliance labels are mandatory to inform vehicle owners about safety features and compliance with crash-test standards. Similarly, emission control labels are required to disclose information about the vehicle’s emissions systems and compliance with environmental regulations. As vehicle production expands, manufacturers must adhere to these regulations for each unit produced, resulting in a growing demand for accurate and durable labels that meet various regional standards.

Globalization of the automotive industry further drives label demand. Automakers operate in multiple countries, each with its own set of regulatory requirements and consumer preferences. This necessitates a variety of labels tailored to meet the specific standards of different regions.

Growing Demand for Automotive Vehicles and its Increasing Population Boosts Market Growth

The growing global population plays a crucial role in driving the increased demand for automotive vehicles, affecting both developing and established markets. As the number of people increases, several related factors contribute to the heightened need for both personal and commercial transportation, leading to significant changes in the automotive sector.

With the expansion of urban and suburban areas, the need for vehicles to transport individuals and families grows. In densely populated cities, the demand for personal transportation becomes more prominent as people seek convenience and flexibility amidst crowded public transit systems. Similarly, in expanding suburban regions, families increasingly require personal vehicles for daily activities such as commuting, shopping, and leisure, further driving vehicle demand.

Additionally, the rise in population is closely linked to greater economic activity, which in turn boosts vehicle demand. As populations increase, so do the economies of their regions. Economic growth typically results in higher disposable incomes, allowing more individuals to afford personal vehicles. In many developing nations, economic progress has led to the emergence of a middle class with the financial means to purchase automobiles, thereby expanding the market.

The changing demographic profile of the global population impacts automotive demand. Younger generations, who are maturing and entering the workforce, have unique preferences and transportation needs. This demographic shift is expected to drive interest in various vehicle types. Thus, the growing demand for vehicle numbers due to the growing population will enhance the automotive labels market share during the forecast period.

RESTRAINING FACTORS

Increasing Technological Advancements in Car Can Limit Market’s Growth

The biggest challenge impeding the growth of this market is keeping up with the fast changes in automotive technology and materials. As car manufacturers are adopting new technologies such as electric engines and self-driving systems, there is a greater need for specialized and durable automotive labels. However, rapid innovation can outpace the ability of label manufacturers to adjust quickly, leading to delays and higher costs.

Moreover, automotive labels need to endure tough conditions, such as extreme temperatures and exposure to chemicals, necessitating the use of high-performance materials. These materials are often costly and complicated to produce, thus limiting the growth of this market.

Automotive Labels Market Segmentation Analysis

By Material Analysis

Polyester Labels Drive Growth with Unmatched Durability and Performance

Based on material, the market is segmented into polyethylene, poly vinyl, polycarbonate, polyester, and others. Polyester is the dominating segment of this market and contributes to the largest market share. Polyester labels are prominently used in the automotive industry as they are very tough and can handle rough conditions. Cars are exposed to extreme temperatures, chemicals, and a lot of wear and tear, and polyester stands up well under these challenges. It is resistant to scratching, moisture damage, and fading under sunlight, ensuring that labels stay clear and in good shape, even in places such as engine compartments or on the outside of the car. Additionally, polyester sticks well to different surfaces, keeping automotive labels securely in place and bolstering the segment’s growth. This segment is likely to capture 40.13% of the market share in 2025.

Poly vinyl is the second dominating segment of the market. It is known for its flexibility and strong stickiness. It is mostly useful when labels need to wrap around or fit irregularly shaped surfaces, such as those in different car parts. Such flexibility allows the labels to fit perfectly and stay in place, which is important for maintaining their integrity in tough conditions, thus enhancing the segment’s growth. this segment is likely to grow with a considerable CAGR of 6.55% during the forecast period (2024-2032).

By Type Analysis

Glue Applied Labels is the Leading Type Due to its High Adhesion and Versatility

Based on type, the market is segmented into pressure sensitive labels, glue applied labels, sleeve labels, in-mould labels, and others.

Glue applied labels hold the largest share of the market. These labels are popular in the automotive industry as they stick really well and are quite versatile. They are designed to adhere strongly to various surfaces such as plastic, metal, and composite materials found in cars. These labels can withstand tough conditions, including vibrations, extreme temperatures, and exposure to chemicals. Glue-applied labels are built to handle these challenges. Their strong adhesive keeps them securely attached, so that they would not peel off or come loose, which is important for ensuring readability and functionality in demanding environments. This segment is likely to attain 52.64% of the market share in 2025.

Pressure sensitive labels is the second dominating segment and is experiencing significant growth. These labels are made to be easily removed without leaving any sticky residue behind, which is great for situations where labels need to be changed or updated often. They are also highly versatile, coming in different finishes, shapes, and sizes to suit a variety of uses, from labeling parts to displaying safety instructions. Additionally, pressure sensitive labels offer high-quality printing, allowing for clear and readable information, which is crucial in the automotive industry, hence contributing to the automotive labels industry growth. This segment is anticipated to record substantial CAGR of 6.26% during the forecast period (2024-2032).

Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Interior Segment Dominates Owing to Rise In Safety Regulations

Based on application, the market is segmented into interior, exterior, and underhood. Interior is the leading segment of the market. Interior labels are commonly used in cars as they provide important information and help keep things safe inside the vehicle. These labels are made to be easily readable so that drivers and mechanics can quickly find the information they need, which can include how the vehicle works or maintenance instructions. These labels are crucial for keeping everything running smoothly and safely, making them crucial. The segment captured 62.99% of the market share in 2024.

Underhood holds the second-largest share as these labels offer several benefits in the automotive market by providing essential information for vehicle maintenance and safety. They help identify engine components, fluid levels, and maintenance schedules.

REGIONAL INSIGHTS

Asia Pacific Automotive Labels Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a value of USD 0.52 billion in 2023 and USD 0.56 billion in 2024. Asia Pacific is the dominating region of this market. The growing industrialization and increasing disposable income in the region are increasing the demand for automotive vehicles. The Chinese market is foreseen to be valued at USD 0.22 billion in 2025. Furthermore, the presence of the world’s largest automotive vehicle producers, such as China, Japan, India, and South Korea, is bolstering the growth of this region. India is expected to be worth USD 0.11 billion in 2025, while Japan is set to reach USD 0.13 billion in the same year.

North America is the third leading region poised to gain USD 0.27 billion in 2025. North America is expected to grow significantly during the forecast period due to the presence of some of the largest players in the automotive labels, such as 3M Company, CCL Industries, and Avery. In addition, the increasing focus on vehicle safety and regulatory compliance is expected to increase demand for labels in the region. The U.S. market is foreseen to grow with a value of USD 0.23 billion in 2025.

Europe is the second leading region expected to hold USD 0.31 billion in 2025, registering a considerable CAGR of 4.84% during the forecast period (2024-2032). Europe is experiencing moderate growth due to the increasing demand for electric or hybrid vehicles. These vehicles need extra precautions and details to handle. The U.K. market is estimated to be valued at USD 0.02 billion in 2025. The growing technological advancement in the region is one of the reasons for its flourishing growth. Germany is set to gain USD 0.09 billion in 2025, while France is foreseen to reach USD 0.05 billion in the same year.

Latin America is the fourth largest market estimated to be worth USD 0.11 billion in 2025. The region will experience lucrative growth during the projected period due to the rising demand for vehicles in the region. Along with this, the growing investments in Mexico and Brazil are augmenting the demand in this region.

The Middle East & Africa is growing at a steady rate due to the rising ownership of vehicles and developing infrastructure. The demand for labels that can withstand harsh temperature conditions is also bolstering growth in this region. The GCC market is poised to hit USD 0.01 billion in 2025.

KEY INDUSTRY PLAYERS

Innovative Packaging Offerings by Key Participants Provides Significant Growth Opportunities

The global automotive labels market is highly fragmented and competitive in terms of market share, and the few major players dominate by offering innovative packaging in the packaging industry. These players are constantly focusing on innovation and expanding their customer base across regions.

Major companies in the market include 3M Company, Avery Dennison Corporation, Resource Label Group, CCL Industries, and others. Numerous other players operating in the industry are focused on delivering advanced packaging solutions to contribute to the market growth.

List of Top Automotive Labels Companies:

- 3M Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Resource Label Group (U.S.)

- CCL Industries (Canada)

- CILS International (U.K.)

- Brady Corporation (Belgium)

- LINTEC EUROPE (Netherlands)

- Polyonics Inc. (U.S.)

- Imagetek Labels (U.S.)

- Weber Packaging Solutions (U.S.)

- Advantage Label & Packaging Inc. (U.S.)

- Label-Aid Systems Inc. (U.S.)

- Clarion Safety Systems (U.S.)

- UPM Raflatac (Finland)

- Multipack (India)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 - AWT Labels & Packaging Inc. (AWT) announced the acquisition of American Label Technologies (ALT), a provider of innovative RFID and label solutions for healthcare, retail, warehousing, and automotive markets across North America. ALT offers a wide suite of RFID and NFC printing technologies. The business will continue to operate as American Label Technologies, an AWT Company.

- April 2023 - One of America's premier thermal label printing companies, OMNI Systems, announced the acquisition of ITW Labels, a manufacturer of custom and stock labels for the consumer packaged goods, durable, and retail markets. The acquisition enables the company to expand its distribution capabilities for a wide range of label printing needs for commercial customers.

- February 2023 - Brook + Whittle, a U.S. labeling solutions provider, declared its agreement to purchase Ohio-based LLT Labels. LLT Labels specializes in thermal transfer labels and ribbons, custom direct thermal labels, industrial labels & other custom labeling solutions. This acquisition is expected to boost Brook + Whittle’s product portfolio.

- January 2022 - Resource Label Group, LLC announced the acquisition of Everett, MA-based QSX Labels, expanding its regional strength in New England and leading position in the label and packaging industry.

- October 2021 - Armor Group declared the acquisition of International Imaging Materials (IIMAK). The acquisition reinforced Armor’s position as one of the leading global companies in the design and production of thermal transfer ribbons.

REPORT COVERAGE

The market research report provides a detailed market share analysis and focuses on key aspects such as leading companies, competitive landscape, product types, Porter’s five forces analysis, and leading end-use industries of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market's growth in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.57% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The Fortune Business Insights study shows that the global market was USD 1.25 billion in 2024.

The global market is projected to grow at a CAGR of 5.57% in the forecast period.

The market size of Asia Pacific stood at USD 0.52 billion in 2023.

Based on material, the polyester segment dominates the global market.

The global market size is expected to reach USD 1.92 billion by 2032.

The key market drivers are increasing regulatory compliance and growing demand for automotive vehicles.

The top players in the market are 3M Company, Avery Dennison Corporation, Resource Label Group, and CCL Industries, among others.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us