Automotive Software Market Size, Share & Industry Analysis, By Type (Application Software, Middleware, and Operating System), By Application (ADAS & Safety, Infotainment & Instrument Cluster, Engine Management & Powertrain, and Others), By Vehicle Type (Passenger Cars and Commercial Vehicles), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

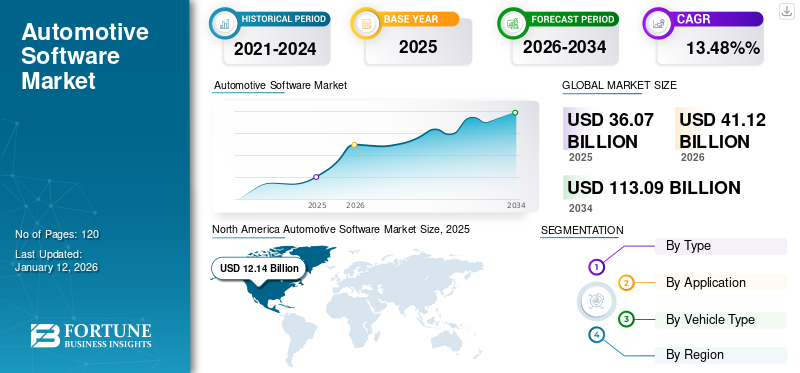

The global automotive software market size was valued at USD 36.07 billion in 2025 and is projected to grow from USD 41.12 billion in 2026 to USD 113.09 billion by 2034, exhibiting a CAGR of 13.48% during the forecast period. North America dominated the automotive software market with a market share of 33.65% in 2025.

The market is being driven by the increased integration of software into automotive systems, technological advancements, and rising demand for connected, autonomous, and electric vehicles. Furthermore, there is a growing demand for vehicles equipped with connectivity features that allow for real-time communication and data exchange between vehicles, infrastructure, and cloud services. These factors are expected to propel the automotive software market forward during the forecast period.

Furthermore, the proliferation of shared mobility services and fleet management platforms is driving demand for advanced automotive software solutions. As ride-hailing and car-sharing models expand, fleet operators will require intelligent vehicle tracking, predictive maintenance, and driver behavior analytics, propelling the software landscape in automotive ecosystems.

GLOBAL AUTOMOTIVE SOFTWARE MARKET OVERVIEW

Market Size:

- 2025 Value: USD 36.07 billion

- 2026 Value: USD 41.12 billion

- 2034 Forecast Value: USD 113.09 billion, with a CAGR of 13.48% from 2026–2034

Market Share:

- Regional Leader: North America held a 33.65% market share in 2025, driven by high adoption of connected and autonomous vehicles supported by major players such as Tesla, General Motors, and Waymo.

- Fastest-Growing Region: Asia Pacific is the fastest-growing region, driven by rapid electrification, expanding EV infrastructure, and strong government initiatives in China, Japan, and South Korea.

- End-User Leader: The passenger car segment led the market in 2024, driven by increased integration of IoT and vehicle-to-everything (V2X) technology enhancing safety, connectivity, and user experience.

Industry Trends:

- Shift to Software-Defined Vehicles (SDVs): Transition to OTA-enabled, software-centric vehicles.

- Integration of Generative AI: Accelerating design and predictive maintenance efficiency.

- Connected & Autonomous Vehicles: Advancing safety, mobility, and in-car intelligence.

Driving Factors:

- Rising Connected Vehicle Adoption: Boosting real-time data integration.

- AI & Machine Learning Advancement: Powering autonomous and intelligent systems.

- Electric Vehicle Expansion: Driving battery and energy optimization.

- Fleet Management Demand Growth: Enhancing predictive and telematics operations.

- Government & Regulatory Support: Promoting safety and emission compliance.

Automotive software refers to a wide range of software solutions used in the design, manufacture, operation, and maintenance of vehicles. These solutions are tailored to automotive applications such as embedded systems, vehicle management systems, infotainment, safety and security systems, telematics, autonomous driving, and more. These solutions can help automakers, suppliers, and service providers improve vehicle performance, safety, user experience, and overall efficiency.

The COVID-19 pandemic had a negative impact on several industries around the world. The pandemic caused significant disruptions in global supply chains, which impacted the availability of hardware components required for automotive software systems. These disruptions caused delays in production and development cycles. However, the pandemic hastened the automotive industry's transition to digitization, with a focus on improving online sales, remote diagnostics, and Over-the-Air (OTA) software updates.

The scope of work includes solutions provided by companies such as BlackBerry Limited, KPIT Technologies Ltd, MONTAVISTA SOFTWARE, LLC., Microsoft, Intellias, HARMAN International, and others.

The Impact of Generative AI

Increasing demand for process automation and quality control is expected to drive market growth.

Generative AI technology creates new content and solutions from previously learned patterns and data. This software has a significant impact on a variety of industries, including the automotive sector. Generative AI can quickly generate and evaluate multiple design options for vehicle components, resulting in faster iteration and refinement processes. AI algorithms can optimize designs for aerodynamics, weight reduction, and material usage, resulting in increased vehicle efficiency and performance.

Generative AI can also optimize manufacturing processes, identifying the most efficient ways to assemble components while reducing waste. Artificial intelligence-powered vision systems can detect defects and anomalies in real time, resulting in higher production quality standards. Furthermore, generative AI can improve the accuracy and robustness of advanced drivers.

For instance,

- In May 2024, KPIT Technologies engaged into partnerships with multiple U.S. car manufacturers. Through this partnership, the company aimed to launch its proprietary generative AI technology embedded into cars.

Generative AI is increasingly being used to improve in-cabin experiences by tailoring infotainment, voice assistants, and climate control systems to user preferences. AI-powered behavioral learning models allow vehicle systems to dynamically adapt to driver habits, ensuring both comfort and safety. This shift enables OEMs to provide differentiated and intuitive user experiences.

Automotive Software Market Trends

The shift to Software Defined Vehicles (SDV) is boosting market growth.

Vehicles are increasingly defined by their software capabilities, rather than their hardware. This shift allows for continuous updates and enhancements via Over-the-Air (OTA) software updates. Automakers are adopting modular software architectures to make it easier to update and integrate new features. As vehicles become more connected, it is critical to implement robust cybersecurity measures to prevent hacking and data breaches.

Regulatory bodies in Europe, North America, and Asia require vehicle software for compliance reporting, emissions monitoring, and real-time diagnostics. These shifting regulatory requirements are driving automakers and Tier 1 suppliers to invest heavily in next-generation software platforms that can ensure compliance and provide reporting transparency.

Another growing trend is the use of open-source software frameworks like AUTOSAR Adaptive and ROS2, which allows for faster development and standardization across automotive software platforms. These frameworks are gaining traction among both OEMs and startups due to their modularity, scalability, and reduced time-to-market advantages.

In addition, market players are increasingly focusing on integrating sustainability and eco-friendly solutions into autonomous vehicles. This includes development of software that optimizes vehicle performance to reduce emissions and improve fuel efficiency. Features such as eco-driving modes help drivers reduce their environmental impact. As the industry continues to innovate, software will play an increasingly critical role in defining vehicle capabilities and enhancing the overall driving experience. These advancements are expected to fuel market growth during the forecast period.

Download Free sample to learn more about this report.

Automotive Software Market Growth Factors

Increasing technological advancements in vehicles drive market growth.

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) into automotive software enables advanced features such as self-driving, predictive maintenance, and personalized user experiences. Advanced software plays a significant role in the development of sophisticated ADAS features such as lane-keeping assist, adaptive cruise control, and automatic emergency braking.

The growing integration of cloud and edge computing into automotive architectures boosts processing speeds, data security, and system scalability. Cloud platforms enable centralized management of software updates, analytics, and remote diagnostics, whereas edge computing speeds up response times for critical ADAS features, resulting in a seamless hybrid infrastructure that supports real-time vehicle intelligence.

Furthermore, the proliferation of IoT devices in vehicles enables real-time data exchange and connectivity, which improves functions such as real-time navigation, vehicle diagnostics, and remote control capabilities. Furthermore, the increasing demand for telematics systems for fleet management, usage-based insurance, and vehicle tracking is driving the need for strong automotive software solutions. These factors will shape the market's future, resulting in continued growth and development.

For instance,

- According to an industry survey report, it is projected that 12% of vehicles on the road globally in 2030 will be fully autonomous.

RESTRAINING FACTORS

Data privacy and safety concerns may impede market growth.

Automotive software frequently operates in safety-critical environments, where failures can have serious consequences. Ensuring high reliability and fail-safe operation is critical, necessitating extensive testing and validation. Even minor safety flaws can result in major safety issues or recalls, reducing consumer trust and increasing automakers' costs.

The lack of global standardization for automotive software platforms across OEMs and regions complicates development, leads to interoperability issues, and increases certification costs. This fragmented ecosystem complicates scalability and uniform compliance, especially as vehicles operate more frequently in cross-border environments with diverse regulatory landscapes.

Furthermore, this software frequently collects and processes large amounts of personal data, raising questions about data privacy and security. Ensuring compliance with data privacy laws such as the General Data Protection Regulation (GDPR) and the Central Consumer Protection Authority (CCPA) is critical. Maintaining consumer trust by securely managing and transparently disclosing data usage is an ongoing challenge in this industry. These factors are expected to slow market growth.

Automotive Software Market Segmentation Analysis

By Type Analysis

Application software Segment Led due to Growing Demand for Autonomous Driving Capabilities

Based on type, the market is classified into application software, middleware, and operating system.

Application software accounted for the largest market share of 50.97% in 2026, as it is essential to the development and operation of autonomous driving systems, which allow vehicles to navigate and make decisions without human intervention. Combining data from multiple sensors (LIDAR, cameras, and RADAR) using software applications improves the accuracy and reliability of autonomous systems.

The operating system is expected to grow at the fastest CAGR during the forecast period, as the automotive OS efficiently allocates system resources (CPU, memory, and I/O) to various applications, ensuring peak performance. Operating systems schedule tasks by prioritizing critical functions like safety and real-time processing over non-critical tasks. These factors are expected to accelerate market growth in the coming years.

Middleware is gaining popularity because it acts as a communication link between the operating system and the application layers, ensuring smooth data flow, system modularity, and interoperability across various electronic control units (ECUs). As vehicle architectures become more complex, automakers are increasingly turning to middleware for faster integration and agile software development.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

ADAS & safety Segment Dominated the Market due to Increasing Focus on Enhanced Safety

Based on application, the market is divided into ADAS & safety, infotainment & instrument cluster, engine management & powertrain, and others (telematics and connectivity).

ADAS and safety had the largest market share of 34.50% in 2026, as automotive software powers critical ADAS features like lane-keeping assist, adaptive cruise control, automatic emergency braking, and blind-spot detection, which significantly improve vehicle safety.

Furthermore, this software enables real-time data processing and decision-making to avoid collisions, thereby protecting both passengers and pedestrians. As technology advances, the importance and impact of application software in the automotive industry are expected to increase, resulting in further innovation and improvements in vehicle performance and user satisfaction.

Infotainment and instrument clusters are expected to grow at the fastest CAGR during the forecast period, as they have become an important feature in automobiles. Analog gauges and dials gave way to digital instrument clusters as technology advanced. It displays important vehicle information such as speed, engine status, and fuel level. Furthermore, modern infotainment systems integrate with smartphones, support voice commands, and provide a variety of services to improve the driving experience.

The rising demand for AR/VR-powered navigation systems, driver alerts, and immersive entertainment in luxury and next-generation vehicles is driving innovation in the infotainment industry. OEMs are investing in Human-Machine Interface (HMI) software to create interactive dashboards that boost user engagement and brand value.

By Vehicle Type Analysis

Passenger cars Segment Led owing to Rising Integration of IoT and V2X Technology

Based on vehicle type, the market is bifurcated into passenger cars and commercial vehicles.

In 2026, passenger cars accounted for the largest market share of 74.44%. The integration of IoT devices and V2X (Vehicle-to-Everything) communication technologies allows vehicles to communicate with one another, traffic infrastructure, and the cloud. This connectivity enables real-time data exchange and better traffic management. Furthermore, many passenger cars now include semi-autonomous features like autopilot and self-parking. These capabilities use advanced software algorithms to improve driver convenience and safety.

The growing use of electric light commercial vehicles (e-LCVs) in logistics and last-mile delivery operations is increasing demand for software such as route optimization, battery health monitoring, and fleet efficiency analytics. Fleet managers are increasingly viewing these digital capabilities as critical cost-cutting tools.

Commercial vehicles are expected to grow at the fastest CAGR in the coming years, as telematics software advancements make features like real-time vehicle diagnostics, remote monitoring, and usage-based insurance more prevalent. Automotive software is critical in enabling commercial vehicle operators to track and ensure compliance with safety, emissions, and driver hours regulations, all of which are important in many regions around the world.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Automotive Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 12.14 billion in 2025 and USD 13.7 billion in 2026. The region, particularly the U.S. and Canada, is experiencing significant growth in the adoption of electric vehicles, driven by companies such as Tesla and regulatory incentives. The U.S. market is projected to reach USD 9.7 billion by 2026.

Advanced software for managing battery performance, energy efficiency, and charging infrastructure is critical for the growing EV market. Major automakers and tech companies in North America, such as Waymo, General Motors, and Tesla, are heavily investing in the development of autonomous driving technologies.

Furthermore, the region is seeing more collaboration between tech titans and automotive OEMs to develop cloud-native software-defined vehicles. Strategic investments in mobility-as-a-service (MaaS) platforms and data monetization frameworks are driving market growth.

For instance,

- The National Highway Traffic Safety Administration (NHTSA) and other regulatory bodies are encouraging or mandating the inclusion of certain ADAS features to improve road safety.

Asia Pacific

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. China, Japan, and South Korea are leading in the EV market, with significant investment in technologies and infrastructure. The growth of local software development hubs, government-backed EV subsidies, and strategic alliances with global OEMs are all contributing to Asia Pacific's innovation-driven automotive software development ecosystem. The Japan market is projected to reach USD 2.07 billion by 2026, the China market is projected to reach USD 2.26 billion by 2026, and the India market is projected to reach USD 1.58 billion by 2026.

Advanced battery management systems are crucial for optimizing battery performance and ensuring the safety and efficiency of EVs. Moreover, there is a high demand for advanced infotainment systems in the region, offering seamless integration with smartphones, internet connectivity, and sophisticated user interfaces. Connected vehicles provide real-time navigation, traffic information, and remote diagnostics, enhancing the overall driving experience. For instance,

- In April 2024, Huawei, a Chinese technology provider company, launched a novel automotive software for intelligent driving. Through this software launch, the company aimed to expand its business in the electric vehicle industry.

Europe

Europe is anticipated to grow at a noteworthy CAGR in the coming years. ADAS features such as, adaptive cruise control, lane-keeping assist, automatic emergency braking, and parking assistance are widely adopted in European vehicles. The European Union (EU) has stringent safety regulations, such as the General Safety Regulations (GSR), mandating the inclusion of certain ADAS features in new vehicles to enhance road safety. The UK market is projected to reach USD 2.24 billion by 2026, and the Germany market is projected to reach USD 2.38 billion by 2026.

The rise of mobility-as-a-service (MaaS) in urban areas, combined with widespread digital adoption, is driving up demand for scalable automotive software platforms. Europe's strong emphasis on data governance and cybersecurity is encouraging OEMs to use robust, compliant software architectures. Moreover, European vehicles are integrating advanced Human-Machine Interfaces (HMIs), including touchscreens, voice controls, and augmented reality displays, to enhance user experience.

Middle East & Africa and South America

The Middle East & Africa is expected to showcase prominent growth during the forecast period. Many automakers in the region are adopting over-the-air update capabilities allowing remotely software updates, features addition, and address security vulnerabilities without requiring physical visits.

Furthermore, the region's increased emphasis on smart city initiatives and intelligent traffic management systems creates new opportunities for V2X and telematics software providers. Premium vehicle demand in Gulf countries is also driving software innovation in the luxury segment.

In South America the market is increasing steadily as automakers are increasingly investing in autonomous driving technologies. Numerous pilot programs and testing initiatives are underway, particularly in Brazil and Argentina paving the way for broader adoption of autonomous vehicles.

Government initiatives to digitize transportation networks and modernize logistics are increasing interest in connected commercial vehicles, resulting in a greater demand for automotive software solutions tailored to regional operating conditions.

KEY INDUSTRY PLAYERS

Leading Organizations are Joining Forces to Increase their Global Footprint

Leading companies are concentrated on solidifying their market position by showcasing industry-specific services. These companies are deploying acquisitions and merger strategies with domestic players to cement their position. Established firms are unveiling cutting-edge solutions to increase their customer pool. Additionally, rising capital expenditure in research and development to launch technologically advanced products is anticipated to develop market expansion. Furthermore, prominent companies are deploying strategies to maintain an edge over other companies in the competitive market.

List of Top Automotive Software Companies:

- BlackBerry Limited (Canada)

- KPIT Technologies Ltd (India)

- Google LLC (U.S.)

- Airbiquity Inc (U.S.)

- Wind River Systems, Inc. (U.S.)

- Microsoft (U.S.)

- MONTAVISTA SOFTWARE, LLC. (U.S.)

- Robert Bosch GmbH (Germany)

- Intellias (U.S.)

- HARMAN International (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Tata Motors selected the HARMAN Ignite Store, as its in-vehicle app store, helping customers to access apps easily and securely across worldwide.

- March 2024: Valeo partnered with SDVerse Vehicle Software Marketplace, General Motors, Magna, and Wipro to develop a B2B sales platform for selling and buying automotive software.

- March 2024: Arm revealed its state-of-the-art Arm Automotive Enhanced (AE) processors along with novel virtual platforms to boost automotive development cycles by up to two years.

- January 2024: Hyundai Mobis selected Wind River to propel its software-defined vehicle development, aiming to strengthen its automotive software business using Wind River Linux and VxWorks real-time operating system.

- October 2023: Hozon New Energy Automobile Co., Ltd. engaged into partnership with Wind River to build the Hozon Automotive Intelligent Security Vehicle Platform, offering new possibilities for consumers and car makers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.48% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By Vehicle Type

By Region

|

Frequently Asked Questions

The market is projected to reach USD 113.09 billion by 2034.

In 2025, the market was valued at USD 36.07 billion.

The market is projected to grow at a CAGR of 13.48% during the forecast period.

By vehicle type, passenger cars led the market in 2023.

Growing adoption of technological advancements in vehicles is a key factor fueling market growth.

BlackBerry Limited, KPIT Technologies Ltd, MONTAVISTA SOFTWARE, LLC., Microsoft, Intellias, and HARMAN International are the top players in the market.

North America dominated the automotive software market with a market share of 33.65% in 2025.

By application, infotainment & instrument cluster is expected to grow at a highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us