Bentonite Market Size, Share, & Industry Analysis, By Product (Calcium Bentonite, Sodium Bentonite, and Potassium Bentonite), By Application (Construction, Oil & Gas, Metallurgy, Pharmaceuticals & Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

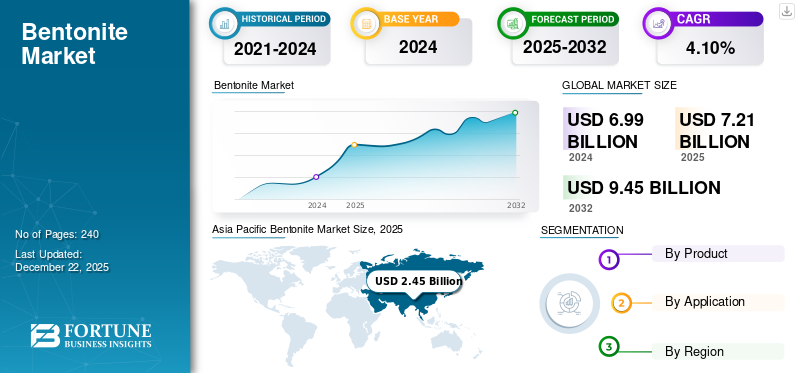

The global bentonite market size was valued at USD 7.2 billion in 2025. The market is projected to grow from USD 7.43 billion in 2026 to USD 10.24 billion by 2034, exhibiting a CAGR of 4.10% during the forecast period. Imerys, Clariant, Minerals Technologies Inc., Wyo-Ben, Inc., and Ashapura Group are key players operating in the industry. Asia Pacific dominated the bentonite market with a market share of 34% in 2025.

Bentonite is a naturally occurring clay composed of the mineral montmorillonite. It is widely recognized for its high absorbency and swelling capacity, making it an essential component in various industrial applications. It plays an important role in enhancing the functionality and performance of products across sectors such as construction, agriculture, pharmaceuticals, cosmetics, and drilling. It is commonly used for sealing, binding, thickening, and purifying. Its ability to absorb water and expand, along with its excellent viscosity and plasticity, provides significant advantages in drilling operations, fluids, iron ore pelletizing, and soil conditioning. With its unique properties and natural origin, the product is in demand for industrial processes and environmental solutions.

Global Bentonite Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 7.2 billion

- 2026 Market Size: USD 7.43 billion

- 2034 Forecast Market Size: USD 10.24 billion

- CAGR: 4.10% from 2026–2034

Market Share:

- Asia Pacific dominated the bentonite market with a 34% share in 2025, driven by rapid industrialization, expanding construction activities, and increasing adoption of bentonite in drilling, metallurgy, and personal care applications.

- By product, sodium bentonite is expected to retain the largest market share in 2025, supported by its superior swelling capacity, high absorbency, and rising use in drilling fluids, civil engineering, waste management, and iron ore pelletizing.

Key Country Highlights:

- Japan: Market growth is driven by strong demand from the pharmaceuticals, cosmetics, and high-performance industrial sectors, supported by advanced processing technologies and strict quality standards.

- United States: The country leads in technological innovation and production, with strong consumption in drilling, foundry applications, and environmental engineering, backed by robust industrial infrastructure.

- China: As a major consumer and producer, China drives regional demand through large-scale construction activities, metal casting operations, and extensive usage in drilling and environmental applications.

- Europe: Growth is supported by increasing focus on sustainable construction materials, widespread use in waste management and sealing applications, and strong regulatory emphasis on natural, non-toxic industrial inputs.

Bentonite Market Trends

Advancements in Processing Technologies and Expanding Industrial Applications to Drive Market Growth

The market is witnessing significant advancements driven by innovative processing technologies and the growing range of industrial applications. These developments enable higher purity, improved performance, and broader utility across construction, oil & gas, pharmaceuticals, and environmental engineering sectors.

Manufacturers are focusing on refining activation and purification techniques to enhance the properties of bentonite, such as swelling capacity, rheology, and adsorption efficiency. These advancements are essential in oil well drilling fluids, where consistent performance is critical under high-pressure and high-temperature conditions.

In addition, developing modified bentonite, particularly organically modified and acid-activated variants, is creating new opportunities in niche areas, including water treatment, personal care products, and polymer nanocomposites. These specialized variants offer superior dispersion, tailored surface properties, and improved compatibility with organic compounds.

Furthermore, the use of products in sustainable construction solutions, such as geosynthetic clay liners and eco-friendly binders, highlights its growing importance in environmentally conscious building practices and remediation projects.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Growing Industrial Focus on Efficiency, Sustainability, and Material Innovation to Accelerate Market Expansion

A growing industrial focus on efficiency and cost optimization is driving increased adoption of products across a wide range of operations. Its natural ability to influence physical and chemical properties, such as improving viscosity, enhancing binding strength, and regulating filtration, makes it a practical choice for streamlining processes. The material’s availability and low environmental impact make it a reliable and economical solution in today’s cost-sensitive industrial landscape.

Rising sustainability demands and the push for cleaner production methods drive innovation in processing. Manufacturers are increasingly implementing eco-conscious techniques to improve material purity and reduce production waste. This shift aligns the product with global environmental standards and makes it a favorable alternative to synthetic additives due to its biodegradable and non-toxic nature.

Ongoing investments in research and development are driving product evolution into a more versatile and functional industrial input. Techniques such as surface modification, chemical activation, and custom blending are expanding their usability in complex and demanding environments. As a result, bentonite is emerging as a dynamic material solution capable of meeting the changing needs of performance-driven and sustainability-focused industries.

Market Restraints

Regulatory Pressures and Availability of Substitutes to Limit Market Expansion

Stringent environmental regulations and the rise of advanced substitutes are key barriers to the growth of the market. In several regions across the globe, stricter controls over mining activities, including land restoration, groundwater preservation, and emissions compliance, are increasing operational costs and delaying project approvals. Meeting these regulatory demands often requires significant investments in permits, environmental assessments, and sustainable practices. Additionally, the growing adoption of synthetic alternatives and engineered materials that offer consistent performance and enhanced functionality poses a competitive challenge to traditional bentonite-based solutions. These factors are expected to restrain market expansion and push producers toward more sustainable and innovative approaches.

Market Opportunities

Rising Product Demand in Personal Care and Cosmetics to Create New Growth Opportunities

The increasing preference for natural and multifunctional ingredients in the personal care and cosmetics industry opens new opportunities for the product. With its strong absorbent, purifying, and soothing qualities, it is commonly included in skincare products such as face masks, creams, and exfoliants. It removes impurities, controls excess oils, and eases irritated skin, making it ideal for sensitive or acne-prone formulations. As the demand for clean, chemical-free, and sustainably sourced beauty products continues to rise, bentonite is gaining traction among brands focused on wellness and natural beauty.

In addition, the push for innovation in cosmetic formulations drives interest in adaptable ingredients that support product performance and sustainability claims. It enhances skincare products' consistency, stability, and feel while aligning with the trend toward transparency and eco-conscious sourcing. Manufacturers are developing advanced forms of the product, such as ultra-fine powders and plant-based blends, to cater to specific needs and offer added skin benefits. This evolution in product development reinforces the product’s role as a valuable ingredient in next-generation, environmentally responsible personal care solutions.

Market Challenges

Raw Material Constraints and Supply Chain Issues Posing a Challenge to Market Expansion

The market is increasingly facing challenges due to scarcity of raw materials and disruptions across the supply chain. Since bentonite is a naturally occurring mineral, its extraction is influenced by mining restrictions, environmental regulations, and geographic concentration of deposits, which can create inconsistencies in supply. Additionally, logistical issues, including transportation delays, rising fuel costs, and global supply chain disruptions, further impact processed product’s timely and cost-effective delivery. These challenges can lead to production bottlenecks, price volatility, and difficulties in meeting consistent quality standards, posing a significant hurdle for manufacturers and end-users reliant on stable supply.

Impact of COVID-19

The COVID-19 pandemic had an immediate and pronounced impact on the bentonite market in early 2020, as global manufacturing activity slowed and supply chains experienced significant disruptions. Lockdowns and restrictions affected mining operations, processing facilities, and transportation networks, leading to raw material shortages and delivery delays. Many industrial sectors, such as the construction industry, foundry, and oil & gas, scaled back operations or halted projects altogether, resulting in a sudden dip in demand. Labor shortages, social distancing protocols, and compliance with health guidelines further limited production capacity and created operational inefficiencies across the value chain.

By mid-2021, the market had entered recovery mode, driven by resumed industrial activity, infrastructure investments, and rising demand for natural materials in health and personal care products. However, persistent logistics challenges and fluctuating input costs continued to impact profitability and planning well into 2022.

In response, manufacturers explored alternate sourcing strategies, invested in process automation, and focused on diversifying application areas to build greater market resilience. The pandemic also heightened industry focus on sustainability and supply security, prompting a shift toward more localized supply chains and digital procurement systems. While the market has largely stabilized, these strategic shifts are expected to have a lasting influence on how the industry operates.

Segmentation Analysis

By Product

Sodium Bentonite Segment Led Due to its Superior Absorption and Swelling Properties

By product, the market is segmented into calcium bentonite, sodium bentonite, and potassium bentonite.

The sodium segment dominated the global bentonite market share of 22.48% in 2026, driven by its high absorption capacity and excellent swelling ability, making it a preferred choice in various industrial applications. Its ability to form stable gels and strong sealing properties make it valuable in civil engineering, drilling, and waste management sectors.

The calcium segment is projected to grow continuously, owing to its natural binding capabilities and increasing usage in refining, agriculture, and personal care products. Meanwhile, the potassium segment is expected to grow notably by 2032, fueled by its specialized use in niche applications and increasing awareness of its unique properties.

By Application

To know how our report can help streamline your business, Speak to Analyst

Construction Segment Held Dominant Share Due to Rising Infrastructure Development and Soil Sealing Applications

By application, the market is segmented into construction, oil & gas, metallurgy, pharmaceuticals & cosmetics, and others.

The construction segment dominated the market share of 15.88% in 2026 and is expected to maintain its dominance with steady growth throughout the forecast period. The product is highly used in the construction industry for applications such as foundation sealing, tunneling, and slurry walls, owing to its excellent water retention, swelling properties, and ability to form impermeable barriers. The growing demand for eco-friendly and long-lasting construction materials is further boosting the adoption of product in the sector.

The oil & gas segment is projected to be the second fastest-growing application due to the product’s critical role in drilling mud formulations, where it helps lubricate drill bits and stabilize boreholes.

The pharmaceuticals and cosmetics segment is also expected to grow considerably over the projected period, driven by rising demand for natural, skin-safe ingredients in personal care products and its use as an excipient in pharmaceuticals.

Bentonite Market Regional Outlook

The global market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Bentonite Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the largest and fastest-growing market, driven by rapid industrialization, expanding construction activities, and growing demand from key sectors such as oil & gas, metallurgy, and personal care. The region generated a value of USD 2.45 billion in 2025.

China leads the Asia Pacific market, supported by its large-scale infrastructure projects, extensive metal casting industry, and growing use of products in environmental and drilling operations. The country’s robust manufacturing base and focus on industrial development continue to fuel demand for products across multiple sectors. China market is projected to reach USD 1.11 billion by 2026

India is emerging as the fastest-growing market, driven by increasing investments in the construction industry and infrastructure and a surge in demand from the cosmetics and pharmaceutical industries. Government-led initiatives supporting industrial development and urban expansion are further accelerating the consumption, making India a key contributor to regional bentonite market growth. India market is projected to reach USD 0.45 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America’s market is shaped by technological innovation, increasing environmental awareness, and a strong demand for natural and efficient industrial materials. The region benefits from well-established industrial sectors and a growing focus on sustainable practices, making products a preferred choice across various applications.

The distinct dynamics of U.S. and Canada also influence the North American market. While the U.S. leads in production volume, generating a value of USD 1.33 billion in 2026 and technological advancement, Canada is witnessing growing demand due to the expansion of mining and construction industries and a rising preference for natural, eco-friendly materials in manufacturing and personal care.

Europe

Europe holds a significant share of the market, driven by consistent demand across the construction industry, environmental engineering, and industrial applications. Countries including Germany, France, and U.K. contribute notably to regional consumption, supported by a well-developed infrastructure and a strong emphasis on sustainable building materials. While the region’s strict environmental regulations encourage using natural, non-toxic substances, they push manufacturers to innovate in processing and application techniques. The demand for the product in waste management, sealing applications, and metallurgy remains strong, with ongoing industrial projects and environmental initiatives sustaining market growth. The UK market is projected to reach USD 0.18 billion by 2026, while the Germany market is projected to reach USD 0.65 billion by 2026.

Latin America

The market in Latin America shows diverse trends across nations, including Brazil, Mexico, Argentina, and Chile. Demand is driven by expanding industrial sectors such as construction, mining, and agriculture, where the product is a vital material due to its binding, sealing, and filtration properties. While the market faces certain challenges, including evolving regulatory standards and growing interest in alternative materials, advances in processing technologies and the broadening scope of applications are helping to maintain momentum. In the future, the focus on sustainable, cost-effective solutions is expected to play a key role in shaping regional product usage.

Middle East & Africa

The market in the Middle East & Africa region is influenced by growing demand across GCC, South Africa, and other developing regions. Increasing activity in construction, oil & gas exploration, and water treatment are driving the use of products in various applications such as drilling, sealing, and environmental protection. Saudi Arabia plays an important role due to its large infrastructure development plans and strong focus on industrial growth. As nations pursue economic diversification and prioritize sustainable development, the need for natural and efficient materials continues to rise, supported by improvements in processing techniques and a growing emphasis on environmental responsibility.

COMPETITIVE LANDSCAPE

Key Market Players in Bentonite Market

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Prominent Participants Focus on Acquisition Tactics to Gain Market Share

Major 5 companies in the market include Imerys, Clariant, Minerals Technologies Inc., Wyo-Ben, Inc., and Ashapura Group, representing nearly 40% of the global market. Top producers are aggressively increasing their operations to boost their competitive position and mitigate the risks posed by new entrants. The market remains highly competitive, driven by international and regional contenders leveraging strong supplier ties, regulatory knowledge, and wide distribution. Strategic mergers, joint ventures, and contract agreements are becoming essential tactics to enhance visibility and strengthen competitive positioning.

LIST OF KEY BENTONITE COMPANIES PROFILED

- Imerys (France)

- Clariant (Switzerland)

- Minerals Technologies Inc. (U.S.)

- Wyo-Ben, Inc. (U.S.)

- Ashapura Group (India)

- Gimpex (India)

- Bentonite Performance Minerals LLC (U.S.)

- Kemira (Finland)

- Shanghai Songhan Plasticization Technology Co., Ltd. (China)

- KUNIMINE INDUSTRIES CO., LTD. (Japan)

KEY INDUSTRY DEVELOPMENTS

- November 2023 – Wyo-Ben Inc. acquired the bentonite operations of M-I SWACO, marking a significant consolidation in the bentonite market and enhancing Wyo-Ben’s ability to meet the growing global demand for high-quality bentonite-based drilling and industrial solutions.

- June 2023 – Clariant launched Desi Pak ECO desiccant packets in response to the growing demand in the bentonite market for sustainable and high-performance solutions. This innovative desiccant, made with responsibly mined bentonite clay, offers superior moisture absorption and a lower environmental impact than synthetic options.

- July 2021 – Minerals Technologies Inc. acquired Normerica Inc., a major supplier of bentonite-based cat litter products, reinforcing its presence in the North American bentonite market and expanding its capabilities in the growing global pet care segment.

REPORT COVERAGE

The market research report provides a detailed market analysis and focuses on crucial aspects such as leading companies, products, and end-use industries. Additionally, the report offers insights into market trends and highlights vital industry developments. In addition to the abovementioned factors, the report encompasses various factors contributing to the market's growth in recent years.

This report includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) Volume (Kiloton) |

|

CAGR (2025-2032) |

CAGR of 4.10% from 2026 to 2034 |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 7.43 billion in 2026 and is projected to reach USD 10.24 billion by 2034.

Growing at a CAGR of 4.10%, the market will exhibit steady growth during the forecast period.

In 2025, the Asia Pacific market size stood at USD 2.45 billion.

By application, the construction segment led the market in 2025.

The growing focus on efficiency, sustainability, and technological advancement is a key factor driving market growth.

Imerys, Clariant, Minerals Technologies Inc., Wyo-Ben, Inc., and Ashapura Group are major players operating in the industry.

Asia Pacific dominated the bentonite market with a market share of 34% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us