Bio-based Nylon Market Size, Share & Industry Analysis, By Application (Textiles, Automobiles, Electrical & Electronics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

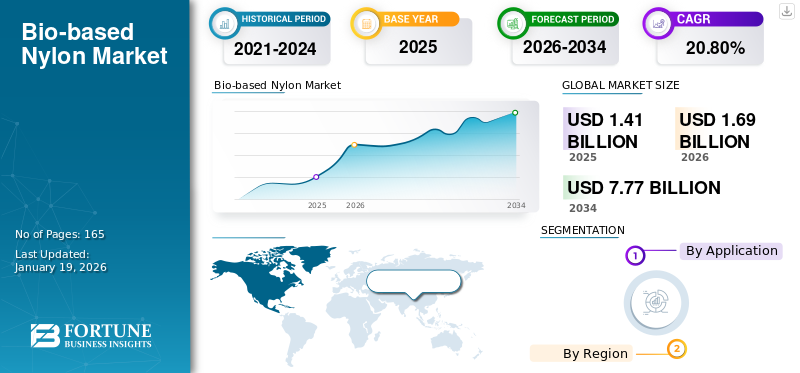

The global bio-based nylon market size was valued at USD 1.41 billion in 2025. The market is projected to grow from USD 1.69 billion in 2026 to USD 7.77 billion by 2034 at a CAGR of 20.80% during the forecast period of 2026-2034. Asia Pacific dominated the bio-based nylon market with a market share of 40% in 2025.

Bio-based nylon, also known as bio-polyamide, is a type of nylon produced from renewable sources, such as corn, sugar cane, castor oil, and other plant materials. It is a biodegradable and environmentally friendly alternative to traditional fossil fuel-based nylon with similar properties and functions. Bio-based nylon is used in a broader range of applications in automotive, textile, and consumer goods industries due to its extraordinary characteristics including versatility, durability, improved high performance, and cost effectiveness.

The COVID-19 pandemic had a major influence on the market’s progress. The government-imposed restrictions resulting in a notable slowdown in economic activities, reduced the product demand in many industry verticals, such as electronics, automotive, and textile. Moreover, supply chain disruptions and extreme fluctuations in the prices of raw materials also had an adverse impact on the market. However, the gradual reopening of economic activities in various countries and the growing need for eco-friendly materials are projected to boost the market growth in the coming years.

LATEST TRENDS

Rising Demand in Automotive Sector to Emerge as Major Market Trend

The demand for plant-based nylons in the automotive industry, particularly for manufacturing automotive engine components and interiors, is increasing. These nylons offer high mechanical strength, abrasion resistance, and flexibility, and are used in the production of engine covers, airbag containers, wheel covers, seat belts & frames, casing, connectors, and switches. Improved ductility and lightweight features make this nylon a preferable choice in the automotive sector. Moreover, growing demand for compact and fuel efficient vehicles will also contribute to the bio-based nylon market growth. Growing adoption of electric vehicles will further drive the product demand in the automotive sector.

Download Free sample to learn more about this report.

DRIVING FACTORS

Rising Awareness about Environmental Sustainability to Foster Market Growth

Bio-based nylon is an eco-friendly form of polyamide offering functionalities that are similar to the conventional petroleum-based nylon. The growing environmental concerns and need for reducing carbon footprint have increased the adoption of eco-friendly and renewable products by various end-use industries, thereby driving the growth of the bio-based nylon market.

Also, continuous technological innovations in materials and manufacturing processes, coupled with growing investment from various associations and governments to encourage sustainability, has promoted the market’s growth.

RESTRAINING FACTORS

High Production Cost Compared to Petroleum-based Nylon Production May Pose Challenge to Market Growth

Bio-based nylon is made from renewable sources, such as natural oils and fats. The technologies and processes involved in the production or extraction of these bio-polyamides are complex and costly as compared to the conventional nylon. In addition, the production process requires large amounts of water and energy and emits harmful greenhouse gases other than carbon dioxide. To combat these effects, manufacturers need to adopt advanced technologies, which further increases the production cost. There is minimal awareness regarding the utilization of bio-based nylon in various applications as compared to its counterpart, thereby restricting the growth of the market.

SEGMENTATION

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Automobiles Holds a Major Market Share on Account of Its Better Environmental Profile

Based on application, the market is segmented into textiles, automobiles, electrical & electronics, and others. The automobiles segment holds a dominant share of 34.91% in 2026, the market and is expected to grow considerably during the forecast period. Bio-based nylon has a better environmental profile as they are made from renewable sources and helps in reducing carbon emission. They improve the performance and reduce the weight and size of automobiles thus are specially utilized in automotive interiors and engine compartments.

Bio-based nylon is also used in the production of textiles which are further utilized for manufacturing fashion apparel, sportswear, and intimate wear. Features, such as biocompatibility, reusability, and lightweight nature make this product a preferable choice for fabric and other textile production. The growing demand for antimicrobial polyamide textiles is expected to drive the adoption of bio based nylon in the textiles industry.

Bio-based nylon is also used as an alternative to conventional polymers such as Polyethylene Terephthalate (PET), Acrylonitrile Butadiene Styrene (ABS), and Polybutylene Terephthalate (PBT), and others which are used in consumer electronics, such as mobiles, LED’s, and others. Rising disposable income coupled with growing technological adoption will support the market growth.

REGIONAL INSIGHTS

Regionally, the market is classified into North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific dominated the market with a valuation of USD 0.56 billion in 2025 and USD 0.71 billion in 2026. driven by the strong expansion of the automotive and electronics industries. China holds a dominant market share due to its status as a global manufacturing hub. This trend is expected to further propel the market's growth in the region. Additionally, the growing population and rising disposable income levels in the Indian market are bolstering the consumption of electronic goods and textiles which will further drive the demand for the product. The Japan market is projected to reach USD 0.1 billion by 2026, the China market is projected to reach USD 0.47 billion by 2026, and the India market is projected to reach USD 0.07 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is projected to grow significantly in the coming years. The U.S. holds a prominent position in the regional market. The U.S. market is projected to reach USD 0.37 billion by 2026. capturing a substantial share. The market’s growth is characterized by a rising demand for sustainable alternatives in polymers for various applications, which, in turn, will drive the consumption of bio based nylon in the region.

Europe is poised to witness steady growth in the coming years due to the widespread application of bio-based nylon across several industries, including automotive and electronics. Notably, Germany, France, and the U.K. are the major contributors to the bio-based nylon market share in Europe. The UK market is projected to reach USD 0.05 billion by 2026, while the Germany market is projected to reach USD 0.14 billion by 2026.

The market’s growth in Latin America is associated with the increasing demand for polymers or chemical intermediates in the production of finished goods. The demand for these products is moderately high in Brazil, Mexico, and Argentina, which are among the most prominent contributors toward the regional market’s growth.

During the forecast period, the market in the Middle East & Africa is expected to experience moderate growth. This growth is due to the increasing demand for consumer goods, apparel, and consumer electronics, which will lead to a surge in the demand for bio based nylon during the forecast period.

KEY INDUSTRY PLAYERS

Key Players’ Product Development and Capacity Expansion Strategies to Help Them Maintain Their Market Dominance

The market’s competitive landscape is highly consolidated. Some of the key market players are planning to boost their investment to create better technologies to enhance their product output. This, along with efforts to enhance their operational efficiency, will help market leaders enhance their growth. They are also increasing their focus on acquisition and expansion activities to boost their market share.

LIST OF KEY PLAYERS PROFILED

- Genomatica (U.S.)

- Cathay Biotech (China)

- Radici Group (Italy)

- Aquafil Group (Italy)

- DOMO Chemicals (Belgium)

- Arkema (France)

- BASF SE (Germany)

- Evonik Industries (Germany)

- Koninklijke DSM N.V. (Netherlands)

- Wuxi Yinda Nylon Co. Ltd. (China)

KEY INDUSTRY DEVELOPMENTS

- February 2024 – South Korea's LG Chem and CJ CheilJedang entered a partnership to produce a bio-based nylon that will replace conventional synthetic polymers.

- July 2022 – Biotech firm Genomatica and textile company Aquafil co-developed plant-based nylon-6 using sugar cane and industrial corn. This polymer will be used for making yarn that can be used for textiles by Prada, Gucci, Louis Vuitton, Burberry, and others.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies and leading applications. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion), Volume (Kilo Tons) |

|

Growth Rate |

CAGR of 20.80% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 1.41 billion in 2025 and is projected to reach USD 7.77 billion by 2034.

Recording a CAGR of 20.80%, the market will exhibit exponential growth during the forecast period of 2026-2034.

In 2025, the market value in Asia Pacific stood at USD 0.56 billion.

Based on application, the automotive segment led the market in 2023.

Rising awareness about environmental sustainability is the crucial factor driving the market.

Genomatica, Cathay Biotech, Radici Group, Aquafil Group, and BASF SE are the top players in the market.

Asia Pacific held the highest market share in 2025.

Rising demand from the textiles sector will support the products adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us