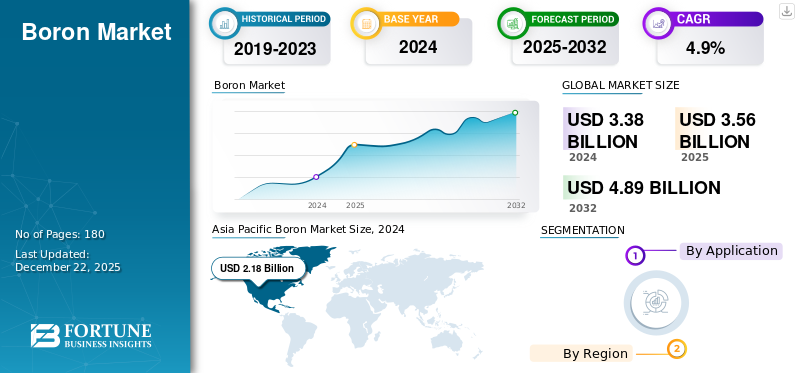

Boron Market Size, Share & Industry Analysis, By Application (Glass, Ceramics, Agricultural, Detergent, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global boron market size was valued at USD 3.56 billion in 2025. The market is projected to grow from USD 3.75 billion in 2026 to USD 5.48 billion by 2034 at a CAGR of 4.90% during the forecast period of 2026-2034. Asia Pacific dominated the boron market with a market share of 65% in 2025.

Boron is a lightweight metalloid element (atomic number 5) that occurs naturally in compounds rather than in pure form. It possesses unique properties, including a high melting point, low density, and exceptional hardness, making it valuable across diverse industries. Key applications include borosilicate glass production for laboratory equipment and cookware, ceramic manufacturing for heat-resistant materials, agricultural fertilizers to correct boron deficiency in crops, detergent formulations as cleaning agents, and advanced composites for aerospace and automotive sectors.

Rio Tinto, 3M, SB Boron Corporation., Eti Maden, and QUIBORAX S.A. are the key players operating in the market.

Boron Market Trends

Growing Clean Energy Adoption to Propel Market Growth

With global momentum building toward renewable energy adoption, it is increasingly being recognized as a high-potential material powering the green transition. Known for its heat resistance, lightweight nature, and chemical versatility, it plays a critical role in solar energy (boron-doped silicon), wind turbines (permanent magnets), and next-generation batteries. Notably, its compounds, such as metal borohydrides and boron nitride are under intense research for hydrogen storage applications. These materials can safely absorb, store, and release hydrogen at controllable rates under moderate conditions, addressing major challenges in hydrogen transport and infrastructure. As hydrogen gains traction as a clean fuel, its role is becoming increasingly strategic in global decarbonization and energy security efforts.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Rising Demand for Durable and Heat-Resistant Materials Spurs Boron Use in Glass and Ceramics Industry

The glass and ceramics industry is a major driver of the market due to the elements’ unique ability to enhance thermal resistance, chemical stability, and durability. Boron compounds such as borosilicate are essential in the production of specialty glass used in laboratory equipment, cookware, and display panels, applications where performance under extreme conditions is critical.

In ceramics, it is used to improve mechanical strength, reduce thermal expansion, and enhance resistance to wear and corrosion. This makes it ideal for tiles, glass, and industrial ceramic components. As construction, electronics, and consumer goods industries increasingly demand high-performance materials, the consumption of boron-based glass and ceramics continues to rise, solidifying its role in high-growth manufacturing sectors.

Market Restraints

Supply Constraints and Environmental Concerns to Curb Market Expansion

Concentrated supply and complex extraction processes significantly limit the growth of the market. With over 70% of global reserves in Turkey and major deposits in the U.S., geopolitical tensions and trade restrictions disrupt supply chains, particularly for import-reliant regions such as Europe and Asia Pacific. High boron production costs and the intricate refining required for high-purity boron, especially in ceramics and electronics, restrict scalability, causing price volatility and deterring investments. This poses challenges for industries such as ceramics, where it is essential for enhancing material durability and thermal resistance despite rising demand.

Environmental challenges are another factor that constrains the growth of the market. Open-pit mining methods contribute to habitat destruction and water pollution, triggering strict regulations and environmental opposition. Energy-intensive extraction clashes with sustainability goals, while concerns over reserve depletion limit consumption, impeding the market’s ability to meet growing industrial demand.

Market Opportunities

Rising Agricultural Industry’s Dependency on Product Demand to Create Opportunities in the Market

The agricultural industry’s increasing reliance on boron as a vital micronutrient is creating significant opportunities for the market. Boron, primarily in the form of boric acid, is essential for addressing soil deficiencies, enhancing crop yields, and improving the quality of fruits, vegetables, and grains. As global food demand rises, driven by population growth and changing dietary patterns, particularly in regions such as Asia Pacific and Latin America, farmers are adopting boron-based fertilizers to boost agricultural productivity. This trend is amplified by a push for precision agriculture, where its role in optimizing plant growth drives its demand, opening new avenues for market expansion and encouraging innovation in fertilizer formulations.

Moreover, the shift toward sustainable farming practices further fuels opportunities. Its non-toxic nature aligns with eco-friendly agricultural trends, supporting its use in organic and high-efficiency farming systems. Countries like Brazil and India, with expansive agricultural sectors, are driving demand to enhance soil health and crop resilience. The growing focus on food security and sustainable agriculture globally positions it as a critical input, fostering partnerships between boron suppliers and agribusinesses.

Market Challenges

High Production Costs for High-Purity Boron to Hinder Market Growth

The high production costs of high-purity boron, essential for electronics and advanced ceramics, pose significant challenges to the market. Complex refining processes, such as chemical vapor deposition, demand substantial energy and specialized equipment, driving up production costs. These factors limit scalability and affordability, particularly for niche applications such as semiconductors, constraining market expansions. The high costs also deter investment and innovation, impacting industries reliant on high-purity boron despite growing demand in Asia Pacific’s tech sector.

Trade Protectionism and Geopolitical Impact

Trade protectionism and geopolitical conflicts significantly impact the market by disrupting supply chains and increasing costs. With over 70% of reserves in Turkey, export restrictions driven by resource protectionism and tensions, such as U.S.-China trade disputes, limit availability for key import-dependent regions such as Europe and the Asia Pacific. Geopolitical risks, including sanctions and regional instability, exacerbate supply uncertainties, particularly for high-purity boron used in ceramics and electronics. These factors heighten price volatility and constrain boron market growth despite rising demand from the agricultural and clean energy sectors.

Segmentation Analysis

By Application

Download Free sample to learn more about this report.

Glass Segment Dominated the Market Due to Its Increasing Use In Various Industries

In terms of application, the market is segmented into glass, ceramics, agricultural, detergent, and others.

The glass segment dominated the boron market share of 44.27% in 2026, because boron compounds, especially borates, are essential in producing borosilicate and fiberglass. These materials offer superior thermal resistance, mechanical strength, and chemical durability, making them ideal for applications in construction, automotive, electronics, and laboratory equipment. The growing demand for energy-efficient buildings and lightweight, durable materials further drives the consumption of boron in the global glass manufacturing industry.

The ceramics segment is also experiencing favorable growth over the projected period. The product is used to enhance the strength of tiles and sanitary ware, making it the key material for the construction market. Its role in reducing firing temperatures aligns with energy-efficient manufacturing trends. Innovation in advanced ceramics for industrial applications continues to expand this segment’s potential.

Boron Market Regional Outlook

By region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Boron Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 2.31 billion in 2025 and USD 2.44 billion in 2026. Rapid urbanization across the region drives demand for borosilicate glass in the construction sector, while China’s leadership in the tile production and India’s expanding farming sector are boosting growth in ceramics and fertilizer use. Japan and South Korea advance in boron applications in electronics and clean energy technologies, such as battery storage. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 1.92 billion by 2026, and the India market is projected to reach USD 0.05 billion by 2026. The region’s strong manufacturing and government infrastructure investments create a thriving market.

To know how our report can help streamline your business, Speak to Analyst

North America

North America’s boron market is driven by the strong demand from the glass and defense sectors, with the U.S. leading due to its construction and automotive industries. The U.S. market is projected to reach USD 0.27 billion by 2026. The product is widely used to enhance insulation and produce borosilicate glass, supporting sustainable building options. High-purity boron also plays a critical role in defense innovations, including advanced materials such as body armor. Canada contributes to the market through mining activities and its growing focus on clean energy technologies.

Europe

Europe's boron market remains stable, driven by agriculture and ceramics, with countries such as Germany and the U.K. focusing on high-quality sanitary ware and sustainable farming. Boron’s role in advanced ceramics in electronics, especially in electric vehicles, is further fueling demand. Innovation in clean energy applications, such as solar panels, supports steady progress. The UK market is projected to reach USD 0.08 billion by 2026, while the Germany market is projected to reach USD 0.12 billion by 2026.

Latin America

Latin America exhibits rising growth in the market, primarily through agriculture, with Brazil leading through its vast agricultural industry. Mexico’s automotive and manufacturing industry also drives demand for ceramics and industrial applications. The region benefits from sustainable agriculture trends, as boron’s non-toxic nature aligns with eco-friendly farming, creating opportunities.

Middle East & Africa

The Middle East and Africa show rising growth, with Turkey dominating as a global boron supplier, fueling local and export markets in glass and ceramics. Saudi Arabia and South Africa drive demand through construction and agriculture, respectively, with boron supporting sustainable farming. However, the region faces challenges such as geopolitical risks and environmental concerns related to mining, particularly habitat destruction. Despite these challenges, increasing infrastructure investments and clean energy initiatives, such as solar energy projects, are positioning the region for steady market development.

Competitive Landscape

Key Market Players

Key Players Focus on Adopting Sustainable Mining Practices to Meet Various Industry Needs

Rio Tinto, 3M, SB Boron Corporation., Eti Maden, and QUIBORAX S.A. are the major players operating in this market. Leading companies are driving the market forward through strategic R&D investments, launching products, and adopting sustainable mining practices, effectively meeting rising demand in agriculture, ceramics, and clean energy sectors.

List of Top Boron Companies Profiled

- Eti Maden (Turkey)

- 5E Advanced Materials, Inc. (U.S.)

- Rio Tinto (U.K.)

- 3M (U.S.)

- Quiborax (Chile)

- Boron Molecular (Australia)

- Gujarat Boron Derivatives Pvt. Ltd. (India)

- Inkabor (Peru)

- SB Boron Corporation. (U.S.)

- Qinghai Zhongli Technology Co., Ltd (China)

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects, such as leading companies and product applications. Besides this, it offers insights into the market and current industry trends and highlights key industry developments. In addition to the factors mentioned above, it encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) and Volume (Kiloton) |

|

Growth Rate |

CAGR of 4.90% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3.56 billion in 2025 and is projected to record a valuation of USD 5.48 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 2.31 billion.

Recording a CAGR of 4.90%, the market will exhibit steady growth during the forecast period (2026-2034).

In 2024, the glass led the segment by application.

Rising demand for durable and heat-resistant materials in the glass and ceramics industry is a key factor driving the growth of the market.

The Asia Pacific region is poised to capture the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us