Brazil Cloud Computing Market Size, Share & Industry Analysis, By Type (Public Cloud, Private Cloud, and Hybrid Cloud), By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Enterprise Type (SMEs and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Government, Consumer Goods and Retail, Healthcare, Manufacturing, and Others) and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

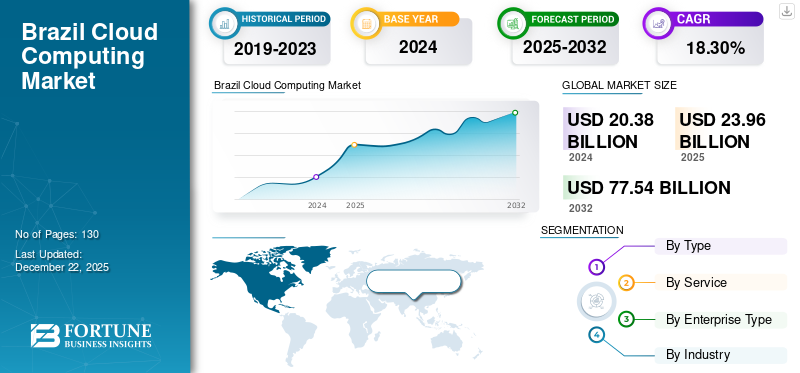

Brazil cloud computing market size was valued at USD 20.38 billion in 2024. The market is projected to grow from USD 23.96 billion in 2025 to USD 77.54 billion by 2032, exhibiting a CAGR of 18.30% over the forecast period.

Brazil's cloud computing market is growing steadily. This growth is fueled by demand from various sectors such as finance, retail, and agriculture. Unlike markets with well-established digital infrastructure, Brazil faces unique challenges. These include connectivity issues and regulatory requirements that affect how the country adopts cloud technologies. Cloud technologies are helping Brazilian businesses improve efficiency, support remote work, and encourage innovation, particularly in urban areas. The government is also playing a role by supporting digital transformation. Its initiatives focus on modernizing public services and improving data security.

Brazil Cloud Computing Market Trends

Hybrid Cloud Adoption to be a Key Driver for Market Growth

Many organizations in Brazil are using hybrid cloud models to balance data security with the flexibility of the cloud. This approach keeps sensitive data and critical workloads on private or local systems. It helps businesses follow regulations such as LGPD while using public clouds for less sensitive tasks and scaling during peak demand. Hybrid cloud provides more control, better cost efficiency, and an easier shift to cloud technologies. This makes it a more popular choice for Brazilian companies modernizing their IT infrastructure.

Key takeaways

- The Brazil Cloud Computing Market is projected to be worth USD 77.54 billion in 2032.

- In by type segmentation, public cloud accounted for around 54.6% of the Brazil Cloud Computing Market in 2024.

- In the by service segmentation, Infrastructure as a Service (IaaS) is projected to grow at a CAGR of 19.8% during the forecast period.

- In the enterprise type segmentation, Large Enterprises accounted for around 52.60% of the market in 2024.

Brazil Cloud Computing Growth Factors

Focus on Data Security and Compliance to Boost Market Growth

Brazil’s strict data protection laws, especially the Lei Geral de Proteção de Dados (LGPD), emphasize how companies handle and protect personal and sensitive information. As a result, data security and compliance are now top priorities for organizations looking to adopt cloud services.

Cloud service providers that offer solutions tailored to meet these legal requirements are earning more trust from businesses. They make sure that data is stored, processed, and transferred in ways that follow LGPD guidelines, reducing the chances of data breaches and legal penalties, in turn driving the Brazil cloud computing market growth.

Brazil Cloud Computing Market Restraints

Resistance to Change Limits Market Growth

In Brazil, many traditional industries including manufacturing and finance are reluctant to shift from their long-established legacy systems. These companies often see cloud adoption as risky as they worry about data security, migration costs, and possible disruptions. The need for staff training and the fear of losing control over their IT environments also contribute to their hesitation.

This resistance to change slows the growth of the cloud computing market since businesses tend to stick with familiar systems instead of investing in new cloud technologies. Addressing these challenges will require education, clear benefits, and strong support for migration.

Brazil Cloud Computing Market Segmentation Analysis

By Type

Based on type analysis, the market is divided into public, private, and hybrid.

The public cloud holds a majority Brazil cloud computing market share, due to a need for digital flexibility and cost savings. Startups and tech companies led the way, but now larger companies are also shifting key operations to the cloud in order to remain competitive in a rapidly changing digital economy. As worries about data localization and compliance rise, hybrid cloud strategies are gaining importance. Brazilian businesses, particularly in heavily regulated fields including finance and healthcare, are starting to merge local infrastructure with cloud services to maintain performance and manage data properly.

By Service

Based on service analysis, the market is segregated into infrastructure as a service, platform as a service, and software as a service.

In Brazil, Software as a Service (SaaS) is expected to lead the cloud computing market. Companies are increasingly choosing flexible, subscription-based software to improve operational efficiency and reduce their dependence on in-house IT resources. The benefits of quick deployment and low maintenance make SaaS especially attractive for businesses updating their workflows. At the same time, Infrastructure as a Service (IaaS) is set to grow the fastest. This growth is fueled by rising demand from industries such as retail, finance, and technology for scalable infrastructure capable of handling increased data needs and digital growth.

By Enterprise Type

Based on enterprise type, the market is segmented into Large Enterprises and SMEs.

In Brazil, large enterprises hold a majority in the cloud computing market share. This is especially true in sectors such as banking, telecommunications, and energy. These companies use cloud platforms to update old systems and promote innovation on a large scale. They focus on the cloud to boost their ability to operate during tough times and meet rising digital demands. At the same time, small and medium-sized businesses in Brazil are rapidly closing the gap. They benefit from cheap internet access, government support for going digital, and a growing network of local cloud providers.

By Industry

Based on industry, the market is segmented into BFSI, IT and Telecom, Government, Consumer Goods, Healthcare, Manufacturing, and Others.

In Brazil, the IT and Telecom industries lead the cloud computing market, they use cloud technology to grow digital infrastructure, improve network services, and handle rising data traffic throughout the country. These industries depend on the cloud’s ability to scale and perform to satisfy the needs of a quickly digitizing population. Meanwhile, the healthcare sector is becoming one of the fastest-growing users of cloud solutions. The growth of telemedicine, electronic health records, and AI-driven diagnostics is encouraging healthcare providers to adopt secure and scalable cloud platforms.

List of Key Companies in the Brazil Cloud Computing Market

In Brazil’s quickly changing cloud computing market, key local companies including UOL, Invent Cloud, CI&T, and TOTVS are vital in pushing digital transformation across different industries. UOL provides a wide range of cloud services with a strong emphasis on flexible infrastructure and data security. Invent Cloud focuses on custom cloud solutions that assist startups and growing businesses with adaptable deployment options. CI&T is recognized for its skill in agile software development and modernizing cloud-native applications, helping businesses innovate fast. Together, these companies are influencing Brazil’s cloud landscape by offering innovative, secure, and industry-specific cloud solutions.

LIST OF KEY COMPANIES STUDIED

- COMPASS UOL TECNOLOGIA LTDA (Brazil)

- UOL (Brazil)

- Inventcloud (Brazil)

- CI&T (Brazil)

- TOTVS (Brazil)

- Locaweb Internet Services S/A (Brazil)

- Valcann (Brazil)

- Wevy (Brazil)

- Snowman Labs (Brazil)

- Softo (Brazil)

- Digitrix (Brazil)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Brazil’s Patria Investimentos has launched Omnia, a USD 1 billion hyperscale data center platform focused on AI and cloud services. The first site will be built in Brazil, with expansion into Mexico and Chile, using only renewable energy. The platform targets major global tech firms as cloud and AI demand surges across Latin America.

- September 2024: Amazon Web Services (AWS) will invest USD 1.8 billion in Brazil by 2034 to expand its data center operations. The investment will support building, connecting, and maintaining infrastructure.

REPORT COVERAGE

This report provides a comprehensive analysis of Brazil’s cloud computing market, exploring the adoption trends across various industries such as finance, and healthcare. It examines the growing preference for hybrid cloud models alongside traditional public cloud services, driven by the need for flexibility and stringent data governance requirements. The study also highlights the impact of Brazil’s commitment to renewable energy and favorable conditions for data center investments, which are attracting both domestic and international players. Additionally, the report covers strategic partnerships, government initiatives, and the development of innovative cloud-based solutions that are shaping the future of Brazil’s digital landscape.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.30% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Service

|

|

|

By Enterprise Type

|

|

|

By Industry

|

Frequently Asked Questions

Fortune Business Insights says that the Brazil cloud computing market was worth USD 20.38 billion in 2024.

The market is expected to exhibit a CAGR of 18.30% during the forecast period of 2025-2032.

By industry, the IT and Telecommunications industry is set to lead the market.

COMPASS UOL TECNOLOGIA LTDA, UOL, Inventcloud, and CI&T are the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us